Crypto markets are holding their breath in anticipation of the Fed's interest rate decision in the final days of July. The decision from the Federal Open Market Committee (FOMC) meeting, scheduled for July 29-30, could profoundly impact not only traditional markets but also the crypto asset universe. While the market is expected to hold interest rates steady, analyst Paul Barron's "surprise rate cut" scenario has piqued the interest of crypto investors.

Could a July rate cut send crypto soaring?

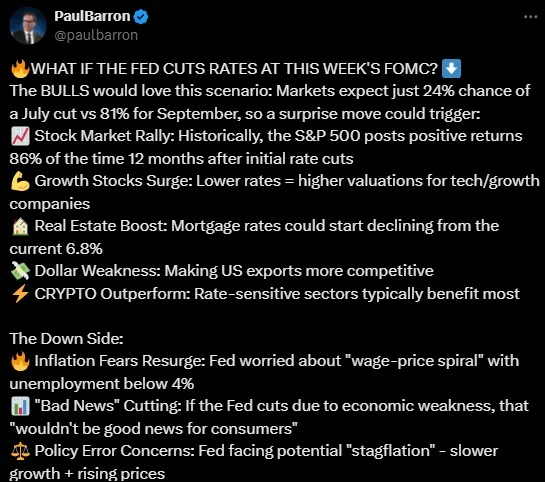

Crypto analyst and media host Paul Barron, in a statement on X (formerly Twitter), suggested that an unexpected interest rate cut in July could trigger sharp increases in risky asset classes such as stocks, real estate, and cryptocurrencies. Although markets have only priced in a 24% chance of a rate cut at this meeting, Barron believes such a surprise move could inject new momentum into the bull market.

According to Barron, a sudden interest rate cut could lower borrowing costs, particularly driving value into growth-focused technology stocks and cryptocurrencies. The analyst, noting that the S&P 500 has performed strongly in similar scenarios in the past, stated that crypto assets like XRP and ADA could also benefit from this headwind.

Deaton's support: The crypto market could boom

John E. Deaton, a leading figure in the crypto market, also made a statement echoing Barron's. Deaton stated that if Fed Chair Jerome Powell cuts interest rates, crypto assets could see a significant price appreciation. These statements reinforced expectations within the crypto community for a "major rally."

Another noteworthy element in Barron's analysis is the potential dangers of an interest rate cut. If the Fed reacts with panic to a potential economic slowdown, rather than in line with inflation and labor market data, this could be perceived as a loss of confidence by the markets.

Especially despite inflation falling to 2.3%, wage growth outpacing productivity poses the risk of a "wage-price spiral." This could lead to a resurgence of inflation and deepening economic uncertainty. According to Barron's, if the cut is not aimed at growth but rather a panic reaction to signs of recession, the rally will be short-lived and will give way to fears of stagflation.

Cryptocurrencies Cautious

At the time of writing, Bitcoin is fluctuating around $118,800, while Ethereum is trading in the $3,800 range. Most investors are hesitant to take aggressive positions without anticipating the Fed's move. The total crypto market capitalization is still below $4 trillion and needs a new catalyst.

Forecast platforms like Polymarket have a 96.3% expectation that interest rates will remain stable. Only 3% have invested in the possibility of a 25 basis point cut. This suggests that Barron's scenario is currently considered a "marginal" possibility. However, given the Fed's history of surprise moves, it would be a mistake to completely dismiss this possibility.