Politics

This page lists the latest Politics news and market analysis. Browse articles, expert insights, and updates in this category on JrKripto. Stay informed with in-depth coverage of cryptocurrency trends and developments.

This page lists the latest Politics news and market analysis. Browse articles, expert insights, and updates in this category on JrKripto. Stay informed with in-depth coverage of cryptocurrency trends and developments.

News

Politics News

Browse all Politics related articles and news. The latest news, analysis, and insights on Politics.

Senator Cynthia Lummis's Bitcoin Proposal Creates Excitement in Financial WorldU.S. Senator Cynthia Lummis recently sparked considerable excitement in the cryptocurrency community with her bold suggestion: "Let's sell a portion of our gold reserves and buy Bitcoin." Such a proposal from a top-tier politician of the world’s largest economy is far from ordinary.Protecting Economic Sovereignty and Aiming for Digital LeadershipSenator Lummis's statements not only strengthen cryptocurrency's position within the financial system but also reshape perspectives towards digital assets. What seems today like a small spark could soon ignite a massive financial revolution.The foundation of Lummis's proposal is the desire to protect America's economic sovereignty and lead in the digital asset space. Given Bitcoin's remarkable performance in recent years, such a strategic move could have significant economic consequences and fuel extensive discussions.The Rising Importance of Bitcoin in the Global EconomyThis groundbreaking proposal is powerful enough to shift global perceptions toward cryptocurrencies, extending beyond U.S. borders. Influential policies like these could position digital assets to play a more central role in the future global financial system.As cryptocurrencies gain prominence globally, Lummis's proposal might inspire more countries to seriously consider digital asset reserves in the future.A Critical Proposal for the Future of FinanceSenator Cynthia Lummis's proposal is significant and warrants close monitoring. What may appear today as a modest idea could become a cornerstone of the global financial system tomorrow.Financial policymakers and investors must closely follow innovative policies such as this, as today’s proposals may define tomorrow’s economic reality.

ARBARB Coin is trying to hold its ground near the $0.2958 support level within a descending channel. In this analysis, we take a detailed look at critical resistance zones and possible scenarios.After forming a peak, Arbitrum (ARB) entered a long-term downtrend. Currently, the price is trading around $0.3662, close to the upper boundary of the descending channel. After touching the lower boundary of the channel, the price has seen a reaction. Additionally, the slight recovery from the $0.29 level suggests that this zone is attracting buyer interest. ARB The strongest support level is found at $0.2958. This level serves as both a psychological and technical defense zone. If the price remains below this level, it may decline toward $0.27, increasing the risk of breaking below the channel structure.In a bullish scenario, the first major resistance level is at $0.4148. This area has been tested several times previously but failed to hold as support. If the price can close above this level, the next targets would be $0.4812, $0.5112, and $0.6054. Particularly, a sustained move above $0.6054 would indicate a breakout from the descending channel and could be seen as a potential trend reversal signal.Another key zone is the $0.7169 – $0.7613 range. This region could act as a strong medium-term resistance and may determine the longer-term direction. If this band is broken, investor confidence might be restored, pushing the price toward the psychological resistance at $1.00.Key technical levels for ARB Coin: • Support levels: $0.2958 – $0.2700 • Resistance levels: $0.4148 – $0.5112 – $0.6054 – $0.7169 – $0.7613In summary, although ARB Coin is still trading within a strong descending channel, the recent reaction from the lower boundary and the flattening of price action suggest a potential short-term direction shift. The key level to watch in the coming days is the $0.4148 resistance. A break above this level could trigger an upward movement. However, if selling pressure resumes from this zone, the price might once again head toward the lower boundary of the channel.This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.Author: Ilahe

