News

Bitcoin News

Bitcoin News

Browse all Bitcoin related articles and news. The latest news, analysis, and insights on Bitcoin.

SEC Takes Historic Step for ETFs: Cryptocurrency Trading Period Begins

The U.S. Securities and Exchange Commission (SEC) has made a critical decision for cryptocurrency markets. It has greenlit "in-kind" transactions, meaning the creation and redemption of cryptocurrencies directly, for Bitcoin and Ethereum spot ETFs. This development offers significant flexibility in the sector's operations compared to the period when spot ETFs, approved in early 2024, were limited to cash transactions only.This decision, taken by the SEC's vote on July 29th, is expected to reduce costs, increase liquidity, and provide tax advantages for both ETF issuers and institutional investors. Commission Chairman Paul S. Atkins stated after the vote, "Developing a fit-for-purpose regulatory framework for cryptocurrency markets is one of my top priorities. These decisions will contribute to lower cost and more efficient investment products." The image in the X post shared by Atkins regarding the subject. Traditional ETF mechanism brought to crypto"In-kind" transactions have been used for years in traditional stock and commodity ETFs. In this system, authorized participants can create or redeem ETF shares directly in exchange for the underlying asset. For example, in gold ETFs, this mechanism allows investors to purchase ETF shares instead of physical gold, or to redeem shares to receive gold.With the SEC extending this practice to crypto ETFs, ETF companies will now be able to directly purchase or deliver the underlying asset, Bitcoin or Ethereum. This will largely eliminate issues such as price fluctuations, transaction delays, and high costs associated with cash transactions.The decision also introduces a significant tax advantage for investors. In cash redemptions, the issuing ETF is required to liquidate the fund by selling the underlying asset, resulting in capital gains that are passed on to investors. However, in in-kind redemptions, the investor will purchase Bitcoin or Ethereum directly, leaving the sale decision entirely at their discretion. This will defer taxation.Furthermore, this flexibility will enable market makers and fund managers to better manage liquidity. Results such as narrowing spreads, increased trading volume, and enhanced market depth are expected. Experts note that this development could trigger new institutional inflows into ETF products. The SEC's decision also aligns with the US's attempt to catch up with international developments. Hong Kong initially allowed in-kind transactions in the Bitcoin and Ether ETFs it launched in April 2024. In some jurisdictions, such as Ontario, Canada, this flexibility was not initially granted. However, the clarity in Hong Kong and the SFC's requirement to work with licensed crypto exchanges ensured the system's smooth operation from the outset.On the US side, the process was challenging. Even within the SEC, this strict approach was criticized. Commissioner Mark Uyeda, during the January 2024 approval process for spot Bitcoin ETFs, stated that "approaching crypto with such caution while the same transaction is standard for physical gold-backed ETFs is a double standard," stating that the decision set a "worrying precedent."The ETF market and the crypto sectorThe approval of spot Bitcoin ETFs in early 2024 led to significant growth in the sector. These products, which have reached billions of dollars in assets under management, have seen their transaction volume increase, while new applications have also accelerated. The SEC's latest move could lead to a more flexible and investor-friendly structure for both approved products and future fund applications.

