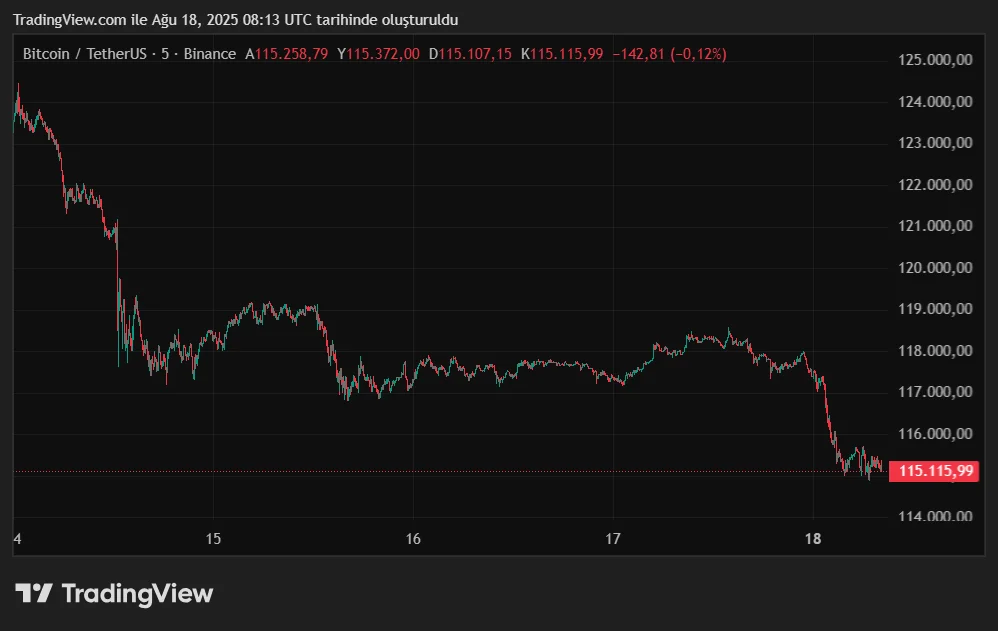

Last week, the price of Bitcoin fell from $124,000 to $118,000. This move led to liquidations exceeding $1 billion in futures markets. While this doesn't signal a reversal of the trend, it's believed to be a natural consequence of profit-taking. Selling pressure subsequently continued throughout the weekend. Bitcoin fell to $115,500 on Sunday night, while Ethereum fell to $4,330. Higher-than-expected inflation data from the US was particularly influential in this decline. While the data weakened the prospects for a September interest rate cut, it also fueled investor risk aversion. "High inflation is dampening interest rate cut hopes, strengthening the dollar, and reducing risk appetite in the crypto market," said Vincent Liu, CIO of Kronos Research.

Rise in Leveraged Trading

Meanwhile, leveraged trading in cryptocurrency markets is approaching bullish levels again. According to Galaxy Research's "State of Crypto Leverage" report, crypto-backed lending volume increased by 27% in the second quarter alone, reaching $53.1 billion. This was the highest level since the beginning of 2022. The increase in borrowing demand on DeFi platforms and the return of risk appetite contributed to the market's upward trend. However, this rise also highlights the market's fragility.

The Galaxy report also highlights stress points in the market. In July, massive outflows on Aave pushed ETH borrowing yields above Ethereum staking yields. This disrupted the widely used "looping" strategy and led to the rapid unwinding of staking positions. As a result, the outflow queue from the Ethereum Beacon Chain reached a record 13 days.

Furthermore, while USDC borrowing costs rose rapidly in over-the-counter markets, on-chain interest rates remained stable. The spread between on-chain and off-chain dollar markets reached its highest level since the end of 2024. According to analysts, this mismatch could further exacerbate volatility when liquidity tightens.

Although ETF inflows and institutional demand continue to support the market, analysts warn that rising credit volumes and liquidity imbalances are exacerbating the fragility. Indeed, the recent $1 billion liquidation demonstrated the double-edged impact of leveraged transactions.

All eyes on the Fed meeting

Further price action is now focused on US macro data. Analysts believe the Fed's Jackson Hole meeting this week and the unemployment claims data released on August 21 will play a critical role. BTC Markets analyst Rachael Lucas said, "Dovish messages from Jackson Hole could revitalize risk appetite. ETF inflows and institutional buying are also providing a floor to the market."

At press time, Bitcoin was trading at $115,245, a 1.8% drop. The coin has lost almost 5% of its value in the last seven days.