News

Bitcoin News

Bitcoin News

Browse all Bitcoin related articles and news. The latest news, analysis, and insights on Bitcoin.

Coinbase, Uniswap, Solana, and 5 Other Companies Join Forces for Crypto in Washington

The crypto industry's most powerful companies and lobbying groups have taken a new step to deepen their relationships with policymakers in the US. Industry giants such as Coinbase, Kraken, Uniswap Labs, Paradigm, Andreessen Horowitz, the Solana Policy Institute, and the Digital Currency Group (DCG) have announced the establishment of a nonprofit called the American Innovation Project (AIP).The new organization aims to provide direct information to US politicians and officials on not only cryptocurrency but also artificial intelligence and other decentralized technologies. Julie Stitzel, DCG's vice president of policy, said that the AIP aims to "bridge the gap between policymakers and the public by translating complex technological developments into understandable and actionable insights."Establishing an Education-Focused, Nonpartisan StructureOne of the AIP's key strengths is its focus on education and its emphasis on political neutrality. Stitzel stated that the organization will complement its existing lobbying efforts, but aims to inform, rather than influence, lawmakers. AIP will operate in the US under 501(c)(3) status. This legal status places it in the same category as churches, museums, and schools, providing tax exemption. However, according to IRS regulations, such organizations are required to engage in limited political lobbying activities.The organization's board of directors includes some of the most influential lobbyists in the industry. Solana Policy Institute President Kristin Smith, Blockchain Association COO Allie Page, and Coinbase policy strategist Nick Carr will serve on AIP's board.Crypto Regulation Emerges in WashingtonAIP's establishment comes at a time when crypto regulations are accelerating in the US. Last month, President Donald Trump signed a bill establishing a federal framework for stablecoins. The House of Representatives passed a comprehensive bill broadly regulating the crypto sector. The SEC has also launched a new initiative called "Project Crypto" to update rules regarding token distributions, custody solutions, and trading activities. During this period, the AIP will organize various events to help policymakers make more informed decisions about technology. According to the statement, the organization will bring together industry representatives and legislators through closed-door sessions, workshops, and roundtable discussions.First Event: Jackson Hole SummitAIP's inaugural event will be held concurrently with a special crypto policy summit in Jackson Hole, Wyoming. Co-hosted by Anthony Scaramucci's SALT conference and Kraken, the event will host high-level politicians and regulators. Attendees include Senate Banking Committee Chairman Tim Scott, Wyoming Senator Cynthia Lummis, SEC Chairman Paul Atkins, and Fed Vice Chair Michelle Bowman.Kristin Smith, President of the Solana Policy Institute and President of the AIP, said, "Our goal is simple yet urgent: to equip America's leaders with the knowledge and tools to make the right decisions in a rapidly evolving technological environment."

Google Becomes Largest Shareholder in Bitcoin Mining Company

A new era is dawning in the world of crypto mining and artificial intelligence. Google has increased its stake in Bitcoin miner TeraWulf to 14 percent, making it the company's largest shareholder. This move represents a milestone in combining crypto mining with AI infrastructure. Google Provides $3.2 Billion in BackstopsGoogle has provided a $3.2 billion backstop guarantee for TeraWulf's 10-year data center agreement with AI cloud provider Fluidstack. The agreement stipulates that if Fluidstack fails to meet its lease obligations, Google steps in. In return, the tech giant has acquired the right to purchase over 73 million TeraWulf shares, increasing its stake in the company to 14 percent.TeraWulf executives are calling this move a strong endorsement. Kerri Langlais, the company's chief strategy officer, said the deal demonstrates confidence in TeraWulf's zero-carbon infrastructure and its ability to meet the demand for high-performance computing (HPC). The CB-5 data center will open in 2026.This agreement includes the opening of a new data center at the Lake Mariner campus in New York. The facility, called "CB-5," is scheduled to be operational in the second half of 2026. The agreements with Fluidstack secure 360 MW of computing capacity. With this capacity, TeraWulf aims to become a major player not only in Bitcoin mining but also in artificial intelligence and HPC.The company is projected to generate $6.7 billion in revenue from this partnership. It is reported that this figure could rise to $16 billion if the options are exercised.Transformation from Mining to AIFollowing the 2024 Bitcoin halving, block rewards dropped to 3,125 BTC, and mining revenues began to shrink. This situation has led the industry to turn to alternative revenue sources. TeraWulf is following this trend, maintaining Bitcoin mining to generate cash flow without completely abandoning it, while placing AI and HPC services at the center of its long-term growth strategy.According to Langlais, Bitcoin mining is still valuable for "generating cash flow and balancing the power grid." However, the company's real growth story will be driven by long-term contracts with strong, corporate partners in AI and HPC services.Investment giant VanEck estimates that if major mining companies shifted just 20% of their energy capacity to AI and HPC by 2027, the sector could generate approximately $14 billion in additional annual profits over the next 10 years. This clearly explains TeraWulf's shift.This transformation is critical for the crypto mining industry, which has long struggled with shrinking profit margins. However, because AI infrastructure requires different hardware and optimizations than traditional mining, the transition is expected to be challenging. Nevertheless, with the support of giants like Google and Fluidstack, TeraWulf's future is promising for now.