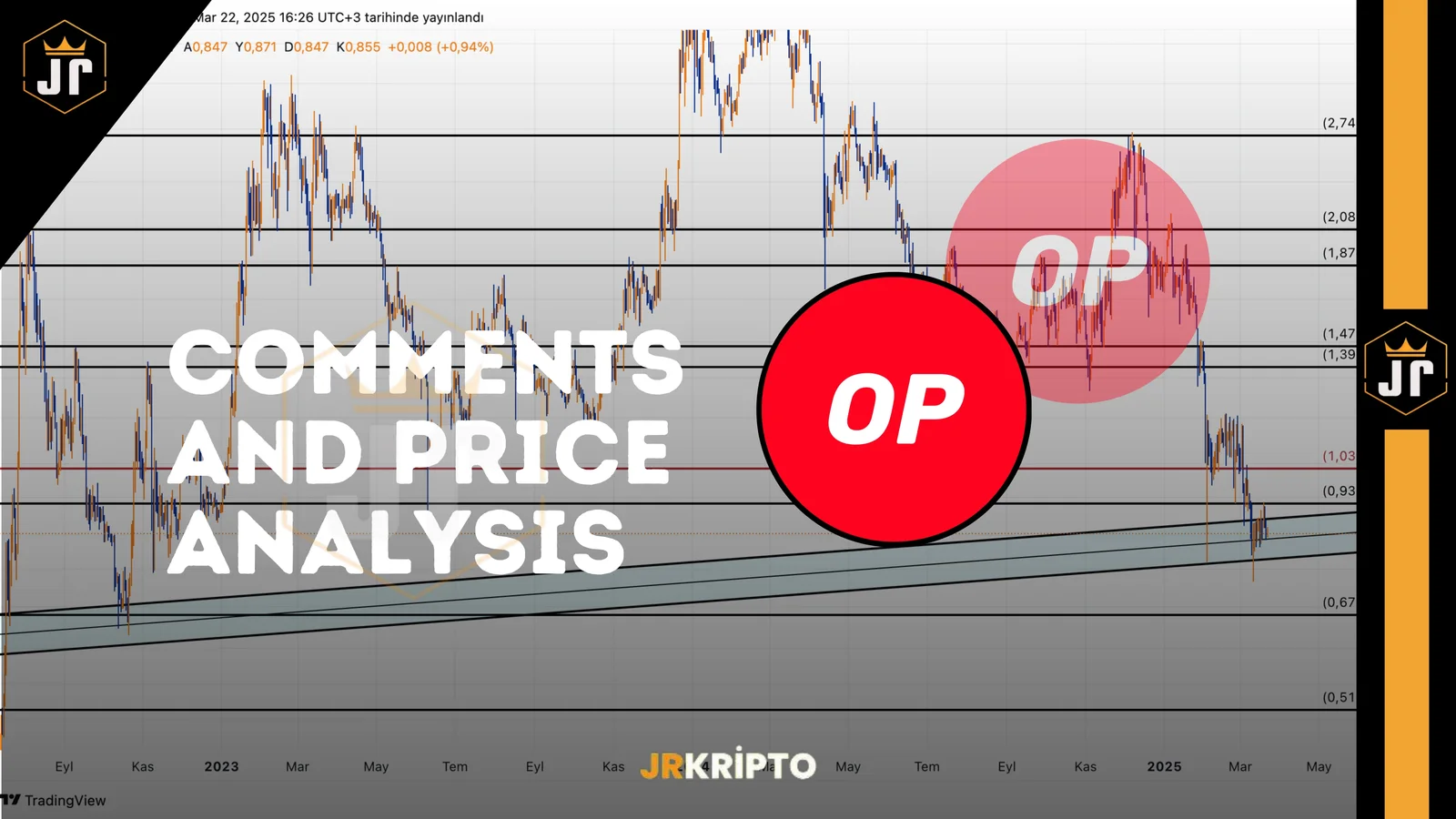

OPOptimism continues to move within a descending channel. After a bounce from the $0.674 support level, the price shows signs of recovery. In this analysis, we examine the short-term direction of the OP token based on key support and resistance zones. OP OPUSDT is currently trading near a technically important region while maintaining its descending channel structure. The price has rebounded from the $0.674 level and climbed to $0.865. While this move indicates a potential short-term recovery, the overall trend remains bearish.According to the current structure, the nearest resistance for OP Coin is located at $0.936. If this level is broken, the next resistance zone stands at $1.041. These two resistance zones are considered technically strong, and without significant volume, price action may struggle to break through them.If the price can surpass the $1.041 level and maintain above it, upward momentum could increase. Sustained closes above $1.404 may lead the price to target $1.892 and higher.On the other hand, if OP fails to break above the $1.041 resistance, a pullback toward the $0.760 level is possible. The $0.674 level remains the main support area, and a breakdown below this point could increase selling pressure.Despite the overall bearish trend, the bounce from the lower boundary offers a potential buying opportunity in the short term. A sustained move above the $0.936 level could boost investor confidence and create a positive breakout.Key technical levels to monitor for OPUSDT: Support levels: $0.730 – $0.674 Resistance levels: $0.936 – $1.041In conclusion, OPUSDT is approaching a critical resistance zone, and price action around this area will be decisive. A breakout above $1.041 could support a continued rally, but failure to break through may result in renewed selling pressure.Disclaimer:This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.Author: Ilahe

