News

Regulation News

Regulation News

Browse all Regulation related articles and news. The latest news, analysis, and insights on Regulation.

Watch Out for July 22: Cryptocurrency Report to be Presented in the US

The US is preparing to take another important step towards its goal of becoming a global leader in cryptocurrencies. The Trump administration is continuing its work on a new “Digital Asset Report” expected to be presented on July 22. This comprehensive report will include recommendations and regulations that will shape US policies on cryptocurrencies.This development comes after US President Donald Trump signed an executive order in January that aims to strengthen America’s position in the crypto industry. The administration’s ultimate goal is to make the US a global hub for cryptocurrencies.Bitcoin reserve on the agenda: Funding can be provided without increasing tax burdenOne of the most striking headlines of the report is America’s plan to create a strategic Bitcoin reserve. According to industry sources, alternative funding methods that will not impose an additional burden on taxpayers are proposed for the financing of this reserve. Although this plan has not yet been finalized, it is expected that the US government’s influence on cryptocurrencies will increase if it is implemented.If this reserve plan is formalized, America’s leadership in the crypto market will be further consolidated and a strong national asset base will be created in the digital economy. A new era may begin in the US's crypto policies.National framework for cryptocurrenciesThe report being prepared is not limited to the Bitcoin reserve. With the proposal of the US Congress, the establishment of a federal digital asset regulatory framework for stablecoins is also on the agenda. In addition, it is suggested that steps be taken to ensure that crypto companies receive equal service from banking institutions such as the Federal Reserve. This approach aims to reduce discrimination against crypto companies in the financial system and provide more equitable access to the sector.Statement from the CFTC Chair: "Crypto roadmap"Caroline Pham, Interim Chair of the US Commodity Futures Trading Commission (CFTC), defined the report in question as a "cryptocurrency roadmap". The report is expected to include new legal and regulatory proposals, as well as the steps taken by federal institutions for digital assets to date. The idea of a national digital asset reserve, announced by Trump in March, will also be one of the focal points of the report.The timing of the proposals to be included in the report is also noteworthy. The Trump administration has declared the week of July 14 as “Crypto Week.” Within this scope, crypto regulation bills will be discussed in the House of Representatives. Experts state that this report can be used as a critical policy tool in Trump’s upcoming election process. In general, we can say that there has been positive news about cryptocurrencies from the US recently. As we have previously reported, two US institutions will hold important hearings on cryptocurrencies on July 9, tomorrow. The House of Representatives will hold a hearing titled “Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Fit for the 21st Century.” The Senate will hold a hearing titled “Building Tomorrow’s Digital Asset Markets.” In particular, providing legal clarity for Bitcoin and altcoins is very valuable for the sector.

