Cryptocurrency markets are poised to close the week in the red. The sharp sell-off in Bitcoin has severely weakened investors' risk appetite and wreaked havoc on leveraged trading. Galaxy Digital was one of the main actors in this sell-off.

13,000 BTC transfer crashes the market

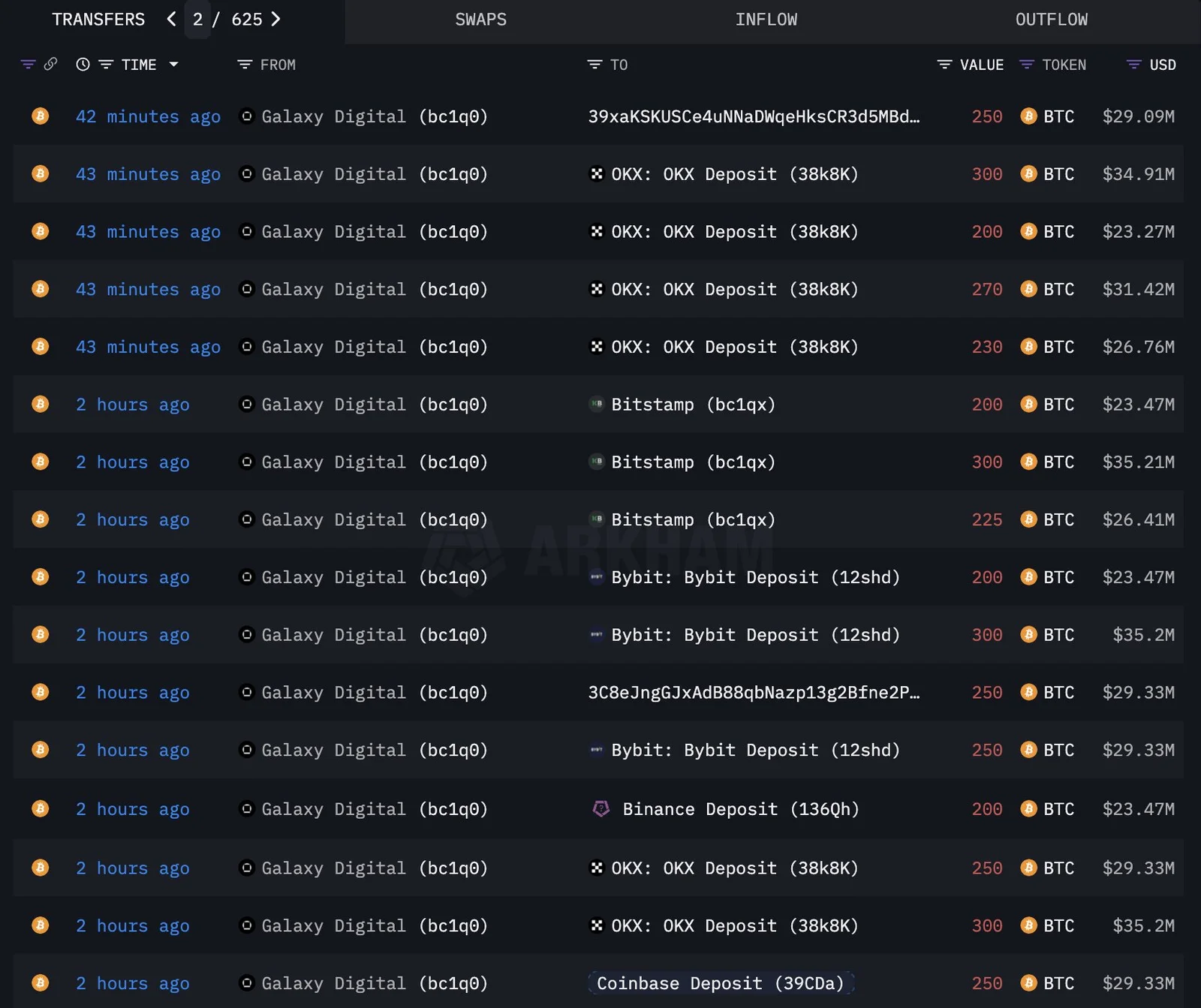

Galaxy Digital, run by Mike Novogratz, sent a total of 13,000 BTC to centralized exchanges in the last 24 hours. This transfer is estimated to be worth approximately $1.5 billion at current prices. According to blockchain analysis platform Lookonchain, the company withdrew $370 million worth of USDT from Binance, Bybit, and OKX, indicating that the transferred Bitcoins were being sold.