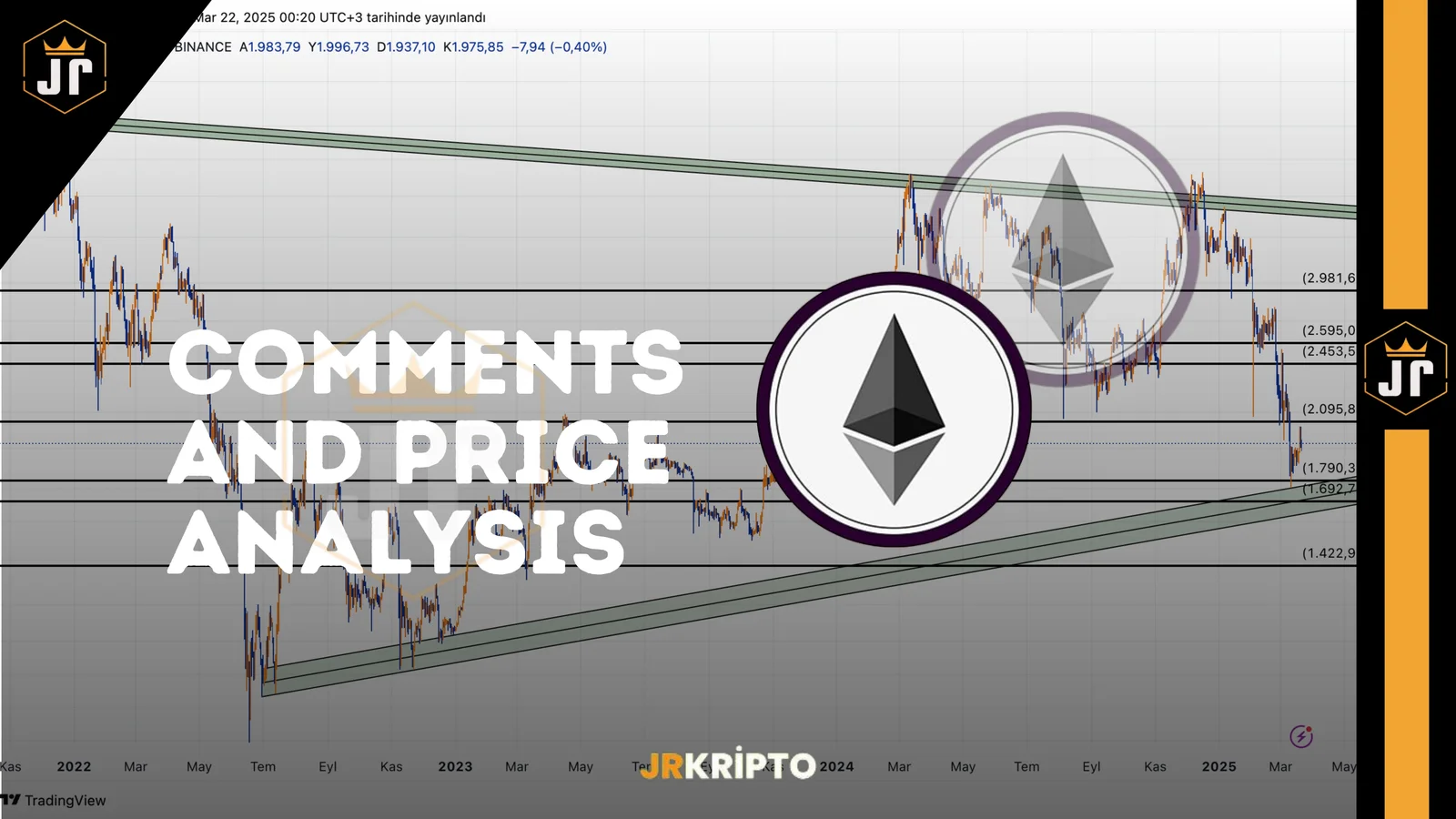

Ethereum (ETH) Technical Analysis: Key Levels and Possible Scenarios Ethereum continues to find direction at major support levels, with strong buyer interest. To understand the broader market trend, ETH's price movements at support and resistance levels should be closely monitored. Here are the key levels to watch in the upcoming period: 1,692$ - 1,574$ → Strong Demand Zone with Buyer Interest ETH may encounter significant buying interest at this level. If the price holds this region, an upward reaction and new rallies may begin. ETH However, if the 1,692$ level is lost, the selling pressure may increase, pulling the price down to the 1,574$ area. This level will be crucial in determining the direction for Ethereum. 2,083$ - 2,108$ → SR Flip and Strong Seller Zone This area is important for a potential Support-Resistance Flip (SR Flip), where the price may face strong selling pressure. If ETH surpasses this region with strong volume, the uptrend is likely to accelerate. However, if rejected, the price may return to lower support levels where buyers are waiting. How strong the buyers are at this level will determine the market's next move. 2,534$ - 2,723$ → Macro Resistance Zone This zone represents a critical resistance point where Ethereum could form a higher trend structure. If the price holds and buyers prevail at this level, a new rally towards 3,402$ may begin. However, if strong rejection occurs here, the price could be pulled back to lower support levels. 3,402$ → Strategic Level Watched by Large Investors This is a key resistance area where large players are focusing, and any movement here could trigger significant market volatility. If Ethereum sustains above 3,402$, an accelerated uptrend is possible, with a psychological target of 5,000$ becoming likely. Breaking this level could lead Ethereum into a price discovery phase, testing new highs. 5,000$ and Layer 2 Effect If Ethereum rises to this level, substantial capital inflows into the ecosystem are expected, potentially driving major movements in Layer 2 projects (e.g., OP, STRK, ZKSYNC, ARB). If 1,692$ and 1,574$ levels hold, a strong recovery may follow. If 2,083$ - 2,108$ is broken, the uptrend could accelerate. If Ethereum maintains above 2,534$ - 2,723$, new highs may follow. If 3,402$ is surpassed, the 5,000$ level could become inevitable. Watching how ETH reacts at these levels is crucial for determining the best strategy moving forward. TOTAL2 – Key Levels and Possible Scenarios in the Altcoin Market TOTAL2, representing the total market capitalization of all altcoins excluding Bitcoin, continues to provide significant signals for the overall market direction. The price movements of Ethereum and major altcoin projects have a direct impact on TOTAL2, so these levels must be monitored closely. TOTAL 2 988B → Strong Support Zone Where Buyers Enter This area indicates the beginning of capital inflows into the altcoin market and rising investor confidence. If 988B holds, it will be crucial for ETH and other major altcoins to continue their upward trend. If this support is broken, increased selling pressure may lead to a deeper correction in the market. 1.09T → Turning Point for Uptrend This level represents a resistance zone where volatility in the altcoin market could rise, and momentum may become crucial. If TOTAL2 surpasses 1.09T, we may see strong acceleration in the altcoin market, potentially leading to new price discoveries for Ethereum and major altcoins. However, if a strong rejection occurs here, the price could retrace back to 988B. 1.32T – 1.35T → Key Zone for Strong Altcoin Rally This area is a critical resistance point for TOTAL2 to enter a new uptrend and initiate major movements in the altcoin market. If 1.09T is held, TOTAL2’s next target will be the 1.32T – 1.35T range. Reaching these levels could speed up price movements for Ethereum and major altcoins. However, short-term profit-taking and pullbacks may occur in this region. If the 988B level holds, the altcoin market will likely remain strong. Breaking 1.09T could accelerate the uptrend, with Ethereum and large projects likely seeing strong price movements. The 1.32T – 1.35T region could be where the altcoin bull market reaches new heights. Tracking TOTAL2's reactions at these levels is crucial for identifying opportunities in the altcoin market.

