News

Altcoin News

Altcoin News

Browse all Altcoin related articles and news. The latest news, analysis, and insights on Altcoin.

Investment Firm Holds $450 Million SUI Treasury

While corporate treasuries have been increasingly popular in the crypto markets recently, Mill City Ventures III has emerged with a noteworthy strategy. The company announced the establishment of an official SUI treasury with a $450 million private equity raise. This move marks a first in the market as the only treasury strategy directly supported by the Sui Foundation.Mill City has currently added a total of 76,271,187 SUI tokens to its portfolio at an average cost of $3.6389. Initial purchases were made through over-the-counter (OTC) agreements and in-kind contributions with the Sui Foundation. The company announced that further SUI acquisitions will be made on the open market and that this accumulation strategy will continue."In partnership with the Sui Foundation, Mill City is operating the only crypto treasury strategy in the market with official foundation support." 98% of private capital deployedMill City operates as a company offering short-term non-bank lending services and specialized financing solutions. However, the company's latest move brings it directly into the digital asset ecosystem. Approximately 98% of the private capital raised will be used for the acquisition of SUI and the management of this treasury.Investors participating in this private equity round include prominent names in the crypto world: Big Brain Holdings, Galaxy Digital, Pantera Capital, M2, Electric Capital, and GSR have become part of this structure. Statements from Galaxy CEO Mike Novogratz, in particular, highlight the strategic vision behind this move:“Mill City offers public investors clean, liquid, and institutional-grade access to the digital asset ecosystem. Backing the treasury with SUI and combining it with experienced management creates a strong foundation for long-term growth.”As a result, not only BTC and ETH but also next-generation Layer-1 blockchains are now on the radar of institutional investors. Sui stands out as a Layer-1 chain developed by Mysten Labs and powered by the proprietary Move programming language derived from Meta's (formerly Facebook) blockchain initiative. Standing out with its high scalability and transaction efficiency, Sui could herald a new era with its integration into enterprise-level treasury structures.At press time, the SUI price was $3.4 and has fallen 3% in the last 24 hours.

SOL Commentary and Price Analysis July 31, 2025

SOL Technical AnalysisWhen analyzing SOL on a daily time frame, we can clearly see that the coin has been trading within an ascending channel pattern for a long time. In a wide perspective, the lower and upper borders of the channel still work properly. However, the price seems to be stuck within a narrowing range in the middle zone of this channel.It is clear on the chart that SOL tested the horizontal support level at $167.87, which, at the same time, intersects with a minor falling trend line. Thus, this level seems to be a strong support area for SOL, which is currently trading around $176.78 and is struggling to hold above it.We could expect the upward movement to carry on if the price can hold above the level at $167. According to this prediction, we should be following the levels at $191.89, $201.24, and then $233.18 as possible targets ahead. The upper border of the channel corresponds to $300, and this level can be considered a medium-term target.We have the first strong support at $167.87 in the event of a pullback. Below it, we should be following the range between the levels $146.86–$140.03 as a key support zone. Moreover, if we see a deeper correction, the price could test the range $121.00–$122.00, which is a strong low level. Rising Channel Structure Summary:• Price: $176.78, trading within an ascending channel structure• Horizontal resistance: $167.87 was broken, it is trying to hold above it• Upside targets: $191.89 → $201.24 → $233.18 → $300• Support levels: $167.87 → $146.86 → $140.03 → $121.00Channel upper and lower borders are still valid, trend structure is maintained.These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.

AVAX Comment and Price Analysis July 31, 2025

AVAX Technical OutlookAnalyzing AVAX on a daily time frame, it is clearly seen that the coin has been trading within a wide descending channel pattern for a long period of time. So far, the lower, mid, and upper borders of this falling channel have worked properly and are still valid, continuing to give direction to the price.AVAX is currently trading at the mid-border of the mentioned channel. The range between the levels at $22.40–$23.80 is crucial as this range works as a horizontal support and as a previous reversal zone. The price is trying to bounce from this zone. If it can hold above this area, upside potential could be kept.We see that the upper border of the channel and the resistance zone intersect at $30.20–$32.90, which could serve as a strong resistance level in the next uptrend. If this zone gets broken with huge momentum, the descending channel formation will also be broken above, and a medium-term positive trend will probably start then.We should be following the range between the levels $20.00–$18.74 as the first support line in case of a possible drop scenario. If the price closes below this zone, then it can pull back to the lower border of the channel formation. Falling Channel Structure Summary:• Price: $22.97, trading around the middle border within the descending channel• Support: $22.40 – $23.80 (holding above it is positive)• Resistance: $30.20 – $32.90 (overlapping the upper border of the channel)• Lower support: $20.00 → $18.74The price is trading within the falling channel. However, as long as the price holds above $22, positive expectations remain. The upper border of the channel is a key area for a trend reversal.These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.

What is Sei (SEI)?

