Politics

This page lists the latest Politics news and market analysis. Browse articles, expert insights, and updates in this category on JrKripto. Stay informed with in-depth coverage of cryptocurrency trends and developments.

This page lists the latest Politics news and market analysis. Browse articles, expert insights, and updates in this category on JrKripto. Stay informed with in-depth coverage of cryptocurrency trends and developments.

News

Politics News

Browse all Politics related articles and news. The latest news, analysis, and insights on Politics.

Circle Makes History By Getting the First Stablecoin License in JapanCircle became the first company officially able to conduct stablecoin transactions in the country with a license issued by the Japan Financial Services Agency (FSA). Circle's US dollar-pegged stablecoin, USDC, has been awarded the title of the first dollar-based stablecoin to be legally accepted in Japan.This development, which took place after a detailed regulatory process lasting about two years, allows the company to conduct its operations through Circle Japan KK.The Importance of the Partnership between Circle and SBI HoldingsCircle entered the Japanese Sunday by establishing a strategic partnership with SBI Holdings. With this cooperation:Blockchain-based financial innovation will gain momentum.The digital pay infrastructure will be strengthened.Positive effects will be provided to Japanese financial markets.USDC will be traded on the SBI VC Trade platform from March 26 and will soon be available on other important platforms such as Binance Japan, bitbank and bitFlyer.Japan's Advantageous Regulatory EnvironmentJapan's clear and strict regulatory policies have made it possible for Circle to launch USDC in a safe and transparent environment. This regulatory structure prevents uncertainties and allows companies to operate safely.The Future of USDC in JapanCircle aims to increase the use of USDC in digital pay solutions, cross-border transfers and corporate finance processes in Japan. Circle CEO Jeremy Allaire stated that the USDC will support the Japanese economy and strengthen the digital finance infrastructure.While Circle's stablecoin license is considered a significant development globally, it is expected to further consolidate Japan's leadership in fintech innovation.

