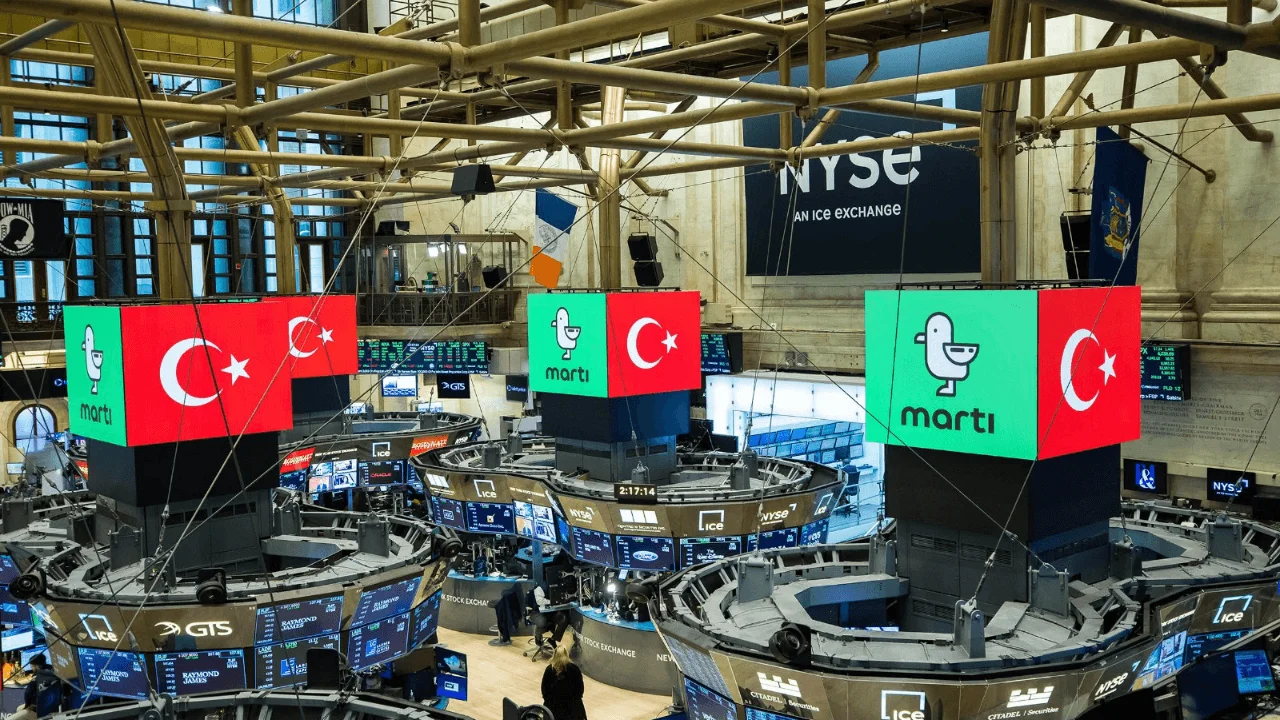

Martı Technologies (MRT), a Turkey-based mobility startup listed on the NYSE, has taken a significant step that challenges traditional treasury management approaches. The company announced that it will allocate 20% of its cash reserves to Bitcoin, integrating crypto assets into its corporate treasury strategy. With this move, Martı has become one of the companies that view crypto assets not only as a speculative tool but also as a long-term store of value and a shield against financial risks.

Cryptocurrency investments could reach up to 50%

The company announced that the crypto asset ratio could be increased to 50% over time. It was also stated that this potential increase may not be limited to Bitcoin; other leading crypto assets such as Ethereum and Solana could also be included in Martı's reserves in the future. All digital assets will be securely stored through platforms that provide institutional-grade custody services in compliance with regulations.

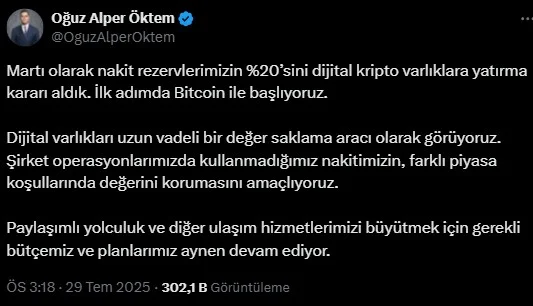

Martı Founder and CEO Oğuz Alper Öktem summarizes the motivation behind this strategy:

“Our decision to allocate capital to crypto assets demonstrates our belief that Bitcoin and other digital assets have proven their store of value alongside hard currencies and gold over the past few years. This strategy represents a prudent and long-term stance in the current economic environment, where we face inflationary pressures and currency risks.”

The company emphasized that this move will not disrupt its current operations or business plans. It was stated that crypto asset purchases will be made from excess cash reserves and will not impact operational expenses. It also announced that future digital asset transactions will be announced transparently, in accordance with legal requirements.

The company announced that it had reached 2.15 million passengers and 314,000 registered drivers as of June 3, 2025. This represents a 12.7% increase in passengers and an 8.3% increase in drivers in just two months. Martı's fleet consists of micromobility vehicles such as electric scooters, bicycles, and mopeds, operating in major cities across Turkey. The company plans to expand its presence from major cities like Ankara, Istanbul, Izmir, and Antalya to include Konya, Kayseri, Bursa, Mersin, Adana, and Kocaeli. With this expansion, Martı aims to increase its potential user base from 28.8 million to 42 million.

Co-founder Cankut Durgun was appointed Chief Operating Officer as of June 12, 2025. Cenk Özeker, with over 25 years of experience, has also joined the new Chief Financial Officer.

As a result, this move marks Martı Technologies' inclusion among publicly traded companies, joining giants like MicroStrategy, Tesla, and Blockchain, in incorporating crypto into their balance sheets.