Speed, efficiency, and user experience are more crucial than ever in the crypto world. Building on these very needs, Sei (SEI) stands out as a high-performance layer-1 blockchain network built from the ground up for decentralized finance (DeFi) applications. Specifically targeting order-book blockchain applications, the Sei network stands out with its capacity of up to 20,000 transactions per second and a block time of approximately 300 milliseconds. Built on the Cosmos SDK, this network offers a secure and fast infrastructure thanks to Tendermint consensus. The development team aims to bring the speed and efficiency needs of traditional financial markets to the blockchain, making Sei an ideal platform for DeFi projects, NFT applications, and on-chain games. The SEI token, the network's native cryptocurrency, is actively used in transaction fees, staking, and governance processes. If you're wondering, "What is Sei?", "What is Sei coin?", or "What is Sei token used for?" If questions like these are on your mind, in this guide, we will explore in detail what the Sei network is, who owns Sei coin, what its release date is, and what its future holds.Definition and Origins of SeiSei (SEI) is a high-speed and powerful layer-1 blockchain network specifically developed for decentralized finance (DeFi) applications. Its native cryptocurrency is also commonly known as SEI coin. Built on the Cosmos SDK infrastructure, Sei incorporates a specialized version of the Byzantine Fault Tolerant (BFT) consensus engine called Tendermint Core. Thanks to this architecture, blocks can be generated in a very short time of approximately 300 milliseconds, and the network can theoretically offer a transaction capacity of up to 20,000 transactions per second. This entire system is specifically optimized for decentralized exchanges and derivative platforms operating on an order book model. Sei's development team aimed to create a brand new solution by combining the speed and efficiency of traditional finance with blockchain technology. This has led to the emergence of a DeFi network that offers a robust and effective infrastructure for both individual users and institutional projects.As a blockchain focused on DeFi, the Sei network was developed to address long-standing challenges in the crypto world, such as scalability and speed, from a fresh perspective. The "exchange trilemma"—the difficulty of balancing decentralization, scalability, and capital efficiency—a common problem particularly encountered in platforms with high transaction loads, such as decentralized exchanges, was one of the primary motivations for Sei's creation. Combining high transaction throughput with low latency was a key goal in the network's design.To achieve this goal, Sei has been equipped with various technical improvements to the block generation and processing processes. In particular, thanks to a special architecture called Twin-Turbo consensus, the network combines both intelligent block propagation and optimistic block processing. This allows validators to process transactions much faster, significantly reducing block times. As a result, the Sei network achieves a very fast and efficient blockchain structure that can respond in milliseconds, not seconds. SEI network Because Sei is built on the Cosmos SDK, it inherits its security and network structure from the Tendermint consensus system. However, the block time, which typically reaches around 6 seconds in traditional Tendermint, has been reduced to milliseconds thanks to Sei's innovative architecture. This difference is one of the clearest indicators of the network's speed. The project was founded in 2022 under the umbrella of Sei Labs, established in California. The team includes highly experienced individuals: Jayendra (Jay) Jog, a software developer who previously worked as an engineer at Robinhood, and Jeffrey Feng, with his investment banking background at Goldman Sachs, brings strategic vision to the project. Dan Edlebeck, known for his work in the Cosmos ecosystem, also serves as the founding team.Throughout 2022, the project took shape from both a technical and community perspective. The development team launched the first testnets, established the technical infrastructure, and grew the community with early-stage participants. The Sei mainnet (v1) then went live in 2023. At the time, major investors such as Multicoin Capital, Delphi Digital, and Coinbase Ventures supported the project, enabling Sei to reach a wider audience. Developed open-source from the outset, the network adopts the community governance approach unique to the Cosmos ecosystem. This means SEI token holders have a say in important network decisions and can vote on protocol changes.Sei's History: Key MilestonesThe Sei network has come a long way in a short time since 2022. The development team has achieved steady growth not only technically but also in the community. Below, you can see the key milestones, from Sei's initial testnet to its listing on major exchanges, from EVM compatibility to ecosystem expansion:2022: The Sei Network's first testnet phases began. During this period, incentivized testnets like "Atlantic" and the community program "Seinami" helped establish both early adopters and a developer ecosystem. In August, Sei Labs received a $5 million seed investment, significantly accelerating the project. 2023: After intensive testing, Sei's mainnet, Sei v1, went live on August 15, 2023. The network's integration with the mainnet and Cosmos Hub was completed, bridges were activated, and users were now able to stake SEI tokens.August 2023: The SEI token reached a wide audience by being listed on leading exchanges such as Binance, Coinbase, and Bybit. With these listings, Sei, previously known only within the technical community, now entered the radar of a wider user base.2024: The development team announced Sei's next version, Sei v2. This new version integrates EVM (Ethereum Virtual Machine) support into the network and further enhances its parallel transaction processing capabilities. The public testnet went live in early 2024, with the mainnet update targeted for completion by mid-year. Thus, Sei took a significant step toward becoming the "first parallel EVM blockchain." The differences between SEI v1 and v2 can be illustrated as follows:FeatureSei v1Sei v2Release DateAugust 20232024 (testnet: Q1, mainnet: planned for Q2/Q3)Consensus MechanismTendermint CoreOptimized Tendermint + Parallel Execution EngineBlock Time~300 millisecondsSame (more consistent performance via optimizations)Transaction Throughput (TPS)~20,000 (theoretical)Similar TPS, but more efficient with parallel processingParallel Execution CapabilityLimited (basic level)Yes – full parallel execution supportedEVM CompatibilityNoYes – can run Ethereum smart contractsVirtual Machine (VM)CosmWasmCosmWasm + Ethereum Virtual Machine (EVM)Developer ExperienceCosmos ecosystem focusedCompatible with Ethereum developer toolsOrder Book Application SupportOn-chain Central Limit Order Book (CLOB)On-chain CLOB (enhanced logic + EVM compatibility)Frontrunning ProtectionFrequent Batch Auction (FBA)FBA + improved transaction orderingIBC (Cosmos Interoperability)SupportedUnder debate – proposal to remove Cosmos support submitted2025: The Sei ecosystem expanded rapidly. Many projects in areas such as DeFi, NFTs, and blockchain-based games became active on Sei. For example, Astroport became one of the first decentralized exchanges to launch on the network, while well-known protocols like Sushi also integrated into the Sei network. More than 200 projects operated on Sei, and the total asset value locked (TVL) exceeded $500 million.Why Is Sei Valuable?After exploring all the technical details about the Sei network, the most natural question that comes to mind is: "So why do all these features make it so special?" This is where the many details that distinguish Sei from other layer-1 blockchains, both technically and in terms of user experience, come into play. Equipped with innovations such as high transaction speed, a parallel transaction architecture, and a built-in order book infrastructure, Sei offers a strong foundation not only for DeFi projects but also for a wide range of applications, from NFTs to on-chain games. Below, let's examine each of the fundamental building blocks that make Sei so valuable. High speed and efficiencySei reduces block generation time to approximately 0.3 seconds, completing transactions almost instantaneously. It can theoretically reach an impressive 20,000 transactions per second. This speed is a significant advantage, especially for high-frequency traders and high-throughput applications. For comparison, in terms of finality time, it is almost twice as fast as next-generation chains like Sui and 1.5 times faster than Aptos. Comparison of SEI and other cryptocurrencies in terms of expiration time. Source: Maple Finance Parallel Transaction ProcessingThe Sei network features parallel execution. When appropriate, it can process transactions simultaneously, in parallel. Only transactions affecting the same data are executed sequentially. This reduces transaction times on the blockchain and increases overall transaction throughput. Thanks to this structure, applications running on Sei deliver smoother and more efficient results, as if they were running on a multi-core computer.Order Book InfrastructureSei features an embedded order matching engine at the protocol level. This allows decentralized applications to operate directly on-chain using a central limit order book (CLOB) model. Instead of AMM-based structures like other chains, real-time buyer and seller orders are matched directly on-chain. This reduces both slippage and temporary liquidity issues. It also makes Sei much more resilient to MEV-based sandwich attacks. Compared to other major DEXs, SEI can be compared as follows:Feature / ProjectSei (Sei DEX)Serum (Solana)dYdX (StarkEx v3)InjectiveChain TypeLayer-1Layer-1Layer-2 (StarkEx)Layer-1 (Cosmos SDK)Order Book TypeOn-chainOff-chainOff-chainOn-chainBlock Time~300 ms~400 ms~600 ms~1 secondTPS (Transactions per Sec.)