The crypto market is preparing for one of the largest derivatives transactions of October. Bitcoin (BTC) and Ethereum (ETH) options contracts, with a total value approaching $17 billion, will expire on Friday, October 31, 2025, on the Deribit exchange. According to Deribit data, Bitcoin accounts for $13.5 billion of the expiring contracts, while Ethereum accounts for $2.5 billion. This volume surpassed last week's $6 billion weekly close, making October one of the most active periods of the year.

Cautious Optimism on Bitcoin

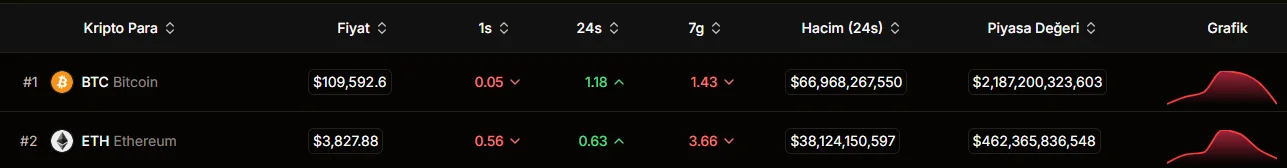

Bitcoin's price was trading around $109,000 at the time of writing. There are more than 124,000 Bitcoin options contracts expiring, and the "max pain" level, or the price point where the greatest loss occurs, is set at $114,000. Historically, the Bitcoin price tends to trend toward these levels as expiration approaches. This is because market makers adjust their positions accordingly to hedge against these levels. The put/call ratio is hovering around 0.70, indicating that investors are not overly pessimistic but rather cautiously optimistic. However, market data indicates that the market is "fragile," and selling pressure may increase in areas below $112,000. The $106,000 support level is considered critical in the event of a potential decline.

Ethereum Takes a More Cautious Stance

On the Ethereum side, more than 646,000 options contracts are set to expire on Friday. Total volume is $2.49 billion. The "maximum pain" level is set at $4,100, just above the current price. While Ethereum's put/call ratio is also 0.70, traders are generally more cautious. Deribit analysts commented, "Ethereum positions are cautiously optimistic. However, investors are still hedging against a potential downside." The number of open interest on the ETH side has fallen to around 70,000 in the last month, indicating a decline in trader interest. This strengthens the possibility of a period of sideways movement or consolidation in the market.

Macro Trends and Expectations

Analysts note that the easing of trade tensions between the US and China has increased risk appetite, but markets remain cautious. The Deribit team warned, "While the overall macro outlook is turning positive, market participants should be prepared for a potential increase in volatility." This $17 billion maturity event could determine the short-term direction of Bitcoin and Ethereum prices. The maximum pain levels of $114,000 (BTC) and $4,100 (ETH) could cause prices to temporarily retreat to these levels. However, if no new catalysts emerge, a period of directionless consolidation is also possible in the market.

At the time of writing, Bitcoin is trading around $109,500, while Ethereum is trading around $3,800.