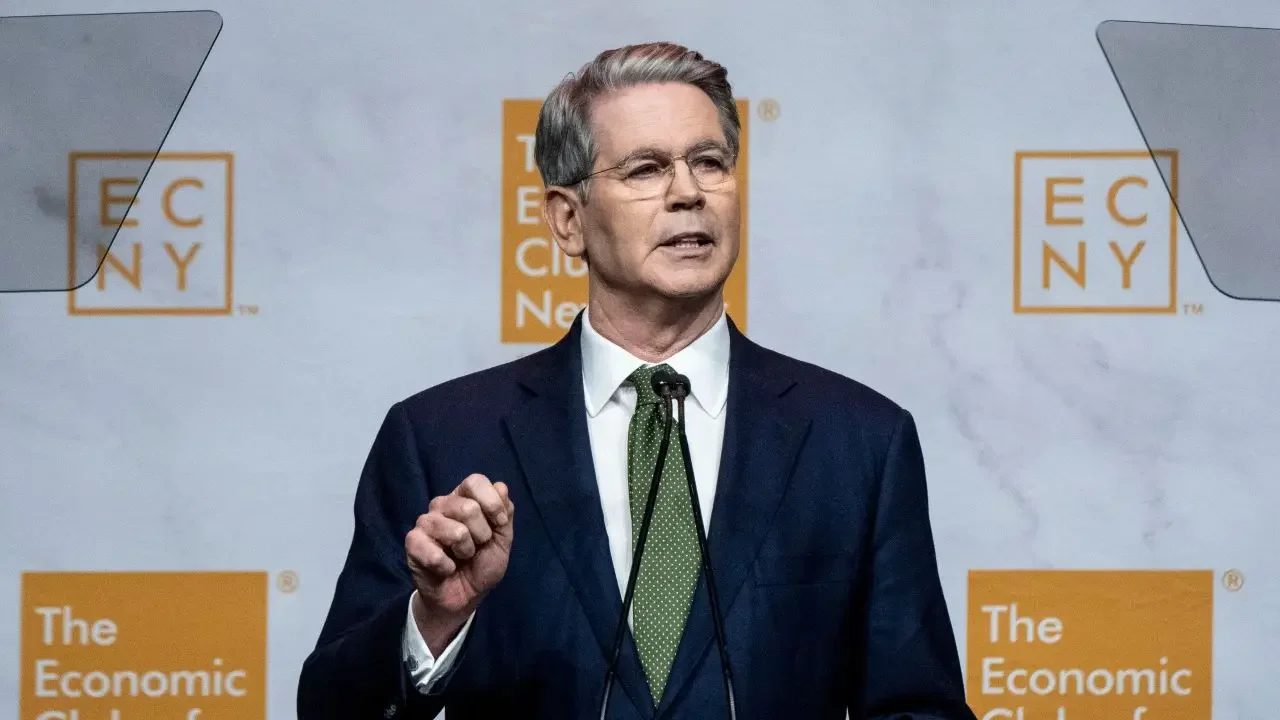

In recent weeks, the crypto market agenda has been dominated by discussions of interest rate cuts, trade tariffs, and the global economy. New statements by US Treasury Secretary Bessent have added to this busy agenda. His remarks regarding Bitcoin reserves, in particular, have attracted investor attention.

Bessent made it clear that the US does not plan to purchase new cryptocurrencies. Emphasizing that existing assets will be protected, the Secretary stated that seized cryptocurrencies will not be sold and that Bitcoin reserves are valued at between $15 billion and $20 billion. While this situation did not create immediate selling pressure in the market, it did reshape the expectations of crypto investors.

In the past, Wyoming Senator Cynthia Lummis, a cryptocurrency-friendly politician, suggested converting the state's gold reserves into cash to purchase Bitcoin. However, Bessent's comments indicate that this idea is currently lacking support. Lummis's plan has not yet garnered sufficient political support.

Interest Policy and Global Trade

In his speech, Bessent also shared his views on the Fed's interest rate cuts. He said the first step could be a cautious 25 basis point reduction, followed by an acceleration of this process. The Minister emphasized that a total reduction of approximately 1.5 points is required to reach a neutral level, and stated that he does not favor the Fed taking consecutive aggressive actions.

On the trade front, he noted that Europe and India continue to import refined oil from Russia. He noted that August and September will be a critical period for customs duty revenues, stating that revenues could exceed $300 billion. He said these revenues alone have the potential to reduce the budget deficit to 5%.

Bessent also touched on the competition between the US and China in chip production. He claimed that China has narrowed its room for maneuver with its own moves in this regard, stating that one of the US goals is to maximize value for taxpayers and the other is to reduce the interest rate differential between MBS and Treasury bonds. He also stated that gold will continue to be held as a safe store of value.

Trump-Putin summit is expected.

In addition to all these announcements, markets are also focused on the Trump-Putin meeting scheduled to take place tomorrow in Alaska. It's rumored that Putin is preparing to take a significant step regarding the Ukraine war, and Trump wants to take an active role in this process. Crypto investors are eagerly awaiting how the potential geopolitical consequences of this meeting will impact the markets.

While Bessent's decision not to sell his Bitcoin reserves has eased uncertainty in the crypto market in the short term, interest rate policy, trade disputes, and global developments are expected to shape both digital assets and traditional markets in the coming months.