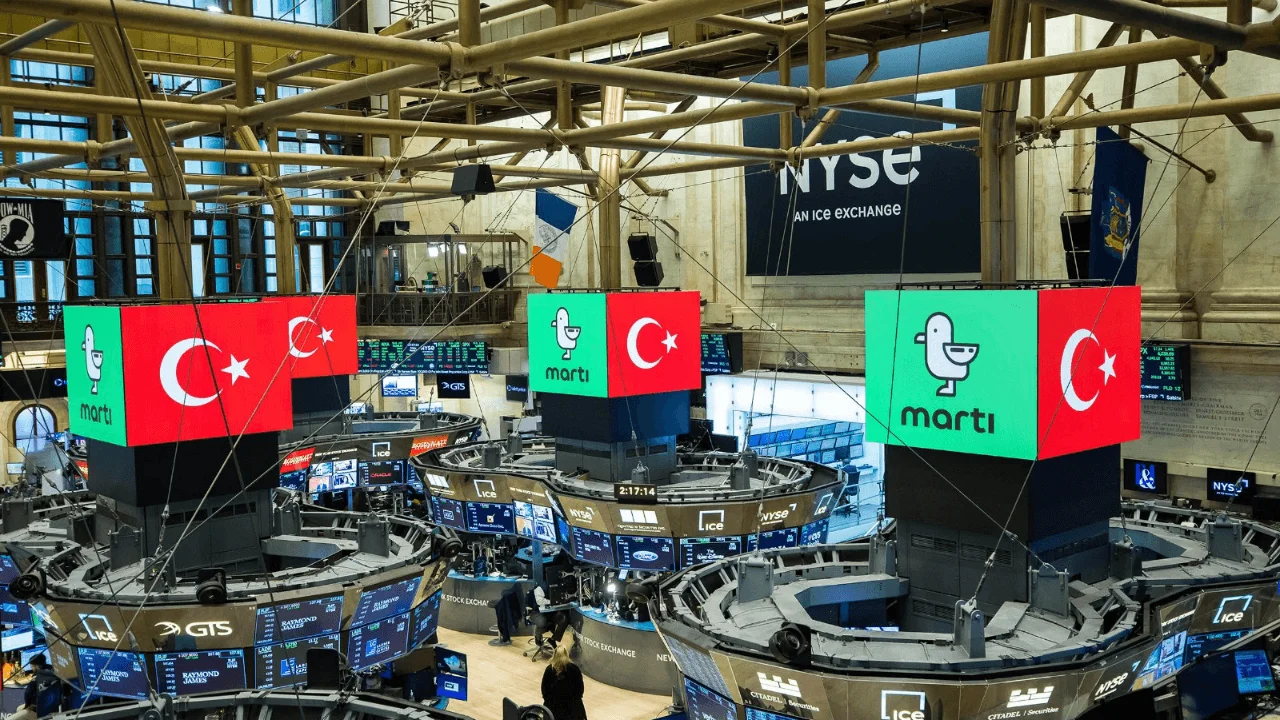

NYSE-Listed Martı Makes Crypto Treasury Move: Invest in Bitcoin, Altcoins Next

Martı Technologies (MRT), a Turkey-based mobility startup listed on the NYSE, has taken a significant step that challenges traditional treasury management approaches. The company announced that it will allocate 20% of its cash reserves to Bitcoin, integrating crypto assets into its corporate treasury strategy. With this move, Martı has become one of the companies that view crypto assets not only as a speculative tool but also as a long-term store of value and a shield against financial risks.Cryptocurrency investments could reach up to 50%The company announced that the crypto asset ratio could be increased to 50% over time. It was also stated that this potential increase may not be limited to Bitcoin; other leading crypto assets such as Ethereum and Solana could also be included in Martı's reserves in the future. All digital assets will be securely stored through platforms that provide institutional-grade custody services in compliance with regulations. Martı Founder and CEO Oğuz Alper Öktem summarizes the motivation behind this strategy:“Our decision to allocate capital to crypto assets demonstrates our belief that Bitcoin and other digital assets have proven their store of value alongside hard currencies and gold over the past few years. This strategy represents a prudent and long-term stance in the current economic environment, where we face inflationary pressures and currency risks.”The company emphasized that this move will not disrupt its current operations or business plans. It was stated that crypto asset purchases will be made from excess cash reserves and will not impact operational expenses. It also announced that future digital asset transactions will be announced transparently, in accordance with legal requirements.The company announced that it had reached 2.15 million passengers and 314,000 registered drivers as of June 3, 2025. This represents a 12.7% increase in passengers and an 8.3% increase in drivers in just two months. Martı's fleet consists of micromobility vehicles such as electric scooters, bicycles, and mopeds, operating in major cities across Turkey. The company plans to expand its presence from major cities like Ankara, Istanbul, Izmir, and Antalya to include Konya, Kayseri, Bursa, Mersin, Adana, and Kocaeli. With this expansion, Martı aims to increase its potential user base from 28.8 million to 42 million.Co-founder Cankut Durgun was appointed Chief Operating Officer as of June 12, 2025. Cenk Özeker, with over 25 years of experience, has also joined the new Chief Financial Officer.As a result, this move marks Martı Technologies' inclusion among publicly traded companies, joining giants like MicroStrategy, Tesla, and Blockchain, in incorporating crypto into their balance sheets.

SEC Postpones Trump's Bitcoin ETF Until September: INJ and SOL ETF Applications on the Table

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on the Truth Social Bitcoin ETF, filed in June by Trump Media & Technology Group. This ETF, offered by the company, which operates the Truth Social platform, aims to offer investors direct exposure to Bitcoin through a publicly traded fund structure.In a statement, the SEC stated that it needed more time to evaluate the proposed ETF and announced that the review period has been extended until September 18th. The agency's official statement read, "The Commission has determined that a longer period is appropriate to consider the proposed rule change and the issues it raises."The Truth Social Bitcoin ETF is just one of many noteworthy crypto products recently being offered to the U.S. market. However, the primary reason this fund stands out is its direct connection to former U.S. President Donald Trump. Trump frequently posts on Truth Social and has not been shy about publicly expressing his interest in digital assets. Besides the Truth Social Bitcoin ETF, other Trump-linked crypto ventures are also showing a notable increase. Various meme coin projects bearing Trump's name are gaining market share, while World Liberty Financial, a DeFi project allegedly backed by figures close to the Trump family, is also making headlines.The SEC's cautious approach continues: Applications also received for INJ and SOLThe SEC's cautious approach to ETF applications is noteworthy. The commission is meticulously reviewing ETF applications related not only to Bitcoin but also to leading tokens like Ethereum and Solana. The regulator prioritizes investor protection while fostering innovation. This balancing act often leads to lengthy decision-making processes. On the same day, Cboe BZX also filed a formal application with the SEC for the Canary Staked INJ ETF, which will track Injective's native token, INJ. Canary Capital Group, the ETF sponsor, first introduced the product earlier this month. On the same day, an application was also submitted for the Solana ETF, developed in partnership with Invesco and Galaxy.

Daily Market Summary with JrKripto July 29, 2025

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin is starting the new week in the accumulation zone. We mentioned the importance of the $117,900 level in our previous newsletters. It continues to trade above this level. On the downside, the key support level stands at $111,800. In a potential upward move, the trend resistance near the $122,000 region could be the next target.Ethereum has broken out of the short-term parallel channel structure and is currently trading in the downtrend zone that has been in effect since 2021. After a sharp rally toward the $3,950 region, ETH has entered this trend zone. A breakout here could pave the way for notable gains. In the event of a pullback, the $3,500 level is expected to serve as support.Crypto NewsUAE credit institution RAKBANK will begin offering crypto services to its retail customers through Bitpanda.Invesco Galaxy has applied for the Solana ETF with the CBOE. Interactive Brokers, a brokerage firm with $600 billion in client assets, is considering introducing 24/7 stablecoin and cryptocurrency deposits into its investment accounts.Trump: Powell will be gone soon. I will miss him.PayPal allows US businesses to accept payments in more than 100 cryptocurrencies.Financial firm Mill City Ventures will acquire $441 million worth of $SUI tokens, transitioning to a crypto treasury strategy.The strategy firm made no new Bitcoin purchases last week.CryptocurrenciesTop Gainers:CFX → Up 38.3% to $0.25899976ZBCN → Up 20.0% to $0.00508004KTA → Up 12.2% to $1.21CKB → Up 10.7% to $0.00657596QUBIC → Up 10.1% to $0.00000245Top Losers:TKX → Down 37.5% to $5.77USELESS → Down 17.4% to $0.32020474CVX → Down 15.5% to $4.75FARTCOIN → Down 14.8% to $1.18PUMP → Down 12.6% to $0.00241791.Fear Index:Bitcoin: 74 (Greed)Ethereum: 63 (Greed)Dominance:Bitcoin: 61.52% ▲ 0.19%Ethereum: 11.90% ▼ 0.68%Total Daily Net ETF InflowsBTC ETFs: $157.10 MillionETH ETFs: $65.20 MillionGlobal MarketsGlobal risk appetite started the week cautiously. Trump's 15% tariff announcement against the EU created short-term market activity, but its impact was limited. US futures are slightly higher this morning. Markets remain cautious ahead of tomorrow's Fed and Thursday's BOJ interest rate decisions.As the critical August 1st deadline approaches, the US's extension of the tariff ceasefire with China and the start of a third round of talks are easing trade uncertainty. Although markets opened strongly yesterday following the agreement with the EU, they closed slightly lower due to criticism from European leaders. The VIX index remains low at 15.03.Today, US consumer confidence, housing prices, and job openings will be monitored. The ECB's June Consumer Expectations Survey will also be released.Most Valuable Companies and Stock PricesNVIDIA (NVDA) → $4.31 trillion market capitalization, $176.75 per share, up 1.87%.Microsoft (MSFT) → $3.81 trillion market capitalization, $512.50 per share, down 0.24%. Apple (AAPL) → $3.2 trillion market capitalization, $214.05 per share, increased by 0.08%.Amazon.com (AMZN) → $2.47 trillion market capitalization, $232.79 per share, increased by 0.58%.Alphabet (GOOG) → $2.33 trillion market capitalization, $193.42 per share, decreased by 0.34%.Borsa IstanbulJuly sectoral inflation expectations were announced. 12-month ahead inflation expectations fell to 23.4% among market participants and 39% in the real sector, while household expectations rose to 54.5%. According to TİM's June report, the export demand index decreased by 0.6% month-on-month and 0.5% year-on-year to 99.8, remaining below the long-term average. The BIST100 index closed down 0.9% yesterday, driven by sales in banking, defense, aviation, and holding stocks. In a week marked by financial statements, Tofaş and Medikal Park reported net profits above expectations, while Türk Traktör increased its profit despite weak results. Results from Akbank, Tüpraş, Aygaz, TAV, and Otokar will be released today. The BIST100 is expected to open the day with a slight gain, in line with international markets.Companies with the Highest Market Value on Borsa IstanbulQNB Finansbank (QNBTR) → Market capitalization of 1.31 trillion TL, price per share of 400.00 TL, increased by 2.56%.Aselsan Elektronik Sanayi (ASELS) → Market capitalization of 826.73 billion TL, price per share of 178.2 TL, decreased by 1.71%. Türkiye Garanti Bankası (GARAN) → Market capitalization of 576.24 billion TL, price per share of 138.9 TL, increased by 1.24%.Koç Holding A.Ş. (KCHOL) → Market capitalization of 432.37 billion TL, price per share of 171.2 TL, increased by 0.41%.Enka İnşaat ve Sanayi A.Ş. (ENKAI) → Market capitalization: 405.64 billion TL, price per share: 67.10 TL, decreased by 3.03%.Precious Metals and Currency PricesGold: 4326 TLSilver: 49.81 TLPlatinum: 1803 TLDollar: 40.57 TLEuro: 47.03 TLWe look forward to bringing you the latest updates again tomorrow.

