A new era is dawning in the world of crypto mining and artificial intelligence. Google has increased its stake in Bitcoin miner TeraWulf to 14 percent, making it the company's largest shareholder. This move represents a milestone in combining crypto mining with AI infrastructure.

Google Provides $3.2 Billion in Backstops

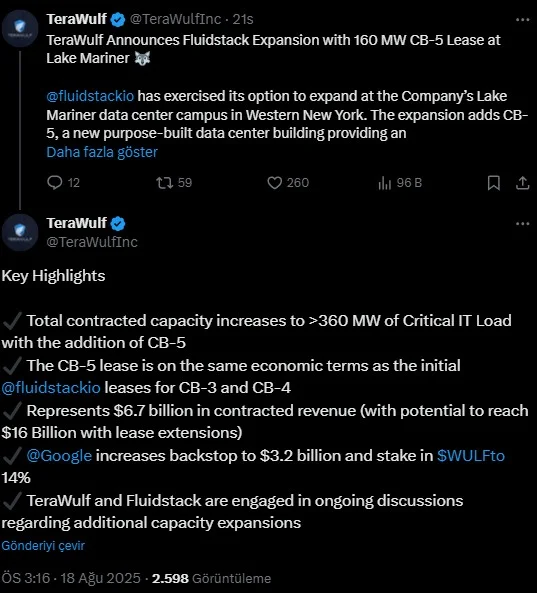

Google has provided a $3.2 billion backstop guarantee for TeraWulf's 10-year data center agreement with AI cloud provider Fluidstack. The agreement stipulates that if Fluidstack fails to meet its lease obligations, Google steps in. In return, the tech giant has acquired the right to purchase over 73 million TeraWulf shares, increasing its stake in the company to 14 percent.

TeraWulf executives are calling this move a strong endorsement. Kerri Langlais, the company's chief strategy officer, said the deal demonstrates confidence in TeraWulf's zero-carbon infrastructure and its ability to meet the demand for high-performance computing (HPC). The CB-5 data center will open in 2026.

This agreement includes the opening of a new data center at the Lake Mariner campus in New York. The facility, called "CB-5," is scheduled to be operational in the second half of 2026. The agreements with Fluidstack secure 360 MW of computing capacity. With this capacity, TeraWulf aims to become a major player not only in Bitcoin mining but also in artificial intelligence and HPC.

The company is projected to generate $6.7 billion in revenue from this partnership. It is reported that this figure could rise to $16 billion if the options are exercised.

Transformation from Mining to AI

Following the 2024 Bitcoin halving, block rewards dropped to 3,125 BTC, and mining revenues began to shrink. This situation has led the industry to turn to alternative revenue sources. TeraWulf is following this trend, maintaining Bitcoin mining to generate cash flow without completely abandoning it, while placing AI and HPC services at the center of its long-term growth strategy.

According to Langlais, Bitcoin mining is still valuable for "generating cash flow and balancing the power grid." However, the company's real growth story will be driven by long-term contracts with strong, corporate partners in AI and HPC services.

Investment giant VanEck estimates that if major mining companies shifted just 20% of their energy capacity to AI and HPC by 2027, the sector could generate approximately $14 billion in additional annual profits over the next 10 years. This clearly explains TeraWulf's shift.

This transformation is critical for the crypto mining industry, which has long struggled with shrinking profit margins. However, because AI infrastructure requires different hardware and optimizations than traditional mining, the transition is expected to be challenging. Nevertheless, with the support of giants like Google and Fluidstack, TeraWulf's future is promising for now.