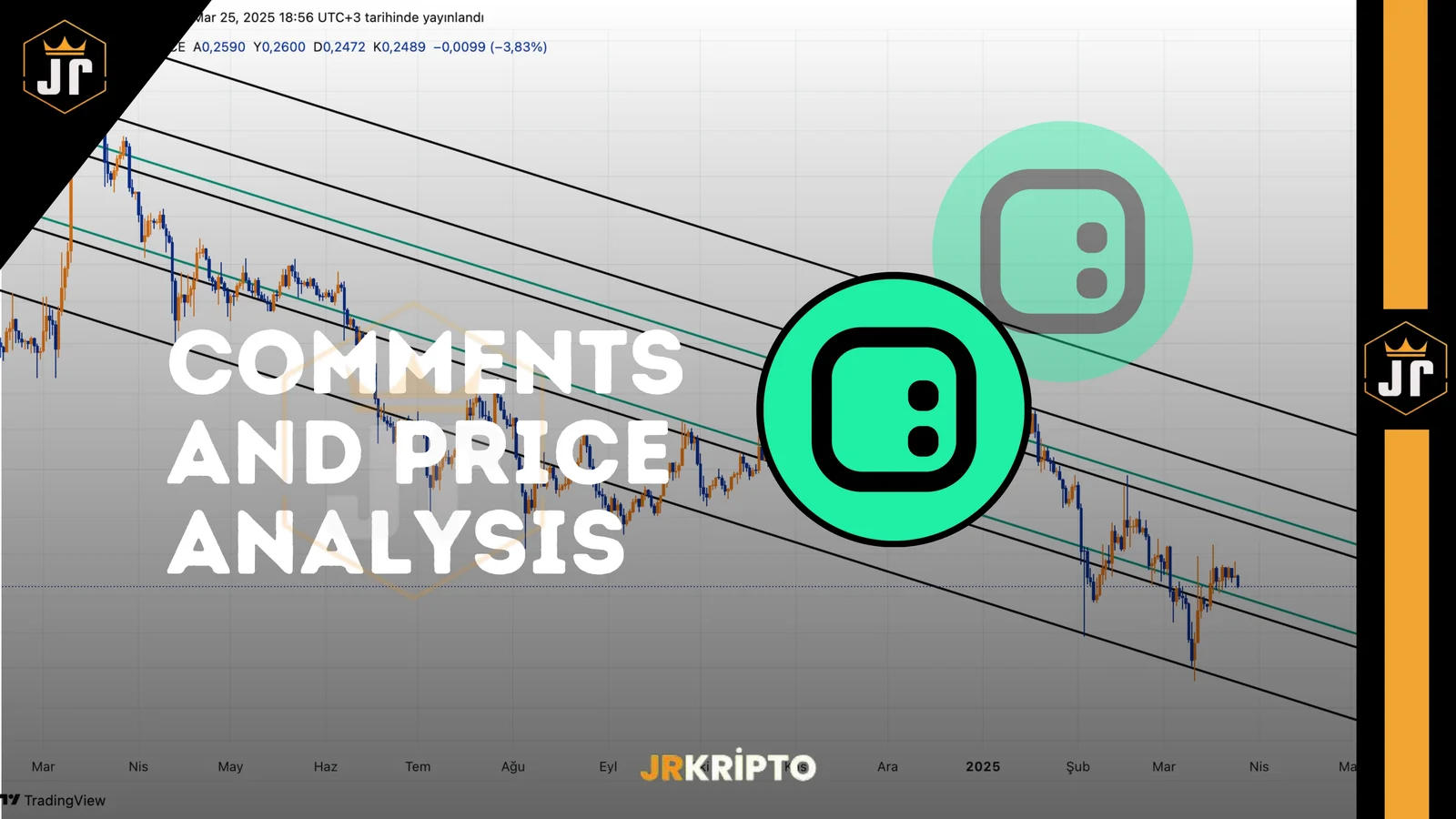

Space ID (ID) Technical Analysis: Is the Horizontal Jam Ending?The Space ID Coin is exhibiting a horizontal squeeze within the channel formation, which has been falling in recent weeks. The IDUSDT pair is currently priced at 0.2506, and this level indicates a technically important decision zone. The price is based on both the upper band of the falling channel and the horizontal resistance zone. Therefore, it is quite possible that volatility will increase in the coming days. ID When we look at the past price movements, we see that Space ID Coin has received a strong reaction from the 0.2200 level. This region stands out as the support where the recent dips are formed and buyers are active. The current chart structure indicates the need for a break in order for the rise to continue.Outstanding Technical Levels For IDUSDTSupport Levels: 0.2365 (Short-term support) 0.2200 (Main support) 0.1950 (Lower band of the channel) 0.1700 (Oversold zone)Resistance Levels: 0.2864 – 0.3038 (Horizontal resistance + above channel) 0.3587 (Medium-term target region) 0.4235 – 0.4492 (Long-term resistance) 0.5394 (Main resistance)At the moment, the price is trying to stay above the 0.2365 support. Maintaining this level may lay the groundwork for the price to accelerate back to the 0.2864 – 0.3038 band. In particular, this region is considered to be a strong breaking area for both horizontal resistance and intersection with the upper boundary of the falling channel.What Does the Falling Channel Structure Tell?The falling channel on the chart shows that Space ID Coin has been under pressure for a long time. However, the contacts made to the upper band of this channel began to become frequent. This may mean that the trend is weakening and preparations are being made for a possible break.Although there is no significant increase in the volume side yet, the price making high dips can be considered as a bullish signal. If a close above 0.2864 occurs, a technical trend change may be on the agenda for Space ID Coin. This may also trigger new waves of purchases.Strategy Suggestions For Investors 1. Short-Term Follow-up: The positive scenario remains valid as long as the hold above 0.2365 continues. 2. Channel Breakage: Closures above 0.3038 may trigger an increase in the medium term. 3. Stop Level: Closures below 0.2200 mean a transition to a risky zone.Conclusion: The Breakdown in Space ID Coin Is ApproachingThe Space ID Coin rested on the upper band of the falling channel, holding on to a strong support area. Technical indicators indicate that buyers are about to gain strength. If the 0.2864 – 0.3038 December breaks volumetrically in the coming days, a medium-term positive trend may start in the IDUSDT parity.This compression in the channel structure can be a harbinger of a potential trend transformation. From this point of view, Space ID Coin may be on the verge of a new ascension story.These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions. Author: Ilaha

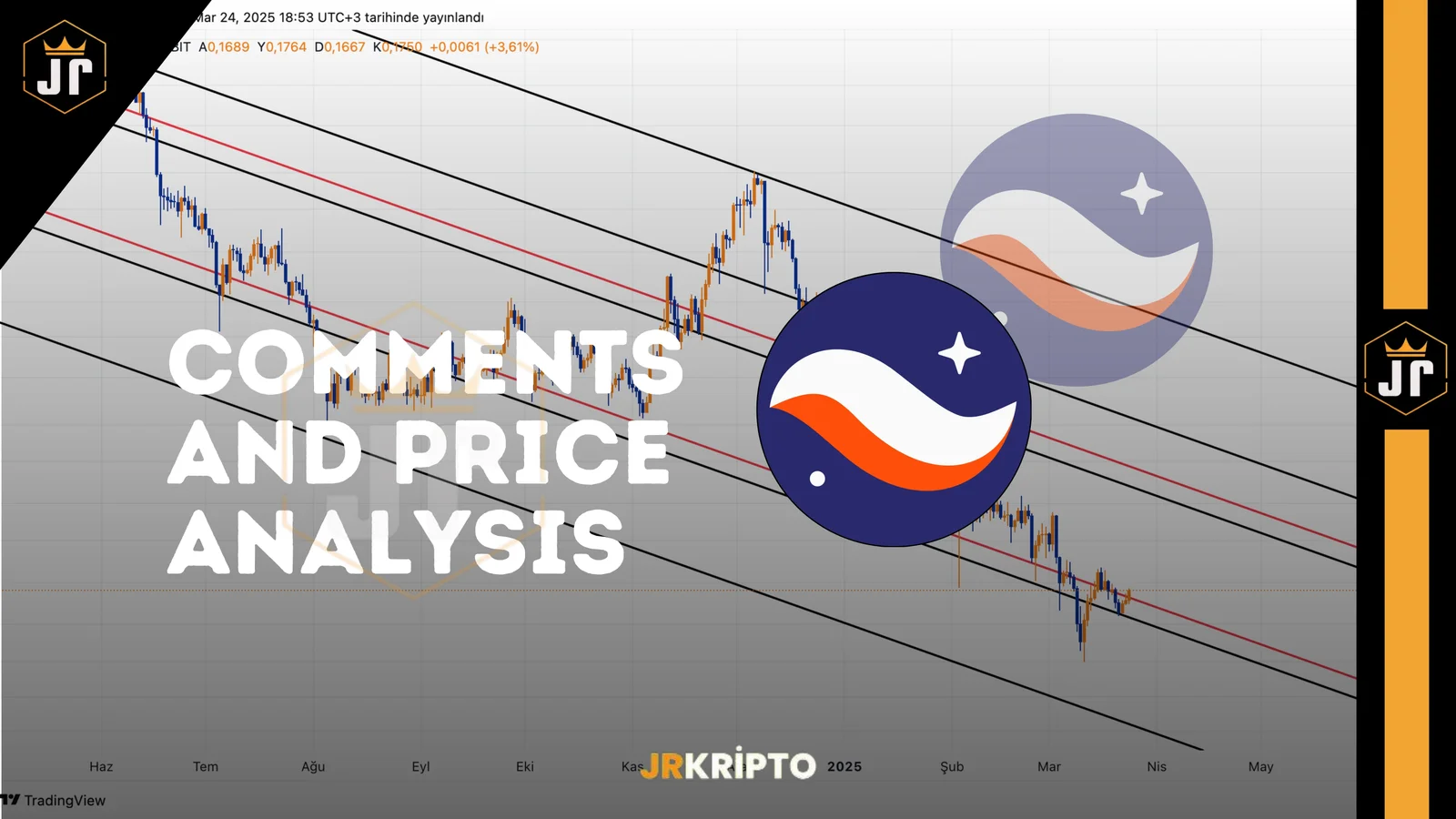

Open Campus (EDU) Technical Analysis The EDU/USDT pair has been priced in a descending channel for a long time. According to the current chart data, the price is at 0.1498 levels. This indicates that it is very close to critical support areas.The fact that EDU Coin is under pressure attracts the attention of investors. Especially the hardening declines in the recent period reveal the strength of the downward trend in technical terms. However, the structures formed on the chart may now give a possible return signal due to the approach to the lower band of the falling channel. EDU Critical Technical Levels For EDU/USDTSupport Levels: 0.1250 (Channel lower limit) 0.1490 – 0.1500 (Psychological threshold)Resistance Levels: • 0.1899 (Initial technical resistance) • 0.2334 – 0.2495 (Channel upper band and horizontal resistance) • 0.3008 (Wide-time target region) • 0.3627 – 0.3876 (Key area for trend reversal) • 0.4763 (Long-term main resistance)According to the EDU/USDT technical analysis, the price is trying to hold on to the 0.1500 support. This region is very critical both in terms of being close to the channel subband and working as a support in the past. If this level is broken downwards, the 0.1250 region can be tested.What Does the Channel Formation Tell?The striking element on the chart is that the falling channel is in a very narrow structure. Such structures are usually considered as accumulation zones. In other words, investors can start to collect positions during periods when the price is suppressed but at the same time creates a bottom.Especially when the volume indicators and momentum data such as RSI are examined, it seems that the oversold zone has been reached for EDU Coin. This indicates that short-term reaction purchases may be possible. However, in order for these reactions to be permanent, the price must first break the resistance of 0.1899 in volume.What Should be the Investor Strategy in EDU Coin?Trend Break Tracking: Daily closures above 0.1899 should be monitored.Volume Confirmation: If there is no increased volume in upward movements, the rise may be short-lived.Conclusion: Footsteps of the Rise in EDU CoinEDU Coin may be nearing the end of a long-standing downtrend. Technical indicators and channel structure indicate a possible turn signal. The price reaching the bottom regions offers an important opportunity for investors. Especially if permanence is achieved above the 0.1500 level, the probability of a short-term recovery may strengthen.If the first upward break is experienced at the 0.1899 level, a rapid recovery may begin in the EDU/USDT parity. This may cause the price to accelerate towards the resistances of 0.2334 and 0.3008, respectively. While the chart presents a positive picture for patient investors, it indicates that EDU Coin may become the center of attention again.These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions. Author: Ilaha

