Politics

This page lists the latest Politics news and market analysis. Browse articles, expert insights, and updates in this category on JrKripto. Stay informed with in-depth coverage of cryptocurrency trends and developments.

This page lists the latest Politics news and market analysis. Browse articles, expert insights, and updates in this category on JrKripto. Stay informed with in-depth coverage of cryptocurrency trends and developments.

News

Politics News

Browse all Politics related articles and news. The latest news, analysis, and insights on Politics.

The Trump family is making headlines once again with a new initiative that aims to further expand their influence in the world of digital assets. Eric Trump and Donald Trump Jr. have announced the launch of a Bitcoin mining companynamed “American Bitcoin.” Formed in partnership with Canada-based mining firm Hut 8, this new venture is not just an investment but is seen as a long-term strategic move.Hut 8 will own 80% of the company, while the remaining 20% stake will be managed by American Data Centers Inc.,a firm owned by the Trump brothers. Eric Trump will serve as co-founder and chief strategy officer of the project.From Mining to Value PreservationAmerican Bitcoin’s operations will be carried out across 11 data centers owned by Hut 8 throughout the United States. The company’s CEO, Asher Genoot, emphasized that the U.S. has a competitive edge globally in this space thanks to low energy costs and strong infrastructure. Eric Trump also highlighted that the U.S. offers a more efficient mining environment from an environmental sustainability perspective.The Trump family is positioning this initiative not only as a production-focused venture but also as part of a long-term reserve strategy. The goal is to gradually build a significant Bitcoin reserve, setting American Bitcoin apart from traditional mining projects.The Trump Family and the Crypto MarketThis is not the Trump family’s first step into digital assets. Previously, they launched a decentralized finance platform called World Liberty Financial. WLFI Coin serves as the central token of the project and acts as the key to all economic activities on the platform.Donald Trump has also softened his stance on cryptocurrencies compared to the past, and now openly advocates for making the United States “the crypto capital of the world.” WLFI and the Trump Family In the short term, American Bitcoin aims to build a strong infrastructure across the country. In the long term, it seeks to become a leading global Bitcoin mining company. Eric Trump is expected to share this vision publicly during an upcoming live broadcast.This move by the Trump family shows that crypto policies in the U.S. are no longer shaped solely by financial concerns, but also by political and strategic considerations.

Grayscale, one of the leading investment firms in the crypto market, has taken a significant step to strengthen the bridge between traditional finance and digital assets. The company has filed an S-3 form with the U.S. Securities and Exchange Commission (SEC) to convert its private fund, the “Grayscale Digital Large Cap Fund,” into an exchange-traded fund (ETF).This move marks the company’s second major transformation following the conversion of its Bitcoin Trust into an ETF last year. If approved by the SEC, investors will gain much easier access to a regulated and diversified portfolioconsisting of major cryptocurrencies such as Bitcoin, Ethereum, XRP, and Cardano.Fund Structure: Balanced, Large-Cap, and Free from SpeculationGrayscale’s filing clearly outlines the fund’s scope and strategy. The asset allocation is as follows:79.4% Bitcoin (BTC)10.69% Ethereum (ETH)The remaining portion is allocated to large projects such as XRP, Solana, and CardanoGrayscale also emphasizes that the fund does not include stablecoins or meme coins. Instead, it follows a structure that covers approximately 75% of the digital asset market by market capitalization. This approach makes the fund more stable and appealing to institutional investors.The fund’s performance is also noteworthy. Launched in 2018, the Grayscale Digital Large Cap Fund has delivered a total market return of over 478% to date. The company continues to update its portfolio based on market conditions. For example, in January 2025, Avalanche (AVAX) was removed from the fund and Cardano (ADA) was added, reflecting the fund’s ability to adapt to evolving market dynamics.What Does the ETF Conversion Mean?Grayscale’s transition to an ETF not only reflects a shift in the company’s strategy but also signals the institutionalization of the crypto market. Once the conversion is complete:Retail investors will be able to access major digital assets through a regulated investment vehicleInvestments could become more transparent and cost-effectiveInstitutional interest could increase, leading to broader market participation and enhanced liquidityThis development marks a strategic move by Grayscale into the multi-asset ETF space. Following the success of the Bitcoin Trust, the company’s expansion into a multi-asset digital ETF highlights its commitment to broadening its product offerings.