BTC.D Comment and Price Analysis July 28, 2025

Bitcoin Dominance Cycle: Altcoin Bull Runs Occur SystematicallyThe pattern on the chart on a monthly time frame shows the BTC dominance cycle that has been forming since 2016. This isn't just a chart but a system precisely showing the structural conditions and technical triggers initiating three separate altcoin bull runs. Different coins flourished in each cycle, but the triggering structure was always the same. And now, the 2025 altcoin rally is at the threshold where that structure re-forms, counting the days until it begins.Every one of the major peak formations for BTC.D has been the starting point for subsequent altcoin bull runs. These peaks occurred both when downward resistance trends rejected and when oscillators like the MACD and RSI showed signs of deterioration. The 2017 and 2021 altcoin bull runs were built on these structures. And now, the same scenario is being repeated for 2025. Bitcoin Dominance Cyclical Pattern: Three Bulls, Three Rejections, Three OpportunitiesThe dominance chart has a distinct descending wedge structure over a long period. Each peak formed lower than the previous one. At the 2017 peak, dominance was approximately 72%. The 2021 peak was limited to 70%. The 2025 peak was rejected around 65%. This is a cyclical scenario based not only on price but also on timing and momentum.In 2017, 2021, and now 2025, the price hits this descending trendline, gets rejected, and then the altcoin bull run begins. This isn't just a historical coincidence. From a technical perspective, the declines following these breakouts led to a decline in BTC dominance and booms in altcoins, resulting in out-of-market returns.After each rejection, dominance fell to the 42–45% range. If the same thing happens again, and structurally all conditions are the same, it is not at all unlikely that BTC.D will ease to this band again and altcoins will rally between 300% and 1000% in the meantime.MACD: 3 Triggers, 3 Bullish CrossingsThe MACD data in the bottom panel has shown the same signal in 2017, 2021, and now 2025: The MACD line crossed on the monthly chart, initiating a transition into the red zone. This signal perfectly timed the periods in the previous two cycles when BTC dominance declined and altcoin bullish activity began.This is the third time the same pattern has formed. Such oscillator signals are rare in the long term, and when they do occur, especially on monthly charts, the probability of coincidence is almost zero. The MACD has now turned red for the third time. The result of the previous two red crossovers has been the inflow of millions of dollars of new capital into altcoins.RSI: Uptrend Broken, Selling Pressure BeginsThe ascending trend line that has been forming on the RSI since 2021 has been broken this month. The RSI rejected before reaching 70 and dropped below 60. This indicates that momentum is weakening and that BTC dominance no longer has the strength to fuel upward momentum.We saw this pattern in 2017 and 2021. The RSI failed to peak, broke below, the dominance declined, and the altcoin season began. The same pattern is being redrawn in 2025.2025 Scenario: Altcoins Will Explode in a Few MonthsIf the pattern repeats, BTC.D will decline to the 42–45% range. During this period, total market capitalization will expand, Bitcoin will plateau or decline slightly, and altcoins will begin to price in a chain fashion.In this cycle, large-cap altcoins like ETH, SOL, and XRP will first gain prominence. L2 tokens, AI coins, and low-cap Layer-1s will follow. Barring a macroeconomic shock, all technical signals suggest a chain capital rotation is imminent. This season is consistent not only with the chart but also with time. The previous two altcoin bull runs began with BTC.D hitting this resistance line, and now the third crash has occurred.Bitcoin dominance is not only technically reversing but also completing its cyclical nature. The MACD, RSI, and price structure are all converging on one point: BTC.D will fall. This decline will herald a new season of expansion in the cryptocurrency market.

