Strategy, which has placed Bitcoin at the center of its balance sheet strategy, continues its purchases without slowing down. The company announced that it purchased a total of 2,932 Bitcoin between January 20-25. According to the 8-K filing with the US Securities and Exchange Commission (SEC), approximately $264.1 million was spent on this purchase, and the average cost per Bitcoin was $90,061.

Another Bitcoin move from Strategy

With this latest purchase, Strategy's total Bitcoin holdings have reached 712,647 BTC. The company's co-founder and CEO, Michael Saylor, shared that the total cost of the current portfolio is approximately $54.2 billion, and the average purchase price is $76,037. Considering current prices, Strategy's on-paper profit is calculated to be approximately $8.3 billion.

These figures also reveal the company's weight in the Bitcoin supply. Strategy's Bitcoin holdings represent approximately 3.4% of the total supply, which has a maximum of 21 million BTC. This positions the company uniquely, not only among institutional investors but also within the global Bitcoin ecosystem.

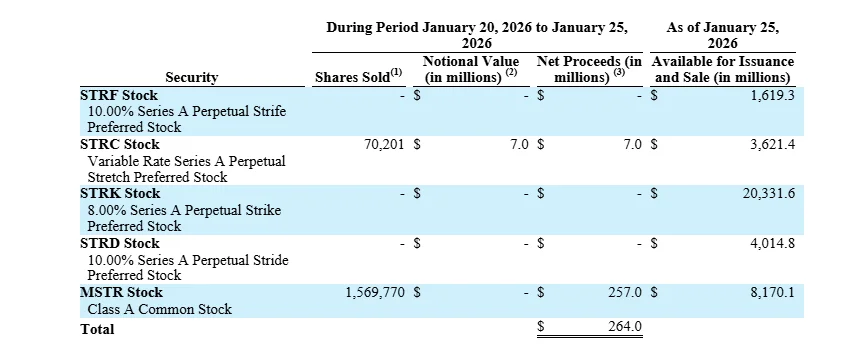

The financing for recent purchases came from sales of Class A common shares (MSTR) and perpetual preferred shares (STRC). Last week, Strategy generated approximately $257 million by selling around 1.57 million MSTR shares. During the same period, it raised approximately $7 million from the sale of 70,201 STRC shares. The company states that it still has the capacity to issue billions of dollars worth of additional shares under its current programs.

This financing structure is part of Strategy's long-term capital plan. Under this strategy, called the "42/42 plan," the company aims to raise a total of $84 billion in capital by 2027. This plan includes both equity issuances and convertible debt instruments and aims to directly finance Bitcoin purchases. In addition, investors are offered perpetual preferred shares with different risk-return profiles, such as STRK, STRC, STRF, and STRD. Michael Saylor, as usual, hinted at this latest purchase beforehand. On Sunday, he added the note "Unstoppable Orange" to his Bitcoin purchase tracking chart, signaling a new purchase in the market. This post also confirmed that the company had completed its fifth consecutive weekly Bitcoin purchase. Strategy's aggressive accumulation policy coincided with a period of short-term volatility in the Bitcoin price. After rising above $97,000 at the beginning of the year, Bitcoin recently fell to around $87,000, giving back much of its year-to-date gains. In parallel, Strategy shares (MSTR) also came under pressure, with the share price falling by over 2% on a weekly basis. On the other hand, Strategy is not alone. According to Bitcoin Treasuries data, 194 publicly traded companies currently hold Bitcoin on their balance sheets. While names like MARA, Metaplanet, Riot Platforms, Coinbase, Hut 8, and CleanSpark are among the largest institutional Bitcoin holders, Strategy maintains its leading position by a wide margin. It is speculated that if the company continues at its current pace, it could approach the 800,000 BTC mark by the end of the year.