The global crypto investment market experienced a sharp shift in direction during the last week of January. According to a weekly report published by CoinShares, there was a net outflow of $1.73 billion from digital asset investment products. This figure was recorded as the largest weekly fund outflow since mid-November 2025 and indicated a renewed weakening of risk appetite among institutional investors.

CoinShares Research Director James Butterfill states that several key factors stand out behind these outflows. According to Butterfill, weakening expectations for expected interest rate cuts from the US Federal Reserve, negative momentum in crypto prices, and the fact that digital assets have not yet been included in the "debasement trade" narrative led investors to reduce their positions. In particular, increased uncertainty on the macro front led to a more cautious stance in institutional portfolios.

The outflows were centered in the US

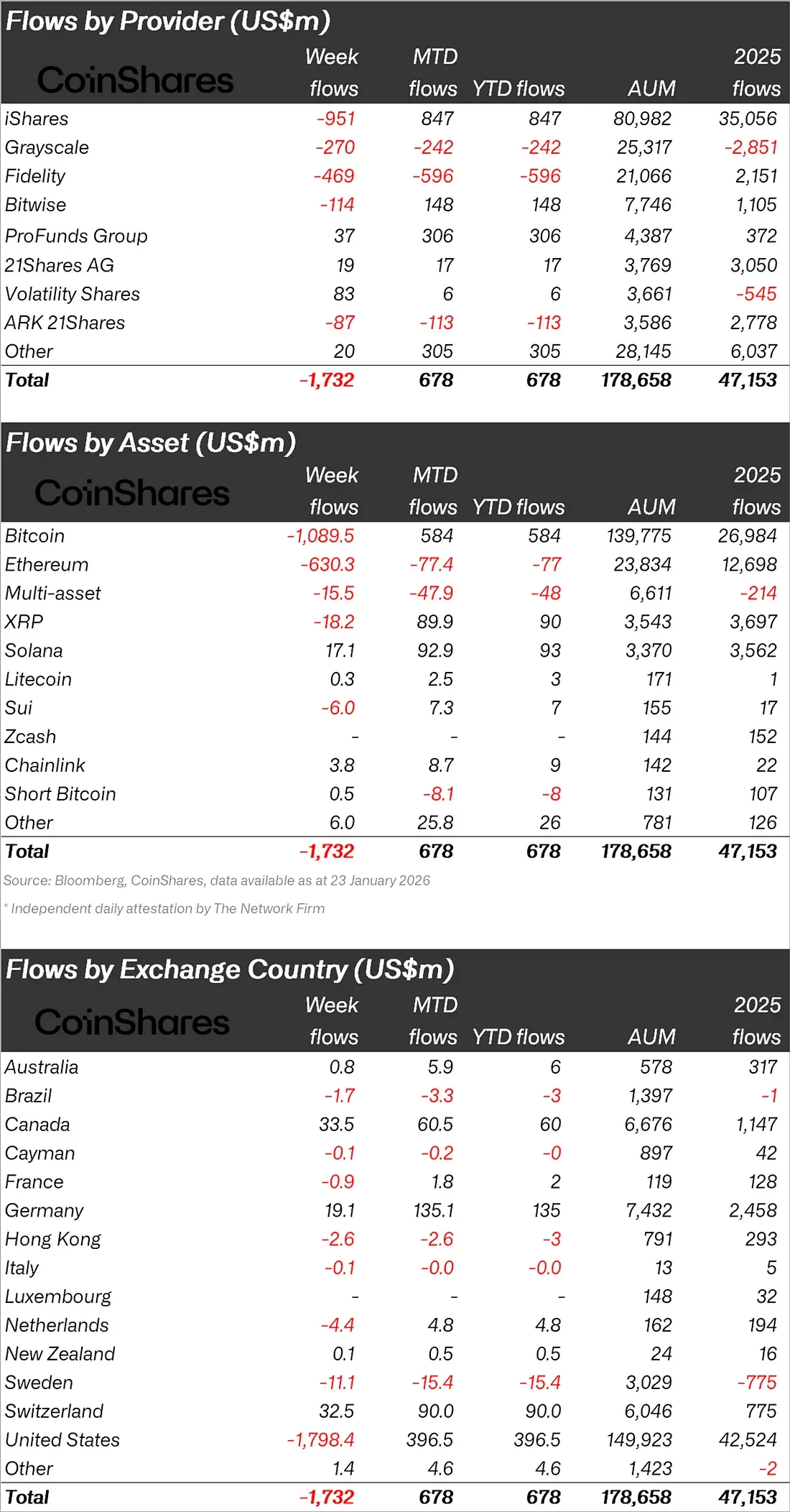

Looking at the regional distribution, it is seen that almost all of the fund outflows originated from the US. While approximately $1.8 billion flowed out of crypto investment products in the US, this constituted the majority of the global total. In contrast, a more balanced picture prevailed in Europe and Canada. Switzerland, Germany, and Canada were among the regions that viewed the recent price pullbacks as buying opportunities. Net inflows of $32.5 million, $19.1 million, and $33.5 million were recorded in these three countries, respectively. On the other hand, some countries, such as Sweden and the Netherlands, saw more limited fund outflows. This indicates that rather than a one-way global risk aversion, regionally differentiated strategies came to the forefront.

Bitcoin and Ethereum at the center of selling pressure

According to asset-based data, the two largest crypto assets in the market were again at the center of selling pressure. Bitcoin investment products experienced weekly outflows of $1.09 billion. This was the sharpest pullback in Bitcoin funds since November 2025. During the same period, $630 million flowed out of Ethereum products. This chart revealed that negative sentiment was not limited to a single asset but spread across the entire market.

On the other hand, a limited inflow of $0.5 million into Bitcoin short-position-based products showed that some investors continued to take positions expecting a decline. CoinShares, however, emphasized that overall sentiment has not significantly recovered since the sharp price drop in October 2025.

Solana, LINK, and BNB stand out

While the overall picture was negative, Solana was a notable exception. Solana-focused investment products recorded a net inflow of $17.1 million, positively diverging from the market. Smaller-scale inflows were also observed in BNB Coin and Chainlink products. This is considered a significant signal that investors are selectively taking positions rather than exiting the market entirely.