~20,000~50,000~9,000~10,000+Frontrunning ProtectionYes (FBA)Partial (off-chain risk)Yes (off-chain controlled)Yes (frequent auction)Parallel Execution SupportYesYesLimitedYesEVM CompatibilityYes (via Sei v2)NoNoNoStructure Preventing FrontrunningThe Sei network prevents frontrunning attacks by processing orders in bulk at the end of a block. This approach is supported by a system called "Frequent Batch Auction (FBA). This prevents any bot or validator from gaining unfair advantage by taking positions before market entry. Because all orders are matched simultaneously at a single price, trading occurs on a much fairer basis.Full Compatibility with the Cosmos EcosystemBecause Sei is part of the Cosmos ecosystem, it supports the IBC (Inter-Blockchain Communication) protocol. This allows Sei to communicate directly with other blockchains, such as Osmosis or Cosmos Hub, and transfer assets. This interoperability allows assets mined on Sei to be easily moved to other chains. It can also be seamlessly used with popular Cosmos wallets like Keplr. Cosmos/SEI compatibility However, it's worth noting that, according to a community proposal that emerged in May 2025, one of the Sei developers proposed discontinuing the network's Cosmos support. The goal of this proposal is to reduce the technical complexity created by the current CosmWasm + EVM architecture and simplify the developer experience by making Sei only compatible with Ethereum. If this transition occurs, Sei will only support EVM-based transactions, and Cosmos features will largely be shelved. However, according to statements from Interchain Labs, Sei will technically remain Cosmos-based, and some core features (e.g., staking and governance) will remain available.SEI Token UsesThe SEI token, the network's native asset, plays a crucial role in both the operation of the technical infrastructure and maintaining economic order. SEI can be used to pay transaction fees and make transfers at low cost. Users can stake their tokens to support validators, contribute to the security of the network, and earn rewards in return. It's also possible to have a say in governance processes; SEI holders have the right to vote on protocol updates or significant changes. It can also be used as collateral in DeFi applications and provide liquidity. SEI is also among the top 100 coins by value. SEI price since launch A robust and balanced token economyThe total supply of the SEI token was set at 10 billion units. Approximately 18% of this supply (1.8 billion SEI) entered circulation in the initial phase. To ensure a community-focused launch, the project distributed 3% of the total supply as an airdrop to testnet users and select chain communities. The remaining supply was allocated to the development team, investors, ecosystem incentives, and community reserves. This balanced distribution ensures network security and creates a sustainable economic structure for long-term growth.Who is the Founder of Sei?Sei Network was founded in California in 2022. The team behind the project includes three experienced individuals from the traditional finance and software worlds: Jayendra “Jay” Jog, Dan Edlebeck, and Jeffrey Feng. Jay previously worked as a software engineer at Robinhood, and Dan is one of the founders of Exidio, a decentralized VPN project operating within the Cosmos ecosystem. Jeffrey Feng, with his background at Goldman Sachs, made a strong contribution to the project in terms of financial strategy. By combining technical knowledge and financial vision, the trio aimed to create a brand-new blockchain infrastructure under the Sei Labs umbrella.From its inception, the project chose a different direction from traditional centralized structures. Its governance approach is based on community participation. Because the Sei network is developed with open source code, developers from around the world can contribute to the project. Decisions regarding the network's future are made by the votes of SEI token holders. This means users become part of a community that not only transacts on the network but also has a voice. This makes Sei an ecosystem that grows alongside its users.The dedicated efforts of both the founding team and the community have played a significant role in Sei's success to this point. Since the mainnet launch, the system has been operating stably, and the development team is constantly taking new steps to further improve performance. Equipped with innovations such as high speed, parallel transaction capabilities, and an order book infrastructure, Sei opens the door to many new projects not only in terms of technical aspects but also with the opportunities it offers. More applications in areas like DeFi, NFTs, and gaming are expected to be deployed on the Sei network in the coming period. Considering all these developments, a very promising picture emerges for the future of Sei coin.Frequently Asked Questions (FAQ)Below are some frequently asked questions and answers about SEI:What is the Sei network and how does it work?: The Sei network is a high-speed blockchain platform built on the Cosmos SDK as its technical infrastructure and uses the Tendermint BFT consensus mechanism. The network operates according to the Delegated Proof-of-Stake (DPoS) model; that is, specific validators verify transactions with SEI tokens staked by users. Thanks to special improvements called Twin-Turbo consensus, transactions are finalized in a very short time of ~300–400ms, and efficiency is maximized with parallel processing. In short, the Sei network is a fast and scalable blockchain secured by validators worldwide.What is the SEI token used for?: The SEI token is the native cryptocurrency of the Sei network and is used for various purposes. First, gas fees for transfers and smart contract transactions on the network are paid in SEI. Users can also contribute to the security of the network by staking their SEI (delegating it to a validator on the network) and earn rewards in return. The SEI token is also part of the governance mechanism; token holders have a say by voting on important network updates or protocol changes. Additionally, SEI can be used as collateral in some DeFi protocols and plays a role in paying transaction fees on decentralized exchanges built on Sei.What are the differences between Sei and chains like Solana and Sui?: While Sei shares a similar goal with high-performance chains like Solana and Sui—to provide a fast and scalable infrastructure—their technical approaches differ. Solana is a singleton chain running on a Proof-of-History mechanism and is known for processing thousands of transactions per second; however, Solana is not directly compatible with the Cosmos ecosystem. Sui, on the other hand, is a new blockchain network that uses the Move programming language and offers object-oriented parallel processing capabilities. Built on the Cosmos SDK, the Sei network combines both Tendermint-based BFT security and parallel processing capabilities. Sei not only achieves speeds as high as Solana, but also offers a protocol-level order book infrastructure, making it particularly prominent in trading applications. Furthermore, thanks to its IBC compatibility, Sei can communicate directly with other blockchains, unlike Solana and Sui, giving Sei a significant advantage in inter-ecosystem interactions.Is the Sei network Cosmos-based?: Yes. The Sei network is built on the Cosmos SDK and uses the Tendermint BFT consensus algorithm. Therefore, it is technically part of the Cosmos ecosystem. Indeed, thanks to the Inter-Blockchain Communication (IBC) protocol, Sei can communicate and transfer assets in a manner compatible with other Cosmos-based chains.What types of applications are being developed on the Sei network?: Decentralized finance (DeFi) applications are the most frequently developed on the Sei network. Decentralized exchanges (DEXs) and derivatives trading platforms that use an order book model are particularly prominent. For example, Astroport launched as the first major DEX on Sei. Furthermore, thanks to the network's high transaction capacity, NFT marketplaces and blockchain-based gaming projects are also emerging within the Sei ecosystem. Transactions like in-game asset buying and selling or NFT minting can provide users with a seamless experience thanks to Sei's fast infrastructure.How to stake SEI: To stake SEI, you first need to transfer your SEI tokens to a supported wallet (e.g., a Cosmos-compatible wallet like Keplr). Then, you can delegate by selecting one of the network's validators through your wallet app or the Sei network's block explorer. This means you lock your SEI assets to a validator of your choosing and delegate your voting rights to them. This way, you both secure the network and earn staking rewards. However, keep in mind that staked assets on Cosmos networks typically have an unbonding period of 14–21 days for withdrawal; you cannot immediately unstake and spend your tokens during this period.For more information on sei and high-speed blockchain technologies, follow our JR Crypto Guide series.

