The US Securities and Exchange Commission (SEC) suspended its approval of Grayscale's plan to convert its multi-asset digital fund into an exchange-traded fund (ETF) just one day after granting it. This sudden decision shocked the crypto markets.

SEC had approved Grayscale's ETF application

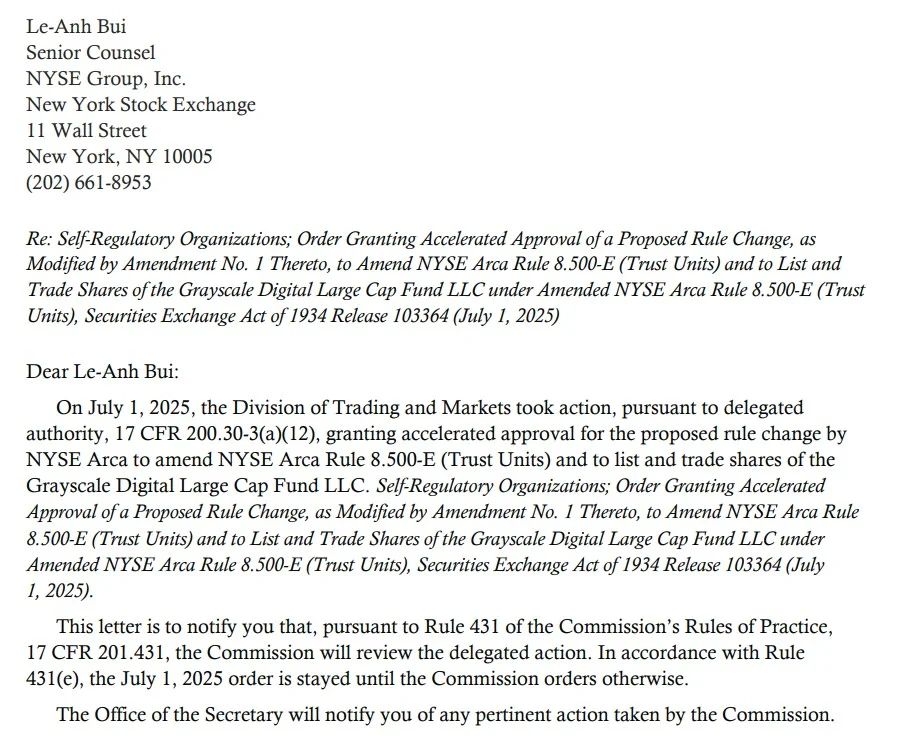

As reported, on July 1, the SEC's Trading and Markets Division had approved Grayscale's Digital Large Cap Fund (GDLC) conversion to an ETF through an expedited procedure. This decision would have paved the way for the fund to be listed on the New York Stock Exchange (NYSE Arca) and offered to institutional investors. However, on the evening of July 2, SEC Vice Chairman J. Matthew DeLesDernier sent a letter to the NYSE stating that the approval had been suspended. The letter explained that the approval would be reviewed by the SEC Commission and that the fund could not be offered as an ETF until this process was completed.

Grayscale has not yet made an official statement on the matter, and SEC spokespeople have also declined to comment. The SEC's decision to suspend the approval has caused some unease, especially given the recent increase in ETF applications based on altcoins such as DOGE, SOL, and XRP.

Grayscale's Digital Large Cap Fund allocates 80% of its portfolio to Bitcoin and 11% to Ethereum. The remaining portion includes altcoins such as Solana, Cardano, and XRP, which carry regulatory uncertainty. This structure is a key factor distinguishing the fund from single-asset-based ETFs. This difference may have influenced the SEC's decision.

A comprehensive law for ETFs may be on the horizon

Bloomberg ETF analyst Eric Balchunas suggested that the SEC's sudden halt decision may be related to its reluctance to introduce multi-asset products to the market before establishing a more comprehensive crypto ETF regulatory framework. According to Balchunas, the Commission prefers to postpone such products before publishing the crypto asset-based ETP (Exchange-Traded Product) standards currently on its agenda.

It is quite rare for the SEC to make such a decision at the Commission level. According to experts, this usually indicates fundamental disagreements within the agency on issues such as investor protection, market readiness, or regulatory authority. In particular, the inclusion of tokens such as XRP and SOL, whose status as securities or commodities remains unclear, in the ETF raises legal gray areas.

James Seyffart of Bloomberg claims that the SEC is trying to buy time with this decision rather than outright rejecting Grayscale. According to Seyffart, since the Commission did not have a clear reason to directly reject Grayscale's application, it may have resorted to an unusual method of “pretending to approve and then suspending” it.

What happens now?

At this point, the SEC has not announced a new timeline or roadmap. This means that the ETF launch has been indefinitely postponed.