OpenAI, one of the most powerful players in the artificial intelligence ecosystem, has once again demonstrated the pace of its growth achieved in just a few years. The company raised a record-breaking $40 billion in its latest funding round, bringing its total valuation to $300 billion. This figure places OpenAI not only at the top of the AI sector but also among the highest-valued private companies globally.The most striking aspect of this funding round is the profile of participating investors. While Microsoft already stands as a deep strategic partner of OpenAI, SoftBank emerged as the lead investor in this round. The participation of technology-focused investment giants such as Coatue Management, Thrive Capital, and Altimeter clearly reflects the confidence in the company’s long-term strategic vision.More Than Just Growth – A Move for Global PositioningWhere OpenAI plans to allocate this massive funding is just as noteworthy as the amount itself. The company will play an active role in the Stargate project, which aims to reshape the AI infrastructure of the United States. The project will involve the establishment of massive data centers, high-energy infrastructure, and AI-optimized computing power, proving that OpenAI is no longer just a model development lab. The goal here is to strengthen technological superiority not only at the software level but also in hardware and infrastructure.This growth also signals a strategic advantage for the U.S. in its AI race with China. OpenAI’s transformation into a key player that not only leads in technology but also influences global networks turns the $300 billion valuation into more than an economic milestone—it becomes a geopolitical signal.Key Highlights:OpenAI reaches a $300 billion valuation with $40 billion in new funding.SoftBank leads the investment round, while Microsoft expands its strategic partnership.Coatue, Thrive Capital, and Altimeter also participated in the funding round.OpenAI will play an active role in the Stargate project to advance U.S. AI infrastructure.The new funding will focus not only on product development but also on infrastructure and global tech competition.OpenAI is no longer just an R&D company—it is now a global strategic powerhouse.

You can find today’s “Daily Market Recap with JrKripto”, where we compile the most important developments in global and local markets, below.Let’s analyze overall market conditions together and take a look at the latest evaluations.Bitcoin (BTC) is currently trading at $81,700. The $79,100 – $80,763 range stands out as a strong support zone. After falling below $85,600, BTC lost momentum. If the price fails to hold at $80,763, the decline could deepen toward the $74,100 – $74,200 range. However, if a strong buying reaction emerges at $80,763, a recovery toward $83,763 and $85,600 may follow.Ethereum (ETH) is trading at $1,790. The $1,800 region stands out as a critical support. If this level is lost, the risk of a drop toward $1,700 increases. On the upside, $1,900 will be the first resistance level to watch. If ETH breaks above $2,000, the recovery may gain momentum toward $2,250, $2,534, and $2,721.Crypto NewsHut 8 launches a Bitcoin mining company backed by Eric