Crypto Markets Hold Their Breath: Fed's Interest Rate Decision Could Set Direction This Week

Crypto markets are holding their breath in anticipation of the Fed's interest rate decision in the final days of July. The decision from the Federal Open Market Committee (FOMC) meeting, scheduled for July 29-30, could profoundly impact not only traditional markets but also the crypto asset universe. While the market is expected to hold interest rates steady, analyst Paul Barron's "surprise rate cut" scenario has piqued the interest of crypto investors.Could a July rate cut send crypto soaring?Crypto analyst and media host Paul Barron, in a statement on X (formerly Twitter), suggested that an unexpected interest rate cut in July could trigger sharp increases in risky asset classes such as stocks, real estate, and cryptocurrencies. Although markets have only priced in a 24% chance of a rate cut at this meeting, Barron believes such a surprise move could inject new momentum into the bull market. According to Barron, a sudden interest rate cut could lower borrowing costs, particularly driving value into growth-focused technology stocks and cryptocurrencies. The analyst, noting that the S&P 500 has performed strongly in similar scenarios in the past, stated that crypto assets like XRP and ADA could also benefit from this headwind.Deaton's support: The crypto market could boomJohn E. Deaton, a leading figure in the crypto market, also made a statement echoing Barron's. Deaton stated that if Fed Chair Jerome Powell cuts interest rates, crypto assets could see a significant price appreciation. These statements reinforced expectations within the crypto community for a "major rally."Another noteworthy element in Barron's analysis is the potential dangers of an interest rate cut. If the Fed reacts with panic to a potential economic slowdown, rather than in line with inflation and labor market data, this could be perceived as a loss of confidence by the markets.Especially despite inflation falling to 2.3%, wage growth outpacing productivity poses the risk of a "wage-price spiral." This could lead to a resurgence of inflation and deepening economic uncertainty. According to Barron's, if the cut is not aimed at growth but rather a panic reaction to signs of recession, the rally will be short-lived and will give way to fears of stagflation.Cryptocurrencies CautiousAt the time of writing, Bitcoin is fluctuating around $118,800, while Ethereum is trading in the $3,800 range. Most investors are hesitant to take aggressive positions without anticipating the Fed's move. The total crypto market capitalization is still below $4 trillion and needs a new catalyst.Forecast platforms like Polymarket have a 96.3% expectation that interest rates will remain stable. Only 3% have invested in the possibility of a 25 basis point cut. This suggests that Barron's scenario is currently considered a "marginal" possibility. However, given the Fed's history of surprise moves, it would be a mistake to completely dismiss this possibility.

Daily Market Summary with JrKripto July 28, 2025

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin is starting the new week in the accumulation zone. We mentioned the importance of the $117,900 level in our previous newsletters. It continues to trade in this area. In a downside scenario, the major support level appears to be $111,800. In an upward movement, the trend resistance level located in the $122,000 area could be targeted.Ethereum has broken upwards from the short-term parallel channel structure and is currently trading in the downtrend zone that has been in place since 2021. Having surged to the $3,800 region with sharp increases, ETH has entered the trend zone. A breakout of this zone could indicate significant upward movement for Ethereum. In the event of a pullback, the $3,500 level will act as support.Crypto NewsTether printed $1 billion worth of USDT.SharpLink Gaming purchased $295 million worth of ETH, bringing its total ETH holdings to 438,000.Upbit will list OP.Trump: The EU has agreed to allow countries to trade duty-free.Trump: We have reached an agreement with the EU.BNB broke a new record, exceeding $820.The US and China agreed to freeze tariffs for another 90 days.Rick Rieder, CIO of BlackRock, which manages $11.5 trillion in assets, called for the US Federal Reserve (Fed) to lower interest rates.CryptocurrenciesTop Gainers:KTA → Up 17.1% to $1.09CAKE → Up 16.9% to $3.29TRIBE → Up 16.1% to $0.60263769ORDI → Up 15.9% to $11.83SPX → Up 14.4% to $2.25Top Losers:REKT → Down 14.5% to $0.97120098GLM → Down 11.9% to $0.29879452TKX → Down 7.8% to $9.21CVX → Down 7.4% to $5.59CRV → Down 4.4% to $1.03Fear Index:Bitcoin: 74 (Greed)Ethereum: 61 (Greed)Dominance:Bitcoin: 60.82% ▼ 0.34%Ethereum: 12.07% ▲ 0.56%Total Daily Net ETF InflowsBTC ETFs: $130.80 MillionETH ETFs: $452.80 MillionGlobal MarketsGlobal markets are starting the week with optimism generated by the 15% tariff agreement reached between the US and the EU. The agreement boosts risk appetite as it prevents higher tariffs expected to take effect on August 1st. US and European futures are slightly positive. The VIX index fell to 14.93, nearing its lowest levels this year.This week, global markets will be closely watching Fed and Bank of Japan interest rate decisions, with no change expected in interest rates. PCE, nonfarm payrolls, and ISM manufacturing data will be released in the US, while the Eurozone CPI will be the leading indicator. Domestically, June external balance, unemployment, and ISO Manufacturing PMI data will be released.Most Valuable Companies and Stock Prices (Based on Data in the Image)NVIDIA (NVDA) → $4.23 trillion market capitalization, $173.50 per share, decreased by 0.14%.Microsoft (MSFT) → $3.82 trillion market capitalization, $513.71 per share, increased by 0.55%.Apple (AAPL) → $3.19 trillion market capitalization, $213.88 per share, increased by 0.06%.Amazon.com (AMZN) → $2.46 trillion market capitalization, $231.44 per share, decreased by 0.34%.Alphabet (GOOG) → $2.34 trillion market capitalization, $194.08 per share, increased by 0.46%.Borsa IstanbulMoody's upgraded Turkey's credit rating from "B1" to "Ba3" and lowered the outlook from "positive" to "stable." Fitch affirmed Turkey's credit rating at "BB-" and kept its outlook unchanged. Inflation is expected to decline to 28% by the end of 2025 and 21% by the end of 2026, while growth is expected to be 2.9% in 2025, 3.5% in 2026, and 4.2% in 2027.Friday evening's rating upgrade could inject some balanced optimism into the new week. Sectoral inflation expectations will be released today. Bank balance sheets will be a key factor in the market starting Wednesday. The tariff agreement between the US and the EU also supports risk appetite. July inflation data, to be released on August 4th, will be a key focus in the second half of the week. The BIST-100 struggled to hold above 10,700 last week, and cautious buyers are expected to start the new week.Companies with the Highest Market Value on Borsa IstanbulQNB Finansbank (QNBTR) → Market capitalization of 1.26 trillion TL, price per share of 380.25 TL, increased by 1.00%.Aselsan Elektronik Sanayi (ASELS) → Market capitalization of 835.39 billion TL, price per share of 180.0 TL, decreased by 1.75%.Türkiye Garanti Bankası (GARAN) → Market capitalization of 588 billion TL, price per share of 139.0 TL, decreased by 0.71%.Koç Holding A.Ş. (KCHOL) → Market capitalization of 441.5 billion TL, price per share of 172.7 TL, decreased by 0.80%.Enka Construction and Industry Inc. (ENKAI) → Market capitalization: 405.35 billion TL, price per share: 68.60 TL, down 0.80%.Precious Metals and Currency PricesGold: 4347 TLSilver: 49.87 TLPlatinum: 1840 TLDollar: 40.54 TLEuro: 47.64 TLWe look forward to bringing you the latest updates again tomorrow.

