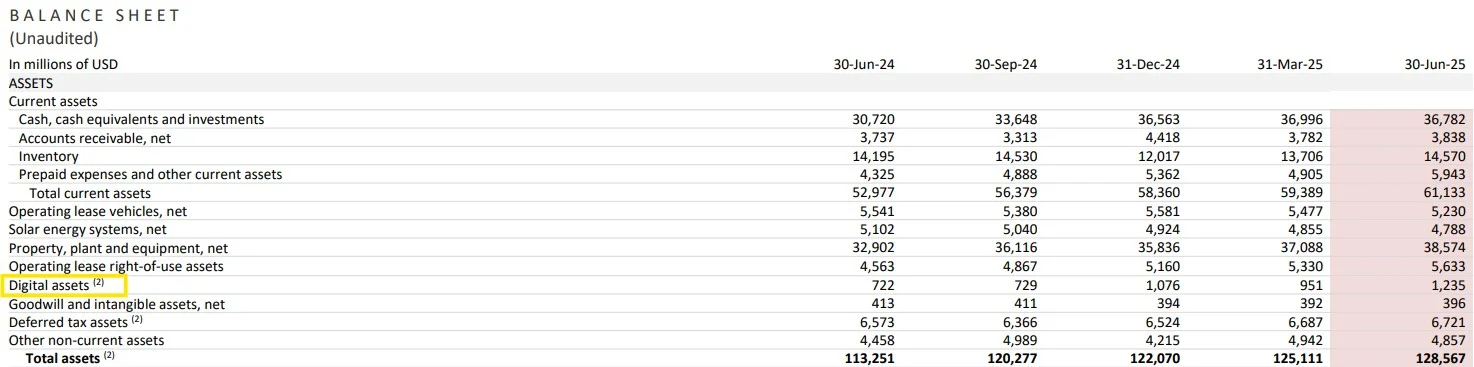

Tesla's Bitcoin portfolio reached approximately $1.2 billion following a 30% surge in the cryptocurrency market in the second quarter. Thanks to new accounting standards, the electric vehicle manufacturer was able to reflect quarterly gains from these assets on its balance sheet for the first time. The company holds 11,509 BTC, making it the tenth-largest Bitcoin holder among publicly traded companies, according to BitcoinTreasuries.Net data.

Bitcoin's rise from $83,000 on April 1st to approximately $118,000 today has directly impacted Tesla's balance sheet under new Financial Accounting Standards Board (FASB) regulations that took effect in the first quarter of 2025. This regulation now allows companies to report their digital assets at fair market value each quarter. Under previous rules, companies could only record their crypto assets at the lowest value reached during the holding period.

Tesla Increases Profits to $1.2 Billion with Bitcoin Rise

US-based electric car manufacturer Tesla made headlines with its second-quarter report, released overnight. As of the second quarter, the company continued to hold 11,509 Bitcoin (BTC), bringing the total value of these assets to approximately $1.2 billion thanks to the rise in the cryptocurrency market. Bitcoin's nearly 30% appreciation between April and June 2025 also significantly improved the company's balance sheet. Tesla is the tenth-largest publicly traded company in this field.

The Financial Accounting Standards Board (FASB), the independent body responsible for corporate financial reporting in the US, introduced new regulations, effective in the first quarter of 2025, allowing companies to report crypto assets based on market value. This regulation now allows companies to show crypto assets on their balance sheets at their current market price each quarter.

Under the previous rule, crypto assets could only be recorded at the lowest value reached during the holding period. For example, even if a company bought Bitcoin at $90,000, dropped to $60,000, and then rose back to $110,000, it would still appear on the balance sheet at $60,000. This created a misleading picture for investors.

The new regulation allows companies to report these fluctuations on a quarterly basis, more transparently reflecting the value gains of digital assets. This represents a significant advantage, especially for companies like Tesla, which holds large amounts of cryptocurrency.

Financial results in line with expectations

Tesla reported revenue of $22.5 billion in its second-quarter 2025 financial results. This figure is nearly in line with analysts' expectations of $22.3 billion, based on FactSet data. Earnings per share were also in line with expectations at $0.40. The company's financial data is showing a more stable outlook due to the new accounting rules. Tesla shares traded at $331.56, up 0.71 percent in after-market trading.