Daily Market Summary – August 19, 2025 | JrKripto

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin and Ethereum Technical OverviewAs it did yesterday, Bitcoin continued its decline after the ATH, falling to the $115,000 region. We can say it found short-term support in this region, but in a downward breakout scenario from the $114,000-$115,000 area, the $111,800 level and then the $107,300 support level are potential reversal levels. It's worth noting that the $117,300 area is the target area after a recovery.On the Ethereum side, we see that after a breathless rise to the $4,800 region, it is undergoing a natural pullback. The $4,250, $4,180, and $4,070 levels serve as sequential support points. The price will target the $4,400 area during the initial price reversal.Crypto NewsSouth Korea's financial regulator will submit its stablecoin regulatory proposal in October.BitMine announced last week that it purchased more than 370,000 ETH ($1.6 billion), bringing its total ETH holdings to 1,520,000 ($6.5 billion).Microstrategy purchased 430 BTC.The SEC postponed applications for the Truth Spot Bitcoin and Ethereum ETFs.The Trump administration is in talks to acquire a 10% stake in Intel.The U.S. Treasury Department has begun collecting public input on the GENIUS Act, which is intended to detect illicit digital asset activity.CryptocurrenciesTop GainersBIO → Up 10.0% to $0.13612067OKB → Up 9.1% to $125.47WEMIX → Up 9.1% to $0.87168974TRIBE → Up 8.5% to $0.66552645AB → Up 8.0% to $0.00960592Top LosersUSELESS → Down 12.8% to $0.25979181M → Down 11.3% to $0.37503649PUMP → Down 11.0% to $0.00282301HNT → Down 6.6% to $2.51KTA → Down 6.5% to $1.23.Fear IndexBitcoin: 59 (Greed)Ethereum: 46 (Neutral)DominanceBitcoin: 59.88% ▲ 0.21%Ethereum: 13.33% ▼ 0.83%Total Daily Net ETF InflowsBTC ETFs: -$14.10 MillionETH ETFs: -$59.30 MillionGlobal Markets and Stocks of the Most Valuable CompaniesGlobal markets are monitoring the ongoing peace talks regarding the Russia-Ukraine war. While no concrete steps have been taken, there is talk of a Putin-Zelenski meeting within two weeks. Following yesterday's Trump-Zelenski-EU leaders meeting, Trump stated that the talks with European leaders were positive and that preparations for a trilateral summit have begun. Putin's advisor, however, stated that only the idea of a summit is being considered. Global stock markets are trading mixed this morning; US futures are slightly down, while European futures are slightly up. July housing starts and building permits data will be released in the US today.NVIDIA (NVDA) → $4.44 trillion market capitalization, $182.01 per share, up 0.86%.Microsoft (MSFT) → $3.84 trillion market capitalization, $517.10 per share, down 0.59%.Apple (AAPL) → $3.43 trillion market capitalization, $230.89 per share, down 0.30%.Amazon.com (AMZN) → $2.47 trillion market capitalization, $231.49 per share, up 0.20%.Alphabet (GOOG) → $2.47 trillion market capitalization, $204.29 per share, down 0.30%.Borsa Istanbul Updates and the Most Valuable CompaniesThe domestic housing price index increased by 0.9% month-on-month in July, reaching a 32.8% annual increase, while declining by 0.5% in real terms. Prices rose by 0.6% in Istanbul, 1.2% in Ankara, and 1% in Izmir. Annual increases were 33.5%, 42.9%, and 31%, respectively. The Bloomberg HT Consumer Confidence Preliminary Index rose by 2.36% in August to 71.71. While buying in stocks that had lagged in previous weeks was evident yesterday on the BIST, profit-taking continued in bank stocks, and the index closed slightly higher but below the 11,000 level. A flat trend is expected on the BIST today.QNB Finansbank (QNBTR) → 2.39 trillion TL market capitalization, 714.50 TL per share, fell by 9.96%. Aselsan Electronics Industries (ASELS) → Market value of 782.95 billion TL, price per share of 170.30 TL, decreased by 0.82%.Türkiye Garanti Bankası (GARAN) → Market value of 592.20 billion TL, price per share of 142.10 TL, increased by 0.78%.Turkish Airlines (THYAO) → Market value of 460.92 billion TL, price per share of 333.25 TL, decreased by 0.22%.Koç Holding (KCHOL) → Market value of 455.19 billion TL, price per share of 180.90 TL, increased by 0.78%.Precious Metals and Currency PricesGold: 4384 TLSilver: 49.97 TLPlatinum: 1761 TLDollar: 40.89 TLEuro: 47.72 TLWe look forward to bringing you the latest updates again tomorrow.

SEC Deals Blow to Altcoin ETFs: XRP, DOGE, and LTC Applications Delayed

The U.S. Securities and Exchange Commission (SEC) has once again postponed its decision on Truth Social's proposed Bitcoin and Ethereum exchange-traded fund (ETF). The application for Truth Social, a social media platform owned by Trump Media & Technology Group, was initially submitted in June. According to the SEC's official statement, the new deadline has been set as October 8, 2025. Furthermore, with its latest move, the SEC will also postpone decisions on DOGE, LTC, and XRP ETFs.Truth Social's ETF application sparks controversyWhile Truth Social's Bitcoin and Ethereum ETF may seem like an ordinary application in the crypto world, its political connections have generated significant buzz. The fact that former US President Donald Trump is behind the application makes the approval process even more controversial. Trump has recently been in the news for his cryptocurrency projects. The DeFi and stablecoin initiative World Liberty Financial, in particular, and the TRUMP and MELANIA-themed memecoins have increased the Trump family's influence in the crypto world. Therefore, some argue that a potential approval could lead to a trust issue in the markets. Caroline Ciccone, president of Accountable.US, a nonprofit that pushes government transparency, said, “If the SEC approves this ETF, it will raise questions in the minds of Americans. Is this decision made in the best interests of the country, or is it serving the President’s business?”Other crypto ETF applications also postponed: XRP, DOGE, LTC affectedSimilar decisions were made for other crypto ETFs alongside the Truth Social application. The SEC announced that it will announce decisions on the CoinShares Litecoin ETF, CoinShares XRP ETF, and 21Shares Core XRP ETF later in October. It was also reported that investigations into the staking permissions of the Canary XRP Trust, Grayscale XRP Trust, and 21Shares Core Ethereum ETF are ongoing.The SEC's list of postponements is quite extensive. The institution postponed not only the Trump family-linked Bitcoin + Ether ETF but also several XRP-focused applications. Grayscale, CoinShares, Canary Capital, Bitwise, and 21Shares all postponed XRP ETF filings to October 19th, while Franklin Templeton’s spot XRP ETF was moved to November 5th. Grayscale’s Dogecoin ETF and CoinShares’ Litecoin ETF were also extended; the Litecoin ETF decision date is October 23rd, while the Dogecoin ETF is slated for a flexible timeframe between late 2025 and early 2026. Furthermore, the proposal to add staking functionality to the 21Shares Core Ethereum ETF is under review, but this filing doesn’t specify a specific deadline. Last week, the SEC similarly postponed applications for the Solana ETF by VanEck, 21Shares, and Bitwise, as well as 21Shares's request for a Dogecoin ETF.The SEC's approach to crypto ETFs has undergone a significant transformation in recent years. During the Biden administration, influenced by court decisions, first spot Bitcoin ETFs were approved, followed by spot Ethereum ETFs. With the Trump administration, more flexible measures have been taken. For example, in July, the SEC accepted in-kind creations and redemptions of crypto ETFs by "authorized participants."This change is leading to speculation that it could pave the way for more products in the crypto market. However, the situation is more sensitive when it comes to the Trump-linked Truth Social ETF, as this approval is directly linked not only to market dynamics but also to politics.