Trump's EU Trade Deal Boosts Bitcoin and Markets

US President Donald Trump has finally signed the long-awaited customs agreement with the European Union (EU). Instead of the hefty 30% tariffs expected to take effect on August 1st, the parties agreed on a flat 15% tariff rate. This development not only helped prevent global trade wars but also ignited financial markets and cryptocurrencies. Following the agreement's announcement, the S&P 500 index surpassed the 6,400 level, moving one step closer to its all-time high. Around the same time, Bitcoin (BTC) surpassed $120,000, a level it hadn't surpassed for nearly two weeks. However, the leading cryptocurrency remains below its all-time high of $123,080.US and EU reach agreementThe agreement, announced after a meeting between Trump and EU Commission President Ursula von der Leyen in Turnberry, Scotland, could herald a new era in the global trading system. The parties agreed to a flat 15% tariff instead of tariffs that could have reached as high as 30%. However, products such as aircraft parts, some chemicals, and pharmaceuticals were excluded from this tariff.Trump also announced that the EU will purchase $750 billion in energy from the US over the next three years and pledge an additional $600 billion in investments. These investments include defense equipment. Von der Leyen emphasized the importance of the agreement, saying, "This is not just a trade agreement; it is a step toward restoring geopolitical balance."Markets soar: Stocks, Bitcoin, and altcoins rallyThe announcement of the agreement revived risk appetite in global markets. Dow Jones futures jumped 180 points (approximately 0.4%), while Nasdaq 100 and S&P 500 futures rose 0.4% and 0.3%, respectively. US stock markets, which had already closed strong on Friday, started the week positively with this development. Looking at the top 10 cryptocurrencies, Bitcoin and Ethereum (ETH) also joined the rally, rising 3% to above $3,850. BNB tested its all-time high of $825 following the news and surpassed Solana to become the fifth-largest cryptocurrency again. Gold steady, Europe on holdFollowing the developments, gold, considered a safe haven, traded flat at $3,335. European markets saw less activity. Major indices like the German DAX, the French CAC 40, and the Spanish IBEX 35 saw no significant change. However, Italy's FTSE MIB rose 0.3%, and Sweden's OMXS30 rose 0.23%.Many EU leaders cautiously welcomed the agreement. German Chancellor Friedrich Merz stated that it was a significant development for the automotive sector, while the Dutch and French commented that "lower tariffs would be better." Italian Prime Minister Giorgia Meloni said that this agreement "prevents direct conflict across the Atlantic."

BTC Comment and Price Analysis July 25, 2025

Structural Behaviour Map of BTC Price ActionUnlike traditional trend structures we know, the falling channel that is clearly seen on the BTC chart is not an ordinary one. We understand from this ascending channel that the price of the coin trades within some specific periodic phases, and it suggests that these moves within the phases exhibit not only directional but also mental and structural continuity. Though the price actions seem to be upward at first glance, the key point to take into account is the cyclical logic underlying this upward trend, as this pattern is not simply a channel but a recurring pattern on the whole. Bitcoin 1. Elegance of the Cyclical Pattern: Intervals, Rhythm, and TimingThe fractal pattern clearly seen on the chart is made up of three main cycles, each of which has the same phases in itself:a) Saturation and accumulation following the riseb) Short-term peak formation and pullbackc) Bouncing from the channel’s mid-borderd) Re-surge of the price and approaching the channel’s upper borderIt can be clearly seen that these patterns have recurred at almost 14-to-18-week intervals. It is obvious on the chart that each of these cycles initiates in a similar way to the previous one; that is, the price retreats to the mid-border of the channel while at the same time the momentum decreases and the volume diminishes, which we can call the market’s recession phase. However, this recession is not a collapse of the price but suggests new accumulation, as sell pressure is absorbed during this time and strong hands gain advantageous positions. This very pattern repeats itself in every cycle. Periods of low volatility are followed by volume expansion, and the price moves back toward the upper region of the channel. The chart in question here acts not only as a technical model but also as a psychological timeline.2. Why Does It Recur in the Same Way?When we look at the very reason why this behavior recurs in the same way, we come to understand that the same market actors display the same reactions under the same conditions. What makes BTC vulnerable to the influence of behavioral cycles is that BTC is still a digital asset on the verge of institutionalization. It is not a coincidence that profit-taking after each rise, followed by a slowdown and then a renewed rise in risk appetite, happen respectively. It's a form of cyclical regulation inherent in cryptocurrency.Waves of liquidity make this repetition of cycles easier for the market, as the price needs to retreat by a certain amount so that major actors can reposition themselves. We see that these pullback phases are usually concentrated at the mid-border of the channel, meaning that every time the price touches this border, it triggers not only a technical level but also a psychological threshold for position management. A buying wave following this threshold triggers a rise along the same curve.3. What Happens if the Trend Continues Unbroken?The broad upward trend marked by the last curve on the chart is not an illusion but a natural extension of the previous three cycles. As long as the structure maintains its continuity, there is no technical reason why this pattern shouldn't reoccur. This is because the cyclical system is still active. The magnitude of the rise carries the energy of the previous fractal.However, this doesn't necessarily mean that it will certainly rise. If the market maintains the same behavior, it can produce the same result again. The disruption of this behavioral cycle, on the other hand, would represent not only a technical but also a structural change. In that case, the price must establish a new structure, making this detailed analysis invalid.4. This Is Not a Picture but a Coded LanguageThis chart is not only made up of just straight lines and colorful curves but a language where the past repeats itself and the algorithmic infrastructure of future movement is deciphered. Each of the corrections develops in the same way, each rise starts from the same level, and each breakout occurs with the same character. This is the coding of a fractal system not memorized but naturally generated in the market. Moreover, new peaks will not be coincidences but mechanical consequences so long as this system works.