You can access the "Daily Market with JrKripto" summary below, where we have compiled important daily developments in cryptocurrency, global and local markets. Come on, let's analyze the general situation in the markets together and take a look at the most up-to-date assessments. Bitcoin (BTC) is currently trading at $87,400. While the $79,100 - $80,763 region stands out as a strong support area, BTC has broken through the $85,600 resistance by holding on to this level and is continuing to rise. If the upward movement continues, the $90,700 level will be a critical resistance point. However, if the price retreats, the $85,600 level will be followed as the first support point.Ethereum (ETH) is trading at $2,070. While the $1,900 level was maintained as a strong support point, ETH received an upward reaction from this level. With the breaking of the $2,000 resistance, the rise gained momentum and the next target will be the $2,250 level. If this level is exceeded, acceleration towards the $2,534 and $ 2,721 levels may be seen. On the other hand, downward movements will be followed by the support of $ 2,000, and closures below this level may bring the support of $1,900 back up.Crypto NewsDWF Labs has launched a $250 million fund to support blockchain projects.Strategy has purchased 6911 BTC.Justin Sun: "I'm expecting something big this week!”Sam Altman's World Network is in talks with Visa for a Stablecoin pay walletTrump plans to postpone the industry-specific customs duty increases that were expected to be launched on April 2.CryptocurrenciesThose Who Have Risen The Most:CRO →increased by 27.1% to $0.104846.LAYER →rose 27.1% to $1.35.AGENTFUN → jumped 25.6% to $2.13.IBERA → jumped 16.6% to $8.01.KET →increased by 15.0% to $ 0.26392759.The Ones Who Fell The Most:NTGL → fell by 17.6% to $0.00123252.ANKR →fell by 9.3% to $0.02025293.ZRO →fell 6.6% to $2.77.PNUT → fell 5.6% to $0.2086054.VENOM →fell 4.9% to $0.11931917.Total Net ETF Inflows Per Day BTC ETFs: $84.20 Million ETH ETFs: $0.0 Million Data to Follow Today17:00 - USA | Conference Board (CB) Consumer Confidence (March)Expectation: 94.2Previous: 98.317:00 - US | New Home Sales (February)Expectation: 682KPrevious: 657KGlobal MarketsUS stock indexes started the week positively due to the impact of news flows over the weekend. In particular, expectations that customs duties will not be as far-reaching as expected and that sectors such as automotive, semiconductors and pharmaceuticals may be exempt were reflected positively on the market. The S&P 500 gained 1.76%, the Dow Jones 1.42% and the Nasdaq 2.27%. The S&P 500 Index technically finished the day above its 200-day moving average. While 10 of the 11 main sectors in the index closed the day with a rise, the infrastructure sector achieved a horizontal negative close. Tesla gained 11.93%, pulling the discretionary consumer sector up, and the sector's shares gained 4.07%, becoming the best performing sector. Telecommunications gained 2.11%, industrial gained 1.87%, financial gained 1.79% and technology gained 1.71%.When we look at the macroeconomic data, the S&P Global manufacturing PMI data for March in the United States remained well below the expected 51.9 with 49.8, while it declined by 2.9 points on a monthly basis. This indicates that the manufacturing sector has moved into contraction territory again after two months. On the other hand, the service sector data increased by 3.3 points on a monthly basis and exceeded the expectation of 51.2 and was announced at 54.3. The US composite PMI increased by 1.9 percentage points to 53.5 per month in March. February January and February It is estimated that this recovery in the service sector is due to the recovery of activities that were reduced due to adverse weather conditions and may be temporary.January February also saw the Chicago Fed National Activity Index in the U.S. rise to 0.18 from -0.08 in January. Manufacturing-related indicators led the increase, while the index's three-month moving average rose to 0.15, the highest level in the last three years. Today, US housing prices, new home sales, Richmond Fed Manufacturing Index and Conference Board Consumer Confidence Index data will be announced. While Asian indices are tracking negatively, European indices are expected to have a horizontal negative start to the day.The Most Valuable Companies and Their Stock PricesApple (AAPL) → market capitalization of $3.32T, price per share is $220.73, an increase of 1.13%. NVIDIA (NVDA) → market capitalization of $2.96T, price per share is $121.41, an increase of 3.15%. Microsoft (MSFT) → market capitalization of $2.92T, price per share is $393.08, an increase of 0.47%. Amazon (AMZN) → market capitalization of $2.15T, price per share is $203.26, an increase of 3.59%. Alphabet (GOOG) → market capitalization of $2.06T, price per share is $169.93, an increase of 2.21%.Borsa IstanbulBorsa Istanbul rose yesterday with a reaction purchase of up to 3%. Although there is some money inflow into the market, it is estimated that this is mainly public-sourced purchases. For this reason, it is not possible to talk about a generally widespread entry into the market at the moment. However, the fact that there is a balancing on the exchange rate and interest rate side may support a reaction movement after the recent sharp declines. While high volatility is expected to continue, positions can be tried by paying attention to close support and stop levels in the short term. In the medium and long-term outlook, expectations are maintained that the BIST 100 index may rise above the 14,000 level.Today, the real sector confidence index, capacity utilization ratio (KKO) and sectoral confidence indices will be followed inside. While the Real Sector Confidence Index and Retail Trade Confidence Index rose in February, the Services and Construction Confidence Index declined. KKO, on the other hand, had risen to 74.9% in February. In addition, Treasury and Finance Minister Mehmet Şimşek is expected to hold a teleconference with international investors today at 16:00 TSI.When we look at bond rates, the 2-year bond rate increased by 1.0 points to 45.6% yesterday, while the 10-year bond rate decreased by 0.2 points to 33.2%. The BIST 100 index made an effort to recover yesterday after last week's sharp declines and ended the day at 9299 with a rise of 2.8%. Although intraday fluctuations were experienced, the index moved upwards, finding support at the 8873 level.Technically, the close support level for the BIST 100 index is seen as the 8980-8725 band. A rise of the index above the 9921 level may create some optimism, but for a stronger upward trend, it is necessary to rise above the 9450-9594 band. In this case, the 9784-9895 band may be brought up again. In terms of downside risks, the 8870 level is considered as interim support, while the 8618-8560 region, which was tested in November 2024, is considered as strong support. Dec. The important support levels for the BIST 100 are 8870-8725-8618-8560-8000, while the resistance levels are 9451-9594-9784-9895-9990.The Shares That Increased The Most:VSNMD → increased by 10.00% to 158.40 TL.REEDR → increased by 9.99% to 11.89 TL.SAMAT → increased by 9.99% to 16.96 TL.AKFIS → increased by 9.99% to 19.93 TL.ENSRI → reached TL 18.27 with an increase of 9.99%.The Most Declining Shares:ATEKS → fell by -9.98% to TL 90.20.DAGHL → fell by -8.33% to 43.60 TL.BINBN → fell by -7.07% to TL 162.90.NUHCM → fell by -5.14% to TL 262.75.TKFEN → fell by -3.85% to TL 125.00.The Companies with the Highest Market Capitalization in Borsa Istanbul:QNB Finansbank (QNBTR) → Market value of TL 1.13 trillion, price per share is TL 345.75, an increase of 2.90%.Aselsan Electronics Industry (ASELS) → Market value of TL 549.02 billion, price per share is TL 119.30, a decrease of 0.91%.Garanti Bank of Turkey (GARAN) → market value of TL 465.36 billion, price per share is TL 118.70, an increase of 7.13%.Turkish Airlines (THYAO) → market value of TL 418.14 billion, price per share is TL 313.00, an increase of 3.30%.Koç Holding (KCHOL) → Market value of TL 412.34 billion, price per share is TL 170.40, an increase of 4.80%.Precious Metals and Foreign Exchange PricesGold: 3680 TL Silver: 40.85 TL Platinum: 1204 TL Dollar: 37.94 TL Euro: 41.16 TL Hope to meet you again tomorrow with the latest news!