Trump and Donald Trump Jr.FTX to begin paying major creditors starting May 30, with $11.4 billion in cash reservesElon Musk’s xAI fully acquires X via stock transaction; both companies valued at $80 billionMarathon ($MARA) plans to raise $2 billion through a stock sale to accumulate more BTCTop Gaining Cryptocurrencies:SAFE → +9.5% to $0.5868WAL → +7.4% to $0.4508ZEC → +5.5% to $37.92EOS → +4.2% to $0.6131BTSE → +3.5% to $1.22Top Losing Cryptocurrencies:NEO → -22.5% to $5.01TEL → -17.6% to $0.0042AIC → -14.3% to $0.1857KET → -12.5% to $0.1860IBERA → -11.5% to $6.71Other Data:Dominance:Bitcoin: 62.22% ▲ 0.01%Ethereum: 8.33% ▲ 0.40%Daily Net ETF Flows:BTC ETFs: -$93.20 millionETH ETFs: +$4.70 millionGlobal MarketsNext week, global markets may be shaken by the 25% additional tariff on imported cars imposed by U.S. President Donald Trump, and uncertainty over how other countries will respond. Europe, Canada, and China are expected to retaliate, putting pressure on risk appetite. Meanwhile, U.S. employment data and inflation reports from the Eurozonewill be in the spotlight.Last week, Trump’s formal tariff announcement and the Personal Consumption Expenditures (PCE) report coming in above expectations triggered a wave of selling in global markets. Concerns that high inflation may persist in the U.S. could push back expectations for Fed rate cuts.This week’s Non-Farm Payrolls (NFP) data and the ISM Manufacturing and Services Indexes will provide key insights into the health of the U.S. economy. The unemployment rate is expected to remain steady at 4.1%, while job growth is projected to slow.In Europe, the European Commission’s plan to impose €26 billion in tariffs on U.S. goods stands out as a major development. The first phase, to take effect on Tuesday, will apply €8 billion in import duties. This move is creating pressure particularly in the automotive, industrial, and healthcare sectors. Germany’s inflation data (due Monday) and the Eurozone inflation report (due Wednesday) will be key for the European Central Bank’s (ECB) interest rate decisions. Annual inflation in February was 2.3%, and it's expected to decline to 2.2% in March.In Asia, the Reserve Bank of Australia’s interest rate decision will be closely watched. Although the bank lowered rates to 4.1% in February, no additional cut is expected this week. Despite inflation dropping to 2.4%, rates are likely to remain unchanged due to still-low unemployment.In summary, Trump’s additional tariffs and global trade tensions continue to create uncertainty in markets. U.S. employment data and inflation indicators will offer clues about the Fed’s monetary policy, while European trade policies and economic indicators will also be closely monitored.Top Companies by Market Cap and Share PriceApple (AAPL) → $3.27T market cap, $217.90/share, ▼ 2.66%Microsoft (MSFT) → $2.82T market cap, $378.80/share, ▼ 3.02%NVIDIA (NVDA) → $2.68T market cap, $109.67/share, ▼ 1.58%Amazon (AMZN) → $2.04T market cap, $192.72/share, ▼ 4.29%Alphabet (GOOG) → $1.89T market cap, $156.06/share, ▼ 4.89%Precious Metals and Exchange RatesGold: 3,801 TLSilver: 41.58 TLPlatinum: 1,213 TLUSD: 37.92 TLEUR: 41.02 TLSee you again tomorrow with the latest updates!