US to Talk Crypto on July 9: Two Historic Sessions for Investors

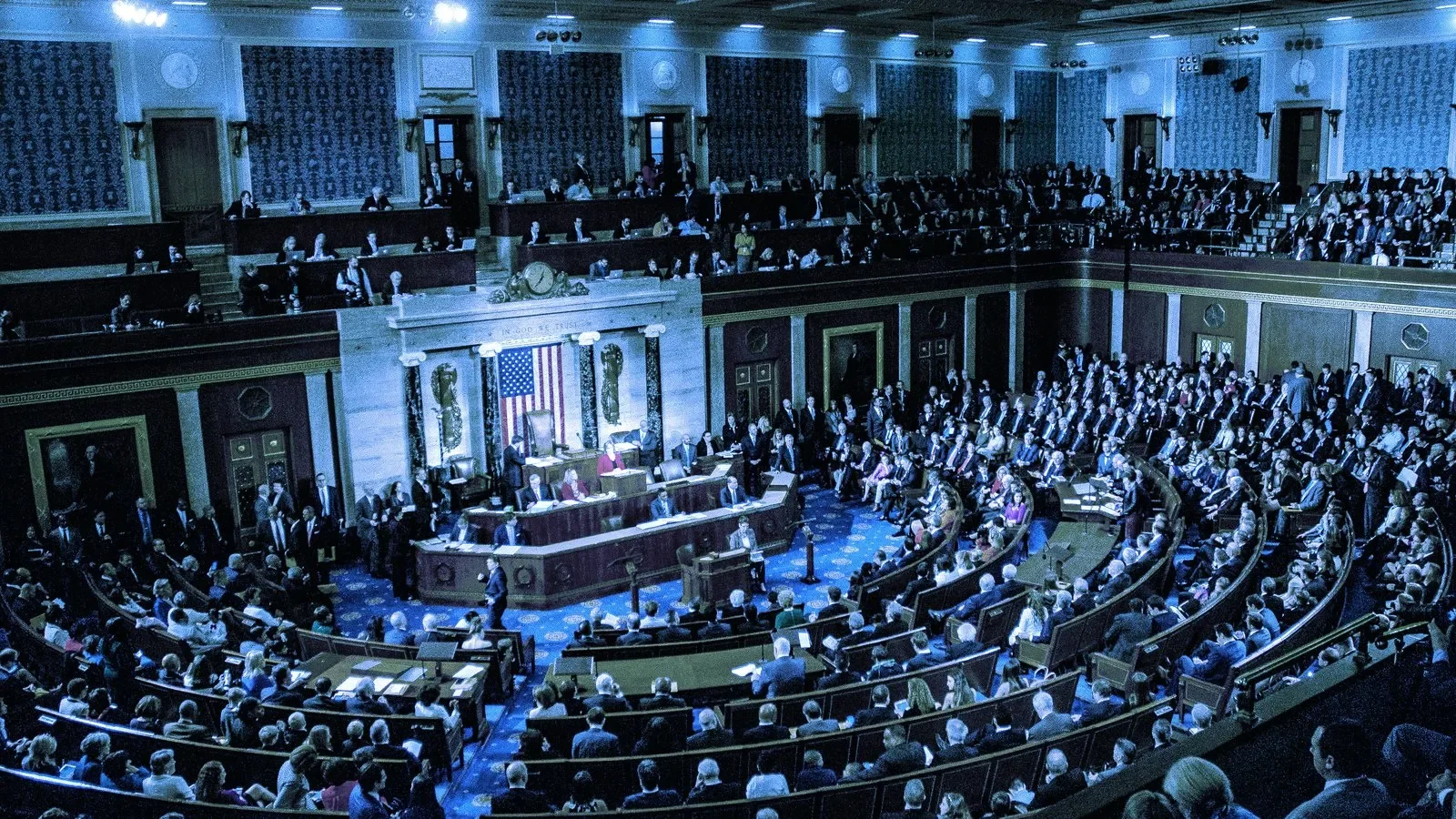

The US Congress has turned its course to the cryptocurrency market following President Trump's comprehensive tax and budget package. On Wednesday, July 9, both the House of Representatives' Ways and Means Committee and the Senate's Banking Committee will hold important hearings on cryptocurrencies. On the other hand, "Crypto Week" is approaching. As will be recalled, House Speaker Mike Johnson declared the week of July 14 as "Crypto Week". Within this scope, bills on the structure of digital asset markets and stablecoins will be voted on.Crypto taxation on the tableThe session titled "Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Fit for the 21st Century" to be held by the House of Representatives will attempt to clarify the framework for cryptocurrency tax policies. Although the witness list has not yet been shared with the public, it is expected that important topics that directly concern investors and developers will be discussed in the session. In particular, the taxation and declaration procedures of leading assets such as Bitcoin and Ethereum and stablecoins will be the subject of discussion.Sector giants to speak in the SenateThe Senate session titled “Building Tomorrow’s Digital Asset Markets” will be attended by familiar names from the sector. Blockchain Association CEO Summer Mersinger, Chainalysis CEO Jonathan Levin, Paradigm partner Dan Robinson and Ripple CEO Brad Garlinghouse will answer questions from Senate members. The Senate will address liquidity systems, custody solutions and the reserve structure of stablecoins in this session. It is aimed to clarify regulatory uncertainties that may especially interest institutional investors.CLARITY and GENIUS laws to be voted onBeyond July 9, July 14 is also eagerly awaited in the crypto field. Because on this date, two important bills will be voted on in the House of Representatives as part of Crypto Week: CLARITY Act and GENIUS Act. The CLARITY Act aims to determine which crypto assets are subject to which regulator by making a clear division of duties between the SEC and CFTC. This law could pave the way for large banks and institutional investors to enter the crypto market more strongly.The GENIUS Act provides a legal framework for stablecoins. This law, which passed the Senate in June, introduces regulations regarding the issuance and trading of stablecoins. If the bill is approved by the House of Representatives, banks, fintech companies and large retailers will be able to start offering stablecoin services. However, the fact that the bill was submitted to a direct vote by skipping the committee stages has drawn criticism from some segments.Although both bills initially received bipartisan support, they later faced serious objections from Democrats. The main reason for this was Trump and his family's close ties to various crypto projects and stablecoin initiatives. Democrats proposed amendments that would prohibit presidential candidates from making private crypto investments. However, these proposals were rejected by the committees, which are mostly Republicans.

US House of Representatives Prepares for “Crypto Week”: Three Critical Bills on the Agenda