This development follows a massive 40,000 BTC transfer that Galaxy Digital recently received from a whale wallet dating back to 2011. These BTCs, which had lain dormant for 14 years, have been reintroduced into the market and are now causing selling pressure. Bitcoin fell 3% due to these developments, falling to $115,200. Ethereum and XRP remained stable, while Solana (SOL) fell 3.3% to $177. The total cryptocurrency market capitalization decreased by 4.7%, falling to $3.84 trillion.

Mass liquidations in leveraged positions: $522 million

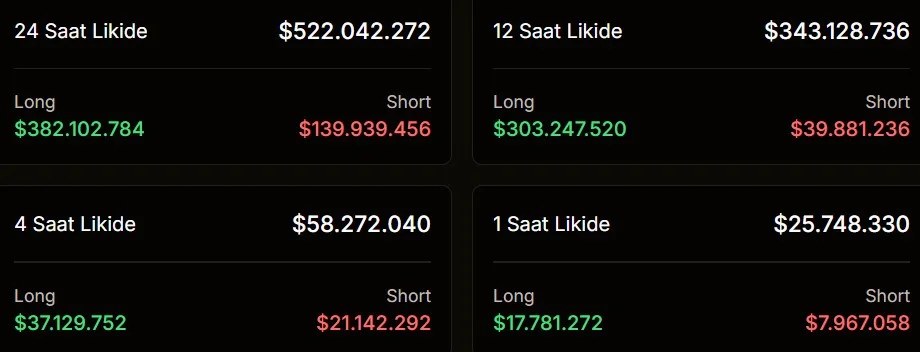

The outlook for liquidations is also bleak. A total of $522,042,272 worth of positions were liquidated in the last 24 hours. $382,102,784 of these liquidations came from long positions, while $139,939,456 came from short positions. In other words, approximately 73.2% of the liquidations occurred in long positions. Over the last 12 hours, $343,128,736 worth of positions were liquidated, 88.4% of which were long positions ($303,247,520 long, $39,881,236 short). Of the $58,272,040 liquidated in the last four hours, $37,129,752 involved long positions, while only $21,142,292 came from shorts. In the one-hour period, the total liquidation of $25,748,330 included $17,781,272 in long positions and $7,967,058 in short positions.

Binance Takes the Biggest Hit

The distribution of liquidations by exchange is also striking. The top 5 exchanges and their details are as follows:

- Binance: $118.7 million in total liquidations, 83.6% long

- Bybit: $93.8 million, 91.02% long

- OKX: $66.9 million, 89.42% long

- Gate: $26.6 million, 88.22% long

- Hyperliquid: $19.3 million, 99.10% long

This data shows that excessively long positions on the largest exchanges are taking a heavy hit.

Whale flight continues

On-chain data shows that large investors (whales) are also gradually withdrawing from the market. The number of wallets holding 1,000 to 10,000 BTC fell from 2,037 to 1,982 in 10 days. This is a 2.7% decrease and the sharpest decline in the last six months.

Furthermore, the increase in the amount of BTC sent to exchanges suggests that whales are opening the door to exit. The "exchange whale ratio" data rose from 0.50 on July 22nd to 0.52 on July 24th. This increase has generally resulted in selling pressure in the past.

Despite all this devastation, the Bitcoin price is struggling to hold above $115,000. The decline in funding rates in perpetual transactions to neutral levels suggests that overheated leveraged structures are being cleared to some extent.