Strategy, Metaplanet Continues Bitcoin Purchases: 2 Other Companies Also Take Action

Institutional appetite for Bitcoin continues to grow. US-based giant Strategy announced that it purchased 430 Bitcoin (BTC) between August 11-17. The company made the purchases at an average price of $119,666. This move marked a new step in Strategy's long-standing Bitcoin accumulation strategy. The company's aggressive Bitcoin policy, along with the growing adoption of the concept of "digital gold" in crypto markets, is attracting the attention of global institutional investors. This move, coupled with similar news from various countries in the past 24 hours, has created a wave of institutional Bitcoin buying.Japan's Lib Work: 5 billion yen Bitcoin decisionImmediately following Strategy's acquisition announcement, Japan-based construction and real estate company Lib Work also made a noteworthy announcement. At the board meeting held on August 18, 2025, it was announced that the company had decided to purchase 5 billion yen (approximately $34 million) worth of Bitcoin.Lib Work stated that it viewed this investment as a long-term store of value and aimed to diversify its cash reserves. The company will make its purchases through reliable crypto exchanges between September and December 2025. This decision demonstrates that institutional Bitcoin investments, led by Metaplanet in Japan, are expanding and spreading into different sectors.Amdax from the Netherlands: "We will acquire 1% of Bitcoin"Amdax, the Netherlands-based regulated crypto service provider, has also announced a major plan. The company aims to establish a new Bitcoin treasury company called AMBTS and list it on the Euronext Amsterdam exchange. Amdax aims to own at least 1% of all Bitcoin in circulation in the long term, and with this ambitious goal, it aims to become one of the most aggressive institutional Bitcoin investors in Europe. AMBTS will initially accumulate BTC through private investments and then expand through an IPO. With the clarification of MiCAR regulations in Europe, Amdax's strategy is expected to encourage institutional investors to access Bitcoin more easily.Metaplanet: 18,888 BTC in Bitcoin reservesMeanwhile, Metaplanet, Japan's leading institutional Bitcoin investor, continues to grow its reserves. With its latest purchase, the company added 775 BTC, bringing its total reserves to 18,888 BTC. This amount is equivalent to approximately $2.18 billion at the current exchange rate.Metaplanet's rapid acquisitions in recent months clearly demonstrate that it is following in the footsteps of US-based MicroStrategy. Analysts note that the company's bold steps could serve as an example for other major companies in Asia and create a regional "Bitcoin reserve trend."This news from various companies, including Strategy, Lib Work, Amdax, and Metaplanet, has energized the crypto market in the last 24 hours. However, the Bitcoin price has been fluctuating in the $115,000-$120,000 range in recent days.

Ethereum Leads, Solana and XRP Follow: Fund Inflows Break Record

According to CoinShares' weekly crypto fund report, a total of $3.75 billion in inflows into crypto investment products occurred last week. This figure is notable as the fourth-highest weekly inflow on record for crypto funds. This brings total assets under management (AuM) to an all-time high of $244 billion.Record inflows for EthereumThe biggest gainer of the week was clearly Ethereum (ETH). With $2.87 billion in inflows in just one week, ETH alone accounted for 77% of the total weekly inflows. Ethereum's inflows since the beginning of the year reached an all-time high of $11 billion. This data demonstrates that Ethereum, which has proportionally surpassed Bitcoin, is becoming an increasingly attractive alternative for investors.Bitcoin Remains More ModestThe picture for Bitcoin (BTC) is quieter. Weekly inflows reached $552 million, bringing total inflows since the beginning of the year to $21 billion. While this figure appears strong, Bitcoin's ratio of assets under management (11.6%) lags behind Ethereum's.Solana and XRP emerged as standouts on the altcoin frontNotable developments also occurred on the altcoin front.Solana (SOL): Proving continued investor interest with $176.5 million in weekly inflows.XRP: Had a strong week with $125.9 million inflows.Sui (SUI): Recorded $11.3 million inflows.Conversely, Litecoin (LTC) and Toncoin (TON) outflows of $0.4 million and $1 million, respectively, were the projects that diverged negatively. iShares Leads Funding ProvidersAccording to the data in the image, iShares/USA held the largest share among funders. With $3.2 billion inflows last week alone, iShares accounted for almost all of the total inflows. Other providers stood out with relatively limited figures:Grayscale: $85 million inflowProShares: $66 million inflowARK 21 Shares: $184 million outflowFidelity: $74 million outflowRegional breakdown: US leads the packIn terms of geographic breakdown, the US market alone accounted for 99% of the total volume, with $3.73 billion inflow. Other regions saw smaller inflows:Canada: $33.7 millionHong Kong: $20.9 millionAustralia: $12.1 millionOn the other hand, Brazil (-$10.6 million) and Sweden (-$49.9 million) were the regions with negative outflows.Recent data shows that institutional investors' interest in crypto continues to grow, with Ethereum, in particular, taking the lead. While Bitcoin still maintains its market leadership, the strong performance of altcoins Solana and XRP is particularly noteworthy.