BTC USDT.D TOTAL Bitcoin (BTC) at Critical Levels! Key Levels That Will Determine the Market's Direction The cryptocurrency market largely moves in line with Bitcoin’s (BTC) price action. Currently, BTC is trading at critical levels, with both technical and macroeconomic factors continuing to shape the market’s direction. So, what are Bitcoin’s key support and resistance levels? Which levels need to be broken for a confirmed bull market? Here’s our in-depth BTC analysis! Major Support Zones and Buying Pressure Bitcoin is seeing strong buying pressure at the $80,691 level, making it one of the most important support zones. As long as BTC holds above this level, the uptrend remains intact. However, if this support is lost, the price could pull back to $73,336. Historically, the $73,336 level has been a key confluence zone during BTC’s massive uptrend from $15,500. When this area was tested in the past, BTC surged by nearly 150%. Therefore, long-term investors should closely monitor this level as a strong support zone. Key Resistance Zones and Seller Strength For upward movements, the $87,500 level acts as an SR Flip (Support-Resistance Flip) and POI (Point of Interest) zone. This area has previously faced significant selling pressure, making it likely that BTC could consolidate here. However, if the price breaks above this level with strong volume, the next major target would be $92,591. If $92,591 is breached, BTC is expected to move toward the $95,745 - $97,213 NPOC (Unbalanced Price Area). Although resistance could be encountered here, surpassing these levels could push BTC toward $110,000, potentially unlocking new all-time highs. The Importance of Macroeconomic Factors Bitcoin’s price movements are not solely dictated by technical levels. Global economic developments, central bank decisions, and macroeconomic indicators also play a major role. The Federal Reserve’s (FED) interest rate decisions and statements regarding the U.S. economy are among the most influential factors for risk assets like Bitcoin. If the FED keeps interest rates steady and signals a rate cut in May, this would be a bullish scenario for Bitcoin. As inflation approaches the 2% target, markets may anticipate increased liquidity, further supporting BTC’s upward momentum. Key Levels to Watch: $80,691 → Strong buyer zone. If BTC remains above this level, the uptrend continues. A breakdown below this level could bring $73,336 into play. $73,336 → Major macro support level. Historically, this level has been a launchpad for significant BTC rallies. $87,500 → SR Flip & POI zone. A breakout above this level would strengthen the bullish scenario. $95,745 - $97,213 → NPOC (Unbalanced Price Area). Breaking through this range could set BTC up for new highs. $110,000 → Main target zone. Once BTC surpasses this level, price discovery could begin. As Bitcoin navigates these critical support and resistance levels, macroeconomic developments will be one of the most important factors shaping the market’s future. Therefore, keeping an eye on both technical levels and global economic news is crucial. USDT Dominance (USDT.D) Analysis and Its Impact on the Market One of the most important ways to understand investor sentiment and risk appetite in the cryptocurrency market is by tracking USDT Dominance (USDT.D) movements. An increase in USDT.D indicates that investors are moving towards stablecoins and away from riskier assets, signaling a risk-off environment. Conversely, a decline in USDT.D suggests that funds are flowing into cryptocurrencies, indicating renewed risk appetite. Therefore, analyzing how USDT.D reacts at certain levels is crucial for predicting potential market trend reversals. Key USDT.D Levels and Their Market Impact 🔴 6.06% – Peak Selling Pressure When USDT.D reaches this level, it signals extreme selling pressure in the market, with panic selling peaking. If USDT.D pulls back from this level, it suggests that investors are shifting back to risk assets and capital inflows into crypto have begun. 🔵 5.03% – The Level That Revitalizes the Market A drop below 5.03% indicates that funds held in stablecoins are starting to flow into risk assets. This is a positive signal for Bitcoin and the altcoin market. If USDT.D continues to decline below this level and fails to hold, it strongly confirms that the market is entering a bullish trend. 🟢 4.68% – Accumulation Zone and Buyer Strength This level has historically acted as a zone where sellers gained strength and the market consolidated. Reaching 4.68% suggests that the market is in a recovery phase and large investors are accumulating assets. Conclusion USDT Dominance levels remain a key indicator for understanding capital flows and investor psychology in the market. If USDT.D sustains levels below 6.06%, Bitcoin and altcoins are expected to gain bullish momentum. Thus, investors should not only focus on price movements but also carefully track how liquidity is distributed across the market. TOTAL Market Cap Analysis: Key Levels and Possible Scenarios To understand the overall state of the cryptocurrency market, the TOTAL market cap serves as a crucial indicator. TOTAL’s movements at certain levels help assess market liquidity and investor confidence. 2.29T – Capital Inflow and Demand Zone This level represents a strategic area where investors inject fresh capital into the market, increasing buying interest. If TOTAL manages to hold this level, it suggests that confidence in the market remains intact. However, losing this support may indicate that investors are becoming cautious and that the market is at risk of a deeper correction. 2.55T – Buyers' Strength Test At this level, buyers are being tested. If they gain control, the uptrend could continue, with stronger resistance levels coming into focus. On the other hand, if selling pressure increases, the price may retrace back to 2.29T. Therefore, it is crucial to closely monitor how this level holds. 2.84T – Key Resistance Level This is one of the most critical resistance zones in the market. If TOTAL breaks above this level with strong volume, a new uptrend could begin, paving the way for new highs in the crypto market. However, if the price gets rejected here, it may head back to lower support levels, with a potential retest of 2.29T. Conclusion The way TOTAL market cap reacts at these levels remains a key indicator of the overall market health and direction. ✅ Holding above 2.29T increases the likelihood of maintaining positive momentum. ✅ Breaking 2.55T strengthens the bullish scenario. ✅ Surpassing 2.84T could open the door for new highs in the crypto market. By closely monitoring these levels, investors can identify opportunities and potential risks in advance.

Metaplanet Appoints Trump's Son to Bitcoin Strategic Advisory BoardJapan-based Bitcoin investment firm Metaplanet announced that it has appointed Eric Trump, the son of former U.S. President Donald Trump, to its newly established Strategic Advisory Board. With this move, the company aims to expand its influence in the Bitcoin ecosystem and enhance its global visibility.Strategy to Increase Bitcoin AdoptionMetaplanet aims to solidify its Bitcoin investments by leveraging Eric Trump's business experience. Simon Gerovich, the company's Representative Director, expressed support for Trump's appointment, highlighting that Trump's expertise in finance, real estate, and brand development would significantly contribute to Metaplanet's growth.The company plans to add other well-known leaders and thought influencers to its advisory board in the future. For now, Eric Trump is the only publicly announced member of the board.Metaplanet’s Bitcoin Strategy and RisksOn March 18, Metaplanet recently acquired an additional 150 BTC, bringing its total holdings to 3,200 BTC. The company's goal is to accumulate a total of 21,000 BTC by 2026. To finance this strategy, the company issued over 44 million shares, earning it the nickname "Asia's MicroStrategy."Metaplanet's average Bitcoin purchase price stands around $83,000. A temporary risk emerged when Bitcoin's price dropped to $76,555 in March 2025; however, the market has since recovered, with Bitcoin currently trading at around $84,000. This situation underscores the sensitivity of the company's investment strategy to market volatility.Eric Trump Strengthens Metaplanet’s Bitcoin StrategyMetaplanet's official announcement stated that Eric Trump's extensive experience in business development, real estate, finance, and strategic planning would be leveraged. Trump is also actively involved in supporting decentralized finance (DeFi) and blockchain innovations through the World Liberty Financial (WLFI) project.Simon Gerovich stated regarding Trump's appointment:"Eric Trump's business acumen, love for the Bitcoin community, and global perspective will be invaluable in accelerating Metaplanet's vision of becoming one of the world's leading Bitcoin treasury companies."Importance of Metaplanet’s Strategic Advisory BoardMetaplanet's Strategic Advisory Board plays a critical role in defining and implementing long-term growth strategies. The board will guide the company by analyzing market trends, managing risks, and identifying growth opportunities.The board’s key contributions will include:Eric Trump’s extensive business experience.Strong interest in Bitcoin and blockchain technology.Potential to attract institutional investors.Metaplanet officials emphasized that this appointment is critical for the company's future and that Eric Trump's support would help achieve their goals more quickly. The company continues its ambitious journey in the sector by accelerating Bitcoin investments.

