Cryptocurrency markets could experience sharp volatility on the last Friday of July. A total of $14.59 billion worth of options contracts on Bitcoin and Ethereum expire today. These large-scale expirations pose both risks and opportunities for investors and traders.

July expiration is comparable to June's

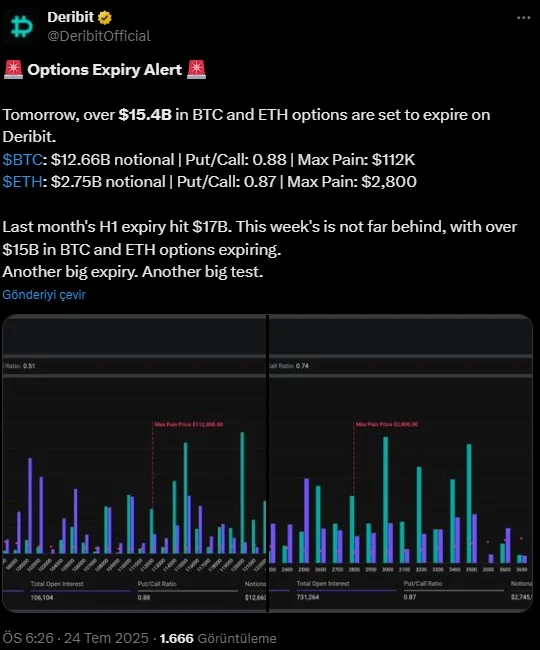

According to Deribit data, the total notional (hypothetical) value of Bitcoin options alone is $11.94 billion. The total open interest in these contracts is 103,584. The put/call ratio (sell/buy balance) is 0.93, meaning there are more buy positions than sell positions. This ratio suggests a cautious but bullish outlook in the market.

The "maximum pain" price for Bitcoin is $112,000. This level represents the price point where the largest investor will experience losses. At the time of writing, the Bitcoin price was $116,381. This suggests that downward pressure may increase in the short term due to options.

On the Ethereum side, the total value of options expiring is approximately $2.65 billion. Open interest has reached 737,361, and call options are also dominant here. The put/call ratio of 0.88 indicates that, similar to Bitcoin, buy positions are dominant. The maximum pain level for Ethereum is $2,900. ETH, currently priced at $3,634, is also likely to experience a correction towards this level due to options pressure.

The Largest Bitcoin Selling Position in History

The largest Bitcoin put option transaction ever recorded on Deribit also occurred during this period. This put option, totaling $600 million, bet that the BTC price would fall below $110,000 by August 8, 2025. This suggests that a significant downward trend is expected in the market.

Furthermore, discussions about the "CME Gap" are once again on the agenda among investors. The price gap between $115,625 and $114,305 in the CME futures market has not yet been fully filled. Since such gaps have historically tended to be filled by the price, Bitcoin is expected to correct towards this region.

Whale movements and liquidations

Large investors are also adding to the market tension. According to Lookonchain data, a whale named AguilaTrades liquidated a position worth 720 BTC (approximately $83.3 million). The total loss from this position exceeded $4 million. As we reported this morning, institutional actors such as Galaxy Digital were also seen transferring large amounts of BTC to exchanges. The company transferred 11,910 BTC to various exchanges in recent days. Another noteworthy development was the movement of 3,962 BTC from a wallet that had been dormant since 2011. This fueled speculation that old whales might be reviving and putting pressure on the market. There are still significant short positions held in the options market. Despite this, long positions are also increasing, with volatility around 30%. Similarly, the dominance of call options is notable even in Tesla stocks, while the "buy the dip" strategy is gaining traction in the crypto market. As Bitcoin and Ethereum expire in July, prices are likely to retreat to their "maximum pain" levels. However, historical data suggests that the market generally tends to recover after options expire. Options on Deribit will expire at 11:00 PM Turkish Time, after which the market will seek new direction.