The United States House of Representatives is preparing to take a historic step in the field of digital assets by declaring the week of July 14 as “Crypto Week.” Three important bills are expected to be on the House agenda during this process: the GENIUS Act, the CLARITY Act, and the Anti-CBDC Surveillance State Act. The bills are seen as part of President Donald Trump's goal of making the US “the crypto capital of the world.”French Hill, Chairman of the House Financial Services Committee, said in a statement, “We are taking historic steps to ensure that the US remains a leader in innovation,” highlighting the importance of establishing a legal framework for both investors and consumers. Hill also noted that priority will be given to issues such as the regulation of payment-based stablecoins and the prohibition of central bank digital currency (CBDC) as part of “Crypto Week.” GENIUS Act: Clear rules coming for stablecoinsThe GENIUS Act, which was approved by the Senate in June and is now before the House of Representatives, requires stablecoin companies to operate with full reserves in US dollars or similar liquid assets. The bill, which imposes an annual audit requirement on companies with a market value exceeding $50 billion, also sets rules for foreign companies. President Trump has made it clear that he wants the bill to be signed by August.Following discussions on the House's own version, the STABLE Act, which was previously on the agenda, members are expected to focus on the version passed by the Senate. This approach aims to speed up the process and align with President Trump's requested timeline.CLARITY Act: CFTC takes center stageThe CLARITY Act aims to end regulatory uncertainty in the cryptocurrency market. The bill proposes to transfer oversight of digital commodities to the US Commodity Futures Trading Commission (CFTC) while limiting the authority of the Securities and Exchange Commission (SEC). Representative Glenn Thompson, who supports the bill, emphasized that they are responding to the industry's calls by saying, “We are providing the long-awaited regulatory clarity.”Anti-CBDC Act: No Passage for the Digital DollarAnother important bill to be discussed during Crypto Week is the Anti-CBDC Surveillance State Act. This law aims to prevent the US Federal Reserve (Fed) from offering individuals direct central bank digital currency. Republican Whip Tom Emmer, who introduced the bill, stated that this initiative is critical to protecting the financial privacy of the American people. “When we send these three bills to President Trump's desk, we will position the US as a leader in digital assets,” he said.While the bills are advancing with Republican support, criticism is also coming from the Democratic side. In particular, President Trump's interest in cryptocurrency and the reported $620 million in income his family has earned from cryptocurrency projects are sparking debate. Democrats argue that some parts of the bills were rushed through and not adequately reviewed.

SPK Blocks Access to PancakeSwap and Numerous Other Sites

Turkey is tightening its regulatory measures in the cryptocurrency markets. In a bulletin published on July 4, 2025, the Capital Markets Board (CMB) announced that it had blocked access to several websites, including the decentralized finance (DeFi) platform PancakeSwap. This decision marks the beginning of the first direct intervention in the DeFi sector in Turkey.First intervention against a DeFi platformAccording to the CMB's decision, the reason for blocking access to PancakeSwap is its “unauthorized cryptocurrency asset service provider activities” in Turkey. This decision is noteworthy as it marks the SPK's first direct intervention targeting decentralized finance protocols. Until now, access to many global cryptocurrency exchanges operating without a license in Turkey had been blocked, but these exchanges were mostly centralized in nature. The inclusion of DeFi platforms like PancakeSwap on the list indicates that the scope of regulation has been expanded. Following the decision, a short-term decline was observed in the price of PancakeSwap's native token, CAKE. This situation once again highlighted how regulatory news can impact the market.Which sites are targeted?The SPK bulletin stated that access to dozens of websites had been blocked. Among these sites are FX platforms offering leveraged services abroad, unauthorized crypto asset service providers, and the crypto comparison site CryptoRadar. The decision was made in accordance with Articles 99/A and 99 of the Capital Markets Law. The SPK had previously announced that it would take similar steps against all platforms operating in Turkey without a license.The SPK's jurisdiction and the new eraWith the legal amendment made in 2023, the SPK gained the authority to block access to foreign crypto platforms operating without a license in Turkey. The new decisions taken in this context are in line with Turkey's desire to act in a more structured manner in the crypto currency field. The access restrictions imposed are also evaluated within the scope of the integrity of the financial system and the fight against money laundering.However, these decisions have also sparked some debate regarding the decentralized nature of decentralized finance. DeFi protocols generally operate with smart contracts rather than centralized servers, so access restrictions may not completely cut off access to platforms. Users can continue to access these platforms through alternative methods such as VPN usage. However, the symbolic and legal impact of the decision is significant.Are other DeFi projects next?Following the SPK's decision on PancakeSwap, attention has turned to other major DeFi projects such as Uniswap, Curve, and Aave. These platforms also operate with similar decentralized structures and have active user bases in Turkey. If the SPK begins to apply similar access restrictions to these projects, it could lead to a significant disruption in the DeFi ecosystem.

SEC Suspends Grayscale's Crypto ETF Plan: Backtrack Just One Day After Approval

The US Securities and Exchange Commission (SEC) suspended its approval of Grayscale's plan to convert its multi-asset digital fund into an exchange-traded fund (ETF) just one day after granting it. This sudden decision shocked the crypto markets.SEC had approved Grayscale's ETF applicationAs reported, on July 1, the SEC's Trading and Markets Division had approved Grayscale's Digital Large Cap Fund (GDLC) conversion to an ETF through an expedited procedure. This decision would have paved the way for the fund to be listed on the New York Stock Exchange (NYSE Arca) and offered to institutional investors. However, on the evening of July 2, SEC Vice Chairman J. Matthew DeLesDernier sent a letter to the NYSE stating that the approval had been suspended. The letter explained that the approval would be reviewed by the SEC Commission and that the fund could not be offered as an ETF until this process was completed.Grayscale has not yet made an official statement on the matter, and SEC spokespeople have also declined to comment. The SEC's decision to suspend the approval has caused some unease, especially given the recent increase in ETF applications based on altcoins such as DOGE, SOL, and XRP. Grayscale's Digital Large Cap Fund allocates 80% of its portfolio to Bitcoin and 11% to Ethereum. The remaining portion includes altcoins such as Solana, Cardano, and XRP, which carry regulatory uncertainty. This structure is a key factor distinguishing the fund from single-asset-based ETFs. This difference may have influenced the SEC's decision.A comprehensive law for ETFs may be on the horizonBloomberg ETF analyst Eric Balchunas suggested that the SEC's sudden halt decision may be related to its reluctance to introduce multi-asset products to the market before establishing a more comprehensive crypto ETF regulatory framework. According to Balchunas, the Commission prefers to postpone such products before publishing the crypto asset-based ETP (Exchange-Traded Product) standards currently on its agenda.It is quite rare for the SEC to make such a decision at the Commission level. According to experts, this usually indicates fundamental disagreements within the agency on issues such as investor protection, market readiness, or regulatory authority. In particular, the inclusion of tokens such as XRP and SOL, whose status as securities or commodities remains unclear, in the ETF raises legal gray areas.James Seyffart of Bloomberg claims that the SEC is trying to buy time with this decision rather than outright rejecting Grayscale. According to Seyffart, since the Commission did not have a clear reason to directly reject Grayscale's application, it may have resorted to an unusual method of “pretending to approve and then suspending” it.What happens now?At this point, the SEC has not announced a new timeline or roadmap. This means that the ETF launch has been indefinitely postponed.