You can access the summary of the "Daily Market with JrKripto" below, where we compile daily important developments in cryptocurrency, global and local markets.Come on, let's analyze the general situation in the markets together and take a look at the most up-to-date evaluations.Bitcoin (BTC) is currently trading at $83,900. While the $79,100 - $80,763 region stands out as a strong support area, if BTC can hold on at this level, it can rise towards the $85,600 and $90,700 levels. However, if this support is lost, there is a risk of a pullback to the $74,100 - $74,200 band.Ethereum (ETH) is trading at $1,970. The $1,900 level is a critical support point, and in case of an upward reaction, the $2,000 and $2,250 resistance levels will be followed. If ETH breaks the $2,250 level, it could accelerate towards the $2,534 and $2,721 levels. On the downside, losing the $1,900 support could increase the risk of a pullback towards the $1,800 levels.Crypto NewsSEC accepts application for 21Shares Spot Polkadot ETF.SEC confirms that Bitcoin and crypto mining do not violate securities laws.NYSE proposes to allow staking for Bitwise Ethereum ETF.Justin Sun: TRX ETF is coming.Donald Trump calls on Congress to pass stablecoin law.Pakistan to legalize cryptocurrency.CryptocurrenciesTop GainersORCA → Up 169.3% to $4.26. ZRO → Up 23.2% to $3.08. MEOW → up 19.2% to $0.00277231. AUCTION → up 13.5% to $46.66. IBERA → up 13.4% to $6.15.Top FallersPI → down 23.4% to $0.89995012. PENGU → down 9.1% to $0.00621443. PLUME → down 8.3% to $0.20370333. ZEC → down 8.3% to $31.35. AI16Z → down 8.3% to $0.17253949.Total Daily Net ETF InflowsBTC ETFs: $165.70 MillionETH ETFs: -$12.50 MillionGlobal MarketsAlthough US stock indices started the first trading day after the Fed meeting with purchases, they finished the day with losses. The S&P 500 lost 0.22%, the Dow Jones lost 0.03%, and the Nasdaq lost 0.33%. Four of the 11 main sectors in the S&P 500 Index closed the day with gains. The best performers were the energy and infrastructure sectors (up 0.41%), the finance sector (up 0.19%), and the healthcare sector (up 0.11%). The sectors that lost the most value were raw materials (0.62%), essential consumption (0.52%), and technology (0.49%). In the US, the Philadelphia Fed Manufacturing Index was announced as 12.5, above the market expectation of 8.8. While Asian stock markets remain under selling pressure, European stock markets are expected to start the day flat and slightly positive.The Bank of England (BoE) kept its policy rate unchanged at 4.50% as expected. In the decision, 8 members voted to keep the rate unchanged, while 1 member requested a 25 basis point rate cut. The BoE predicts that inflation will rise to 3.75% in the third quarter of 2025. While inflation is expected to decline starting in the fourth quarter, it was emphasized that caution will be exercised regarding inflationary pressures. The bank stated that monetary policy should remain tight and that it will reassess the situation at each meeting.The Swiss National Bank, on the other hand, lowered interest rates by 25 basis points from 0.50% to 0.25%. The Swedish Central Bank, on the other hand, left its policy rate unchanged at 2.25%.Weekly unemployment benefit applications in the US were slightly below expectations. In the week ending March 15, applications increased by 2,000 to 223,000 (expected: 224,000). The four-week average increased by 750 to 227,000. Continuing unemployment applications increased by 33,000 to 1.89 million in the week ending March 8. The insured unemployment rate remained constant at 1.2%.Most Valuable Companies and Stock PricesApple (AAPL) → Market value: $3.22T, Share price: $214.10 (-0.53%)NVIDIA (NVDA) → Market value: $2.89T, Share price: $118.53 (+0.86%)Microsoft (MSFT) → Market value: $2.88T, Share price: $386.84 (-0.25%)Amazon (AMZN) → Market value: $2.07T, Share price: $194.95 (-0.30%)Alphabet (GOOG) → Market value: $2T, Share price: $165.05 (-0.74%)Borsa IstanbulRisk appetite in global markets is low this morning. In Turkey, shortly before the closing of Borsa Istanbul yesterday, the Central Bank (TCMB) announced that it had raised the upper band of the interest rate corridor from 44% to 46% and suspended the 1-week repo auctions of 42.5%, which are monitored as the policy rate. This step means that interest rates have actually been increased. The expectation that "TCMB will encourage growth by reducing interest rates", which has been supporting the markets recently, has been shelved for now. Since it is uncertain how long this process will last, it is possible to expect volatility and selling pressure to continue for a while longer in Borsa Istanbul. At the Monetary Policy Committee (PPK) meeting on April 17, interestIt does not seem reasonable to wait for a reduction at the moment, and non-economic developments may also have a significant impact on the market.While the 9400-9600 point band is technically monitored as the critical support level for the BIST 100 index, the 10200-10300 range above stands out as the important resistance zone. Although the 12-month BIST 100 index target is still above 14,000 points, delaying the interest rate reduction process may cause a slowdown in growth and consumption and may cause downward revisions in these targets.The CBRT held an interim meeting yesterday to evaluate developments in financial markets. At this meeting, the overnight lending rate was increased from 44% to 46%, while the policy rate, the 1-week repo rate, was left unchanged at 42.5% and the overnight borrowing rate at 41%. The CBRT stated that monetary policy would be tightened further if a permanent deterioration in inflation was observed. In addition, it was announced that Turkish lira settled forward foreign exchange sales transactions will be initiated in order to ensure the stable operation of the foreign exchange market and to prevent exchange rate fluctuations.The Turkish Statistical Institute (TÜİK) announced the 2024 annual labor force statistics. The unemployment rate decreased by 0.7 points compared to the previous year, falling to 8.7%. The number of employed people increased by 988 thousand on an annual basis, reaching 32.6 million. While the labor force participation rate increased from 53.3% to 54.2%, the idle labor force rate, also known as the broadly defined unemployment rate, increased by 3.9 points to 26.7%.The Stocks with the Most Increase:YBTAS → increased by 10.00% to 154,385.00 TL.QNBFK → increased by 9.99% to 44.72 TL.TKFEN → increased by 7.72% to 127.00 TL.RUBNS → increased by 7.56% to 23.90 TL.SMRVA → increased by 6.37% to 31.38 TL.The Stocks That Decreasing the Most:MSGYO → decreased by -72.74% to 4.25 TL.BRKO → decreased by -10.00% to 9.99 TL.DERHL → decreased by -10.00% to 38.16 TL.COSMO → decreased by -10.00% to 109.80 TL.MARKA → decreased by -10.00% to 60.75 TL.The Companies with the Highest Market Value on Borsa Istanbul:QNB Finansbank (QNBTR) → 1.39 trillion TL market value, 424.00 TL per share, 2.29% increase.Aselsan Elektronik Sanayi (ASELS) → 535.8 billion TL market value, 112.80 TL per share price, 4.00% decrease.Turkey Garanti Bankası (GARAN) → 492.24 billion TL market value, 109.90 TL per share price, 6.23% decrease.Turkish Airlines (THYAO) → 425.04 billion TL market value, 295.00 TL per share price, 4.22% decrease.Koç Holding (KCHOL) → 421.72 billion TL market value, 163.00 TL per share price, 1.98% decrease.Precious Metals and Currency PricesGold: 3696 TLSilver: 40.57 TLPlatinum: 1203 TLDollar: 37.98 TLEuro: 41.17 TLHoping to meet again tomorrow with the latest news!