Daily Market Summary – August 18, 2025 | JrKripto

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin and Ethereum Technical OverviewWith the start of the new week, Bitcoin extended its decline following the ATH, falling into the $115,000 region. This area appears to be providing short-term support, but in the event of a downward breakout from the $114,000–$115,000 range, the $111,800 and subsequently the $107,300 levels stand out as potential reversal points. On the upside, a recovery could see the price targeting the $117,300 region.On the Ethereum side, we see that after a breathless rise to the $4,800 region, it is undergoing a natural pullback. The $4,250, $4,180, and $4,070 levels serve as sequential support points. The price will target the $4,400 region upon its first reversal.Crypto NewsSouth Korea's financial regulator will submit its stablecoin regulatory proposal in October.Grayscale has filed for a DOGE ETF.Bitwise has filed an updated S-1 form for the DOGECOIN ETF.Trump: Stock markets are at record highs.Bitwise files updated S-1 for Aptos ETFSEC Chairman Paul Atkins said the SEC is mobilizing all departments to make the US the world's crypto capitalCryptocurrenciesTop GainersBIO → Up 21.5% to $0.12345658XMR → Up 4.0% to $275.02B → Up 2.2% to $0.56136309LINK → Up 2.2% to $24.81USDY → Up 1.6% to $1.08Top LosersUSELESS → Down 12.4% to $0.29903607PUMP → Down 9.8% to $0.0031675LPT → Down 9.6% to $6.38RAY → Down 9.2% to $3.34.MNT → Down 9.0% to $1.24.Fear IndexBitcoin: 61 (Greed)Ethereum: 50 (Neutral)DominanceBitcoin: 59.62% ▲ 0.35%Ethereum: 13.58% ▼ 1.06%Total Daily Net ETF InflowsBTC ETFs: -$14.10 MillionETH ERFs: -$59.30 MillionGlobal Markets and Stocks of the Most Valuable CompaniesAlthough the Trump-Putin summit did not produce a lasting peace, talks continue. Zelenskyy and European leaders are expected to meet in Washington today. Global markets started the week optimistically, watching these developments and the expected Fed rate cut in September. The dollar index and Brent crude oil prices continue to decline. This week, data flow is weak, with attention focused on the Zelensky-EU meeting and Powell's speech in Jackson Hole.NVIDIA (NVDA) → $4.4 trillion market capitalization, $180.45 per share, down 0.86%.Microsoft (MSFT) → $3.87 trillion market capitalization, $520.17 per share, down 0.44%.Apple (AAPL) → $3.44 trillion market capitalization, $231.59 per share, down 0.51%.Alphabet (GOOG) → $2.47 trillion market capitalization, $204.91 per share, up 0.53%.Amazon.com (AMZN) → $2.46 trillion market capitalization, $231.03 per share, up 0.02%.Borsa Istanbul Updates and Most Valuable CompaniesInflation expectations for the end of 2025 and 2026 remained unchanged at 29.7% and 20.4%, respectively, in the Central Bank of the Republic of Turkey (CBRT) Market Participants Survey. Long-term expectations also remained stable. The consensus view is that the expectation for a 300 basis point interest rate cut in September has increased. Smaller reductions are expected in October and December. The budget posted a deficit of 23.9 billion TL in July, lower than the same month last year. The budget deficit exceeded 1 trillion TL in the first seven months of the year. This week, the housing price index and consumer confidence are the main drivers. The BIST100 started the week with a slight gain.QNB Finansbank (QNBTR) → Market capitalization of 2.39 trillion TL, price per share of 714.50 TL, decreased by 9.96%. Aselsan Elektronik Sanayi (ASELS) → Market value of 777.02 billion TL, price per share of 168.00 TL, decreased by 1.41%.Türkiye Garanti Bankası (GARAN) → Market value of 600.18 billion TL, price per share of 142.10 TL, decreased by 0.56%.Turkish Airlines (THYAO) → Market value of 456.78 billion TL, price per share of 332.00 TL, increased by 0.30%.Koç Holding (KCHOL) → Market value of 451.64 billion TL, price per share of 179.30 TL, increased by 0.67%.Precious Metals and Currency PricesGold: 4395 TLSilver: 50.03 TLPlatinum: 1757 TLDollar: 40.89 TLEuro: 47.89 TLWe look forward to bringing you the latest updates again tomorrow.

Bitcoin Drops to $115,500: All Eyes on Fed's Jackson Hole Meeting

Last week, the price of Bitcoin fell from $124,000 to $118,000. This move led to liquidations exceeding $1 billion in futures markets. While this doesn't signal a reversal of the trend, it's believed to be a natural consequence of profit-taking. Selling pressure subsequently continued throughout the weekend. Bitcoin fell to $115,500 on Sunday night, while Ethereum fell to $4,330. Higher-than-expected inflation data from the US was particularly influential in this decline. While the data weakened the prospects for a September interest rate cut, it also fueled investor risk aversion. "High inflation is dampening interest rate cut hopes, strengthening the dollar, and reducing risk appetite in the crypto market," said Vincent Liu, CIO of Kronos Research.Rise in Leveraged TradingMeanwhile, leveraged trading in cryptocurrency markets is approaching bullish levels again. According to Galaxy Research's "State of Crypto Leverage" report, crypto-backed lending volume increased by 27% in the second quarter alone, reaching $53.1 billion. This was the highest level since the beginning of 2022. The increase in borrowing demand on DeFi platforms and the return of risk appetite contributed to the market's upward trend. However, this rise also highlights the market's fragility.The Galaxy report also highlights stress points in the market. In July, massive outflows on Aave pushed ETH borrowing yields above Ethereum staking yields. This disrupted the widely used "looping" strategy and led to the rapid unwinding of staking positions. As a result, the outflow queue from the Ethereum Beacon Chain reached a record 13 days.Furthermore, while USDC borrowing costs rose rapidly in over-the-counter markets, on-chain interest rates remained stable. The spread between on-chain and off-chain dollar markets reached its highest level since the end of 2024. According to analysts, this mismatch could further exacerbate volatility when liquidity tightens.Although ETF inflows and institutional demand continue to support the market, analysts warn that rising credit volumes and liquidity imbalances are exacerbating the fragility. Indeed, the recent $1 billion liquidation demonstrated the double-edged impact of leveraged transactions.All eyes on the Fed meetingFurther price action is now focused on US macro data. Analysts believe the Fed's Jackson Hole meeting this week and the unemployment claims data released on August 21 will play a critical role. BTC Markets analyst Rachael Lucas said, "Dovish messages from Jackson Hole could revitalize risk appetite. ETF inflows and institutional buying are also providing a floor to the market."At press time, Bitcoin was trading at $115,245, a 1.8% drop. The coin has lost almost 5% of its value in the last seven days.

