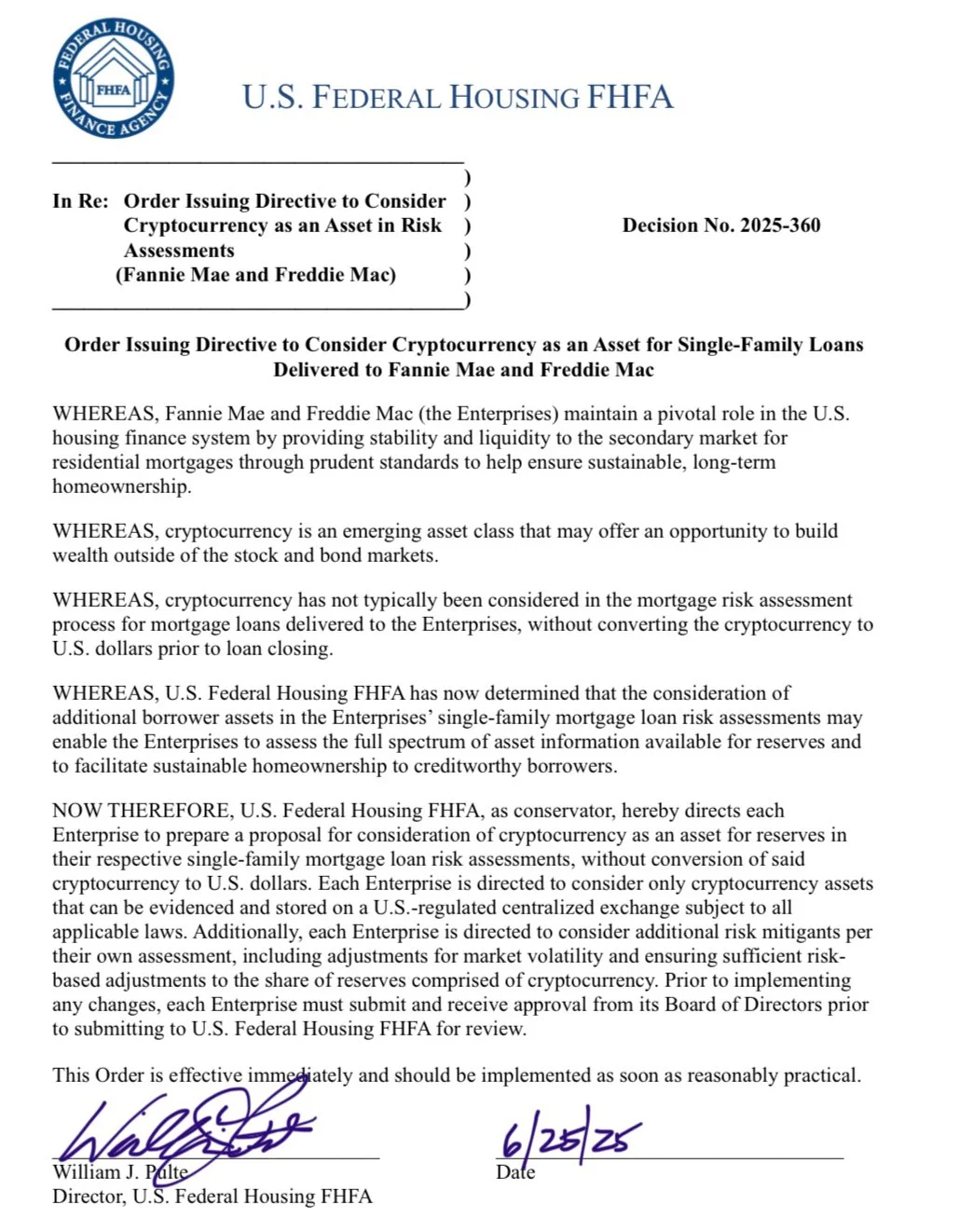

There has been a significant development in the cryptocurrency industry in the US. Federal Housing Finance Agency (FHFA) Director Bill Pulte has instructed two major housing finance institutions, Fannie Mae and Freddie Mac, to prepare a proposal to use cryptocurrencies as reserve assets in mortgage assessments. In a statement made on the FHFA's official X (formerly Twitter) account, it was announced that Fannie Mae and Freddie Mac will prepare a proposal that includes accepting cryptocurrencies as reserve assets in individual housing loan risk assessments. This initiative could pave the way for cryptocurrencies to become collateral in the mortgage system.

Trump's crypto vision is starting to show its effect

FHFA Director Bill Pulte made the following statements in the statement he shared:

"After lengthy research and in line with President Trump's vision of making America the crypto capital of the world, I have today instructed Fannie Mae and Freddie Mac to prepare to include cryptocurrencies in the mortgage system." Pulte’s statements point to the Trump administration’s continued support for the crypto sector since January. Since taking office, Trump has appointed key figures who support crypto-friendly regulations to key positions, while also taking steps such as establishing a strategic Bitcoin reserve.

Fannie Mae and Freddie Mac are two government-backed institutions established by Congress that aim to provide liquidity and stability to the US mortgage market. Instead of directly providing mortgage loans, these institutions securitize loans received from private banks and offer them to the market. Therefore, the fact that these institutions evaluate crypto assets as reserves could be groundbreaking for the sector.

Only cryptos on regulated exchanges will be evaluated

According to the FHFA’s statement, only cryptocurrencies held on centralized crypto exchanges regulated in the US will be evaluated. In other words, assets held in users’ own wallets will be excluded from this scope. This shows that regulatory compliance is at the forefront.

Pulte’s personal financial statements show that he owns assets such as Bitcoin and Solana, and also has investments in crypto mining company MARA Holdings.

Strong support from the crypto sector

The FHFA’s move has had a huge impact in the crypto world. MicroStrategy founder Michael Saylor described the development as “a historic moment for institutional Bitcoin adoption” in a post on social media. Saylor said, “The US mortgage industry is leading the way, the global banking system will follow.”

Blockchain-based real estate startup Propy also described the development as “a big step for crypto adoption in the real estate sector.” The company’s official X account said, “Regulators are taking action, markets are paying attention.”

The way home could be through crypto

Considering that approximately 55 million people in the US own cryptocurrencies, integrating these assets into the mortgage system could pave the way for many people to own a home. If this proposal is implemented, cryptocurrencies will go beyond being an investment vehicle. It will expand its real-world use.