DWF Labs Offers a Strong Support to the Blockchain EcosystemDWF Labs, one of the important investment companies operating in the cryptocurrency market, has launched a new initiative aimed at blockchain-based projects. This $ 250 million fund, called the "Liquid Fund", aims to support the rapid growth of blockchain projects and expand the use of Web3 technologies in everyday life.What are the Goals and Priorities of the DWF Labs Fund?DWF Labs plans to make investments in amounts ranging from Dec. 10 to $50 million each under the fund. In particular, the focus will be on projects that can improve the user experience and increase the real-life use of blockchain technologies. In order for users to adopt blockchain applications more easily, it is aimed that the projects will also be strong in terms of accessibility and usability.Andrei Grachev, managing partner of DWF Labs, noted that the purpose of the fund is not only to provide technical development. One of the main goals of this fund will be for users to have confidence in projects and to clearly understand the value of blockchain technologies.Grachev also stressed that the quality and functionality of the infrastructure encountered by users who are trying blockchain-based applications for the first time is critical for their interest in the sector to become permanent.The Contributions that the Investment Fund will Provide to the ProjectsWith this new fund, DWF Labs will not only offer financial support to projects, but also develop different strategies for the overall development of the ecosystem. Among these strategies are Dec:Creation of credit marketsEnsuring strong brand awarenessExpansion of stablecoin projectsThere are steps such as supporting decentralized finance (DeFi) activities.New Investments and Prospects for the Blockchain SectorThis initiative of DWF Labs could enable the development of innovative applications by providing a significant flow of capital to projects in the blockchain ecosystem. This fund, along with other recently announced major investments in the sector, could make it easier for blockchain technologies to reach a wider audience of users.Experts in the crypto sector say that the biggest obstacle to the adoption of blockchain technologies by large masses is the complexities in the user experience. Chintan Turakhia, director of engineering at Coinbase, points out that the processes that burden users, especially wallet setup and transaction fees, need to be simplified.This fund, launched by DWF Labs, is expected to make a significant contribution to the crypto world by supporting projects that improve the user experience in the industry and develop more user-friendly applications.