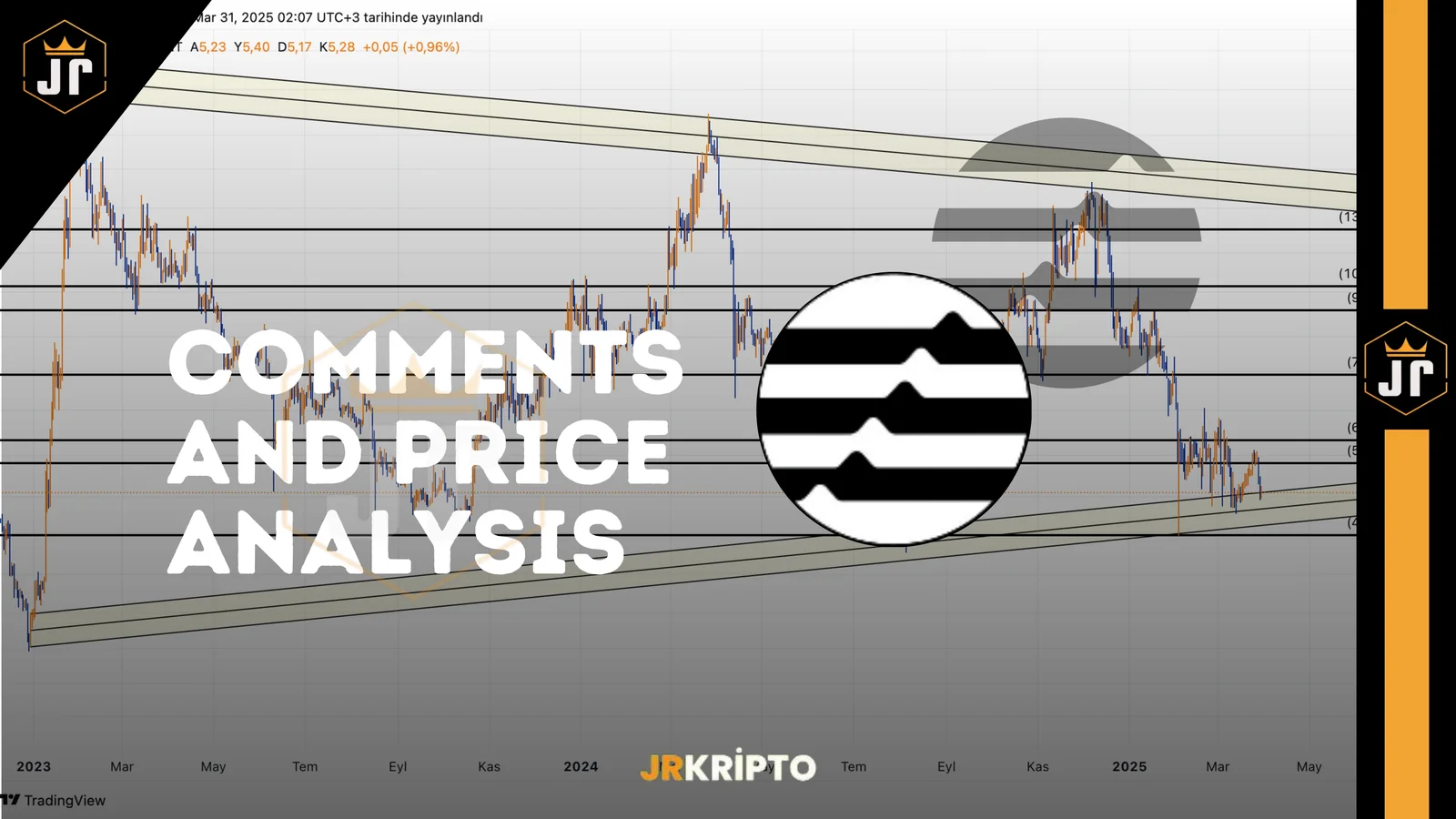

Aptos (APT) Technical AnalysisAptos (APT) has been moving within a downward channel for an extended period and is currently trading quite close to the bottom of this structure. The chart shows that the price is touching a region that has previously acted as strong support, while still facing significant resistance levels above. This means that although APT remains under pressure in the bigger picture, a potential recovery from these levels could present serious opportunities. APT Support Area The current price is around $5.25, and this region was tested multiple times in the last quarter of the previous year. Each time, notable buying reactions followed. Therefore, whether a similar reaction will occur again is of great importance to investors.Support and Resistance LevelsSupport Zones:$5.00 – $4.70: Main support lineClosures below this area could significantly damage market sentiment and accelerate the decline.Resistance Zones:$6.42 – First short-term resistance$7.23 – $7.58 – Medium-term resistance zone$8.67 – $9.92 – Strong reaction zones from the past$10.40 – $12.06 – Major resistanceAs long as there are no daily closures below $4.70, upward attempts remain technically on the table.If the price manages to hold above the $5.00 – $4.70 band, a recovery from this zone could target $6.42 as the first stop. In a stronger scenario, the price may gain momentum toward the $7.58 – $8.67 range. However, if this support area breaks to the downside, a scenario emerges where both technical and psychological supports are breached, deepening the pressure.In conclusion, Aptos is currently positioned at a critical support zone from a technical standpoint. This area has worked previously and is now being retested. The chart offers potential opportunities for patient investors while also signaling the need for caution.Disclaimer: This analysis does not constitute investment advice. It focuses on support and resistance levels that may present short- and medium-term trading opportunities based on market conditions. Trading and risk management decisions are entirely the responsibility of the user. Using stop-loss orders is strongly recommended.