Crypto Regulations in Trump's Massive Legislative Package: Is the July 4 Target in Jeopardy?

US President Donald Trump's massive legislative package, dubbed the “Big Beautiful Bill,” which he aims to pass into law by July 4 Independence Day, has begun to face delays due to intense debates and amendment proposals in the Senate. The bill's provisions, which include budget and tax reforms as well as provisions related to cryptocurrencies, have sparked disagreements among members of Congress. This situation has further complicated the process, while some important regulations have already begun to emerge.Crypto tax exemption proposal: Lummis takes the stageRepublican Senator Cynthia Lummis has proposed a tax reform that closely affects crypto users and miners in the US by adding a provision to the bill. According to Lummis' proposal, the goal is to exempt kripto transactions under $300 and transactions totaling less than $5,000 annually from taxation. Additionally, crypto income obtained through airdrops, staking, and mining is also expected to be exempt from taxation until sold. Senator Lummis said in a statement, “Miners and stakers have been taxed twice for years: first when they receive the block reward, and second when they sell. We must put an end to this injustice.” The proposal also includes exempting most crypto lending agreements from taxation and applying the 'wash-sale' (buy-sell cycle for tax advantage) rules to be applied to crypto.This move is seen as part of Lummis' long-standing regulatory efforts, known for her crypto-friendly stance among Republicans. Indeed, Lummis had previously played a leading role in drafting the GENIUS Act, which covers stablecoin regulations.Warren rejects strict crypto banMeanwhile, a proposal led by Democratic Senators Elizabeth Warren and Jeff Merkley to ban government officials and their family members from owning cryptocurrency assets or promoting them in this field was rejected by the Senate. The bill had been expanded to cover many public officials, including the president, vice president, and members of Congress, as well as their spouses and children. It even aimed to restrict temporary public officials such as Elon Musk for one year after leaving office.Lummis opposed the proposal, arguing that “I understand the ethical concerns, but this proposal undermines American innovation and competitiveness,” claiming that the scope of the bill was excessive.Trump's July 4 goal in jeopardyThe bill passed the House of Representatives in May by a narrow margin of 215 to 214. However, the Republicans' slim majority in the Senate is prolonging the process. The process, known as “Vote-a-rama,” in which hundreds of amendments are put to a quick vote, has been going on for days. So far, negotiations on hundreds of provisions have continued into the night, and no agreement has been reached yet. As a result, the likelihood of the bill returning to the House of Representatives in time to be enacted by July 4 appears to have diminished.Elon Musk's harsh response: “I'll start a new party”The spending authorities and potential debt increase introduced by the bill have also prompted Tesla CEO Elon Musk to take action. Musk, who previously supported Trump's campaign, posted on X (formerly Twitter), “If this insane spending bill passes, I will start a new party the next day,” signaling the launch of a new political movement called the “America Party.”Musk argued that the bill would add $3.3 trillion to the U.S. debt over the next 10 years, saying, “Every member of Congress who promised to reduce government spending and yet voted yes on this bill should be ashamed. I will do everything in my power to unseat them in the next election.”