Visa Adds Support for Stellar, Avalanche, and Three Other Stablecoins

Global payments leader Visa is accelerating its efforts in the stablecoin space. By expanding its support for stablecoins and blockchains, the company aims to make the global payment infrastructure more flexible and inclusive. According to Visa's latest announcement, the payments giant's settlement platform will now be able to support two new USD-backed stablecoins, two new blockchain networks, and the euro-backed EURC stablecoin.More stablecoins, more networksAs part of Visa's new partnership with Paxos, the Global Dollar (USDG) and PayPal USD (PYUSD) stablecoins will be integrated into the platform. These two new digital assets will provide users and partners with more options for stablecoin payments.Visa has also added support for the Stellar and Avalanche blockchains, adding two more important networks to the already supported Ethereum and Solana. With this move, Visa's system can now support four different blockchains and four stablecoins. The company's supported stablecoins include USDC, EURC, PYUSD, and USDG. Expands to Europe with Euro-Backed StablecoinVisa has added the EURC stablecoin, developed by Circle and pegged to the euro, to its system. This means select pilot Visa partners will now be able to process settlement transactions with both USD- and EUR-backed stablecoins. This feature represents a significant advantage, particularly for institutions and fintech startups in Europe. Rubail Birwadker, Visa's Head of Global Growth Products and Strategic Partnerships, commented:“Visa is building a multi-coin, multi-network infrastructure to meet the needs of our partners worldwide. We believe that with reliable, scalable, and interoperable stablecoins, we can fundamentally transform how money moves around the world.”Infrastructure Expands for Stablecoin CardsVisa's stablecoin push isn't limited to its settlement system. Earlier this year, the company announced the expansion of its stablecoin-backed card partners. To ensure the successful scalability of these cards, Visa is building a network that supports stablecoin wallets, enables interoperability across multiple blockchains, and offers flexible settlement options.With the introduction of new stablecoins and blockchains, Visa's goal is clear: to provide a secure, fast, and globally compatible infrastructure for stablecoin payments, just as it does for traditional payments.This step by Visa is critical for solidifying stablecoins' place within the global financial system. By integrating stablecoins into traditional payment infrastructures, cross-border transactions become faster and more cost-effective. It also lays the groundwork for stablecoins to reach a wider user base and be used in compliance with regulations.Visa is currently a leading network facilitating digital payments in over 200 countries and territories. The company's goal is to build an accessible and inclusive financial future for all.

Ethereum Reserves Exceed $10 Billion: 64 Companies Listed

Ethereum's rise in the corporate world continues unabated. Ethereum reserves held by public companies, treasuries, DAOs, foundations, and long-term investors have officially surpassed $10 billion. This represents a 50-fold increase in just four months.In April, it was $200 million, and by July, it surpassed $10 billionAccording to Strategic Ethereum Reserve data, the reserve, which initially held just $200 million in ETH at the beginning of April, reached $3 billion by the end of June and $10.5 billion by the end of July. This increase was particularly driven by the adoption of Ethereum as a strategic asset by public companies. For example, BitMine Immersion Technologies increased its Ethereum reserve to 625,000 ETH, the value of these assets reaching approximately $2.35 billion. The company aims to own 5% of the entire ETH supply in the long term. Similarly, SharpLink currently holds approximately 438,200 ETH, worth $1.69 billion. The company's current unrealized profit from its Ethereum holdings has exceeded $400 million. According to the data, companies holding at least 100 ETH in their treasuries are as follows:1. Bitmine Immersion Tech2. SharpLink Gaming3. The Ether Machine4. Ethereum Foundation5. PulseChain Sac6. Coinbase7. Bit Digital8. Mantle9. Golem Foundation10. BTCS Inc.11. Gnosis DAO12. U.S. Government13. Lido DAO14. Ethereum Name Service15. Frax Finance16. Arbitrum DAO17. Status18. Optimism Foundation19. Zentry20. Request Network21. GameSquare Holdings22. ETH Strategy23. Onchain Foundation24. Intchains Group25. Aave DAO26. KR1 plc27. Kleros28. State of Michigan29. Nouns30. BrainDAO31. Gitcoin32. Axie Infinity33. Renzo Protocol34. Exodus35. Fluid36. Api3 DAO37. Sandclock38. BTC Digital Ltd39. UNCX Network40. Aavegotchi DAO41. Cartesi Foundation42. kpk43. Ready44. Ronin Network45. Harbinger Digital46. Obol47. SporkDAO48. Blockscape49. Botto50. RealmsDAO51. Bankless52. Abstract53. Royal Government of Bhutan54. StarHeroes55. Balancer56. Katana Foundation57. Ekubo Protocol58. Freysa59. The DeFi Collective60. DeFiGeek Community61. After School Club62. MetaLeX Labs63. Centaurus Energy Inc.64. Coinage MediaNew Major Player: The Ether MachineThe Ether Machine announced that it purchased 15,000 ETH to celebrate Ethereum's 10th anniversary, bringing its total reserves to 334,757 ETH. This amount exceeds the Ethereum Foundation's reserves. The company plans to go public on Nasdaq under the symbol ETHM in the last quarter of the year. It aims to raise a total of $1.6 billion.The Ether Machine co-founder Andrew Keys emphasized that Ethereum serves as a backbone for the new digital economy, stating that their mission to accumulate and support ETH is far greater than financial gain. The ETher Machine, which has been making huge purchases recently, took its place in the top 3. Startups Also in the RaceThe race to accumulate Ethereum isn't limited to large companies. BTCS Inc. announced its preparations for a $2 billion new ETH acquisition by filing with the U.S. Securities and Exchange Commission (SEC). Meanwhile, 180 Life Sciences (ATNF) is seeking funding to establish a $425 million ETH treasury and plans to change its name to "ETHZilla Corporation." Even the gaming industry is opening Ethereum reserves. The multiplayer blockchain-based game StarHeroes announced a reserve of 410 ETH. It was stated that this initiative is not limited to accumulating ETH but also aims to increase the utility and long-term value of the $STAR token. According to Standard Chartered analysts, corporate treasuries could hold 10% of the Ethereum supply in the future.

OMNI Comment and Price Analysis July 30, 2025

OMNI Technical Analysis Falling Trend Structure Analyzing the OMNI chart on a daily time frame, we see that the price retreated to the level at $3.28 and below it at first, and then it gained strong momentum and surged to the level at $8. As a result of this huge momentum, OMNI tested the upper end of the trend, yet it saw a sell-off there and pulled back to the range between the levels at $4.80–$4.90.The range between $4.82–$5.63 stands as a strong resistance zone, and for the time being, the $5.63 level in particular is about to be tested. If the price can close above this resistance level and hold above it, we could see renewed buyer interest. We have the strong support level at $3.28 below; if broken downwards, the price is likely to pull back to the range between the levels $2.70–$2.50. This area also contains the previously tested bottom dynamic.These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.