Big Day for Bitcoin and Ethereum: $14.5 Billion Options Expiration Could Shake Markets

Cryptocurrency markets could experience sharp volatility on the last Friday of July. A total of $14.59 billion worth of options contracts on Bitcoin and Ethereum expire today. These large-scale expirations pose both risks and opportunities for investors and traders.July expiration is comparable to June'sAccording to Deribit data, the total notional (hypothetical) value of Bitcoin options alone is $11.94 billion. The total open interest in these contracts is 103,584. The put/call ratio (sell/buy balance) is 0.93, meaning there are more buy positions than sell positions. This ratio suggests a cautious but bullish outlook in the market. The "maximum pain" price for Bitcoin is $112,000. This level represents the price point where the largest investor will experience losses. At the time of writing, the Bitcoin price was $116,381. This suggests that downward pressure may increase in the short term due to options.On the Ethereum side, the total value of options expiring is approximately $2.65 billion. Open interest has reached 737,361, and call options are also dominant here. The put/call ratio of 0.88 indicates that, similar to Bitcoin, buy positions are dominant. The maximum pain level for Ethereum is $2,900. ETH, currently priced at $3,634, is also likely to experience a correction towards this level due to options pressure.The Largest Bitcoin Selling Position in HistoryThe largest Bitcoin put option transaction ever recorded on Deribit also occurred during this period. This put option, totaling $600 million, bet that the BTC price would fall below $110,000 by August 8, 2025. This suggests that a significant downward trend is expected in the market.Furthermore, discussions about the "CME Gap" are once again on the agenda among investors. The price gap between $115,625 and $114,305 in the CME futures market has not yet been fully filled. Since such gaps have historically tended to be filled by the price, Bitcoin is expected to correct towards this region.Whale movements and liquidationsLarge investors are also adding to the market tension. According to Lookonchain data, a whale named AguilaTrades liquidated a position worth 720 BTC (approximately $83.3 million). The total loss from this position exceeded $4 million. As we reported this morning, institutional actors such as Galaxy Digital were also seen transferring large amounts of BTC to exchanges. The company transferred 11,910 BTC to various exchanges in recent days. Another noteworthy development was the movement of 3,962 BTC from a wallet that had been dormant since 2011. This fueled speculation that old whales might be reviving and putting pressure on the market. There are still significant short positions held in the options market. Despite this, long positions are also increasing, with volatility around 30%. Similarly, the dominance of call options is notable even in Tesla stocks, while the "buy the dip" strategy is gaining traction in the crypto market. As Bitcoin and Ethereum expire in July, prices are likely to retreat to their "maximum pain" levels. However, historical data suggests that the market generally tends to recover after options expire. Options on Deribit will expire at 11:00 PM Turkish Time, after which the market will seek new direction.

Daily Market Summary with JrKripto July 25, 2025

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin entered a natural correction period after the ATH. Having lost support in the $117,000 region, BTC is currently trading around $115,000. The CME gap around $114,000 has not yet closed, and we see the price moving in this direction. The broad range of $111,000-$114,000 represents a significant support area. Support found in this area could re-target the $118,000 region.Ethereum, on the other hand, is holding strong despite Bitcoin's decline and even gaining upward momentum. As mentioned earlier, ETH, which is trading within a broad resistance area, continues to trade in this region.Crypto NewsThe Central Bank of the Republic of Turkey lowered its policy rate from 46% to 43%.The European Central Bank left the rate unchanged (it was expected to remain unchanged).Bank of America announced that many banks are preparing to launch their stablecoins. MicroStrategy has updated its capital raising plan for Bitcoin acquisitions. The company has raised its previously announced $500 million fundraising target to $2 billion. With this increase, MicroStrategy is reportedly aiming to further expand its Bitcoin investments.The TON Foundation and Kingsway Capital are planning a $400 million capital raise for the Toncoin treasury.Tether printed $2 billion in USDT.Trump: I want interest rates lowered and the Fed building completed.CryptocurrenciesTop Gainers:SYRUP → Up 21.8% to $0.5877799ENA → Up 14.5% to $0.52252511EUL → Up 11.6% to $12.18B → Up 9.7% to $0.60461203AXL → Up 9.7% to $0.41296338Top Losers:M → Down 18.7% to $0.36242166PUMP → Down 15.1% to $0.00258837TKX → Down 10.5% to $9.63TEL → Down 6.5% to $0.00593213PENGU → Down 6.5% to $0.03746343.Fear Index:Bitcoin: 71 (Greed)Ethereum: 60 (Greed)Dominance:Bitcoin: 61.58% ▼ 0.38%Ethereum: 11.74% ▼ 0.11%Total Daily Net ETF InflowsBTC ETFs: $226.70 MillionETH ETFs: $231.20 MillionGlobal MarketsGlobal markets are balanced this morning. Price action remains limited due to the lack of significant new news. Tariff concerns eased, while the VIX index remained flat at 15.4. The MSCI World Index rose 0.2%, reaching a new high, closing higher for the seventh consecutive day, driven by a moderate rise in US and European stock markets. The US July composite PMI rose to 54.6, buoyed by strength in the services sector. The services index rose to 55.2, while the manufacturing PMI came in at 49.5, below expectations. Companies remain concerned about federal spending cuts and tariffs. Business confidence weakened in both sectors. Jobless claims fell short of expectations at 217,000, supporting the positive employment outlook.Most Valuable Companies and Stock PricesNVIDIA (NVDA) → $4.24 trillion market capitalization, $173.74 per share, up 1.73%.Microsoft (MSFT) → $3.8 trillion market capitalization, $510.88 per share, up 0.99%.Apple (AAPL) → $3.19 trillion market capitalization, $213.76 per share, down 0.18%. Amazon.com (AMZN) → $2.47 trillion market capitalization, $232.23 per share, increased 1.73%.Alphabet (GOOG) → $2.34 trillion market capitalization, $193.20 per share, increased 0.88%.Borsa IstanbulThe Central Bank of the Republic of Turkey (CBRT) cut its policy rate by 300 basis points to 43%, exceeding expectations. Overnight lending and borrowing rates were also reduced by the same amount. Following this move, the BIST-100 index rose 1%, and Turkey's CDS premium fell below 280 basis points. Domestically, the capacity utilization rate, real sector, and sectoral confidence indices will be released today. Moody's and Fitch's credit rating assessments will also be monitored. While the external climate remains calm, we expect the BIST to maintain its upward trend.Companies with the Highest Market Value on Borsa IstanbulQNB Finansbank (QNBTR) → Market capitalization of 1.34 trillion TL, price per share of 400.25 TL, changed by 0.00%.Aselsan Elektronik Sanayi (ASELS) → Market capitalization of 832.66 billion TL, price per share of 185.8 TL, increased by 1.75%.Türkiye Garanti Bankası (GARAN) → Market capitalization of 586.74 billion TL, price per share of 139.6 TL, decreased by 0.07%.Koç Holding A.Ş. (KCHOL) → Market capitalization of 444.29 billion TL, price per share of 173.6 TL, decreased by 0.91%.Turkish Airlines Inc. (THYAO) → Market capitalization of 408.48 billion TL, price per share of 294.50 TL, decreased by 0.51%.Precious Metals and Currency PricesGold: 4,372 TLSilver: 50.76 TLPlatinum: 1,834 TLDollar: 40.55 TLEuro: 47.65 TLWe look forward to bringing you the latest updates again tomorrow.