New York Proposes Tax on Crypto and NFT Transactions

New York State Assembly member Phil Steck has introduced a new bill that would impose a 0.2% excise tax on all digital asset transactions (including cryptocurrencies and NFTs). The proposal, codenamed "Assembly Bill A08966," was introduced on August 13 and referred to the Ways and Means Committee. If approved, the bill would take effect on September 1, 2025. According to the bill, the proceeds would be used to expand substance abuse prevention and treatment programs in schools in northern New York. The bill covers all digital assets created or transferred using distributed ledger or blockchain technology. This definition includes cryptocurrencies such as Bitcoin and Ethereum, as well as stablecoins and NFTs.Who is responsible for the tax?The law defines tax liability as the "person or persons making the sale or transfer." This could create compliance issues, particularly for exchanges, individual investors, and DeFi protocols. For example, if $10,000 of Bitcoin is sold, a $20 tax will be payable. However, the amount is not considered astronomical.New York's strict stance on the crypto market has been a topic of discussion before. The implementation of the BitLicense in 2015 led to the withdrawal of many companies from the state. This new tax proposal could push New York closer to being one of the strictest states in the US in terms of crypto regulations.Crypto Taxation Approaches Around the WorldCrypto taxation policies vary considerably around the world. While China completely bans cryptocurrency transactions, countries like Switzerland and Singapore offer flexible legal frameworks that encourage innovation. In the European Union, the MiCA regulation, which came into effect in 2025, imposes strict licensing and compliance requirements on crypto asset service providers.Some countries, however, are implementing different tax incentive methods. For example, Thailand exempts crypto profits earned on licensed platforms from income tax from 2025 until 2029. While not directly taxed, over 1 billion baht in additional revenue is expected from indirect economic activities.Meanwhile, Indonesia generated $38 million in revenue from crypto taxes in 2024, but this figure decreased to $6.97 million in the first seven months of 2025 due to market volatility. Japan, on the other hand, imposes an income tax of up to 55% on crypto earnings. According to research by the Japan Blockchain Association, 84% of existing investors say they would invest more if the tax were reduced to a flat 20%.The Trump administration pursued a crypto-friendly policy by removing DeFi broker rules in 2025 and easing strict oversight during the Biden administration. However, since tax policies in the US are largely at the discretion of individual states, New York's move could serve as a model for other states.

ETH, SOL, ARB, and LDO Highlighted: Coinbase Announces Altcoin Season Forecast

Coinbase Institutional's latest monthly market report suggests that September could mark the start of altcoin season in the cryptocurrency markets. The report highlights three key factors: a decline in Bitcoin dominance, increased market liquidity, and a rise in investor risk appetite.Coinbase report fuels altcoin season expectationsCoinbase Institutional's monthly market report, published on August 14, predicts that September could mark the start of altcoin season in the cryptocurrency market. According to the report, the decline in Bitcoin's market dominance, improved liquidity conditions, and a rise in investor risk appetite could accelerate the shift of capital from BTC to altcoins in the coming weeks.According to CoinMarketCap data, an altcoin season is defined as at least 75% of the 50 largest altcoins by market capitalization outperforming Bitcoin in the past 90 days. While this rate currently remains below this threshold, the total altcoin market capitalization has increased by more than 50% since the beginning of July, reaching $1.4 trillion. Bitcoin dominance, however, has fallen from 65% in May 2025 to 59%. According to Coinbase, this pattern provides early signs of a potential rotation that could lead to a full-scale altcoin season in September.ETH and "beta" altcoins attract attentionThe report notes that much of the recent surge in the altcoin market is linked to increased institutional interest in Ethereum (ETH). The accumulation of ETH by digital asset treasuries (DAT), combined with positive narratives surrounding stablecoins and real-world assets, is supporting demand. For example, Bitmine Immersion Technologies reportedly reached a total purchasing capacity of 1.15 million ETH with a new $20 billion fund.ARB, ENA, LDO, and OP stand out among altcoins that reacted to ETH price action with high beta. Beta indicates how volatile an asset's price movement is relative to the benchmark asset. A beta greater than 1 indicates that the price is more volatile than the benchmark asset, meaning it may move more sharply during both ups and downs. Among this group, only LDO has clearly benefited from the ETH rally, with a 58% increase since the beginning of August. LDO's performance was influenced by the US Securities and Exchange Commission's (SEC) statement on August 5th that liquid staking tokens are not considered securities under certain conditions.Macro Environment and Liquidity SupportCoinbase predicts that the Fed interest rate cuts expected in September and October could draw some of the record $7.2 trillion currently held in money market funds into the crypto market. The recovery in spot and derivative trading volumes, order book depth, and stablecoin supply in recent weeks is also facilitating entry and exit from the altcoin market. “The decline in Bitcoin dominance and the increase in altcoin market capitalization, combined with investors’ desire to shift to riskier assets, could initiate a capital rotation process that could turn into a mature altcoin season in September,” the report stated.