TOSHI Comment and Price Analysis July 30, 2025

TOSHI Technical Analysis Symmetrical Triangle Formation Analyzing the TOSHI chart on a daily time frame, we can see the clear symmetrical triangle pattern, and the price keeps contracting within this formation through higher lows and lower highs. It is currently trading close to the mid-border of the triangle formation at around $0.00055–$0.00056, which serves as both support and a potential reaction zone. The upper and lower convergence points of the triangle are classically considered potential breakout areas.We see that the upper border of the triangle formation is around the range of $0.00072–$0.00082, and it is hard to get a confirmation for an upward move unless this range is exceeded. The level at around $0.00112 could be a potential target if we can see price closings above this key range.We have the support level at $0.00050 below, and if it gets broken downwards, we can see a pullback towards the range between the levels at $0.00035–$0.00030.These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.

What is Nexo (NEXO)?

Do you have cryptocurrency but don't want to spend it? Imagine a platform that both earns interest and offers instant loans. Nexo (NEXO) meets this need. This innovative platform, launched in 2018 (yes, Nexo was launched in 2018), allows you to instantly convert your digital assets into cash using a crypto-collateralized loan system. It also helps you generate passive income with its crypto interest-earning feature. Users can quickly obtain loans using assets like BTC, ETH, and stablecoins as collateral through the Nexo lending platform, while still benefiting from the returns on these assets.In other words, Nexo is known as a crypto banking startup that allows you to obtain instant loans using cryptocurrencies as collateral and generate income from your assets. If you're looking for answers to questions like "What is Nexo?" or "What is Nexo Coin?", this guide will explore many details, from the platform's logic to its founding team, from its products and interest rates to its future. Nexo's Definition and OriginNexo is a crypto-collateralized lending platform that allows users to obtain instant cash loans by using cryptocurrencies such as Bitcoin, Ethereum, and Litecoin as collateral. The platform allows users to borrow against fiat currency (USD, EUR, etc.) or stablecoins using the digital assets deposited as collateral. This allows cryptocurrency holders to obtain cash liquidity without having to sell their assets.The most striking aspect of this system is that users do not need a credit score or bank procedures to obtain a loan. This means a decentralized and intermediary-free lending experience is provided. The Nexo lending platform assigns a credit limit to the user based on the value of the collateral, and users can access the loan within this limit at any time.Founded in 2018, this initiative was brought to life by a team with backgrounds in traditional finance. The co-founders' previous experience at Credissimo, a fintech company operating in Europe, provided significant technical and regulatory infrastructure for this project.Nexo not only provides loans but also offers users the opportunity to earn interest on their crypto assets. This means you can use your cryptocurrency as collateral to access loans, while simultaneously generating passive income. Thanks to this two-way service model, Nexo combines both borrowing and asset valuation needs under one roof.The NEXO token, the cornerstone of the platform, is at the heart of this system. By holding this token within the platform, users receive benefits such as discounted loan interest rates and increased interest earnings. Furthermore, for those who want to increase their loyalty levels, staking is also required. This provides a clear answer to the question of what the NEXO token does: it serves as both a utility and a rewarding tool. A sample account that demonstrates the many uses of NEXO. Users have access to the Nexo Card, stock trading, futures trading, borrowing, and earning. Nexo is considered one of the pioneers of the "bankless banking" vision in the cryptocurrency world. It offers a revolutionary alternative for crypto holders to both invest their assets and meet their immediate cash needs. The cumbersome procedures encountered in traditional systems, such as approval processes, credit score monitoring, and proof of income, are replaced by a user model that simply deposits crypto into their wallet and provides collateral. This is one of the main reasons why Nexo is preferred by millions of users around the world.Nexo's History: Key MilestonesTo truly understand a platform, we need to consider not only its offerings but also its origins and growth. Nexo's story begins not with ordinary beginnings, but with firm steps aimed at establishing a lasting presence in the crypto finance world. This project, which launched in 2018, has expanded not only its products but also its vision in the intervening years. Let's take a look at Nexo's journey and the significant developments it has experienced during each period. 2018: The Nexo platform launched, offering the first crypto-collateralized loan service (the Nexo launch date is known as 2018). The same year, the NEXO Token (NEXO) was launched, positioning itself at the heart of the ecosystem.2019: Nexo launched interest-bearing crypto accounts (Earn Interest), allowing users to earn passive income through assets like stablecoins and Bitcoin. During this period, the number of users increased by up to 850%.2020: Nexo began distributing a share of company profits (dividends) to NEXO token holders. For example, in August 2020, $6.1 million in dividends were distributed to token holders. That same year, the expansion of the "Earn on Crypto" feature increased interest rates, and the Nexo Loyalty Program was launched.2022: Nexo partnered with global payment giant Mastercard to announce its crypto-collateralized credit card product. This card enabled cryptocurrencies to be used in everyday life by providing collateral and spending opportunities for crypto assets. Furthermore, Nexo strengthened its enterprise-grade security and custody solutions by partnering with institutions such as Fidelity Digital Assets and Ledger Vault.2023–2024: The Nexo ecosystem expanded significantly. The Nexo Pro advanced trading platform, the Nexo Wallet (non-custodial wallet), a user-friendly storage solution, and the globally recognized Nexo Card were launched. In particular, the Nexo Card was launched in Europe as the first crypto-supported card integrated with Mastercard's infrastructure, allowing users to spend their assets without exchanging funds. By 2023, Nexo had become a platform serving over 1 million users in over 200 territories and managing over $4 billion in assets. NEXO Pro. Why is Nexo Valuable?When evaluating a platform, it's often more meaningful to approach it with questions like, "What does it offer, how does it work, and what does it offer the user?" From this perspective, Nexo offers lending, interest-earning, and token-based advantages. You can obtain loans by using your cryptocurrencies as collateral, and you can also earn interest by holding your assets in a Nexo account. Additionally, there's a loyalty system that varies based on the amount of NEXO tokens you hold, which affects your interest rates and loan costs. In other words, the platform operates on a model that combines several core functions. Let's examine these functions one by one:Crypto-Collateralized Instant LoansNexo allows users to instantly obtain loans by using their digital assets (BTC, ETH, etc.) as collateral. This allows users to meet their urgent cash needs with a crypto-collateralized loan; users can secure financing by using their crypto assets as collateral without selling them. Savings rates on the most popular cryptocurrencies Earning passive income from assetsThe platform offers interest income on stablecoins, Bitcoin, Ethereum, and many crypto assets. Users earn daily interest income on the digital assets they hold in their Nexo account. For example, Nexo offers annual interest rates of up to 10% on stablecoin deposits, depending on loyalty levels, and around 5–8% on mainstream cryptocurrencies like Bitcoin. (Nexo interest rates vary depending on asset type, market conditions, and loyalty levels.)Exclusive benefits for NEXO token holdersThe NEXO token, Nexo's native token, provides holders with various privileges within the platform. NEXO token holders can benefit from lower interest rates when taking out loans and receive bonus increases on interest income applied to other assets in their accounts. Additionally, in past years, a portion of platform profits has been distributed to NEXO token holders as dividends.The NEXO token is a central part of the Nexo ecosystem; it is not only an investment tool but also a structure that unlocks a system of benefits and rewards within the platform. Holding NEXO places you in tiers like Base, Silver, Gold, or Platinum within the Loyalty Program, which increases your interest rates, lowers loan interest rates, and earns bonuses like crypto cashback.The requirements for each tier are as follows:Base: You don't need to hold NEXO tokens.Silver: The amount of NEXO tokens in your account must be at least 1% of your total portfolio.Gold: The percentage of NEXO tokens must be at least 5% of your portfolio.Platinum: At least 10% of your portfolio must be NEXO tokens.This means users with higher loyalty levels benefit from benefits such as higher deposit interest