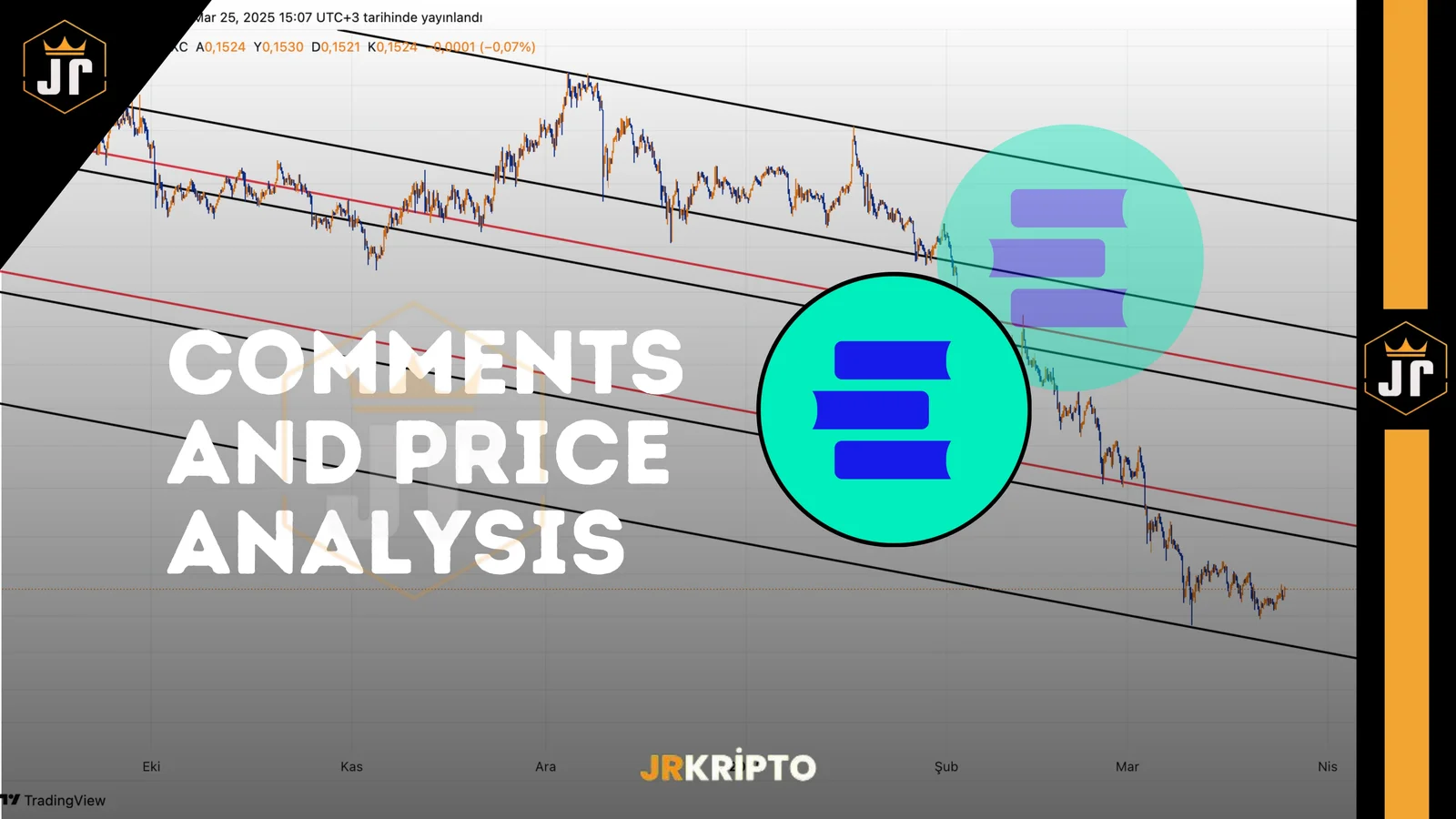

Starknet (STRK) Technical Analysis and Price InterpretationThe STRK/USDT pair is maintaining its long-standing falling channel formation. As can be clearly seen on the chart, the price entered a hard downward correction after a peak of $ 0.8205 and fell to $ 0.1349. In this process, especially the 0.3420 - 0.3836 band worked as a strong resistance zone. STRK As of now, the price is at the level of 0.1751 and is quite close to the channel subband. This may also lead to a potential reaction rise to the agenda. Technically, the levels to be considered are:Prominent Support and Resistance Levels:Support: 0.1349 / 0.1500Resistance: 0,2396 / 0,3420 / 0,3836The first target in an upward break may be the 0.2396 level. If this level is exceeded, the 0.3420 – 0.3836 band will become important. However, since this region corresponds to both the horizontal resistance and the channel upper band, refraction can be challenging.The RSI and volume indicators for STRK Coin are also close to the oversold zone. This supports the potential for a reaction in the short term. However, a volumetric break is necessary for a permanent rise.For Starknet (STRK) investors, this period may be one of the low-risk areas for buying. In particular, the 0.15 – 0.17 band should be followed as support. In the event of an upward break of the channel, medium-term goals will be on the agenda again.These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions. Author: Ilaha

zkSync (ZK) Coin Technical AnalysisZK Coin (zkSync) shows a chart with a sharp downward trend recently. In particular, the price, which has been moving within the falling channel structure since December 2024, continued its retreat from the 0.2800 level to the 0.0570 level. This level also corresponds to the lower band of the channel, where the price is currently trading at 0.0807 with the incoming buying reaction. ZK When we look at the technical structure on the chart, the first important resistance zone for ZK coin is located at 0.0860. This level is quite critical because it coincides with both horizontal resistance and channel resistance. If this region breaks upward, the levels of 0.1007 – 0.1073 and 0.1283, respectively, may become the target. However, in order to reach these levels, the market also needs to remain positive in general.Some technical points that investors should pay attention to in ZK coin are as followsthe 0.0570 level worked as a strong support.the 0.0860 level is in the short-term resistance position.The falling channel structure is still valid.the December 0.1007 - 0.1073 should be monitored as the main resistance zone.In particular, exceeding the 0.0860 level may indicate a trend transformation in the short term. However, in retest situations that may occur at this level, the price may return to the channel and retreat to 0.0650 levels. For this reason, it will be useful to look for volume and formation confirmation when opening a position.As a result, although ZK coin is technically under pressure at the moment, the buying reactions from the bottom levels are attracting attention. If channel breakage occurs, it may offer opportunities to investors in the short term.These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions. Author: Ilaha

