Turkey is tightening its regulatory measures in the cryptocurrency markets. In a bulletin published on July 4, 2025, the Capital Markets Board (CMB) announced that it had blocked access to several websites, including the decentralized finance (DeFi) platform PancakeSwap. This decision marks the beginning of the first direct intervention in the DeFi sector in Turkey.

First intervention against a DeFi platform

According to the CMB's decision, the reason for blocking access to PancakeSwap is its “unauthorized cryptocurrency asset service provider activities” in Turkey. This decision is noteworthy as it marks the SPK's first direct intervention targeting decentralized finance protocols. Until now, access to many global cryptocurrency exchanges operating without a license in Turkey had been blocked, but these exchanges were mostly centralized in nature. The inclusion of DeFi platforms like PancakeSwap on the list indicates that the scope of regulation has been expanded.

Following the decision, a short-term decline was observed in the price of PancakeSwap's native token, CAKE. This situation once again highlighted how regulatory news can impact the market.

Which sites are targeted?

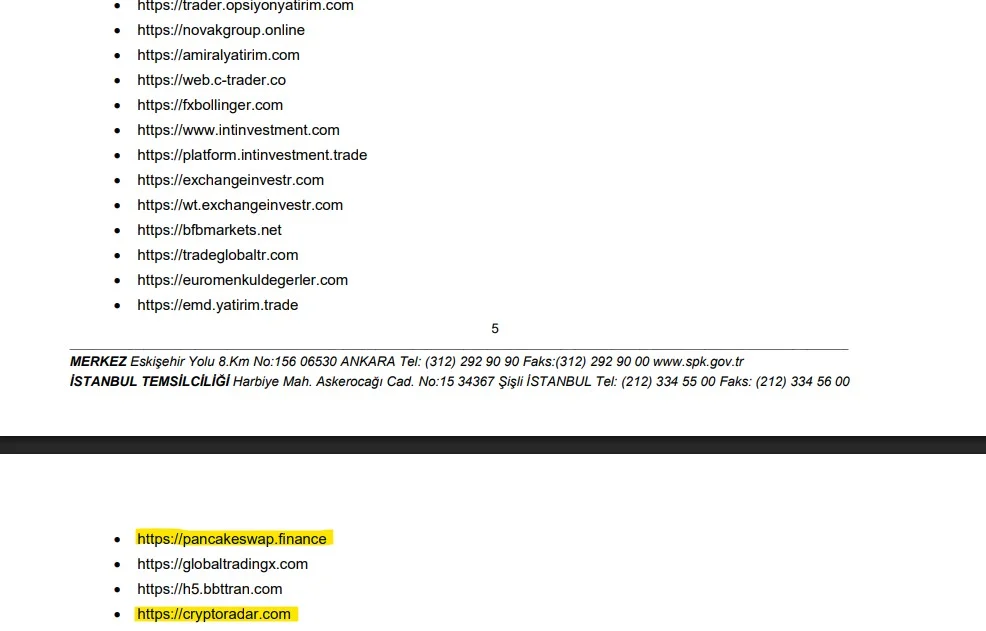

The SPK bulletin stated that access to dozens of websites had been blocked. Among these sites are FX platforms offering leveraged services abroad, unauthorized crypto asset service providers, and the crypto comparison site CryptoRadar. The decision was made in accordance with Articles 99/A and 99 of the Capital Markets Law. The SPK had previously announced that it would take similar steps against all platforms operating in Turkey without a license.

The SPK's jurisdiction and the new era

With the legal amendment made in 2023, the SPK gained the authority to block access to foreign crypto platforms operating without a license in Turkey. The new decisions taken in this context are in line with Turkey's desire to act in a more structured manner in the crypto currency field. The access restrictions imposed are also evaluated within the scope of the integrity of the financial system and the fight against money laundering.

However, these decisions have also sparked some debate regarding the decentralized nature of decentralized finance. DeFi protocols generally operate with smart contracts rather than centralized servers, so access restrictions may not completely cut off access to platforms. Users can continue to access these platforms through alternative methods such as VPN usage. However, the symbolic and legal impact of the decision is significant.

Are other DeFi projects next?

Following the SPK's decision on PancakeSwap, attention has turned to other major DeFi projects such as Uniswap, Curve, and Aave. These platforms also operate with similar decentralized structures and have active user bases in Turkey. If the SPK begins to apply similar access restrictions to these projects, it could lead to a significant disruption in the DeFi ecosystem.