rates, lower loan interest rates, and more free crypto withdrawals. For example, Platinum members can borrow at much lower rates than other users and maximize returns on savings products.Nexo later added a staking mechanism to this loyalty system; you can also earn interest directly by locking NEXO tokens on the platform. For example, when you reach the Platinum level, you can earn significantly higher interest income than other users and benefit from the lowest interest rates when taking out loans. Furthermore, the NEXO token also features dividend distribution; in past years, up to 30% of company profits have been distributed to token holders (this system continues today with an interest-based mechanism). In short, the NEXO token acts as an economic lever that makes the platform's services more advantageous.A product ecosystem that combines traditional and digital financeNexo brings together the worlds of traditional finance and the crypto world with innovative products like the Nexo Pro and Nexo Card. Nexo Pro caters to experienced investors by offering professional-grade trading tools and high liquidity, while the Nexo Card allows you to make purchases using your crypto-secured credit limit for daily expenses. This provides Nexo with a comprehensive ecosystem for using and managing crypto assets in the real world.A user who increases their loyalty level by staking the NEXO token not only earns more interest on their assets but also benefits from lower costs when taking out loans. As the chart above shows, as loyalty levels increase, so do free withdrawals and crypto cashback on spending. This multi-tiered rewards system is a key driver of user loyalty within the Nexo ecosystem (for example, Platinum members can earn up to 2% crypto cashback on Nexo Card spending). Nexo Card platform With the Nexo Card, you can spend with your crypto collateral at over 90 million MasterCard merchants, just like using a traditional credit card. One of the card's key advantages is that there's no minimum payment requirement on your outstanding balance and no interest accrues on unused credit limits. This means the interest you pay applies only to the amount of credit you actually use, and when your debt-to-collateral-to-value (LTV) ratio is below 20%, the interest rate can be as low as 0%. With these features, the Nexo Card stands out as a pioneering product that allows you to meet your daily financial needs without disrupting your crypto assets.The Future of Nexo (NEXO) CoinThe future of the NEXO coin will directly depend on the success of the Nexo platform and the overall trajectory of the crypto finance sector. With the withdrawal of many competing centralized crypto lending platforms (such as Celsius and BlockFi) from the market in 2022–2023, Nexo has become one of the key players remaining in the industry. The platform continues its growth with new product launches and global expansions, processing more than $1.5 billion in crypto loans in 2024 and distributing over $250 million in total interest income to its customers. Nexo's 2025 plans include creating new use cases for the NEXO token, updating its loyalty program, and listing the token on more crypto exchanges. As long as the company maintains its focus on regulatory compliance and transparency, the future of Nexo appears positive. However, given the volatile nature and regulatory dynamics of crypto markets, it's important for investors to proceed with caution and research.Who Founded Nexo?To answer the question of who Nexo is, the platform is backed by an experienced team of Bulgarian origin. The company was founded in 2018 by Antoni Trenchev, Kosta Kantchev, and Kalin Metodiev. The founding partners have strong backgrounds in financial law, fintech, and investment banking, bringing their experience from the European financial world to the crypto sector. For example, Antoni Trenchev served as a Member of the Bulgarian Parliament and is known for his work supporting the adoption of blockchain technologies. The Nexo team consists of professionals with over 30 years of traditional finance experience, and the company operates globally through operations in Zug (Switzerland) and London. Nexo takes a proactive approach to compliance (regulation), focusing on meeting legal requirements in various countries.Since its inception, Nexo has emphasized the principles of reliability and transparency. The team behind the platform has previously achieved success with traditional online lenders like Credissimo. This has enabled Nexo to establish a reliable credit infrastructure in the crypto sector. The company utilizes advanced custody solutions (e.g., Ledger Vault insurance) to secure customer assets and verifies its balance sheet health through regular independent audits. For example, Nexo, one of the first in the industry, announced the implementation of real-time proof-of-reserves through a major auditing firm, transparently demonstrating that the platform holds more assets than liabilities. Additionally, in 2023, Nexo successfully completed a SOC 2 Type 2 audit for system and data security, raising its compliance and security standards to the next level.Frequently Asked Questions (FAQ)Below are some frequently asked questions and answers about NEXO:What is Nexo and how does it work?: Nexo is a digital finance platform that offers instant cryptocurrency-backed loans and also earns interest on deposits. The platform works by allowing users to lock their cryptocurrencies as collateral and receive instant loans in return. Loans on Nexo offer flexible repayment terms; you can keep your loan open by paying only the interest as long as your collateral remains in your account, or you can repay the principal and pay off the debt at any time.What does NEXO token do?: The NEXO token is the native cryptocurrency of the Nexo ecosystem and functions as a key advantage. Users who hold this token receive numerous benefits on the platform: For example, NEXO holders can earn annual returns of up to 12%, start taking advantage of low crypto loan interest rates of 2.9%, and earn crypto cashback rewards of up to 2% on Nexo Card spending. The NEXO token also allows you to increase your loyalty level, allowing you to earn privileges like higher interest rates and free withdrawals on your other assets.How to get a loan with Nexo: Getting a crypto-backed loan on the Nexo platform is quite easy. First, you sign up to the platform and deposit supported cryptocurrencies like Bitcoin and Ethereum into your account. These deposited digital assets are used as collateral to calculate a credit limit; you can generally borrow up to 50% of your asset value (LTV ratio). The loan amount is instantly reflected in your account as fiat currency (e.g., USD, EUR) or stablecoin. Nexo loans have no installment or maturity requirements; you can keep your loan open by making interest-only payments or pay off the principal at any time. Furthermore, as long as you keep your LTV ratio low (for example, if your loan amount doesn't exceed 20% of your collateral), the interest rate can even be 0%. How to earn interest on Nexo?: To earn interest on the Nexo platform, simply deposit your cryptocurrency or stablecoin assets into your Earn account. For example, when you deposit a stablecoin like USD Coin (USDC), you can earn annual interest returns of up to 10–12%, depending on market conditions and your loyalty level. Popular cryptocurrencies like Bitcoin and Ethereum, on the other hand, have annual interest rates of 5–8%. At Nexo, interest returns are calculated daily and credited to your account daily. You can continue to earn compound returns by reinvesting these interest earnings, or you can withdraw and use the accumulated interest at any time.Is Nexo reliable and regulated?: Nexo is one of the most established crypto finance platforms in the industry and actively promotes security and legal compliance. The company meticulously implements KYC (know your customer) and AML (anti-money laundering) processes, ensuring users use the platform in compliance with regulations. Having completed licensing and registration processes in many countries, Nexo protects customer assets with insured custody services and verifies through independent audits that its reserves more than cover its obligations to customers. Furthermore, due to regulatory uncertainties in the US in 2022, Nexo terminated its services in that country and reached a $45 million settlement with the relevant authorities, demonstrating Nexo's commitment to meeting regulatory demands. Of course, as with any financial platform, users should act within their own risk tolerance; however, Nexo is generally recognized as a reliable platform in the industry.What are the benefits of staking NEXO tokens?: Holding (staking) your NEXO tokens on the Nexo platform offers multiple benefits. Firstly, you earn up to 12% annual interest on your NEXO balance, meaning you earn extra income even while your tokens are on the platform. Furthermore, as you hold more NEXO, you reach higher levels in the Loyalty Program, earning higher interest rates on your other assets and lower interest rates on loans. For example, a user who holds NEXO above a certain percentage can reach Platinum status, benefiting from maximum interest rate discounts and the highest cashback rates on the Nexo Card. Historically, NEXO holders have also received a share of Nexo's dividends, which can be seen as a long-term incentive for token ownership.For more information on crypto-enabled financial services and digital asset loans, check out our JR Kripto Guide series.

