STRK/USDT Technical Analysis

As one of the leading Layer-2 solutions addressing Ethereum’s scalability challenges, StarkNet has recently come back into the spotlight with both its technological upgrades and user-focused initiatives. Notably, the StarkNet Foundation’s staking system, which now includes Bitcoin users, has drawn significant attention. The growing number of developers and expanding ecosystem continue to fuel investor interest in STRK.

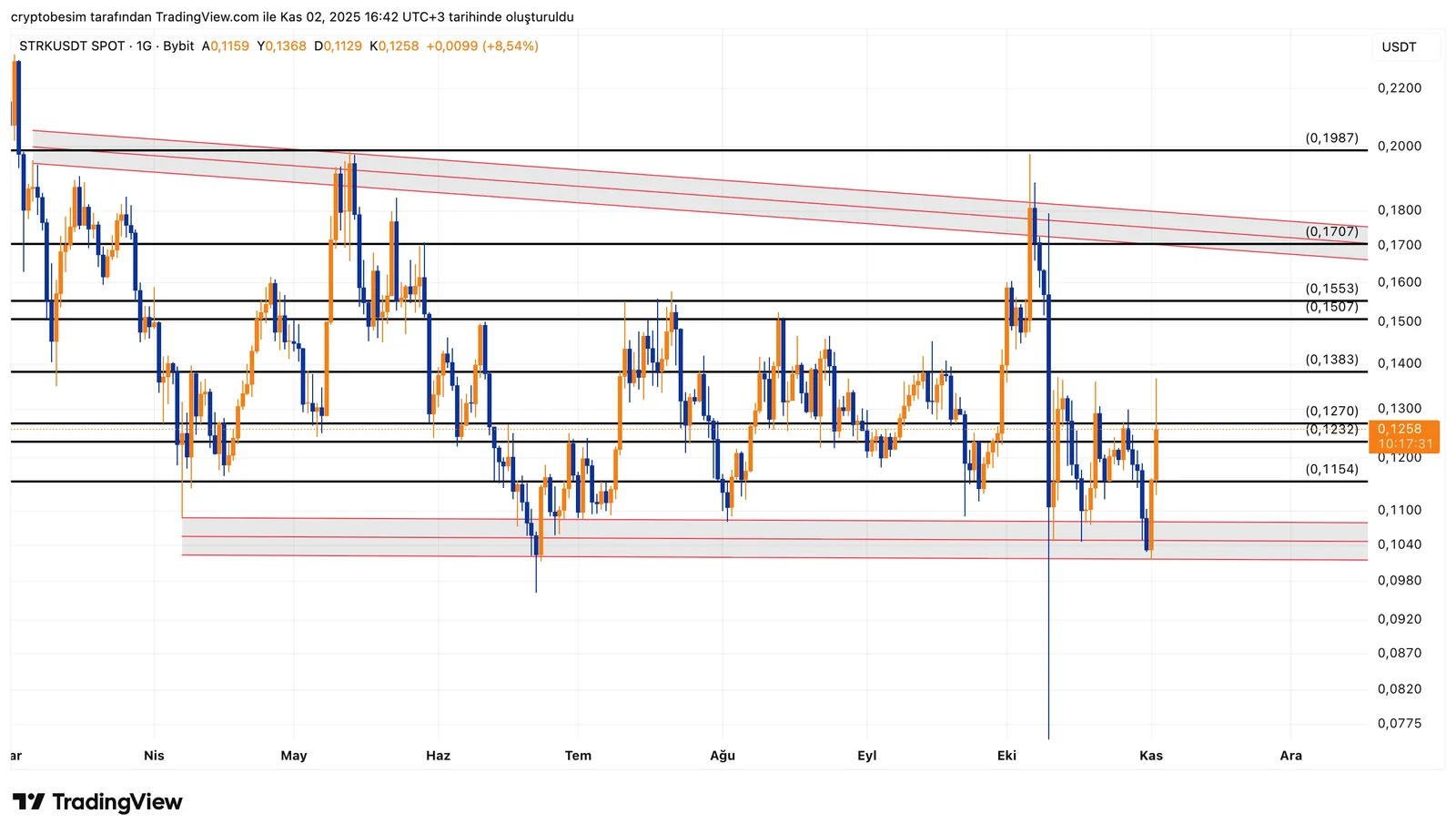

Analyzing the chart on the daily time frame, we see that the coin has been trading within a broad consolidation range for quite some time. The price has recently retested the lower boundary of this range and showed a strong bounce reaction, suggesting that the bottom zone remains valid and short-term momentum has turned positive. The price is currently attempting to hold above the $0.1150–$0.1230 zone. Closes above this area would support further bullish momentum. The first key resistance stands near $0.1380, followed by the $0.1500–$0.1550 region. A confirmed move above this zone could open the path toward $0.1700 and signal a continuation of the recovery trend.

On the other hand, the $0.1150 level will act as initial support below. Losing this area may trigger a deeper retest toward $0.1040–$0.1000. However, current price behavior suggests that buyers are actively defending the range lows, keeping the structure constructive for now.

- Summary• STRK remains in a long-term consolidation structure.• Strong rebound from range support turned short-term outlook positive.• Holding above $0.1230 strengthens the $0.1380 upside target.• Below $0.1150, a retest of lower supports may occur.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.