Coinbase Institutional's latest monthly market report suggests that September could mark the start of altcoin season in the cryptocurrency markets. The report highlights three key factors: a decline in Bitcoin dominance, increased market liquidity, and a rise in investor risk appetite.

Coinbase report fuels altcoin season expectations

Coinbase Institutional's monthly market report, published on August 14, predicts that September could mark the start of altcoin season in the cryptocurrency market. According to the report, the decline in Bitcoin's market dominance, improved liquidity conditions, and a rise in investor risk appetite could accelerate the shift of capital from BTC to altcoins in the coming weeks.

According to CoinMarketCap data, an altcoin season is defined as at least 75% of the 50 largest altcoins by market capitalization outperforming Bitcoin in the past 90 days. While this rate currently remains below this threshold, the total altcoin market capitalization has increased by more than 50% since the beginning of July, reaching $1.4 trillion. Bitcoin dominance, however, has fallen from 65% in May 2025 to 59%. According to Coinbase, this pattern provides early signs of a potential rotation that could lead to a full-scale altcoin season in September.

ETH and "beta" altcoins attract attention

The report notes that much of the recent surge in the altcoin market is linked to increased institutional interest in Ethereum (ETH). The accumulation of ETH by digital asset treasuries (DAT), combined with positive narratives surrounding stablecoins and real-world assets, is supporting demand. For example, Bitmine Immersion Technologies reportedly reached a total purchasing capacity of 1.15 million ETH with a new $20 billion fund.

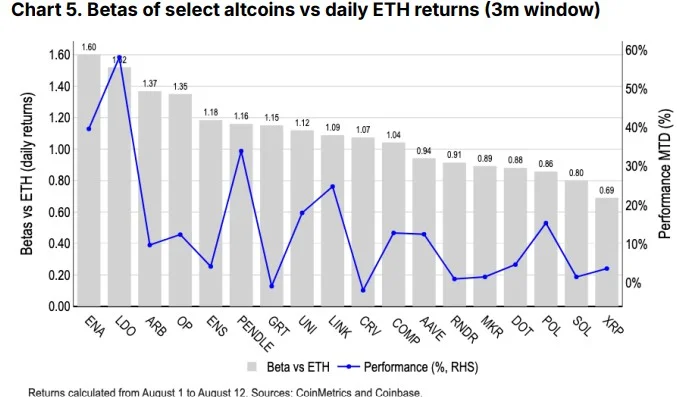

ARB, ENA, LDO, and OP stand out among altcoins that reacted to ETH price action with high beta. Beta indicates how volatile an asset's price movement is relative to the benchmark asset. A beta greater than 1 indicates that the price is more volatile than the benchmark asset, meaning it may move more sharply during both ups and downs. Among this group, only LDO has clearly benefited from the ETH rally, with a 58% increase since the beginning of August.

LDO's performance was influenced by the US Securities and Exchange Commission's (SEC) statement on August 5th that liquid staking tokens are not considered securities under certain conditions.

Macro Environment and Liquidity Support

Coinbase predicts that the Fed interest rate cuts expected in September and October could draw some of the record $7.2 trillion currently held in money market funds into the crypto market. The recovery in spot and derivative trading volumes, order book depth, and stablecoin supply in recent weeks is also facilitating entry and exit from the altcoin market. “The decline in Bitcoin dominance and the increase in altcoin market capitalization, combined with investors’ desire to shift to riskier assets, could initiate a capital rotation process that could turn into a mature altcoin season in September,” the report stated.