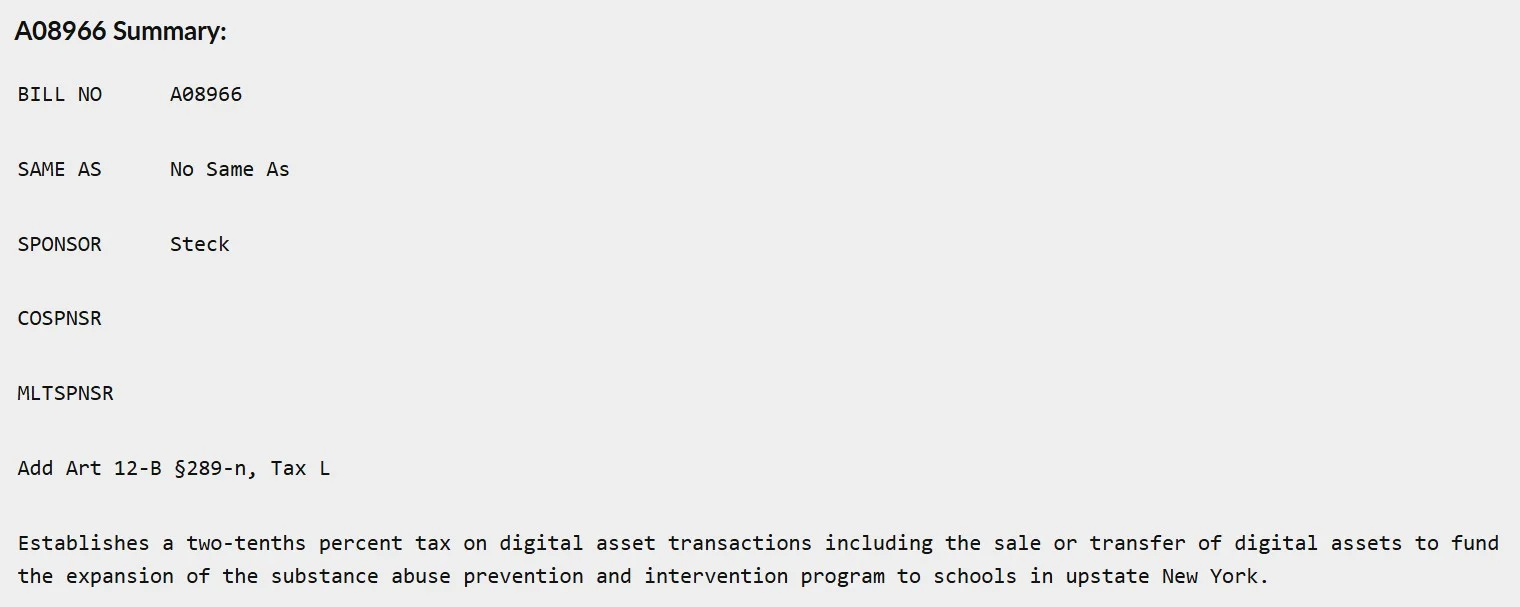

New York State Assembly member Phil Steck has introduced a new bill that would impose a 0.2% excise tax on all digital asset transactions (including cryptocurrencies and NFTs). The proposal, codenamed "Assembly Bill A08966," was introduced on August 13 and referred to the Ways and Means Committee. If approved, the bill would take effect on September 1, 2025.

According to the bill, the proceeds would be used to expand substance abuse prevention and treatment programs in schools in northern New York. The bill covers all digital assets created or transferred using distributed ledger or blockchain technology. This definition includes cryptocurrencies such as Bitcoin and Ethereum, as well as stablecoins and NFTs.

Who is responsible for the tax?

The law defines tax liability as the "person or persons making the sale or transfer." This could create compliance issues, particularly for exchanges, individual investors, and DeFi protocols. For example, if $10,000 of Bitcoin is sold, a $20 tax will be payable. However, the amount is not considered astronomical.

New York's strict stance on the crypto market has been a topic of discussion before. The implementation of the BitLicense in 2015 led to the withdrawal of many companies from the state. This new tax proposal could push New York closer to being one of the strictest states in the US in terms of crypto regulations.

Crypto Taxation Approaches Around the World

Crypto taxation policies vary considerably around the world. While China completely bans cryptocurrency transactions, countries like Switzerland and Singapore offer flexible legal frameworks that encourage innovation. In the European Union, the MiCA regulation, which came into effect in 2025, imposes strict licensing and compliance requirements on crypto asset service providers.

Some countries, however, are implementing different tax incentive methods. For example, Thailand exempts crypto profits earned on licensed platforms from income tax from 2025 until 2029. While not directly taxed, over 1 billion baht in additional revenue is expected from indirect economic activities.

Meanwhile, Indonesia generated $38 million in revenue from crypto taxes in 2024, but this figure decreased to $6.97 million in the first seven months of 2025 due to market volatility. Japan, on the other hand, imposes an income tax of up to 55% on crypto earnings. According to research by the Japan Blockchain Association, 84% of existing investors say they would invest more if the tax were reduced to a flat 20%.

The Trump administration pursued a crypto-friendly policy by removing DeFi broker rules in 2025 and easing strict oversight during the Biden administration. However, since tax policies in the US are largely at the discretion of individual states, New York's move could serve as a model for other states.