You can access the "Daily Market with JrKripto" summary below, where we have compiled important daily developments in cryptocurrency, global and local markets. Come on, let's analyze the general situation in the markets together and take a look at the most up-to-date assessments. Bitcoin (BTC) is currently trading at $87,400. While the $79,100 - $80,763 region stands out as a strong support area, BTC has broken through the $85,600 resistance by holding on to this level and is continuing to rise. If the upward movement continues, the $90,700 level will be a critical resistance point. However, if the price retreats, the $85,600 level will be followed as the first support point.Ethereum (ETH) is trading at $2,090. While the $1,900 level was maintained as a strong support point, ETH received an upward reaction from this level. With the breaking of the $2,000 resistance, the rise gained momentum and the next target will be the $2,250 level. If this level is exceeded, an acceleration towards the $2,534 and $2,721 levels may be seen. On the other hand, downward movements will be followed by the support of $ 2,000, while closures below this level may bring the support of $1,900 back up.Crypto NewsDWF Labs has launched a $250 million fund to support blockchain projects.The Capital Market Board announced new measures.Trump: "I love $TRUMP.”Senator Cynthia Lummis said that the US government should sell its gold and buy Bitcoin.CryptocurrenciesThose Who Have Risen The Most:KET →increased by 42.2% to $ 0.23387824.ANKR →increased by 24.9% to $0.02244941.SPX →increased by 23.6% to $ 0.63053516.CHEEMS → increased by 18.6% to $0.00000178.S → increased by 15.5% to $ 0.60818454.The Ones Who Fell The Most:W →fell 17.1% to $0.10500875.MEOW → fell by 11.0% to $0.00260545.KAVA →fell by 6.4% to $0.50468653.The PI → fell by 6.2% to $0.94838718.VALVE → fell 5.8% to $7.39.Total Net ETF Inflows Per Day BTC ETFs: $83.10 Million ETH ETFs: -18.60 Million$ Data to Follow Today16:45 - US / Manufacturing Purchasing Managers' Index (PMI) (March)Expectation: 51.9Previous: 52,716:45 - US / Service Purchasing Managers' Index (PMI) (March)Expectation: 51.2Previous: 51.0Global MarketsUS stock markets closed slightly higher after following a volatile course on the last trading day of the week. Thus, the major indexes have ended their losses that have lasted for the last four weeks. The S&P 500 and Dow Jones gained 0.08%, and the Nasdaq gained 0.52%. Only 3 of the 11 main sectors in the S&P 500 ended the day with an increase: Telecommunications gained 1.00%, discretionary consumption gained 0.63% and technology gained 0.49%. The worst performing sectors were real estate and raw materials, which lost 1.00%, infrastructure and energy, which ended the day with a loss of 0.65%.There are important developments in terms of markets this week. There is talk that the White House is focusing on reducing some customs duties that are expected to take effect on April 2. It is stated that taxes, especially for the automotive and chip sectors, have been put on the back burner, and steps will be taken towards mutual trade taxes. This news is being priced positively in index futures. The flow of economic data will be quite intense. Monday Tuesday Thursday Friday S&P Global PMI data, Conference Board Consumer Confidence Index, Durable Goods Orders on Wednesday, Thursday U.S. growth data, followed by the Fed's inflation indicator PCE data will be announced on Friday. In addition, the statements of Fed officials will be closely followed throughout the week.Asian stock markets started the week positively. European stock markets are expected to open similarly higher. Also today, leading manufacturing and service sector PMI data for March will be announced in the US, Eurozone and UK. In the Eurozone, the manufacturing PMI was at its highest level in the last 2 years with 47.6 in February. It is expected to increase to 48.2 in March. The manufacturing PMI in the US has been above the critical level for the last two months. February June saw its highest level since June 2022 with 52.7. In March, it is expected to be announced as 51.8. This week, markets are generally expected to focus on global economic data and Fed statements.The Most Valuable Companies and Their Stock PricesApple (AAPL) → market capitalization of $3.28T, price per share is $218.27, an increase of 1.95%.Microsoft (MSFT) → market capitalization of $2.91T, price per share is $391.26, an increase of 1.14%.NVIDIA (NVDA) → market capitalization of $2.87T, price per share is $117.70, a decrease of 0.70%.Amazon (AMZN) → market capitalization of $2.08T, price per share is $196.21, an increase of 0.65%.Alphabet (GOOG) → market capitalization of $2.01T, price per share is $166.25, an increase of 0.73%.Borsa IstanbulGlobal stock markets are starting the new week with a slight recovery trend. In the country, political-oriented developments and decisions from the economic management are being followed. Some of the featured steps are; The CBRT announced that it will issue liquidity securities with futures up to 91 days from today as part of liquidity management, the CMB banned short-selling transactions until April 25 and decided to stretch the equity ratio in credit transactions by facilitating share repurchases of publicly traded companies, while Borsa Istanbul reduced the order/transaction ratio from 5:1 to 3:1 and increased the threshold value overage fee from 0.25 TL to 0.50 TL in order to limit high-frequency transactions. These measures may help to control the recent increased volatility, but it may take time to restore confidence in TL assets. In addition, it is estimated that the CBRT spent $ 20-25 billion from its reserves last week to control exchange rate volatility. A clearer picture will emerge after the CBRT Analytical Balance Sheet is announced today at 14:00. High reserve utilization can increase the fragility of the TL.Borsa Istanbul closed last week with a sharp decline. While the BIST 100 index lost value by 16.6% depending on both the domestic market and global developments, the banking index was the sector that lost the most value with a decline of 26%. While the BIST 100 index closed at 9,045 on Friday, the weak outlook became more pronounced as it fell below the 200-day moving average. Technically speaking, the levels of support 8.980 – 8.725 – 8.618 – 8.560 – 8.000 while standing out as, the resistance levels are 9.221 – 9.451 – 9.594 – 9.784 – 9.895 he is being followed as. In particular, the 8.618 - 8.560 band is being watched as a strong support point, as it coincides with the bottom levels in November 2024. If it goes below this level, the decline may become more pronounced. On the other hand, in order for a positive mood to occur in the stock market again, the 9.594 level needs to be exceeded in the first stage. If this happens, the 9.895 – 10.197 band may come up again.The Shares That Increased The Most:BLSU → increased by 10.00% to TL 15.18.DURDO → increased by 10.00% to 3.52 TL.DCTTR → increased by 10.00% to 36.30 TL.YBTAS → Increased by 10.00% to 169,822.50 TL.SNKRN → reached TL 93.50 with an increase of 10.00%.The Most Declining Shares:ATEKS → fell by -9.97% to TL 100.20.DERHL → fell by -9.75% to 34.44 TL.PCILT → fell by -8.37% to TL 11.16.ETHYLR → fell by -7.78% to 7.70 TL.AKCNS → fell by -5.78% to TL 168.00.The Companies with the Highest Market Capitalization in Borsa Istanbul:QNB Finansbank (QNBTR) → Market capitalization of TL 1.25 trillion, price per share is TL 370.00, a decrease of 0.87%.Aselsan Electronics Industry (ASELS) → Market value of TL 503.88 billion, price per share is TL 115.00, an increase of 4.07%.Garanti Bank of Turkey (GARAN) → market value of TL 450.24 billion, price per share is TL 112.70, an increase of 5.13%.Turkish Airlines (THYAO) → market value of TL 394.33 billion, price per share is TL 301.50, an increase of 5.51%.Koç Holding (KCHOL) → Market value of TL 389.51 billion, price per share is TL 158.90, an increase of 3.45%.Precious Metals and Foreign Exchange PricesGold: 3691 TL Silver: 40.41 TL Platinum: 1195 TL Dollar: 38.08 TL Euro: 41.16 TL Hope to meet you again tomorrow with the latest news!

1. What is the Short-Selling Ban?The Capital Markets Board (CMB) has temporarily banned short-selling, a practice where investors borrow shares they do not own and sell them. The primary purpose of this ban is to prevent sharp market declines and speculative activities.Why is it Important?Short-selling can create negative market pressure based on expectations of price declines.This ban aims to stabilize markets and protect investor confidence.2. Simplifying Share BuybacksPublicly traded companies can now more easily repurchase their own shares from the stock market. This new regulation allows companies to counteract declining share prices and support price stability.Why is it Important?Companies can bolster their share prices, reassuring investors.Supports positive market sentiment and reduces potential panic selling.3. Relaxed Margin Requirements in Credit TransactionsThe equity margin requirements for investors engaging in credit-based trades have been relaxed. Investors can now maintain or even expand their positions using less equity as collateral.Why is it Important?Investors can continue their investments with lower collateral requirements.It enhances market liquidity and reduces selling pressure.Overall Impact of the MeasuresThe primary objective of these three measures announced by the CMB is to mitigate market volatility, safeguard investor rights, and enhance overall market confidence. These actions enable investors to trade in a more stable and balanced environment, strengthening market resilience.Investors should closely monitor such regulatory developments and adjust their investment decisions accordingly.