National Cryptocurrency Reserve Being Established in Kazakhstan

Kazakhstan has announced a new step to increase its influence in the cryptocurrency field. According to a statement by Timur Suleimenov, Governor of the National Bank of Kazakhstan, cryptocurrencies seized in the country and coins obtained from state-supported mining activities will be collected in a national reserve managed by an institution affiliated with the National Bank.A reserve will be created for cryptocurrencies in KazakhstanTimur Suleimenov, Governor of the National Bank of Kazakhstan, has announced a new plan that will take the country's approach to cryptocurrencies one step further. According to the plan, cryptocurrencies seized by the state and those obtained from public mining operations will be collected in a “national cryptocurrency reserve” managed by an institution affiliated with the Central Bank.This development could increase Kazakhstan's influence in the cryptocurrency ecosystem. The country already stands out for accounting for approximately 13% of the global Bitcoin (BTC) mining hash rate. Following an energy crisis in 2022, the state carried out a major operation against illegal mining activities and seized equipment worth approximately $200 million.According to Suleimenov, this new reserve structure will be established in a manner similar to a sovereign wealth fund model. The system, which will be managed through a single governing body, will prioritize transparency, oversight, and secure storage standards. The Central Bank governor stated, “In the face of volatile market conditions and potential cyber threats, a centralized structure will be the most viable solution.”Details of the plan are being worked out by relevant ministries and law enforcement agencies. However, no date has yet been given for when the reserve will be launched or how large it will be.BTC reserves are growingThis move puts Kazakhstan among the countries that have created state-level cryptocurrency reserves. While the idea of a “Strategic Reserve” for Bitcoin is on the agenda in the US, states such as Arizona, Ohio, and Texas have already legalized holding BTC. Meanwhile, in the private sector, companies like MicroStrategy, Metaplanet, and GameStop have begun creating new-generation corporate treasuries by including cryptocurrencies in their balance sheets. In fact, this morning we reported that Metaplanet had added another 1,005 BTC to its treasury.Cryptocurrency experts note that Kazakhstan's move could directly impact global Bitcoin demand. In particular, governments adopting such reserve strategies contributes to the growing acceptance of cryptocurrencies as “new-generation reserve assets.” As of June 30, 2025, Bitcoin's market value reached $2.14 trillion, with a 28.6% increase in value over the past 90 days. This momentum is believed to be driven by institutional purchases, particularly from governments and large institutions.

Critical Day for Crypto Exchanges: Deadline for CMB Applications Approaches

The critical date has arrived for platforms wishing to operate in the cryptocurrency market in Turkey. In accordance with the regulations published by the Capital Markets Board (CMB) on March 13, all cryptocurrency service providers (CSPs) must complete their official applications by today, June 30, 2025. Exchanges that fail to submit their applications will not be able to operate legally in Turkey.The circulars prepared by the CMB cover a wide range of regulations, from the establishment of cryptocurrency exchanges to their operational processes, storage obligations, and security standards. While most of the circulars will come into effect today, the application process will also be officially completed. Capital requirements and storage rules for cryptocurrency platformsUnder the new regulations, cryptocurrency exchanges must have a minimum capital requirement of 150 million TL to obtain an operating license. For institutions providing custody services, this amount is set at 500 million TL. Platforms must hold 95% of user assets in these authorized custody institutions; only 5% can be kept in their own wallets. Additionally, 3% of assets must be set aside as liquid reserves, and no single cryptocurrency asset may exceed 20% of the total reserves. The SPK has also dedicated a separate section to wallet security, mandating that keys be stored within Turkish borders and that encryption meet TÜBİTAK standards.Platforms prepare for compliance and last-minute adjustmentsMajor domestic cryptocurrency exchanges involved in the SPK application process have also completed their preparations in recent weeks. Leading platforms such as CoinTR, Paribu, and Binance TR reviewed their technical infrastructure, revised their internal systems, and submitted their applications on time to comply with legal regulations.During this process, significant investments were made in areas such as capital adequacy, information system security, and storage solutions. Many platforms have completed comprehensive technical compliance efforts, ranging from cold and hot wallet security to integration with the Central Registry Agency (MKK).Acting in line with the conditions set forth by the new regulations, these companies aim to make a strong entry into the new era in terms of both user security and systemic transparency. The compliance process is a critical development for obtaining operating licenses. However, it is also seen as a strategic step in terms of increasing Turkey's global competitiveness in the crypto ecosystem.Exchanges will submit regular reportsUnder the new system established by the SPK, exchanges will now be required to submit regular reports on the 7th, 15th, 23rd, and last day of each month. This regulation aims to prevent potential market manipulation and enable users to trade in a safer environment.

July Decisive Month in Trump’s Crypto Agenda: Pay Attention to GENIUS and CLARITY Acts!

The countdown has begun for the long-awaited legal framework for cryptocurrency regulation in the US. David Sacks, known as the “crypto czar” of the White House in the US, announced on social media that two important laws, the CLARITY and GENIUS Acts, will be signed in July and introduced to the Senate agenda.GENIUS Act: Provides a national stablecoin standard for the USThe GENIUS (Guaranteed Electronic National Innovation for the US) Act aims to introduce comprehensive national regulation for stablecoins. This law draws a clear framework for how cryptocurrencies pegged to fiat currencies such as the US dollar will be issued, their reserve guarantees, and their legal responsibilities. According to Sacks, this law will provide a safer regulatory environment for domestic companies. In addition, it will reduce the US’s dependence on foreign financial technologies.The rapid growth of the stablecoin market has made regulatory uncertainties more visible. With the enactment of the GENIUS Act, it is aimed for stable cryptocurrencies such as USDC and USDT to operate in a more transparent and regulated manner on US soil. CLARITY Act: “Legal clarity” for cryptocurrenciesThe CLARITY (Cryptocurrency Legal Accountability and Regulatory Transparency for Innovation and Yield) Act stands out as a more comprehensive regulation. This law aims to put an end to the legal uncertainty that has been going on for years by introducing clear definitions of whether cryptocurrencies are securities or commodities. In particular, the clarification of the jurisdictions of institutions such as the SEC and CFTC was among the steps that major investors were waiting for.The bill, supported by Senate Banking Committee Chairman Tim Scott and Digital Assets Subcommittee Chairman Cynthia Lummis, will be submitted to the Senate in July and is aimed to be enacted by September. Lummis said in a statement that the CLARITY Act is largely similar to the bill passed in the House of Representatives and will create a “friendlier” regulatory environment for crypto innovators.July is going to be quite busySacks, known for his PayPal background, is a consultant not only in crypto but also in advanced technology areas such as artificial intelligence. Trump’s increasing crypto-focused rhetoric during his election campaign has turned into a concrete strategy with these legal processes.July seems to be busy not only in terms of crypto regulations but also in terms of trade policies. Trump’s new tariffs expected to be announced on July 8-9 and the tax spending package planned to be presented on July 4 are among the other topics that will shape the US’s claim to global technology leadership.