Galaxy Digital's Massive Sale Shakes Bitcoin: Millions of Dollars Worth of Positions Liquidated

Cryptocurrency markets are poised to close the week in the red. The sharp sell-off in Bitcoin has severely weakened investors' risk appetite and wreaked havoc on leveraged trading. Galaxy Digital was one of the main actors in this sell-off.13,000 BTC transfer crashes the marketGalaxy Digital, run by Mike Novogratz, sent a total of 13,000 BTC to centralized exchanges in the last 24 hours. This transfer is estimated to be worth approximately $1.5 billion at current prices. According to blockchain analysis platform Lookonchain, the company withdrew $370 million worth of USDT from Binance, Bybit, and OKX, indicating that the transferred Bitcoins were being sold. This development follows a massive 40,000 BTC transfer that Galaxy Digital recently received from a whale wallet dating back to 2011. These BTCs, which had lain dormant for 14 years, have been reintroduced into the market and are now causing selling pressure. Bitcoin fell 3% due to these developments, falling to $115,200. Ethereum and XRP remained stable, while Solana (SOL) fell 3.3% to $177. The total cryptocurrency market capitalization decreased by 4.7%, falling to $3.84 trillion.Mass liquidations in leveraged positions: $522 millionThe outlook for liquidations is also bleak. A total of $522,042,272 worth of positions were liquidated in the last 24 hours. $382,102,784 of these liquidations came from long positions, while $139,939,456 came from short positions. In other words, approximately 73.2% of the liquidations occurred in long positions. Over the last 12 hours, $343,128,736 worth of positions were liquidated, 88.4% of which were long positions ($303,247,520 long, $39,881,236 short). Of the $58,272,040 liquidated in the last four hours, $37,129,752 involved long positions, while only $21,142,292 came from shorts. In the one-hour period, the total liquidation of $25,748,330 included $17,781,272 in long positions and $7,967,058 in short positions. Binance Takes the Biggest HitThe distribution of liquidations by exchange is also striking. The top 5 exchanges and their details are as follows:Binance: $118.7 million in total liquidations, 83.6% longBybit: $93.8 million, 91.02% longOKX: $66.9 million, 89.42% longGate: $26.6 million, 88.22% longHyperliquid: $19.3 million, 99.10% longThis data shows that excessively long positions on the largest exchanges are taking a heavy hit.Whale flight continuesOn-chain data shows that large investors (whales) are also gradually withdrawing from the market. The number of wallets holding 1,000 to 10,000 BTC fell from 2,037 to 1,982 in 10 days. This is a 2.7% decrease and the sharpest decline in the last six months.Furthermore, the increase in the amount of BTC sent to exchanges suggests that whales are opening the door to exit. The "exchange whale ratio" data rose from 0.50 on July 22nd to 0.52 on July 24th. This increase has generally resulted in selling pressure in the past.Despite all this devastation, the Bitcoin price is struggling to hold above $115,000. The decline in funding rates in perpetual transactions to neutral levels suggests that overheated leveraged structures are being cleared to some extent.

14.5 Years of Silence Broken: Giant Bitcoin Whale Takes Action

Cryptocurrency markets were ablaze with unusual on-chain activity on July 24th. A Bitcoin wallet, dormant for approximately 14.5 years and holding a total of 3,962 BTC, suddenly became active.Traces of a miner from 2009?In the transaction, first spotted by Whale Alert, approximately $468 million worth of BTC was removed from a long-dormant address. More intriguingly, the address's owner was not an ordinary investor but an early Bitcoin miner. An analysis by on-chain analyst Ai (@ai_9684xtpa) revealed that all of the BTC held by this address originated from Coinbase transactions (mining rewards). In other words, the coins were created from scratch, mined directly from the Bitcoin network's first blocks. They were obtained directly through block generation, not through any exchange or third-party transfer. According to analysts, these BTC are assumed to have been acquired between 2009 and 2010. Their estimated cost is only $0.32. This means the miner in question has currently generated a 370,000-fold return on their investment.The movement of large addresses can make investors nervous. Such transactions often have the potential to create "fud" (fear, uncertainty, doubt), that is, fear and uncertainty in the market. The movement of large amounts of BTC, in particular, can create selling expectations in some investors. However, in this case, the fact that the BTC were sent to another wallet rather than directly to an exchange suggests that there was no selling movement. One striking detail is that these 3,962 BTC were sent to another wallet rather than directly to a cryptocurrency exchange. This suggests that the action was not a direct sale, but rather a technical reason such as security, portfolio adjustment, or a cold wallet update. Simultaneous altcoin liquidations in the marketDuring this whale movement, a general selling pressure was also noticeable in the cryptocurrency market. Altcoins, in particular, experienced significant losses. Bitcoin, on the other hand, fell by a limited 0.6% to $117,868. According to market data, a total of $837 million worth of positions were liquidated in the last 24 hours. The largest losses were in long positions on Ethereum ($168 million) and XRP ($92.7 million). Analysts believe that liquidation of leveraged trades and profit-taking were behind this wave.It is currently known that the address in question only made one transfer and did not send BTC to any exchange. Therefore, it may be premature to expect a direct sell-off. However, such on-chain movements can cause temporary fluctuations in investor confidence in the market. Especially at a time when BTC is heading towards $120,000, such "whale movements" accelerate the market's pulse.