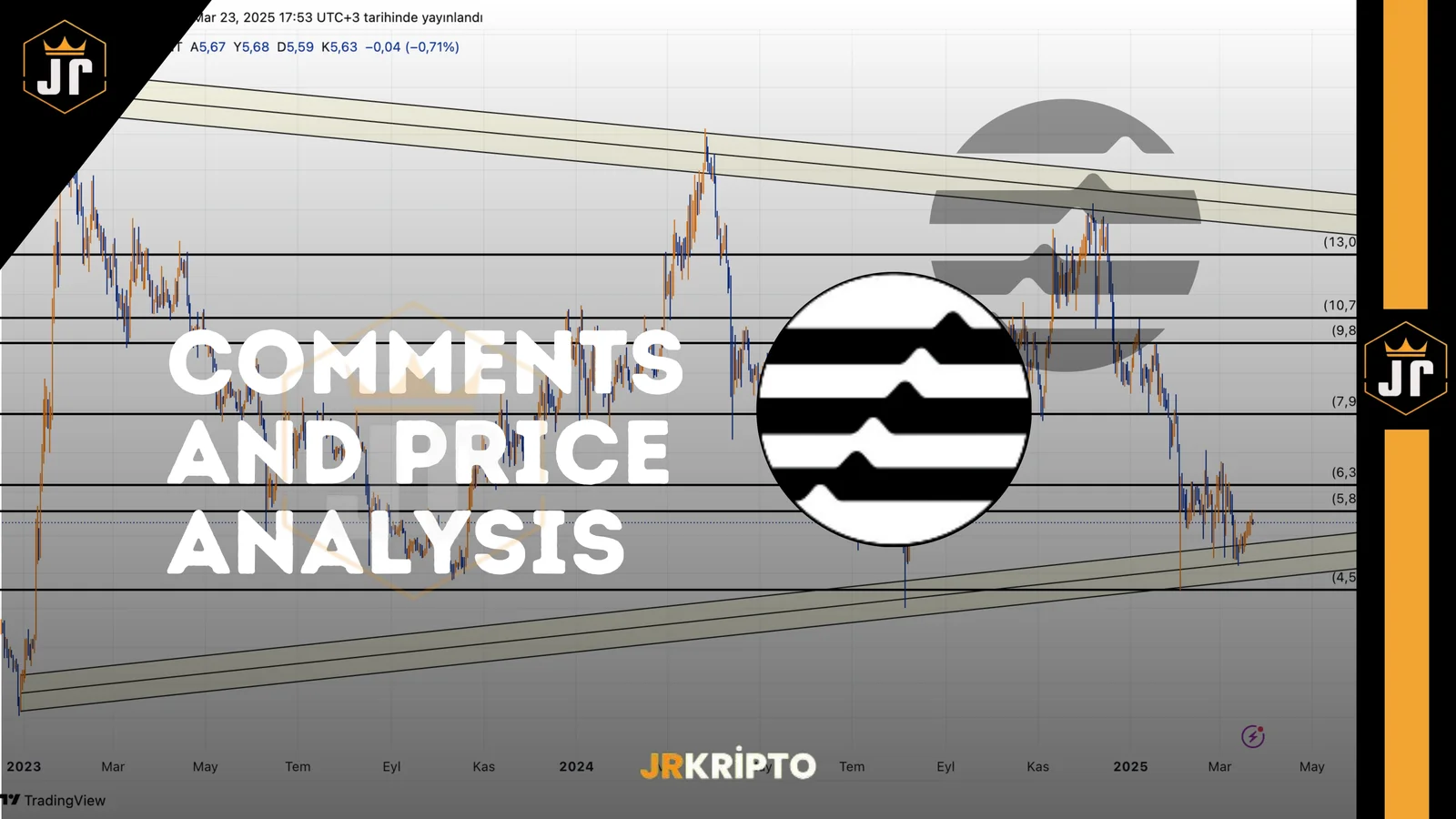

APT Coin Technical AnalysisAPT Coin has experienced high volatility over the past year. After peaking at $14.13 in early 2024, the price steadily declined and reached $5.63 by March 2025. However, this downward trend might present a long-term accumulation opportunity for investors who follow market cycles closely. APT Upon analyzing the chart, $4.90 stands out as a strong support level. The price has bounced from this zone multiple times, indicating demand. On the upside, the $6.15 level serves as the immediate resistance — a zone that has previously acted as both support and resistance.In the medium term, the $7.19 – $7.66 range is a significant resistance area. If this is broken, the next targets would be $9.14, $10.91, and $11.63. The long-term major resistance remains at $14.13.Key price levels for APT Coin:Support Zone: 4.90$ - 5.37$First Resistance: 6.15$Mid-Term Resistance: 7.19$ - 7.66$Other Resistances: 9.14$ - 10.91$ - 11.63$ - 14.13$The technical outlook suggests potential sideways movement in the short term. However, the broader bull market expectation across the crypto sector might uplift APT as well. Especially if Bitcoin remains strong, altcoins like APT could benefit significantly.Disclaimer:This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.Author: Ilahe

SUI Coin Analysis – Can It Hold at the Critical Support Zone?After a strong rally that peaked around $5.36, the SUIUSDT pair entered a correction phase. Currently trading at approximately $2.26, the price is testing the lower boundary of an ascending channel. This zone acts as a significant technical and psychological support. SUI The primary support area lies between $2.10 and $2.37. This range has previously acted as both resistance and support. Holding this region could trigger a short-term recovery towards $3.01. However, a breakdown below may lead to deeper pullbacks toward $1.58 and potentially $1.18.On the upside, the $3.01 resistance level stands out as a key zone. A decisive breakout above it might open the path to the $4.00 – $5.00 range again.Key Levels: Support: $2.10 – $2.37 / $1.58 / $1.18 Resistance: $3.01 / $4.00 / $5.36 Trend: Testing ascending channel supportSUI coin is currently at a decision point. Holding the confluence of the channel and horizontal support may initiate a bounce. Otherwise, lower support levels could come into play.This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.Author: Ilahe

SEC, Proof-of-Work Madenciliğinin Yasal Statüsünü NetleştirdiABD Menkul Kıymetler ve Borsa Komisyonu (SEC), 20 Mart 2025 tarihinde Bitcoin gibi Proof-of-Work (PoW) tabanlı kripto paraların madencilik faaliyetlerinin menkul kıymet arzı kapsamına girmediğini açıkladı. Bu açıklama, kripto madencileri ve yatırımcılar için önemli bir hukuki netlik sağladı.PoW Madenciliği Neden Menkul Kıymet Olarak Değerlendirilmiyor?SEC, kripto madenciliği faaliyetlerinin Howey Testi kriterlerini karşılamadığını belirtti. Yapılan açıklamada şu ifadelere yer verildi:“Madencilik, bireysel çaba ve hesaplama gücüne dayanan bir süreçtir. Ortak bir girişime veya üçüncü kişilerin yönetsel çabalarına dayanmadığı için menkul kıymet arzı kapsamına girmez.”Ayrıca madencilik havuzlarından elde edilen ödüllerin de menkul kıymet işlemi olmadığı vurgulandı.Sektörden Olumlu TepkilerKripto topluluğu, SEC’nin bu açıklamasını memnuniyetle karşıladı. Bitcoin madencilik şirketi CEO’su John Michaels konuyla ilgili olarak:“Bu açıklama madencilik faaliyetlerinin meşruiyetini güçlendiriyor ve sektöre güveni artırıyor.” dedi.Açıklama sonrası halka açık madencilik şirketlerinin hisselerinde hafif yükselişler görüldü.SEC, staking hizmetleri ve bazı ICO’lar gibi diğer kripto faaliyetlerinin ise hâlâ menkul kıymet olarak değerlendirilebileceğini hatırlattı ve şirketlerin hukuki destek almaları gerektiğini belirtti.Yatırımcı Güveni ve Sektörün BüyümesiSEC’nin bu kararı, madencilik sektöründeki önemli hukuki engellerden birini ortadan kaldırıyor. Böylece sektöre daha fazla yatırım çekilmesi ve madencilik faaliyetlerinin genişlemesi bekleniyor. Ayrıca Bitcoin’in emtia olarak konumunu güçlendiriyor.Kripto Düzenlemelerinde Yeni Bir Dönem mi Başlıyor?Bu açıklama, SEC’nin meme coin’lerin menkul kıymet olmadığını belirtmesi ve Ripple davasının sonuçlanmasıyla birlikte, daha net ve şeffaf düzenlemelere doğru ilerleyen sürecin parçası olarak görülüyor. Bu gelişmeler, sektördeki düzenleyici belirsizlikleri azaltabilir. SEC Piyasa Etkileri ve Gelecek BeklentileriSEC’nin PoW madenciliğine yönelik bu net açıklaması, kripto piyasaları açısından olumlu değerlendiriliyor. Madenciler artık yasal belirsizlik olmadan faaliyet gösterebilirken, yatırımcılar da yeni nesil PoW projelerine daha rahat yatırım yapabilecek.