Daily Market Summary – August 15, 2025 | JrKripto

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin and Ethereum Technical OverviewBitcoin continues its volatile rise. Our ATH target in previous newsletters has been achieved. After breaking through the $123,100 region, it can be expected to reach the $127,000 area. In case of pullbacks, the $117,000 area will be closely monitored.Ethereum, on the other hand, has broken its downward trend from 2021, which we mentioned in previous newsletters. ETH's short-term potential has increased significantly after this breakout. The $4540 support and $4770 resistance levels are areas to be closely monitored.Crypto NewsCoinbase acquired Deribit, as expected.Google acquired an 8% stake in Bitcoin miner TeraWulf in a $3.7 billion deal.Trump: I think Putin will make peace.Citigroup is exploring custody and settlement services for stablecoins and crypto ETFs.The Trump administration will reportedly discuss US acquisition of stock in Intel.Treasury Secretary Bessent said the US government is exploring ways to "acquire more Bitcoin to expand the reserve."The SEC postponed its decision on the Bitwise Spot Solana ETF.CryptocurrenciesTop Gainers:SKL → Up 13.3% to $0.04560092HASH → Up 6.9% to $0.02878751ZBCN → Up 6.6% to $0.00502393AERO → Up 6.1% to $1.42M → Up 3.6% to $0.43615755Top Losers:POPCAT → Down 11.0% to $0.30693777CFX → Down 9.9% to $0.1807279SUPER → Down 9.3% to $0.73215213KAITO → Down 9.3% to $1.09MOG → Down 9.2% to $0.00000125.Fear Index:Bitcoin: 67 (Greed)Ethereum: 59 (Greed)Dominance:Bitcoin: 59.44% ▼ 0.29%Ethereum: 14.03% ▲ 0.95%Total Daily Net ETF InflowsBTC ETFs: $230.80 MillionETH ETFs: $639.60 MillionGlobal Markets and Stocks of the Most Valuable CompaniesThe US PPI rose 0.9% month-over-month for July, well above expectations (0.2%), and reached 3.3% year-over-year, the highest level since February 2025. Despite the data increasing inflationary pressures, markets continue to price in a Fed interest rate cut on September 17. Expectations for the Trump-Putin summit are also supporting global stock markets. US and European futures, as well as Asian stock markets, are trading higher this morning. While dollar and bond yields rose after the PPI, the VIX remained low at 14.83, indicating that risk appetite remains intact.NVIDIA (NVDA) → Market capitalization of $4.44 trillion, price per share of $182.02, increased by 0.24%.Microsoft (MSFT) → Market capitalization of $3.88 trillion, price per share of $522.48, increased by 0.36%.Apple (AAPL) → Market capitalization of $3.45 trillion, price per share of $232.78, decreased by 0.24%.Amazon.com (AMZN) → Market capitalization of $2.46 trillion, price per share of $230.98, increased by 2.86%. Alphabet (GOOG) → $2.46 trillion market capitalization, $203.82 per share, increased by 0.39%.Borsa Istanbul Updates and Most Valuable CompaniesIn its third Inflation Report of the year, the Central Bank of the Republic of Turkey (CBRT) separated forecasts from "interim targets." Forecasts are subject to change as data becomes available, while interim targets will remain fixed unless an extraordinary situation arises. Today, the CBRT Market Participants Survey, budget balance, service and construction production indices, and private sector external debt data will be released. Following the US PPI's higher-than-expected performance, the BIST 100 fell 1.1% yesterday, led by major stocks and banks. A slight sell-off is expected today.QNB Finansbank (QNBTR) → $2.39 trillion market capitalization, $714.50 per share, decreased by 9.96%.Aselsan Electronics Industries (ASELS) → Market capitalization of 775.20 billion TL, price per share of 170.70 TL, increased by 0.41%.Turkey Garanti Bank (GARAN) → Market capitalization of 607.32 billion TL, price per share of 144.10 TL, decreased by 0.35%.Koç Holding (KCHOL) → Market capitalization of 450.38 billion TL, price per share of 177.80 TL, increased by 0.11%.Turkish Airlines (THYAO) → Market capitalization of 449.88 billion TL, price per share of 326.25 TL, increased by 0.08%.Precious Metals and Currency PricesGold: 4392 TLSilver: 50.29 TLPlatinum: 1778 TLDollar: 40.86 TLEuro: 47.72 TLWe look forward to bringing you the latest updates again tomorrow.

Citigroup Eyes Stablecoin and Crypto ETF Services

Wall Street giant Citigroup is preparing for a new move in the cryptocurrency market. Following regulatory clarity and supportive legislation introduced during the Trump era, the bank plans to offer custody services for stablecoin reserves and crypto ETFs.Citigroup's Head of Global Partnerships and Innovation, Biswarup Chatterjee, told Reuters that their initial focus will be on safekeeping "high-quality assets that back stablecoins." These assets include secure reserves such as US Treasury bonds and cash.A New Player in the Stablecoin and ETF MarketThe GENIUS Act, enacted in the US this year, mandated stablecoin issuers to hold secure and liquid assets to back their tokens. This has created new opportunities for traditional banks to offer institutional-scale custody services.In addition to stablecoin reserves, Citi also plans to offer custody services for cryptocurrency-backed exchange-traded funds (ETFs). Chatterjee said, “These ETFs require the safe storage of an equivalent amount of cryptocurrency to support them.”Spot Bitcoin ETFs have attracted significant interest since their approval in 2024. Currently, 12 spot Bitcoin ETF companies in the US hold approximately 1.3 million BTC. BlackRock’s iShares Bitcoin Trust fund alone manages approximately $88-90 billion in assets. Ethereum ETFs have also seen rapid influx in recent months. Instant Cross-Border Payment PlansIn addition to its custody services, Citigroup aims to use stablecoins for instant cross-border payments. The bank currently offers blockchain-based “tokenized” dollar transfers between accounts in New York, London, and Hong Kong. It is now working on direct transfers or instant conversion of stablecoins into dollars.Citi CEO Jane Fraser stated during the second-quarter earnings meeting in July that the bank is also evaluating the possibility of issuing its own stablecoin. Fraser said, “Most importantly, we are very active in the tokenized deposit space. Our goal is to securely deliver advancements in stablecoins and cryptocurrencies to our clients.”Competition is heating upCurrently, Coinbase provides custody for over 80% of US-listed crypto ETFs. Citigroup’s entry into this space could intensify competition in both the stablecoin and ETF custody markets. With a global network operating in over 160 countries and 200 million customers, the bank has the potential to bring significant institutional scale to the sector.US banking associations have called on Congress to prohibit affiliates of stablecoin issuers from paying interest to token holders. Bankers argue that such practices could accelerate deposit outflows and increase credit costs. Ultimately, Citigroup’s plans purport to raise institutional security standards in the cryptoasset ecosystem.

