Wall Street giant Citigroup is preparing for a new move in the cryptocurrency market. Following regulatory clarity and supportive legislation introduced during the Trump era, the bank plans to offer custody services for stablecoin reserves and crypto ETFs.

Citigroup's Head of Global Partnerships and Innovation, Biswarup Chatterjee, told Reuters that their initial focus will be on safekeeping "high-quality assets that back stablecoins." These assets include secure reserves such as US Treasury bonds and cash.

A New Player in the Stablecoin and ETF Market

The GENIUS Act, enacted in the US this year, mandated stablecoin issuers to hold secure and liquid assets to back their tokens. This has created new opportunities for traditional banks to offer institutional-scale custody services.

In addition to stablecoin reserves, Citi also plans to offer custody services for cryptocurrency-backed exchange-traded funds (ETFs). Chatterjee said, “These ETFs require the safe storage of an equivalent amount of cryptocurrency to support them.”

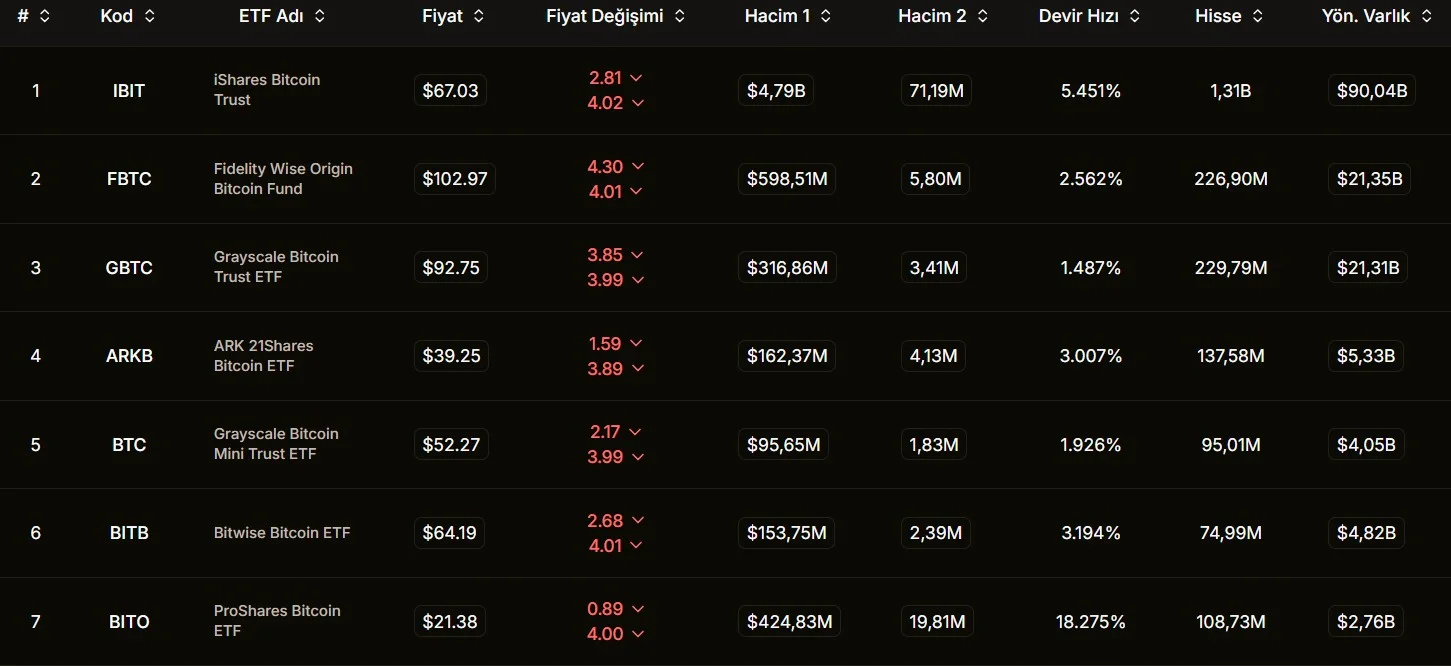

Spot Bitcoin ETFs have attracted significant interest since their approval in 2024. Currently, 12 spot Bitcoin ETF companies in the US hold approximately 1.3 million BTC. BlackRock’s iShares Bitcoin Trust fund alone manages approximately $88-90 billion in assets. Ethereum ETFs have also seen rapid influx in recent months.

Instant Cross-Border Payment Plans

In addition to its custody services, Citigroup aims to use stablecoins for instant cross-border payments. The bank currently offers blockchain-based “tokenized” dollar transfers between accounts in New York, London, and Hong Kong. It is now working on direct transfers or instant conversion of stablecoins into dollars.

Citi CEO Jane Fraser stated during the second-quarter earnings meeting in July that the bank is also evaluating the possibility of issuing its own stablecoin. Fraser said, “Most importantly, we are very active in the tokenized deposit space. Our goal is to securely deliver advancements in stablecoins and cryptocurrencies to our clients.”

Competition is heating up

Currently, Coinbase provides custody for over 80% of US-listed crypto ETFs. Citigroup’s entry into this space could intensify competition in both the stablecoin and ETF custody markets. With a global network operating in over 160 countries and 200 million customers, the bank has the potential to bring significant institutional scale to the sector.

US banking associations have called on Congress to prohibit affiliates of stablecoin issuers from paying interest to token holders. Bankers argue that such practices could accelerate deposit outflows and increase credit costs. Ultimately, Citigroup’s plans purport to raise institutional security standards in the cryptoasset ecosystem.