Daily Market Summary with JrKripto July 24, 2025

You can find today’s edition of “Daily Market with JrKripto” below, featuring a roundup of the most important developments from both global and local markets. Let’s analyze the broader market sentiment and latest insights together.Bitcoin is starting the new week in the accumulation zone. We mentioned the importance of the $117,900 level in our previous newsletters. It continues to trade in this area. In a downside scenario, the major support level appears to be $111,800. In an upward movement, the trend resistance level located in the $122,000 area could be targeted.Ethereum has broken out of the short-term parallel channel structure and is currently trading in the downtrend zone that has been in effect since 2021. Having surged sharply to the $3,800 region, ETH has entered the trend zone. A breakout of this zone could indicate significant upward movement for Ethereum. In the event of a pullback, the $3,500 level will act as support.Crypto News21Shares filed an amended S-1 form for the $DOGE ETF.21Shares has applied for a spot ETF for ONDO.US Treasury Secretary Bessent: Negotiations with the EU are progressing better than before.$MIU Coin has been listed on the XT Exchange.Goldman Sachs and BNY are preparing to announce the development of a system that allows institutional investors to purchase tokenized money market funds.Joe McCann reportedly plans to allocate $1 billion for Solana Treasury Co. amid a nearly 70% decline in liquid funds.Tesla neither sold nor bought Bitcoin in the second quarter.CryptocurrenciesTop Gainers:REKT → Up 13.9% to $0.65251379SYRUP → Up 12.6% to $0.48162868SAROS → Up 9.7% to $0.37939587TKX → Up 7.5% to $10.81M → Up 5.2% to $0.44668162Top Fallers:MOVE → Down 23.6% to $0.13945918PUMP → Down 19.9% to $0.00303355FLR → Down 19.1% to $0.02229203APT → Down 16.5% to $4.63GRASS → Down 16.5% to $0.92743664.Fear Index:Bitcoin: 72 (Greed)Ethereum: 61 (Greed)Dominance:Bitcoin: 61.92% ▲ 0.08%Ethereum: 11.49% ▲ 0.21%Total Daily Net ETF InflowsBTC ETFs: -$85.80 MillionETH ETFs: $332.20 MillionGlobal MarketsGlobal markets continue to find support from the US-Japan trade agreement. The US's initiation of similar talks with the European Union is positively impacting European stock markets. Asian stocks, US and European futures are trading higher this morning.Global markets closed strong yesterday thanks to positive news. Risk appetite remains high today. The VIX index fell 1.1 points to 15.4. This level is the lowest in five months and indicates a diminishing perception of short-term risk in the markets.Most Valuable Companies and Stock PricesNVIDIA (NVDA) → $4.17 trillion market capitalization, $170.78 per share, increased 2.25%.Microsoft (MSFT) → $3.76 trillion market capitalization, $505.87 per share, increased 0.12%.Apple (AAPL) → $3.2 trillion market capitalization, $214.15 per share, decreased 0.12%.Amazon (AMZN) → $2.42 trillion market capitalization, $228.29 per share, increased 0.36%.Alphabet (GOOG) → $2.32 trillion market capitalization, $191.51 per share, fell 0.31%.Borsa IstanbulMarkets are watching the Central Bank of the Republic of Turkey (CBRT) interest rate decision, which will be announced at 2:00 PM today. The CBRT, which held interest rates steady in June, is expected to cut the policy rate by 250 basis points today to 43.50%. Ahead of the decision, the BIST-100 index was trading flat around the 10,600 level. Despite intra-session fluctuations following the Special Consumption Tax (SCT) increase, the index is expected to close the day flat above 10,500.Companies with the Highest Market Capitalization on Borsa IstanbulQNB Finansbank (QNBTR) → $1.34 trillion market capitalization, $400.25 per share, increased 0.06%. Aselsan Electronics Industries (ASELS) → Market value of 821.26 billion TL, price per share of 185.4 TL, increased by 2.94%.Turkey Garanti Bank (GARAN) → Market value of 589.26 billion TL, price per share of 140.4 TL, increased by 0.07%.Koç Holding A.Ş. (KCHOL) → Market value of 432.62 billion TL, price per share of 171.0 TL, increased by 0.23%.Turkish Airlines Inc. (THYAO) → Market value of 406.41 billion TL, price per share of 294.75 TL, increased by 0.08%.Precious Metals and Currency PricesGold: 4,396 TLSilver: 50.85 TLPlatinum: 1,819 TLDollar: 40.46 TLEuro: 47.71 TLWe look forward to bringing you the latest updates again tomorrow.

Tesla's Bitcoin Holdings Exceed $1.2 Billion: No Sales

Tesla's Bitcoin portfolio reached approximately $1.2 billion following a 30% surge in the cryptocurrency market in the second quarter. Thanks to new accounting standards, the electric vehicle manufacturer was able to reflect quarterly gains from these assets on its balance sheet for the first time. The company holds 11,509 BTC, making it the tenth-largest Bitcoin holder among publicly traded companies, according to BitcoinTreasuries.Net data.Bitcoin's rise from $83,000 on April 1st to approximately $118,000 today has directly impacted Tesla's balance sheet under new Financial Accounting Standards Board (FASB) regulations that took effect in the first quarter of 2025. This regulation now allows companies to report their digital assets at fair market value each quarter. Under previous rules, companies could only record their crypto assets at the lowest value reached during the holding period. Tesla Increases Profits to $1.2 Billion with Bitcoin RiseUS-based electric car manufacturer Tesla made headlines with its second-quarter report, released overnight. As of the second quarter, the company continued to hold 11,509 Bitcoin (BTC), bringing the total value of these assets to approximately $1.2 billion thanks to the rise in the cryptocurrency market. Bitcoin's nearly 30% appreciation between April and June 2025 also significantly improved the company's balance sheet. Tesla is the tenth-largest publicly traded company in this field. The Financial Accounting Standards Board (FASB), the independent body responsible for corporate financial reporting in the US, introduced new regulations, effective in the first quarter of 2025, allowing companies to report crypto assets based on market value. This regulation now allows companies to show crypto assets on their balance sheets at their current market price each quarter.Under the previous rule, crypto assets could only be recorded at the lowest value reached during the holding period. For example, even if a company bought Bitcoin at $90,000, dropped to $60,000, and then rose back to $110,000, it would still appear on the balance sheet at $60,000. This created a misleading picture for investors.The new regulation allows companies to report these fluctuations on a quarterly basis, more transparently reflecting the value gains of digital assets. This represents a significant advantage, especially for companies like Tesla, which holds large amounts of cryptocurrency.Financial results in line with expectationsTesla reported revenue of $22.5 billion in its second-quarter 2025 financial results. This figure is nearly in line with analysts' expectations of $22.3 billion, based on FactSet data. Earnings per share were also in line with expectations at $0.40. The company's financial data is showing a more stable outlook due to the new accounting rules. Tesla shares traded at $331.56, up 0.71 percent in after-market trading.