US Expands Bitcoin StrategyUS President Donald Trump's digital asset manager Bo Hines announced that the Trump administration aims to increase Bitcoin reserves to an unprecedented extent. Speaking at the Digital Assets Summit held in New York on March 18, Hines explained the strategies of Americans to earn Bitcoin with the following words:"How much Bitcoin do we want? It's like asking how much gold education in a country. The answer: As much as we can get."This statement shows the importance of the US turning to Bitcoin. The government states that Bitcoin is critical for its economic balances and cannot be sure.Historic Bitcoin Move from the Trump AdministrationThe Trump administration is turning to Bitcoin to create wealth for the American people. Bo Hines supported this approach with the following words:"Our president creates services for the American people by starting to acquire assets. This is the right method."It was reported that the details of obtaining Bitcoin without burdening the budget were discussed at the first Digital Assets Summit held in the White House. Trump announced that he signed the order to launch the "US Strategic Bitcoin Reserve" on March 6, 2025.This reserve aims to solidify the US's long-term Bitcoin earnings. The next day, Trump's cryptocurrency David Sacks said, "Bitcoin is a scarce, valuable asset and should be reserved for the US." Experts say that increasing Bitcoin reserves will support the US's economic power.US Bitcoin Target: 200,000 Bitcoins Per YearUS House of Representatives member Byron Donalds introduced a bill to enact Trump's Strategic Reserve. According to this plan:The US will purchase 200,000 Bitcoins per year for the next five years.A total of 1 million Bitcoins will be acquired.These assets will be held for 20 years.The US will be one of the largest reserve holders of Bitcoin producers.In the long term, Bitcoin reserves provide security against economic currencies.This goal could be a presentation of the US in the Bitcoin market. At the same time, various regulations are planned to be made to secure financial stability.Bitcoin for a Strategic Asset, USAThe Trump administration defines Bitcoin as "digital gold". Bo Hines emphasized the role of Bitcoin in the financial system with the following words:"Bitcoin is not a security, it is a commodity. It is an accepted asset with intrinsic value. That's why we define Bitcoin as digital gold."Economists state that Bitcoin can contribute to financial stability and that even central banks can create Bitcoin reserves in the future. The US wants to learn its economic independence and knowledge in the world financial system with this move.This new strategy reflects the US's goal of securing financial stability with digital assets like Bitcoin. Bitcoin's limited supply and increasing institutional demand make the US contrary to leadership in this regard.