Move from the USA: Cryptos Will Be Included in Mortgage!

There has been a significant development in the cryptocurrency industry in the US. Federal Housing Finance Agency (FHFA) Director Bill Pulte has instructed two major housing finance institutions, Fannie Mae and Freddie Mac, to prepare a proposal to use cryptocurrencies as reserve assets in mortgage assessments. In a statement made on the FHFA's official X (formerly Twitter) account, it was announced that Fannie Mae and Freddie Mac will prepare a proposal that includes accepting cryptocurrencies as reserve assets in individual housing loan risk assessments. This initiative could pave the way for cryptocurrencies to become collateral in the mortgage system. Trump's crypto vision is starting to show its effectFHFA Director Bill Pulte made the following statements in the statement he shared:"After lengthy research and in line with President Trump's vision of making America the crypto capital of the world, I have today instructed Fannie Mae and Freddie Mac to prepare to include cryptocurrencies in the mortgage system." Pulte’s statements point to the Trump administration’s continued support for the crypto sector since January. Since taking office, Trump has appointed key figures who support crypto-friendly regulations to key positions, while also taking steps such as establishing a strategic Bitcoin reserve.Fannie Mae and Freddie Mac are two government-backed institutions established by Congress that aim to provide liquidity and stability to the US mortgage market. Instead of directly providing mortgage loans, these institutions securitize loans received from private banks and offer them to the market. Therefore, the fact that these institutions evaluate crypto assets as reserves could be groundbreaking for the sector.Only cryptos on regulated exchanges will be evaluatedAccording to the FHFA’s statement, only cryptocurrencies held on centralized crypto exchanges regulated in the US will be evaluated. In other words, assets held in users’ own wallets will be excluded from this scope. This shows that regulatory compliance is at the forefront.Pulte’s personal financial statements show that he owns assets such as Bitcoin and Solana, and also has investments in crypto mining company MARA Holdings.Strong support from the crypto sectorThe FHFA’s move has had a huge impact in the crypto world. MicroStrategy founder Michael Saylor described the development as “a historic moment for institutional Bitcoin adoption” in a post on social media. Saylor said, “The US mortgage industry is leading the way, the global banking system will follow.”Blockchain-based real estate startup Propy also described the development as “a big step for crypto adoption in the real estate sector.” The company’s official X account said, “Regulators are taking action, markets are paying attention.”The way home could be through cryptoConsidering that approximately 55 million people in the US own cryptocurrencies, integrating these assets into the mortgage system could pave the way for many people to own a home. If this proposal is implemented, cryptocurrencies will go beyond being an investment vehicle. It will expand its real-world use.

Tough Step for Cryptocurrencies from Şimşek: New Measures

Treasury and Finance Minister Mehmet Şimşek announced to the public a comprehensive regulatory package to prevent the laundering of proceeds from illegal betting and fraudulent activities through crypto assets. In a statement he made on his social media account on the morning of June 24, 2025, Minister Şimşek stated that they were taking new steps to prevent the laundering of criminal proceeds through crypto asset transactions. Şimşek emphasized that the primary goal was to prevent the entry of proceeds from illegal betting and fraud into the system through platforms, and said, "Administrative, legal and financial sanctions will be imposed on platforms that do not comply."Strict supervision and new requirements are coming for crypto currenciesWithin the scope of the new regulations, stricter supervision mechanisms are being introduced for Crypto Asset Service Providers (KVHS). It is becoming mandatory for platforms to obtain detailed information about the source of funds used in transactions made by users and the purpose of crypto asset transfers. In this context, it will also be required to obtain a transaction description of at least 20 characters from the user for each crypto asset transfer.In addition, compliance with the international regulation known as the “travel rule”, which requires the matching of identity information of the parties in transfer transactions, will be made mandatory. A time limit will be imposed for transactions that do not apply to this rule. Accordingly, if a crypto asset is being withdrawn for the first time, the transaction can be carried out after 72 hours at the earliest, and after 48 hours for other withdrawals. Transfer limit for stable cryptocurrenciesAnother important heading of the regulation is related to stable cryptocurrencies, also known as “stablecoins”. In order to prevent the rapid removal of criminal proceeds from the system, a daily limit of 3 thousand dollars and a monthly limit of 50 thousand dollars is imposed on cryptocurrency transfers with a fixed value. However, this limit can be doubled for platforms that fully fulfill their “travel rule” obligations.Flexibility for legitimate users, harsh sanctions for those who do not complyŞimşek also stated that legitimate areas of activity in the crypto ecosystem will be protected. He stated that transfer limits will not apply to liquidity providers, market makers or users who conduct arbitrage transactions and document their transaction sources. However, platforms will be required to carry out these transactions under their own supervision.Sending a clear message to Crypto Asset Service Providers, Şimşek said that platforms that do not comply with the new rules will face not only administrative penalties, but also serious legal and financial sanctions such as license revocation or non-granting of a license. All eyes are now on how determined Turkey will be in implementing these rules within the scope of cryptocurrency regulations and how platforms will adapt to this process.