Was BtcTurk Hacked? Statement Released After Suspicious $50 Million Withdrawal

BtcTurk, one of Turkey's leading cryptocurrency exchanges, temporarily suspended cryptocurrency deposits and withdrawals today due to a technical issue with its hot wallets. The company stated that users would be notified when transactions reopened, and that trading, as well as Turkish Lira deposits and withdrawals, continued uninterrupted.The development came to light following findings by blockchain security firm CertiK. According to information shared by CertiK Alert, a total of over $50 million in cryptocurrency was withdrawn from three separate wallets identified as belonging to BtcTurk on August 14th. This raises the possibility of a potential security breach or system vulnerability.BtcTurk's statementIn its official statement, BtcTurk did not provide detailed information about the security of user funds, citing only a "technical issue with hot wallets." However, the exchange emphasized that trading and Turkish Lira transactions continued and that users could manage their assets. Hot wallets are known on cryptocurrency exchanges as wallets accessible via an internet connection and used for daily transactions. While these types of wallets offer the advantage of fast transfers, they are more vulnerable to cyberattacks than cold wallets. Therefore, such "suspicious exits" are of great importance to investors.The exchange stated that cryptocurrency deposits and withdrawals will be reopened once the technical issue is resolved, and that updates will be shared with users during this process. The source of the incident, whether it was a cyberattack or another technical issue, is not yet known.

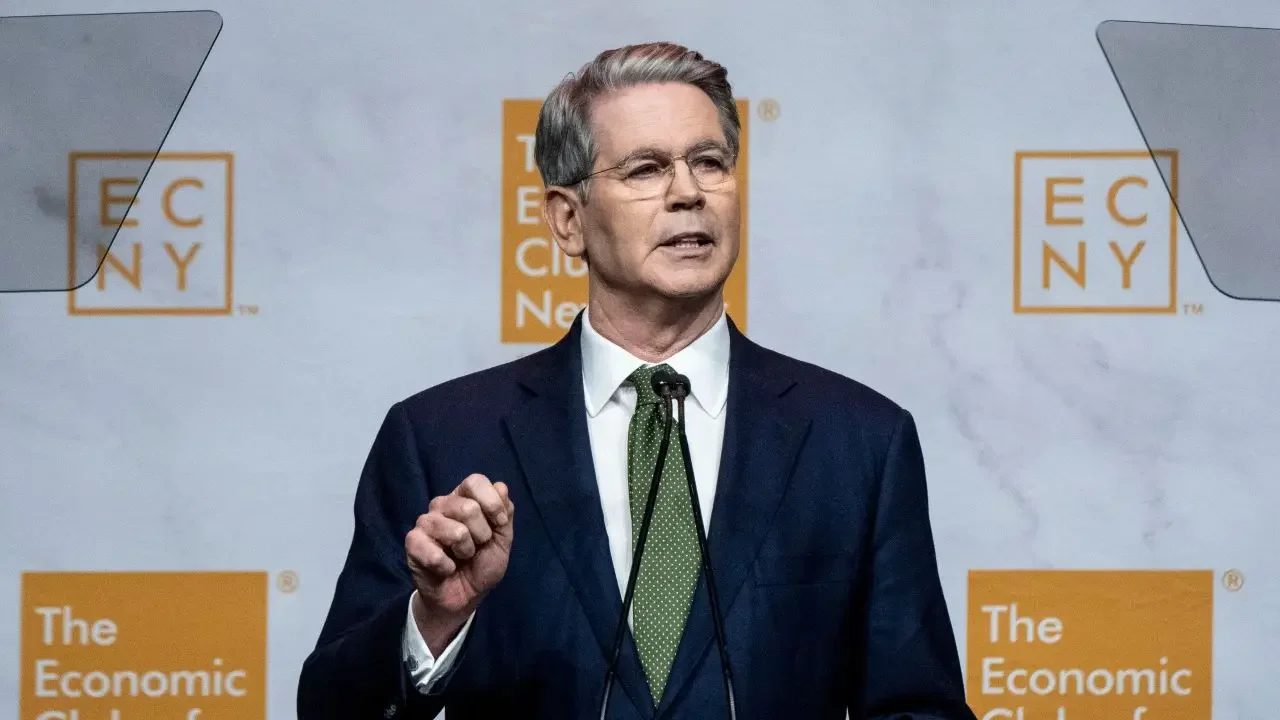

Bessent's Cryptocurrency and Economy Statements: Bitcoin Reserves Will Not Be Sold

