The World Liberty Financial USD (USD1) stablecoin, reportedly linked to the family of US President Donald Trump, has seen remarkable growth following Binance's announcement of a new token-focused yield program. After the announcement on Wednesday, USD1's market capitalization increased by approximately $150 million, rising from $2.74 billion to $2.89 billion. This increase once again highlighted the accelerating competition in the stablecoin market and the direct impact of major exchanges' product strategies on token demand.

Binance's campaign benefits USD1

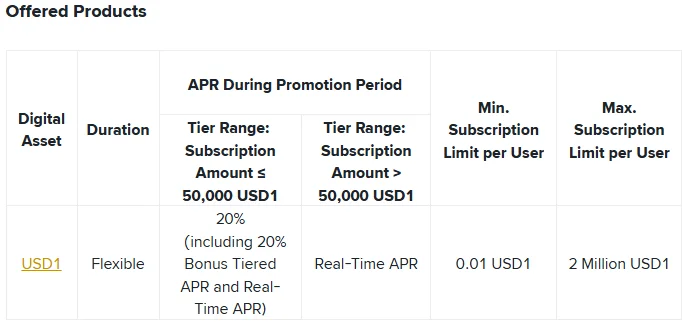

The new campaign, announced by Binance as a "booster program," offers up to 20% annual return (APR) on flexible yield products for USD1. The program is designed for USD1 investments exceeding $50,000. According to the exchange, this initial promotion aims to increase the passive income of USD1 holders and will continue until January 23, 2026. Bonus earnings are automatically credited to Binance Earn accounts daily.

USD1 stands out as part of the crypto ventures that the Trump family has been developing in recent years. According to shared data, these crypto projects generated approximately $802 million in revenue in the first half of 2025. This shows that the stablecoin is positioned not only as a payment instrument but also as part of a broader financial and political ecosystem.

According to market data, USD1 has reached the position of the seventh largest stablecoin in the world with its recent surge. Coin data reveals that this rise has been accelerated especially thanks to Binance's ecosystem integrations. According to market data, USD1 is just behind PayPal USD in terms of market capitalization.

Binance has taken successive steps in recent months to make USD1 a more central part of its ecosystem. On December 11, the exchange added new trading pairs for USD1 that can be traded with leading cryptocurrencies without transaction fees. The same announcement stated that all collateral assets supporting the Binance USD (BUSD) stablecoin would be converted to USD1 at a 1:1 ratio. This move was seen as a significant decision that strengthened USD1's role within Binance. On the other hand, USD1 wasn't limited to exchange-based use cases. In May, it was announced that MGX's $2 billion investment in Binance was finalized using USD1. This information was shared publicly by Eric Trump at the Token2049 event in Dubai, indicating that the stablecoin was beginning to be used in institutional transactions. However, despite all this growth, some questions remain about the relationship between Binance and World Liberty Financial. A Bloomberg report published in July suggested that some of the technical infrastructure behind USD1 was developed by Binance. The report cited anonymous sources close to the matter. In response, Binance founder Changpeng Zhao argued that the report contained factual errors and hinted that he might file another defamation lawsuit against Bloomberg. The debate continues on the political front as well. In October, Connecticut Senator Chris Murphy alleged that Binance.US promoted Trump-linked crypto projects. This announcement, coming after Trump's pardon of Binance's owner, has sparked a renewed questioning of the relationship between crypto, politics, and regulation in the US.