US House of Representatives Member Byron Donalds has introduced a remarkable bill to make the Strategic Bitcoin Reserve decision signed by former President Donald Trump permanent and prevent future administrations from repealing it. This move could pave the way for the US to integrate Bitcoin more deeply into its financial strategy.Strategic Bitcoin Reserve Could Now Be PermanentDonald Trump signed an executive order on March 7, 2025, creating a national Bitcoin reserve using Bitcoin (BTC) assets seized by the US government from criminal cases. The new bill introduced by Byron Donalds would prevent the removal of this reserve by future administrations through executive orders and make it permanent.According to the bill, the US Strategic Bitcoin Reserve and Digital Asset Stock applications would be legally based and protected from interference by the executive branch.The Bill Has a Strong Chance of Passing the SenateThe bill needs at least 60 votes in the Senate and a majority in the House of Representatives to become law. The Republican majority in the Senate and the growing support for crypto-friendly policies strengthen the chances of the bill becoming law.Byron Donalds said in a statement on the subject:"For years, Democrats have waged war on crypto. It is now time for Republicans to end this war."Bitcoin Reserve Will Become a Core Part of the US Economic StrategyThe idea behind the bill is to ensure that digital assets play a strategic role in the national economy by making the US government's Bitcoin reserve of approximately 200,000 BTC (approximately $16.8 billion) permanent. This reserve, which is described as a "Digital Fort Knox," includes BTCs obtained from cases such as the 2016 Bitfinex cyber heist and the Silk Road investigation.In addition, a separate stockpile system will be created for other seized crypto assets (such as Ethereum). This stockpile will also be legally based, preventing any future president from making unilateral changes. The changes will be subject to Congressional approval.US Plays for Crypto LeadershipThe Donalds said the bill supports Trump’s vision of “making America the crypto capital.” Following his election victory, the Trump team held a lavish crypto summit at the White House, promoting digital assets as economic stabilizers.“This bill provides legal basis for Trump’s executive order and could provide a clear government stance on digital assets,” said blockchain expert Anndy Lian.State Support for Bitcoin Reserves GrowsAccording to Bitcoinlaws data, at least 23 US states have now introduced bills supporting Bitcoin reserves. This shows interest in integrating crypto assets into state-level fiscal policies.The current plan does not require the government to make new Bitcoin purchases. However, the US Treasury Department and Commerce Department will be able to develop strategies that will not add additional burden to the budget and purchase Bitcoin. At this point, creating the right financing and custody infrastructure is critical.The bill, introduced by Byron Donalds, has the potential to fundamentally change the US’s stance on digital assets. If enacted, the bill would provide legal clarity for the crypto sector and bring the US one step closer to Bitcoin leadership.Author: Besim Şen

STRKSTRK is moving within a falling wedge formation in the medium and long term. This formation usually exhibits a structure that carries the potential for an upward breakout. The price is currently at $0.1809 and is moving close to critical support areas.Currently, the price is approaching an important support area at $0.1367. Since this area has been a critical point where strong buying reactions have been received in the past, holding here may cause upward movements to begin. In a downward scenario, losing the $0.1367 level may cause the price to decline to the $0.1200 support.In a possible rise, the first resistance level stands out as $0.2100. In case this level is exceeded and maintained, the price can be expected to test the resistances of $0.2559, $0.3773 and $0.6083, respectively. In particular, the $0.6083 - $0.7130 range should be monitored as the target area of the formation.STRK has reached the final stages of the falling wedge formation. Since this structure generally carries the potential for an upward breakout, it can be expected that the price will gain strength at support levels and show an upward trend. Especially closing above the $0.2100 level can confirm the formation breakout and allow the price to reach higher resistances. For a strong rise, the protection of supports and the increasing possibility of an upward breakout as the price gets tighter should be followed carefully.These analyses, which do not provide investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the user is entirely responsible for trading and risk management. In addition, it is strongly recommended to use stop loss in relation to shared transactions.Author: Ilahe

dgfnhsfghsrtfjhsfgxhtSFGXjssrydfhrstjsryhfsjdjdrsyhsrtyhetsyh

Russia has introduced cryptocurrencies to overcome economic sanctions imposed by the West and to provide flexibility in international trade. It is reported that the use of digital assets such as Bitcoin (BTC) and Tether (USDT) has increased in oil trade with China and India. So how does this new financial move work and what effects could it have on global markets?Russia Turns to Selling Oil with CryptocurrencyIn 2024, Russia adopted new regulations that provide legal grounds for the use of cryptocurrencies in international trade. According to Reuters, following these regulations, digital assets have increasingly become preferred in oil transactions with China and India.This method, which remains outside the traditional financial system, provides a way out for Russia, whose access to the SWIFT system has been restricted due to banking sanctions. Cryptocurrency transactions make trade more fluid by accelerating cross-border payments.How is Cryptocurrency Oil Trade Done?This trading model works as follows:A Chinese or Indian buyer makes a payment to a contracted brokerage firm.The broker converts this payment into cryptocurrency and transfers it to the seller in Russia.Finally, the cryptocurrencies received are converted into rubles and become usable in Russia.This system offers a faster and safer transaction mechanism against sanctions risks compared to traditional banking methods.Will Oil Trading with Crypto Continue?According to economists, it is likely that Russia will continue to use this method not only because of sanctions but also because of its operational advantages. The increasing use of cryptocurrencies in international trade may herald major changes in financial systems. Especially if major economies turn more to such alternative payment systems, the traditional structure of global trade may significantly transform.As a result, Russia's cryptocurrency-supported oil trade may usher in a new era in the global economy. The increasing use of digital assets such as Bitcoin and USDT may weaken the effectiveness of financial sanctions and create a new paradigm in international trade. As the role of cryptocurrencies in trade expands day by day, it is eagerly awaited how this trend will shape in the future.Author: Besim Şen

SOLIn the short term, the Solana price is at a critical resistance level and is looking for direction. The $134.16 level is the short-term direction determinant, and if it is sustained above, an increase towards $141.89 and the $150-$153 region can be expected. Closing above $153 can trigger an accelerated rise. In the opposite scenario, the $123.63 level will act as the first strong support in downward movements. If this is broken, the $112.50 liquidity line can be followed as a strong buying zone. In general, if the price holds above $134.16, upward movements may continue, but if this level cannot be overcome and selling pressure increases, support zones can be tested.When Solana's price movements are examined, the formation of the Cup and Handle formation attracts attention in the long term. This formation is generally considered a harbinger of a strong rise. A deep cup base was formed with the sharp decline that followed a big rise in 2021-2022. In 2023-2024, an upward movement began by recovering from the bottom levels. In the 2024-2025 period, a small correction (handle) occurred as the price approached the resistance and is now close to the breakout phase. If the $ 250-300 resistance zone achieves a strong volume breakout, an increase as deep as the formation target can be expected. While the $ 125-150 zone works as a strong support in the long term, the $ 100-120 level stands out as a critical buying zone in possible pullbacks.These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the user is entirely responsible for trading and risk management. In addition, it is strongly recommended to use stop loss in relation to shared transactions.Author: Ilahe