Iran Central Bank Restricts Crypto Exchanges After Cyber Attack

The Central Bank of Iran has issued a mandatory regulation requiring all cryptocurrency exchanges in the country to operate only between 10:00 a.m. and 8:00 p.m. The sudden decision comes after Iran’s largest crypto exchange, Nobitex, was hit by a massive cyberattack worth around $90 million. The incident caused a huge stir both domestically and in the global crypto community.The Nobitex hack and the Israeli connectionAs previously reported, the attack is alleged to have been carried out by an Israeli-linked hacker group called “Gonjeshke Darande” (Sparrow of Prey), which has previously been linked to operations targeting Iranian infrastructure. It is known that this group has infiltrated energy and industrial systems in Iran in the past. The Nobitex hack suggests that the group has also targeted financial infrastructures. Iran’s cybersecurity units continue to investigate the details of the attack.The new regulation implemented by the Central Bank aims to prevent possible attacks that may occur during night hours by fixing crypto transactions to traditional bank hours. According to authorities, night hours are both less monitored and stand out as the time periods when cyber attackers operate more frequently. Nobitex is Iran's largest cryptocurrency exchange. Source: Chainalysis However, while the cryptocurrency market offers a decentralized ecosystem where transactions can be made 24/7 by its nature, such restrictions have been the focus of criticism. Iranian investors and industry representatives argue that the application could undermine user trust and increase the shift from local exchanges to international platforms.According to Andrew Fierman, Director of National Security Intelligence at Chainalysis, this restriction is not only security-focused. The Iranian regime wants to take more control of cross-border money transfers made through cryptocurrencies. This may be aimed at preventing cryptocurrencies from being used as a tool by the Iranian people to bypass sanctions.Fierman also reminds us that the Central Bank has previously attempted similar restrictions for different reasons. In the past, some transactions were restricted, especially in order to combat the depreciation of the Iranian Rial.Crypto mining and sanctionsIran has been using cryptocurrency technologies to bypass economic sanctions for years. It is also an important center for crypto mining due to its cheap electricity. However, this advantage has come under serious pressure with the recent tensions and cyber attacks. The long-term effects of the new regulation on the crypto ecosystem will be more clearly seen in the coming weeks. However, for now, the “crypto working hours” for Iranian investors and developers are stuck between 10 a.m. and 8 p.m.

US Takes Landmark Step in Crypto: GENIUS Act Passes Senate

A development that is seen as a turning point for the cryptocurrency market has taken place. The U.S. Senate has taken an important step in the cryptocurrency field by passing the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) by a vote of 68-30, focusing on stablecoin regulations. The bill is expected to become law by August with the support of the Trump administration.Stablecoins are now subject to official regulationsThe GENIUS Act provides the first comprehensive legal framework for dollar-backed stablecoins in the U.S. The law requires these assets to be fully backed by U.S. dollars or similar highly liquid assets, while making annual audits mandatory for stablecoin companies with a market value of over $50 billion. In addition, restrictions are also placed on algorithmic stablecoins and models that do not have sufficient collateral.The law, which also takes important steps in terms of financial transparency and investor protection, foresees that stablecoin users will be placed in the position of priority creditors in the event of a company's bankruptcy. In other words, we see that the concept of “super-priority”, which increases the security of investor funds, is being applied in this area for the first time. Another striking article of the law is aimed at technology giants such as Meta and Amazon. Such large companies will have to meet certain privacy and financial security standards if they want to issue stablecoins or operate in this area. Otherwise, their activities may be restricted. At the same time, the law opens the door to a wider range of “stablecoin issuer” companies such as banks, fintech startups and retail giants, paving the way for new players to enter the market.Opposition from DemocratsAlthough the law was passed with bipartisan support, some Democratic senators opposed the bill and requested various changes to be made before the vote. One of the most notable proposals from Democrats was to prevent President Trump and his family from profiting from crypto ventures. However, this proposal was not reflected in the law; the final text only included a regulation prohibiting members of Congress and their families from profiting from such activities. On the other hand, another stablecoin law called the STABLE Act, which aims to provide more transparency, continues to advance on the Congressional agenda.Trump administration fully supports cryptoThe Trump administration is known for its open support for crypto assets. Treasury Secretary Scott Bessent stated that the legislation will increase the global use of dollars by offering stablecoins backed by US bonds. The next stop for the legislation to be enacted is the House of Representatives. The House can either submit its own version or directly vote on the text passed by the Senate. Either way, time is running out. President Trump wants the stablecoin bill to reach his desk before August.With the stablecoin market expected to reach $3.7 trillion by 2030, the passage of the GENIUS Act in the Senate is a critical milestone.

