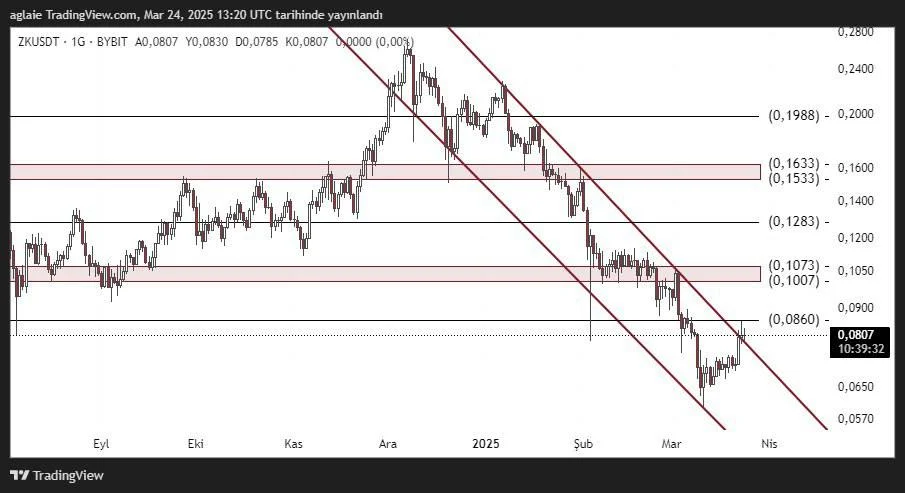

zkSync (ZK) Coin Technical Analysis

ZK Coin (zkSync) shows a chart with a sharp downward trend recently. In particular, the price, which has been moving within the falling channel structure since December 2024, continued its retreat from the 0.2800 level to the 0.0570 level. This level also corresponds to the lower band of the channel, where the price is currently trading at 0.0807 with the incoming buying reaction.

When we look at the technical structure on the chart, the first important resistance zone for ZK coin is located at 0.0860. This level is quite critical because it coincides with both horizontal resistance and channel resistance. If this region breaks upward, the levels of 0.1007 – 0.1073 and 0.1283, respectively, may become the target. However, in order to reach these levels, the market also needs to remain positive in general.

Some technical points that investors should pay attention to in ZK coin are as follows

- the 0.0570 level worked as a strong support.

- the 0.0860 level is in the short-term resistance position.

- The falling channel structure is still valid.

- the December 0.1007 - 0.1073 should be monitored as the main resistance zone.

In particular, exceeding the 0.0860 level may indicate a trend transformation in the short term. However, in retest situations that may occur at this level, the price may return to the channel and retreat to 0.0650 levels. For this reason, it will be useful to look for volume and formation confirmation when opening a position.

As a result, although ZK coin is technically under pressure at the moment, the buying reactions from the bottom levels are attracting attention. If channel breakage occurs, it may offer opportunities to investors in the short term.

These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions.

Author: Ilaha