In recent weeks, the crypto market agenda has been dominated by discussions of interest rate cuts, trade tariffs, and the global economy. New statements by US Treasury Secretary Bessent have added to this busy agenda. His remarks regarding Bitcoin reserves, in particular, have attracted investor attention.Bessent made it clear that the US does not plan to purchase new cryptocurrencies. Emphasizing that existing assets will be protected, the Secretary stated that seized cryptocurrencies will not be sold and that Bitcoin reserves are valued at between $15 billion and $20 billion. While this situation did not create immediate selling pressure in the market, it did reshape the expectations of crypto investors.In the past, Wyoming Senator Cynthia Lummis, a cryptocurrency-friendly politician, suggested converting the state's gold reserves into cash to purchase Bitcoin. However, Bessent's comments indicate that this idea is currently lacking support. Lummis's plan has not yet garnered sufficient political support.Interest Policy and Global TradeIn his speech, Bessent also shared his views on the Fed's interest rate cuts. He said the first step could be a cautious 25 basis point reduction, followed by an acceleration of this process. The Minister emphasized that a total reduction of approximately 1.5 points is required to reach a neutral level, and stated that he does not favor the Fed taking consecutive aggressive actions.On the trade front, he noted that Europe and India continue to import refined oil from Russia. He noted that August and September will be a critical period for customs duty revenues, stating that revenues could exceed $300 billion. He said these revenues alone have the potential to reduce the budget deficit to 5%.Bessent also touched on the competition between the US and China in chip production. He claimed that China has narrowed its room for maneuver with its own moves in this regard, stating that one of the US goals is to maximize value for taxpayers and the other is to reduce the interest rate differential between MBS and Treasury bonds. He also stated that gold will continue to be held as a safe store of value.Trump-Putin summit is expected.In addition to all these announcements, markets are also focused on the Trump-Putin meeting scheduled to take place tomorrow in Alaska. It's rumored that Putin is preparing to take a significant step regarding the Ukraine war, and Trump wants to take an active role in this process. Crypto investors are eagerly awaiting how the potential geopolitical consequences of this meeting will impact the markets.While Bessent's decision not to sell his Bitcoin reserves has eased uncertainty in the crypto market in the short term, interest rate policy, trade disputes, and global developments are expected to shape both digital assets and traditional markets in the coming months.

Daily Market Summary – August 14, 2025 | JrKripto

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin and Ethereum Technical OverviewBitcoin continues its volatile rise. Our ATH target in previous newsletters has been achieved. After breaking through the $123,100 region, it can be expected to reach the $127,000 area. In case of pullbacks, the $117,000 area will be closely monitored.Ethereum, on the other hand, has broken its downward trend from 2021, which we mentioned in previous newsletters. ETH's short-term potential has increased significantly following this breakout. The $4540 support and $4770 resistance levels are areas to be closely monitored.Crypto NewsBitMine filed to sell $20 billion worth of stock to acquire more ETH.Traders increased their positions anticipating the Fed's interest rate cut in September.SUI Network accidentally published and then deleted a blog post. The post stated that a listing announcement had been made on Robinhood. This likely indicates a premature release of a draft press release.Trump: He's considering filing a lawsuit against Powell over Fed building costs.SEC's Peirce: We're not waiting for legislation to work on crypto.Ethereum surpasses $4,500 for the first time since December 3, 2021!21Shares filed a revised S-1 form for the Sui ETF.Kazakhstan-based Fonte Capital introduced Central Asia's first Bitcoin ETF.CryptocurrenciesTop Gainers:OKB → Up 174.6% to $126.64FARTCOIN → Up 24.9% to $1.07QUBIC → Up 20.6% to $0.00000278DEEP → Up 15.6% to $0.17445165GT → Up 14.9% to $18.80Top Losers:PROVE → Down 15.3% to $1.43WEMIX → Down 7.8% to $0.79438738ZORA → Down 7.0% to $0.11173092ZBCN → Down 5.5% to $0.00488242B → Down 4.1% to $0.63282928Fear Index:Bitcoin: 71 (Greed)Ethereum: 51 (Neutral)Dominance:Bitcoin: 59.28% ▼ 0.69%Ethereum: 14.08% ▲ 1.78%Total Daily Net ETF InflowsBTC ETFs: $65.90 MillionETH ETFs: $523.90 MillionGlobal Markets and the Most Valuable Companies and Stock PricesThe US July CPI rose 0.2% month-over-month and remained unchanged at 2.7% year-over-year. The core CPI rose 0.3% month-over-month and 3.1% year-over-year. Housing prices rose, while energy prices fell 1.1%. The data's lack of expectations fueled expectations for a Fed interest rate cut. This led to buying in global stock markets. US and European futures are positive, with strong buying in Asia. Progress in trade talks and expectations for the Trump-Putin summit scheduled for Friday in Alaska are also supporting markets. The dollar index and US 2-year Treasury yields declined slightly, while the VIX index fell to its lowest level of the year at 14.73.NVIDIA (NVDA) → Market capitalization of $4.47 trillion, price per share of $183.16, increased by 0.60%.Microsoft (MSFT) → Market capitalization of $3.93 trillion, price per share of $529.24, increased by 1.43%.Apple (AAPL) → Market capitalization of $3.41 trillion, price per share of $229.65, increased by 1.09%.Alphabet (GOOG) → Market capitalization of $2.46 trillion, price per share of $204.16, increased by 1.25%. Amazon.com (AMZN) → Market capitalization of $2.36 trillion, price per share of $221.47, increased by 0.08%.Borsa Istanbul Updates and Most Valuable CompaniesThe current account deficit reached $2.0 billion in June. The 12-month current account deficit increased to $18.9 billion. Energy and gold imports contributed to the increase. The Treasury borrowed a total of 136.1 billion TL in the last two days. The BIST 100 fell 0.8% yesterday, with Aselsan and Tüpraş leading the decline. THY and Destek Finans Factoring limited losses. The Trump-Putin meeting and positive global sentiment may keep the BIST 100 slightly bullish today.QNB Finansbank (QNBTR) → Market capitalization of $2.95 trillion, price per share of $793.50, decreased by 9.98%.Aselsan Electronics Industries (ASELS) → Market value of 784.32 billion TL, price per share of 173.60 TL, increased by 0.93%.Turkey Garanti Bank (GARAN) → Market value of 614.46 billion TL, price per share of 147.20 TL, increased by 0.62%.Koç Holding (KCHOL) → Market value of 455.95 billion TL, price per share of 178.90 TL, decreased by 0.50%.Turkish Airlines (THYAO) → Market value of 440.91 billion TL, price per share of 319.75 TL, increased by 0.08%.Precious Metals and Currency PricesGold: 4377 TLSilver: 50.33 TLPlatinum: 1777 TLDollar: 40.73 TLEuro: 47.59 TL