Markets Hold Their Breath Ahead of Final GENIUS Act Vote

The critical day has come for the Genius Act, one of the regulations that the cryptocurrency world has been waiting for a long time. The US Senate will determine the fate of the bill with its final vote at around 23:30 this evening. If there are at least 51 “yes” votes in the Senate, the bill will be moved to the House of Representatives. This step could pave the way for the formation of much more specific legal frameworks for crypto assets, especially stablecoins.What does the Genius Act aim to do?The Genius Act aims to create a legal basis for digital assets known as stablecoins, whose value is generally pegged to fiat currencies such as the US dollar. These assets, which have been on the agenda for years due to lack of regulation, are now used by millions of people for payment, savings and trade purposes. The bill aims to fill the gaps in this area, increase investor confidence, reduce institutions’ distance from crypto, and make the US a global leader in digital finance.The bill, which has prominent Republican supporters such as Senator John Thune and Senator Bill Hagerty, is seen as an opportunity not only for financial innovation but also for the US dollar to maintain its effectiveness in the digital age. Hagerty emphasized the strategic importance of the bill by saying, “If we do not act, digital dollar innovation will shift to other countries.” Tech giants take actionAnother development that drew attention before the vote was the stablecoin plans of giant companies. While claims that Amazon and Walmart were working on their own stablecoin projects came to the fore last week, JPMorgan also filed a trademark application for a crypto asset called “JPMD.” All these moves show that companies are preparing to enter this market quickly if the legal ground is formed.While support for the bill is strong, there are also quite loud voices of opposition. Democratic Senator Elizabeth Warren, in particular, warns that the regulation could pave the way for tech billionaires and large companies to issue cryptocurrencies that could become data collection tools. “If Congress does not fix this law, billionaires like Elon Musk and Jeff Bezos can launch stablecoins that collect your data and track your habits. Then when they fail, they seek government bailout,” he said, clarifying his opposition to the bill.Similarly, Senator Jeff Merkley is concerned that the system will pave the way for companies that issue coins for their own benefit. Critics argue that if the regulation does not provide sufficient oversight mechanisms, the system could be corrupted.Markets hold their breathThe crypto market is quite cautious ahead of this critical vote. While some assets, especially Ethereum, are experiencing fluctuations, stablecoins (such as USDT, USDC) are moving as balanced as usual. However, various signals that large investors are changing their positions indicate that volatility may increase after the vote.If the Genius Act passes the Senate, it will move on to the House of Representatives stage. This means that the long-awaited comprehensive regulation for stablecoins in the US could finally become law. Today’s vote could be a turning point not only for the US, but also for the global crypto ecosystem.

Vietnam Legalizes Cryptocurrencies with New Digital Tech Law

Vietnam has taken a giant step toward the blockchain world by passing a comprehensive law that officially recognizes cryptocurrencies and artificial intelligence (AI). The “Digital Technology Industry Law,” which was passed by the Vietnamese National Assembly on June 14, 2025, with the approval of 441 out of 445 delegates, will come into effect on January 1, 2026.Cryptocurrencies are now officially recognized in VietnamUnder the new law, blockchain-based cryptocurrencies such as Bitcoin and Ethereum are officially defined as “crypto assets.” Additionally, elements such as in-game items and loyalty points are classified as “virtual assets” under a separate category. Securities, central bank digital currencies (CBDCs), and traditional financial instruments are excluded from this regulation. Cryptocurrencies in Vietnam are now not only recognized as a technological innovation but also as a property right under civil law. The law does not merely recognize cryptocurrencies officially. It also offers numerous incentives to support local startups and prevent brain drain. Under the new regulations, local technology startups will receive tax exemptions, government-backed grants, special visa programs, and various subsidies. The government aims to achieve 8% economic growth in the digital sector with these reforms.This process, which began with Prime Minister Pham Minh Chinh's directive in March, has been transformed into a concrete bill through the joint efforts of the Ministry of Finance and the State Bank of Vietnam. The new regulation, similar to special cryptocurrency regulations implemented in regions such as the European Union and Dubai, offers a structure separate from traditional financial rules.Vietnam was on the FATF's gray listVietnam has been on the Financial Action Task Force (FATF) gray list for a long time. The reason was weak cryptocurrency regulations and insufficient anti-money laundering measures. The new law directly addresses these concerns. The law clearly states AML (Anti-Money Laundering) and CFT (Counter Financing of Terrorism) standards. In addition, measures to prevent cryptocurrencies from being used for illegal purposes, particularly for arms procurement or terrorist financing, have been legally guaranteed.With the law coming into effect in 2026, Vietnam will:Establish licensing processes for cryptocurrency service providers,Impose compliance requirements on financial institutions,Monitor compliance with AML, CFT, and cybersecurity standards.All these developments could bring Vietnam into greater alignment with international cryptocurrency regulations. Additionally, these regulations aim to attract foreign investment and establish the country as a regional digital technology hub. Vietnam, which ranks 5th in Chainalysis' 2024 Cryptocurrency Adoption Index, has the potential to further strengthen its global ranking with this legal reform. Vietnam ranks 5th in Chainalysis' crypto adoption index