Weekly SummaryBlackRock’s BUIDL fund surpasses $1 billion, becoming the largest tokenized Treasury fund.REX Shares launches first Bitcoin Corporate Treasury Bond ETF (BMAX), which invests in convertible bonds of companies holding Bitcoin.VanEck registers Avalanche (AVAX) ETF in Delaware. AVAX is down 55% since the beginning of the year.Circle prepares to move $900 million money market fund under DABA license.Paradigm leads $82 million investment round for crypto payment network Mesh.Cantor Fitzgerald partners with Anchorage Digital and Copper for Bitcoin custody services.MoonPay acquires Iron, an API-focused stablecoin infrastructure developer.TON token rises 20%. France allows Telegram founder Pavel Durov to return to Dubai.Crypto․com has been licensed to offer futures and perpetual contracts for institutional investors in Dubai.Trump’s project WLFI has begun buying $AVAX.US Representative Byron Donalds has introduced a bill to legalize President Trump’s Strategic Bitcoin Reserve and protect it from future administrations.Brazilian MP Luiz Philippe has introduced a bill to regulate the payment of wages and workers’ rights in Bitcoin and cryptocurrencies.The White House has confirmed that crypto chief David Sacks sold off $200 million in assets before assuming the role of Crypto and AI Czar.Russia has begun using Bitcoin, Ether, and USDT in its oil trades with China and India.The White House said the US government “intends to purchase as much Bitcoin as possible.”The White House said the exchange is in a transition period.Senator Lummis has reintroduced the 'Bitcoin Act' bill, which proposes to purchase $1 million BTC within 5 years with a minimum 20-year hold.Technical and Macro OutlookBTCThe Bitcoin (BTC) price has touched the rising trend support that has been effective since 2024. In the current technical structure, the $82,819 - $85,419 range stands out as a significant resistance area in the short term, while the $79,000 - $80,700 region stands out as a strong demand area where both trend support and horizontal support levels intersect.If this region is maintained, upward movements can be expected to gain momentum and an increase towards the $90,000 level can be expected. If this level is exceeded, $95,000 will be followed as the next target. However, if weekly closes come below $79,000, the technical outlook may weaken and the risk of the price falling back to the $75,000 - $76,500 support area may increase.In summary, while price movements above $79,000 support the positive scenario, if this level is broken, selling pressure may deepen and lower support points may be tested.ETHThe Ethereum (ETH) price is trading close to the lower band of the large-scale symmetrical triangle formation, which is at a critical support level. The $1,790 - $1,900 region intersects with long-term upward trend support and stands out as a strong demand area. ETH holding in this region will be important in terms of starting an upward reaction movement.Currently, the price is trading below the $2,000 level, and breaking above this level may strengthen the recovery scenario. The levels of $2,095 and $2,453 are intermediate resistance points, respectively, and if these areas are exceeded, the rise can be expected to accelerate towards the resistances of $2,595 and $2,981.On the other hand, falling below the level of $1,790 and the weekly closing below this area may increase the selling pressure. In this case, the levels of $1,692 and $1,422 will be followed as the next support areas.In summary, Ethereum holding on to the $1,790 - $1,900 area is critical for the continuation of the rise, and if it falls below this area, the risk of deepening selling pressure will increase. In the bullish scenario, if the levels of $2,000 and $2,095 are exceeded, $2,500 and above can be targeted.ETH/BTCWhen the ETH/BTC parity is examined on the weekly chart, it is seen that it has received a strong reaction from the critical support area that has been followed for a long time. This region in particular stands out as an important demand area that has worked many times when past price movements are examined and where buyers have stepped in. The reaction that comes with the current contact indicates that volatility may increase in the upcoming period for Ethereum and significant upward movements may occur. If this support contact is successful, a scenario can be mentioned where ETH may start to gain strength against Bitcoin and upward movements in the parity may accelerate. In a potential recovery process starting from here, it can be expected that the intermediate resistance levels will be tested in the first stage, followed by movements towards higher peak structures.Weekly NotesTrump's Tariffs and the MarketsImpactTrump’s tariffs are still the biggest factor shaking up the markets. According to a Bank of America survey, a potential global trade war is the biggest market risk for 2025. This risk even surpasses fears of AI competition from China. This uncertainty affects everything from cryptocurrencies to traditional financial markets, leading to a decrease in risk appetite.Despite all this gloom, however, US stock markets saw a sharp recovery on Friday. The S&P 500 index rose more than 2%. As markets enter a new period of volatility, short- and medium-term investors should be careful about leverage and position size. However, there are still great opportunities for long-term investors; assets with strong fundamentals can be bought at attractive prices right now.Institutional Adoption AcceleratesDespite the volatility in the market, institutional investors continue to enter the crypto space:The Singapore Exchange plans to list Bitcoin perpetual futures in the second half of 2025.BlackRock has announced a 1-2% allocation in model portfolios for its Bitcoin ETF (IBIT).The US House of Representatives has shown a more positive approach to decentralized finance by repealing the IRS’ DeFi Broker Rule.The SEC is considering classifying XRP as a commodity. This could be a major regulatory change.Abu Dhabi-based investment firm MGX has invested $2 billion in Binance, marking the largest investment in the crypto sector to date.Altcoin Market and Institutional InterestWhile retail investors are fearful, institutional investors are acting in the opposite direction. Last week, major financial institutions filed applications for altcoin ETFs:Franklin Templeton filed with the SEC for the XRP Trust and the Solana ETF.VanEck announced its first Avalanche (AVAX) ETF.Institutions are increasing their interest in major altcoins such as SOL, SUI, XRP, AVAX, DOGE, LTC and HBAR.Developments to Watch Out ForNVIDIA CEO Speech (March 18): Jensen Huang will talk about artificial intelligence and chip technologies. Updates are expected, especially on the Blackwell B300 series and Rubin GPU.FOMC Rate Decision (March 19): The Fed is expected to keep interest rates steady at 4.25-4.50%. However, the possibility of a total rate cut of 70 basis points by the end of the year is being priced in. Powell's statements will guide the markets.Author: Besim Şen