SEC Accepts 21Shares’ Polkadot ETF ApplicationThe U.S. Securities and Exchange Commission (SEC) has taken a notable step by officially accepting the Spot Polkadot (DOT) ETF application filed by 21Shares. This development may significantly strengthen the position of cryptocurrencies within the investment world.Why is the SEC’s Acceptance Important?This acceptance is more than a procedural step; it indicates an expanding regulatory openness towards cryptocurrencies beyond Bitcoin. Here's why it matters:Endorsement for Polkadot: It positions Polkadot as a credible cryptocurrency suitable for regulated financial products.Easier Access: Provides mainstream investors with an easier route to investing in Polkadot without directly holding crypto assets.Institutional Interest: ETFs are preferred investment tools among institutional investors, potentially attracting large institutional funds into Polkadot.Sets Precedent for Other Cryptos: Approval could pave the way for other altcoin ETFs.What is a Spot ETF and Why Does It Matter?A spot ETF holds the actual underlying asset, unlike futures ETFs that track future price movements. Spot ETFs provide direct exposure to Polkadot’s price, making them simpler and attractive to investors.Who is 21Shares?21Shares is a renowned issuer of cryptocurrency Exchange-Traded Products (ETPs) with significant European market experience:Proven Expertise: Successfully launched multiple crypto ETPs.Commitment to Innovation: Leading innovator in crypto investment vehicles.Strategic Partnerships: Previously partnered with ARK Invest on Bitcoin ETF filings.Global Presence: Brings global expertise to the U.S. crypto market.Potential Benefits of a Polkadot ETFA Polkadot ETF could provide several investor advantages:Simplified Investment: No need to navigate complex crypto exchanges.Enhanced Liquidity: Broader investor participation increases trading volume.Regulatory Security: Regulated products enhance investor confidence.Potential Tax Advantages: May offer favorable tax conditions in certain regions.Broader Adoption: Increases awareness and use cases for Polkadot.Challenges for SEC ApprovalDespite the positive outlook, ETF approval faces several hurdles:Market Manipulation Concerns: SEC remains cautious regarding manipulation risks.Regulatory Complexity: Ongoing regulatory uncertainties complicate the approval process.Extended Approval Process: ETF approvals typically require lengthy review periods.Next Steps for Polkadot ETFThe SEC’s acceptance begins the formal review period, including public comments and possible amendments. The application could ultimately be approved, rejected, or delayed. These developments could significantly affect the Polkadot market and investor sentiment.ConclusionThe SEC's acceptance of the 21Shares Polkadot ETF application marks an optimistic development for the crypto sector. It signals increased regulatory openness and could enhance Polkadot’s global prominence. Investors should closely watch this development, as it may signal the beginning of broader crypto ETF approvals.

UAE Announces Historic Investment Initiative in the USThe United Arab Emirates (UAE) has pledged to invest a total of $1.4 trillion in the United States over the next ten years following discussions with former US President Donald Trump. This significant investment commitment aims to enhance economic relations between the two nations and has captured global attention.Key Investment Areas by the UAE in the USThe UAE's planned investments span multiple sectors:Infrastructure Projects: Ports, transportation networks, and energy facilities.Technology and Artificial Intelligence: Innovative startups, software companies, and high-tech ventures.Energy Sector: Renewable energy projects, petroleum, and gas developments.Real Estate: Large-scale residential and commercial construction projects.These initiatives are expected to inject substantial capital into the US economy, potentially creating significant employment opportunities and economic growth. Moreover, this aligns with the UAE's broader strategy to enhance its global economic influence.Growing Interest in Cryptocurrencies and Digital AssetsAs part of this investment plan, the UAE is also rumored to support projects related to cryptocurrencies and blockchain technology. An increased interest in decentralized finance (DeFi) and Web3 initiatives suggests a rise in institutional investments into digital assets within the US.Strategic Partnership Strengthened Between Trump and the UAEDonald Trump had established robust economic ties with the UAE during his presidency. This new investment commitment demonstrates Trump's continued diplomatic and economic influence in the private sector. Experts note that with this agreement, Trump reasserts himself as a prominent player in global economic affairs.UAE officials emphasized that these investments are strategically and politically motivated, potentially reshaping US-Middle East relations. US President Donald Trump with UAE National Security Adviser Sheikh Tahnoon bin Zayed Impact on Investment MarketsThe UAE's $1.4 trillion investment pledge could significantly boost US markets, particularly the stock market. Analysts predict initial benefits primarily in energy, technology, and digital asset sectors.This development could attract global investor attention to UAE-backed projects, influencing international capital movements. As one of the US's major economic partners, the UAE's initiative is likely to play a defining role in shaping the global economy in the coming years.

Major Acquisition Talks Between Coinbase and DeribitU.S.-based popular cryptocurrency exchange Coinbase is in negotiations to acquire Deribit, one of the global leaders in Bitcoin and Ethereum options trading. According to a Bloomberg report, both parties have informed regulatory authorities in Dubai and are currently discussing the terms of the deal. If this acquisition is completed, Coinbase's influence in the crypto derivatives market could significantly expand.A Strategically Important Move for CoinbaseCoinbase's attempt to acquire Deribit is considered strategic amid growing competition in the crypto derivatives market. Although Coinbase is already active in the futures market, it aims to achieve leadership in options trading as well. Deribit has established its strong position in the sector, handling approximately $1.2 trillion in trading volume throughout 2024, making the acquisition even more attractive for Coinbase.Entry into the Middle Eastern Market and Global Expansion GoalsIf the deal goes through, Coinbase could accelerate its entry into the Middle Eastern market by taking over Deribit's Dubai license, capitalizing on the region's crypto-friendly regulations. This strategic move is largely driven by tighter regulatory environments in the U.S. and Europe, prompting Coinbase to pursue growth opportunities in alternative markets.Coinbase's Strategic Moves in a Competitive Crypto Derivatives MarketCoinbase continues to innovate to maintain competitive advantages in the crypto derivatives market:Recently submitted applications to the CFTC for Cardano (ADA) and Natural Gas (NGS) futures trading.Increased competition from major players like Robinhood and CME Group entering the market.If this acquisition is successful, Coinbase will expand both its product offerings and market access, significantly enhancing its potential to become a market leader.Market Anticipation for Deal DetailsThe outcomes of these ongoing negotiations are closely watched by investors and market participants. Should Coinbase's acquisition of Deribit materialize, it would represent a significant milestone in the cryptocurrency ecosystem. Markets are eagerly awaiting the completion of this strategic move.