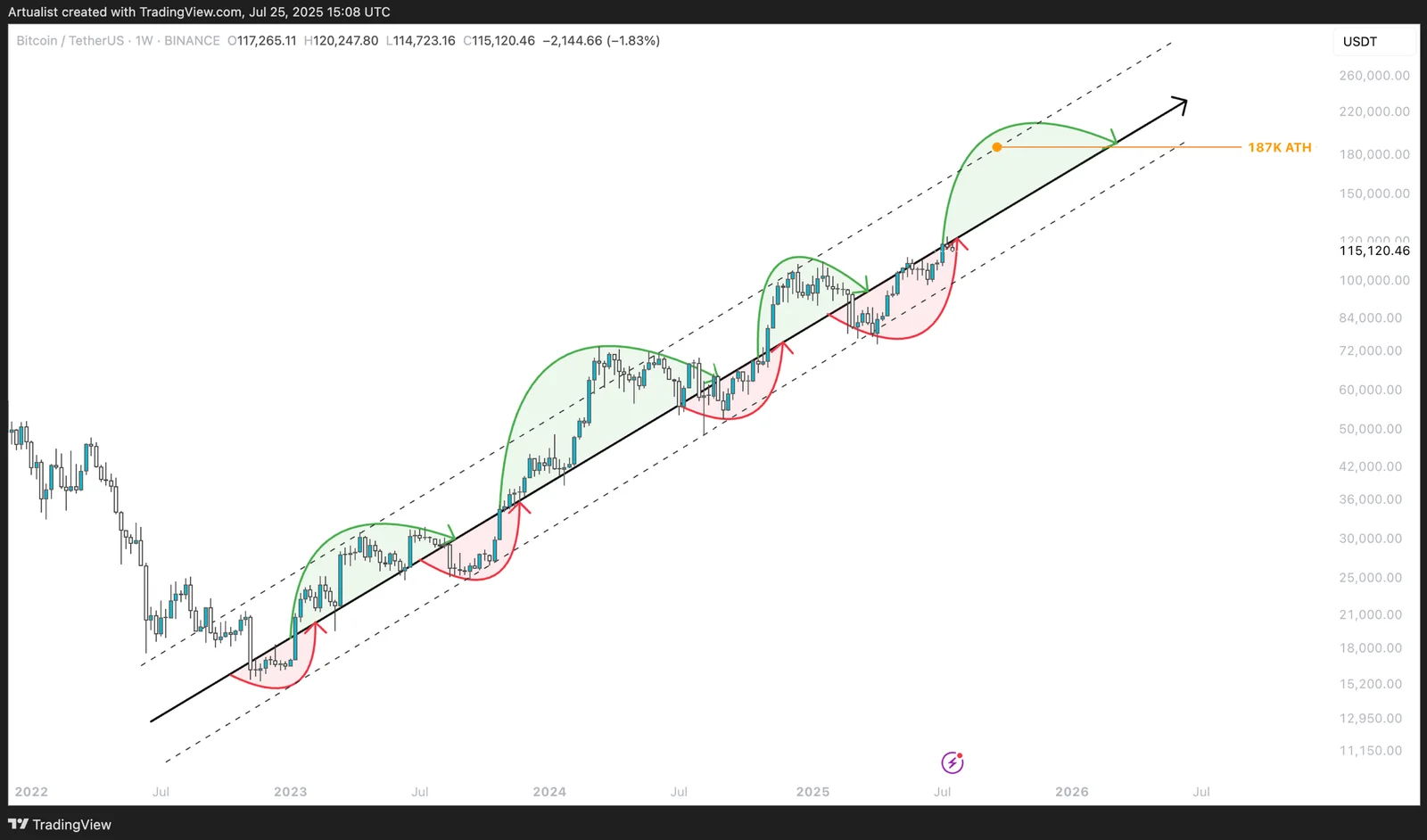

Structural Behaviour Map of BTC Price Action

Unlike traditional trend structures we know, the falling channel that is clearly seen on the BTC chart is not an ordinary one. We understand from this ascending channel that the price of the coin trades within some specific periodic phases, and it suggests that these moves within the phases exhibit not only directional but also mental and structural continuity. Though the price actions seem to be upward at first glance, the key point to take into account is the cyclical logic underlying this upward trend, as this pattern is not simply a channel but a recurring pattern on the whole.

1. Elegance of the Cyclical Pattern: Intervals, Rhythm, and Timing

The fractal pattern clearly seen on the chart is made up of three main cycles, each of which has the same phases in itself:

- a) Saturation and accumulation following the riseb) Short-term peak formation and pullbackc) Bouncing from the channel’s mid-borderd) Re-surge of the price and approaching the channel’s upper border

It can be clearly seen that these patterns have recurred at almost 14-to-18-week intervals. It is obvious on the chart that each of these cycles initiates in a similar way to the previous one; that is, the price retreats to the mid-border of the channel while at the same time the momentum decreases and the volume diminishes, which we can call the market’s recession phase. However, this recession is not a collapse of the price but suggests new accumulation, as sell pressure is absorbed during this time and strong hands gain advantageous positions. This very pattern repeats itself in every cycle. Periods of low volatility are followed by volume expansion, and the price moves back toward the upper region of the channel. The chart in question here acts not only as a technical model but also as a psychological timeline.

2. Why Does It Recur in the Same Way?

When we look at the very reason why this behavior recurs in the same way, we come to understand that the same market actors display the same reactions under the same conditions. What makes BTC vulnerable to the influence of behavioral cycles is that BTC is still a digital asset on the verge of institutionalization. It is not a coincidence that profit-taking after each rise, followed by a slowdown and then a renewed rise in risk appetite, happen respectively. It's a form of cyclical regulation inherent in cryptocurrency.

Waves of liquidity make this repetition of cycles easier for the market, as the price needs to retreat by a certain amount so that major actors can reposition themselves. We see that these pullback phases are usually concentrated at the mid-border of the channel, meaning that every time the price touches this border, it triggers not only a technical level but also a psychological threshold for position management. A buying wave following this threshold triggers a rise along the same curve.

3. What Happens if the Trend Continues Unbroken?

The broad upward trend marked by the last curve on the chart is not an illusion but a natural extension of the previous three cycles. As long as the structure maintains its continuity, there is no technical reason why this pattern shouldn't reoccur. This is because the cyclical system is still active. The magnitude of the rise carries the energy of the previous fractal.

However, this doesn't necessarily mean that it will certainly rise. If the market maintains the same behavior, it can produce the same result again. The disruption of this behavioral cycle, on the other hand, would represent not only a technical but also a structural change. In that case, the price must establish a new structure, making this detailed analysis invalid.

4. This Is Not a Picture but a Coded Language

This chart is not only made up of just straight lines and colorful curves but a language where the past repeats itself and the algorithmic infrastructure of future movement is deciphered. Each of the corrections develops in the same way, each rise starts from the same level, and each breakout occurs with the same character. This is the coding of a fractal system not memorized but naturally generated in the market. Moreover, new peaks will not be coincidences but mechanical consequences so long as this system works.