JPMorgan and Coinbase Partnership Announced: A New Era Begins in 2026

US-based financial giant JPMorgan Chase and cryptocurrency exchange Coinbase have signed a groundbreaking partnership in the digital finance world. As part of this newly announced strategic partnership, users' Chase bank accounts will be directly linked to Coinbase crypto wallets. This connection is expected to be operational in 2026.Direct bank-to-wallet accessThe most striking aspect of the partnership is that, thanks to JPMorgan's secure API infrastructure, Chase customers will be able to directly link their bank accounts to their Coinbase wallets. This will allow users to conduct crypto transactions directly through their banking systems. JPMorgan and Coinbase emphasized that this integration will raise the bar in terms of both security and data privacy in financial transactions.Melissa Feldsher, Head of Payment and Credit Innovation at JPMorganChase, said, “This collaboration with Coinbase will give our customers greater control over their financial future. Thanks to the flexibility provided by our Ultimate Rewards program, users can now securely convert their points into crypto assets.” Credit card and reward points are being converted into cryptoThe two companies' collaboration isn't limited to bank connections. Another feature planned for launch in the fall of 2025 is the availability of Chase credit cards on Coinbase. This step paves the way for the greater integration of traditional financial instruments into the crypto world.Points from JPMorgan's popular "Chase Ultimate Rewards" loyalty program will also be transferred one-to-one to Coinbase accounts. This marks the first time a major credit card rewards program has been used to fund crypto wallets. 100 points can be converted into crypto, worth $1. These features are also planned to launch in 2026.Coinbase's Head of Consumer and Business Products, Max Branzburg, commented on the partnership: "This partnership with JPMorganChase is an important step in making crypto participation more accessible. Together, we are removing the barriers to adoption of blockchain-based financial services by providing consumers with more choice."Coinbase aims to build a more equitable and open financial system through the opportunities offered by the crypto economy. The platform, which currently offers services such as trading, storage, staking, spending, and global transfers to millions of users, also provides infrastructure for projects developing blockchain applications.Coinbase is a US-based platform that offers basic services for users looking to buy and sell cryptocurrencies. The app allows users to trade popular cryptocurrencies, store, and transfer assets. While known for operating in compliance with regulations, it has occasionally been criticized for high transaction fees or delays due to congestion. While it's a popular entry point into the crypto world, it's not a perfect fit for all users.

ENS Comment and Price Analysis July 30, 2025

ENS Technical AnalysisENS witnessed a strong upward momentum following the breakout of the downtrend channel within which it had been trading for a long time. The price swiftly surged to the level at $32.00 following the breakout; however, it is now going through a short-term correction period on account of the sell pressure occurring at this area.ENS is currently trading at around the level of $28.29, and we have the first key support range around the levels at $25.80 – $26.45 in case the downward correction continues. However, if this key support is lost, we should be following the range between the levels at $22.10 – $22.63, which represents a strong support line where previous price pressures have occurred, and buyers could re-enter the picture. ENS Current View Summary:• Price: $28.29, strong rally after downtrend breakout• First support zone: $25.80 – $26.45• Key support zone: $22.10 – $22.63• Resistance levels: $32.01 → $38.73 → $45.27These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.

TIA Comment and Price Analysis July 30, 2025

TIA Technical AnalysisLooking at the TIA chart, we can say that the downtrend pattern which has been active for a long period of time is still valid. Though the price drew near to this downtrend zone again with the help of the latest upward movement, it was rejected at the level of $2.11 and went into a correction.TIA is trading around the level at $1.878, and this level coincides with the short-term support line between the levels at $1.88 and $1.81. As long as this range is maintained, the price could be propelled upward. Moreover, if we see a break above the resistance level of $2.11, the price could rapidly surge to the target range between the levels at $2.36 and $2.45.On the other hand, we have a support zone between the levels at $1.60 and $1.43 to follow in case the downward pressure intensifies and the level of $1.81 gets broken. At this level, we expect that buyer interest will increase. Falling Trend Structure Summary:Price: $1.878Short-term support: $1.81Resistance area: $2.11Targets in case of an upside breakout: $2.36 → $2.45 → $2.78Support in case of a downside scenario: $1.60 → $1.43 → $1.31The downtrend in TIA has not yet been broken. A break above the $2.11 resistance level will provide clearer trend reversal signals. Otherwise, support areas should be closely monitored.These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.

