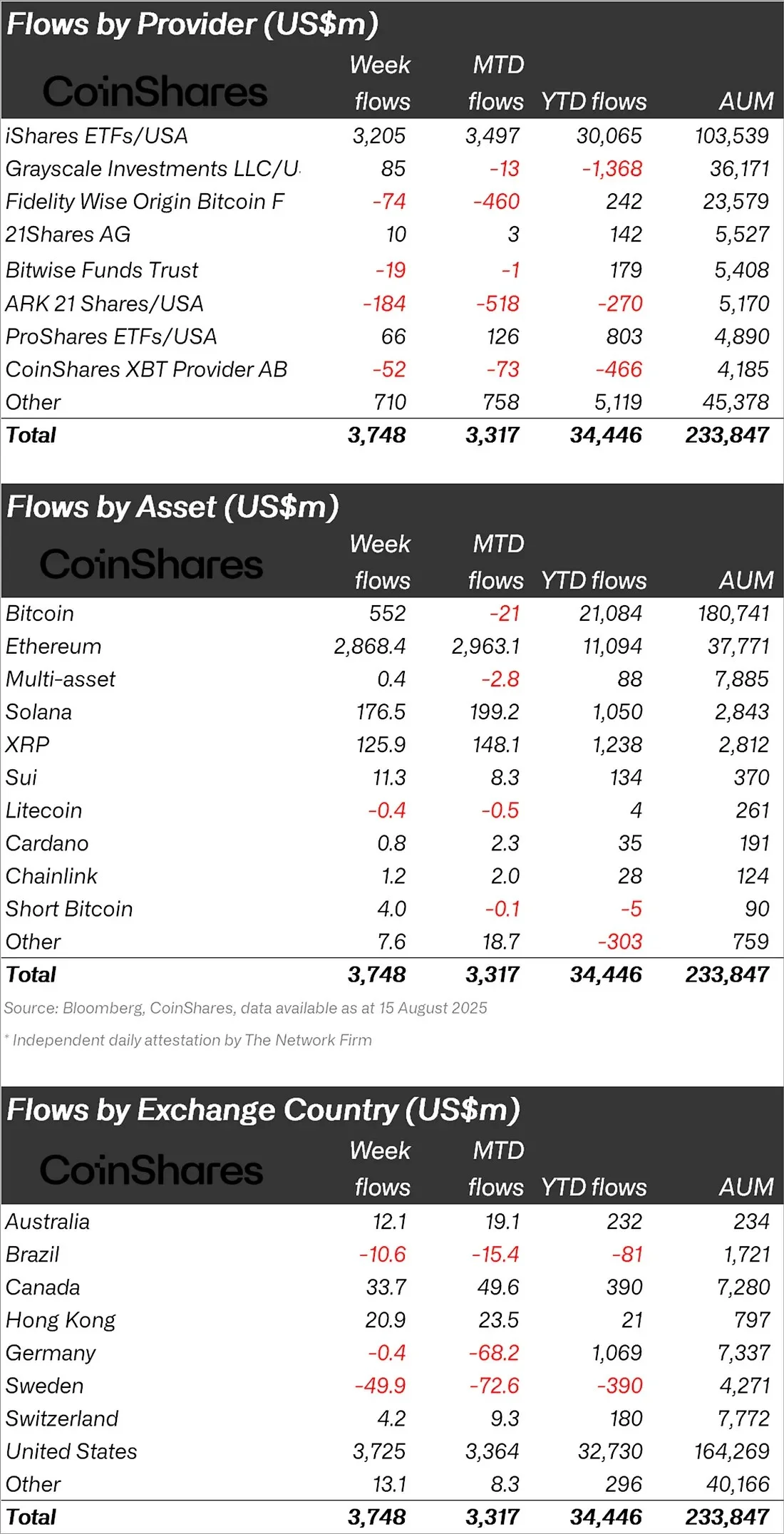

According to CoinShares' weekly crypto fund report, a total of $3.75 billion in inflows into crypto investment products occurred last week. This figure is notable as the fourth-highest weekly inflow on record for crypto funds. This brings total assets under management (AuM) to an all-time high of $244 billion.

Record inflows for Ethereum

The biggest gainer of the week was clearly Ethereum (ETH). With $2.87 billion in inflows in just one week, ETH alone accounted for 77% of the total weekly inflows. Ethereum's inflows since the beginning of the year reached an all-time high of $11 billion. This data demonstrates that Ethereum, which has proportionally surpassed Bitcoin, is becoming an increasingly attractive alternative for investors.

Bitcoin Remains More Modest

The picture for Bitcoin (BTC) is quieter. Weekly inflows reached $552 million, bringing total inflows since the beginning of the year to $21 billion. While this figure appears strong, Bitcoin's ratio of assets under management (11.6%) lags behind Ethereum's.

Solana and XRP emerged as standouts on the altcoin front

Notable developments also occurred on the altcoin front.

- Solana (SOL): Proving continued investor interest with $176.5 million in weekly inflows.

- XRP: Had a strong week with $125.9 million inflows.

- Sui (SUI): Recorded $11.3 million inflows.

- Conversely, Litecoin (LTC) and Toncoin (TON) outflows of $0.4 million and $1 million, respectively, were the projects that diverged negatively.

iShares Leads Funding Providers

According to the data in the image, iShares/USA held the largest share among funders. With $3.2 billion inflows last week alone, iShares accounted for almost all of the total inflows. Other providers stood out with relatively limited figures:

- Grayscale: $85 million inflow

- ProShares: $66 million inflow

- ARK 21 Shares: $184 million outflow

- Fidelity: $74 million outflow

Regional breakdown: US leads the pack

In terms of geographic breakdown, the US market alone accounted for 99% of the total volume, with $3.73 billion inflow. Other regions saw smaller inflows:

- Canada: $33.7 million

- Hong Kong: $20.9 million

- Australia: $12.1 million

- On the other hand, Brazil (-$10.6 million) and Sweden (-$49.9 million) were the regions with negative outflows.

Recent data shows that institutional investors' interest in crypto continues to grow, with Ethereum, in particular, taking the lead. While Bitcoin still maintains its market leadership, the strong performance of altcoins Solana and XRP is particularly noteworthy.