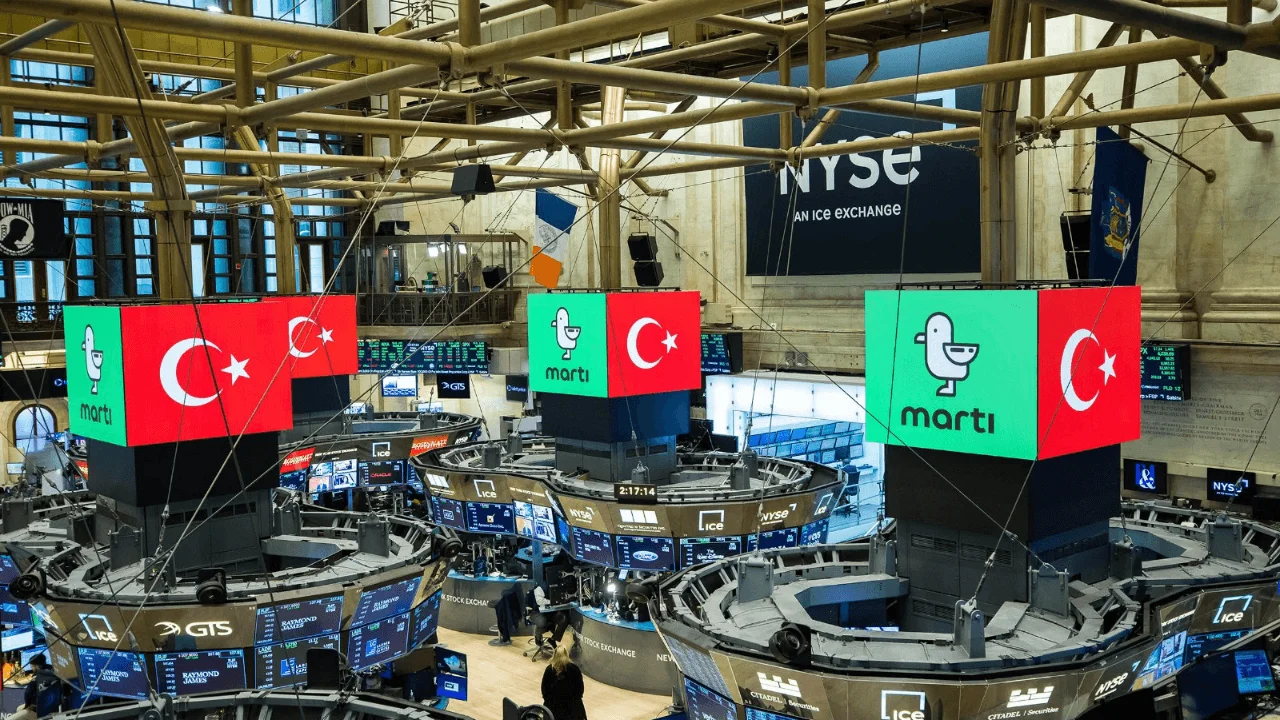

NYSE-Listed Martı Makes Crypto Treasury Move: Invest in Bitcoin, Altcoins Next

Martı Technologies (MRT), a Turkey-based mobility startup listed on the NYSE, has taken a significant step that challenges traditional treasury management approaches. The company announced that it will allocate 20% of its cash reserves to Bitcoin, integrating crypto assets into its corporate treasury strategy. With this move, Martı has become one of the companies that view crypto assets not only as a speculative tool but also as a long-term store of value and a shield against financial risks.Cryptocurrency investments could reach up to 50%The company announced that the crypto asset ratio could be increased to 50% over time. It was also stated that this potential increase may not be limited to Bitcoin; other leading crypto assets such as Ethereum and Solana could also be included in Martı's reserves in the future. All digital assets will be securely stored through platforms that provide institutional-grade custody services in compliance with regulations. Martı Founder and CEO Oğuz Alper Öktem summarizes the motivation behind this strategy:“Our decision to allocate capital to crypto assets demonstrates our belief that Bitcoin and other digital assets have proven their store of value alongside hard currencies and gold over the past few years. This strategy represents a prudent and long-term stance in the current economic environment, where we face inflationary pressures and currency risks.”The company emphasized that this move will not disrupt its current operations or business plans. It was stated that crypto asset purchases will be made from excess cash reserves and will not impact operational expenses. It also announced that future digital asset transactions will be announced transparently, in accordance with legal requirements.The company announced that it had reached 2.15 million passengers and 314,000 registered drivers as of June 3, 2025. This represents a 12.7% increase in passengers and an 8.3% increase in drivers in just two months. Martı's fleet consists of micromobility vehicles such as electric scooters, bicycles, and mopeds, operating in major cities across Turkey. The company plans to expand its presence from major cities like Ankara, Istanbul, Izmir, and Antalya to include Konya, Kayseri, Bursa, Mersin, Adana, and Kocaeli. With this expansion, Martı aims to increase its potential user base from 28.8 million to 42 million.Co-founder Cankut Durgun was appointed Chief Operating Officer as of June 12, 2025. Cenk Özeker, with over 25 years of experience, has also joined the new Chief Financial Officer.As a result, this move marks Martı Technologies' inclusion among publicly traded companies, joining giants like MicroStrategy, Tesla, and Blockchain, in incorporating crypto into their balance sheets.

LDO Comment and Price Analysis July 29, 2025

LDO/USDT Technical AnalysisLooking at the LDO chart, we can clearly see that a downtrend is obvious. The price tested the strong resistance range between the levels at $1.25 – $1.31, which work as both horizontal resistance and the upper border of the triangle pattern. Therefore, it should be considered as normal if the price sees some sell pressure here in terms of technical perspective. Falling Trend Theme LDO is currently trading at around the level of $1.047. The range between the levels at $0.90 and $0.95 seems to be the support area we should be following in the event of a continued pullback. This price range has worked as a significant demand area in the past, and it is highly possible that the price will move back towards the upper border of the triangle with the reaction it receives from here.If the price gains momentum from this support zone and goes up to break out of the triangle pattern, we should be following the resistance levels at $1.318, $1.464, and $1.959 respectively.In case of a downward scenario, we can say that closings below the level of $0.90 could activate the lower support levels at $0.78 → $0.70 → $0.611.These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.

FXS Comment and Price Analysis July 29, 2025

FXS Technical AnalysisThe Frax protocol has restructured its stablecoin system through a new architectural update called "North Star." This update aims to open the frxUSD stablecoin to broader institutional integrations. In particular, thanks to its decentralized reserve model and harmonized governance system, Frax aims to create a stronger foundation for new partnerships and regulation-friendly integrations. The impact of these developments becomes more meaningful when analyzed alongside the technical outlook.The descending channel pattern in action since 2022 catches our attention when we look at the chart on a daily time frame. The price is trading up and down between the lower and middle borders of this falling channel, with no clear directional confirmation yet. We see that FXS got its latest rejection at the upper border of the channel and then it retreated to the level where MA50 is located. There is a potential two-way possibility for the price: either it will go down and retest, or it will go up for a breakout, which could be more likely if we see increased volume, particularly during the price action near the upper border of the channel.There is also a great possibility for a sharper price action following the breakout, as this channel has been active for a long period of time—meaning that when the price breaks in one direction, a serious movement area may arise in terms of the continuity of the trend. Falling Wedge Structure Support and Resistance LevelsThe first major support area lies at the level of $3.20, which has been tested many times before but defended by buyers. However, if the price breaks downwards, then we will probably see a pullback to the level at $2.93.On the other hand, if the price can see closings above the level of $3.50, then we could witness a surge to the levels at $3.90 and $5.00, which will confirm the upward breakout of the formation. However, if the price closes below the level of $3.20, then it seems possible to test $2.93 followed by other lower support levels.These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.