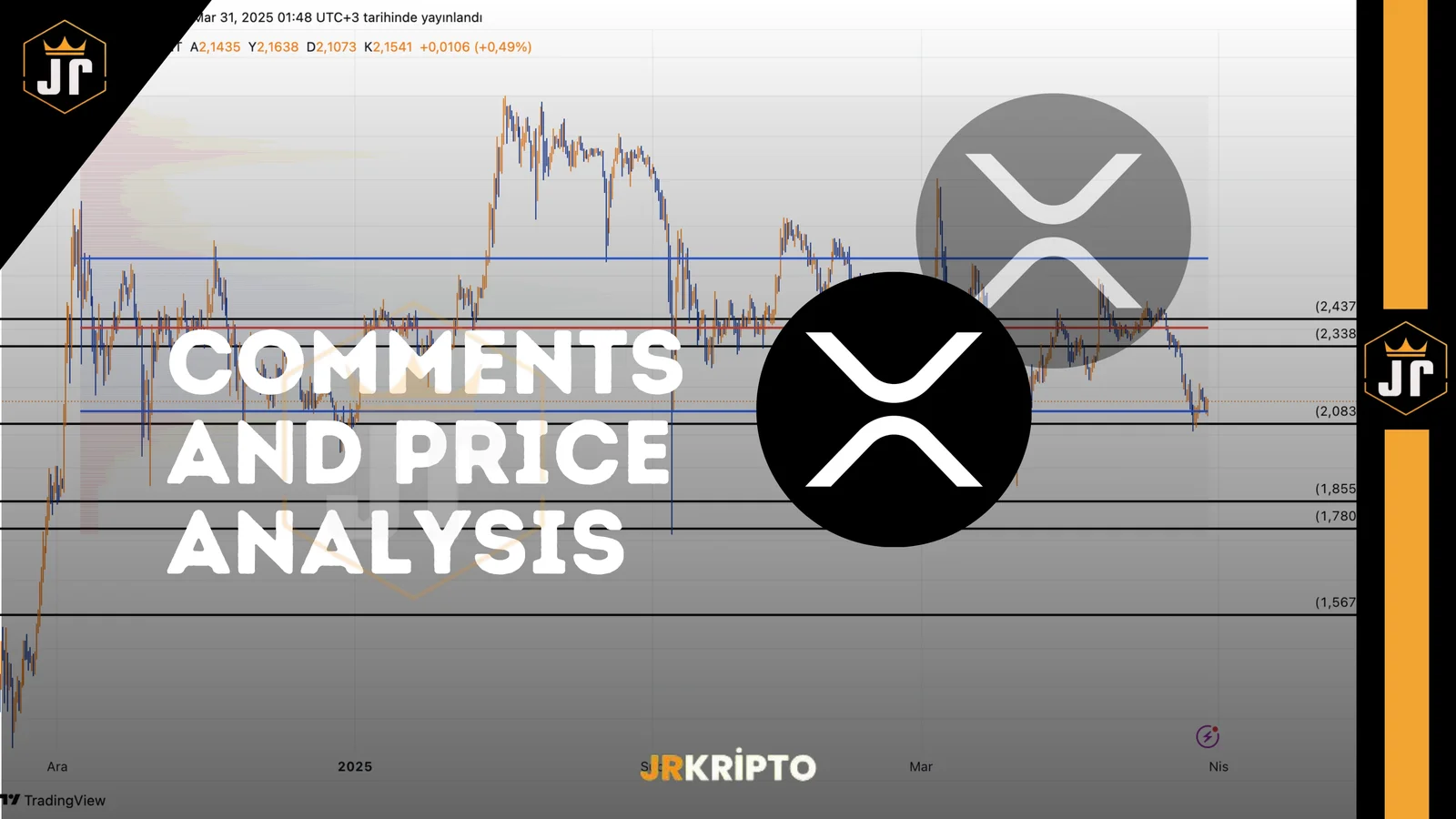

XRP (Ripple) Technical Analysis: Is the Triangle Squeeze Ready to Break?In recent weeks, XRP Coin has been trading within an increasingly narrow price range. A major move could be imminent, as XRP is currently moving within a classic symmetrical triangle formation, which typically begins with quiet consolidation and ends with sharp breakouts. XRP Narrowing Triangle Formation Key Support and Resistance LevelsSupport Zones:$2.0764$1.8480 – $1.7729$1.5593 – Major supportResistance Zones:$2.3330 – $2.4318$2.6948$3.2000 – Major resistanceAt this point, there are several key levels that investors should closely monitor. In particular, daily closes above $2.43could confirm an upward breakout. In such a scenario, the price may first test $2.69, followed by broader targets like $3.20.On the other hand, if the price drops below $2.07, a downward breakout may come into play, with the $1.84 – $1.77 range acting as the first support zone. In the case of a deeper correction, the $1.55 level could come into focus.This means XRP is approaching a true decision point. The market has not yet chosen a clear direction—up or down. However, such indecision typically doesn’t last long. In technical patterns like this, once direction becomes clear, the move is often sharp and fast.For patient investors, these kinds of zones can present opportunities—but they also demand caution. Acting before a breakout is confirmed carries risk, but taking a position at the right level can provide a significant advantage.Disclaimer: This analysis does not constitute investment advice. It focuses on support and resistance levels that may offer trading opportunities under current market conditions in the short and medium term. Trading and risk management decisions are entirely the responsibility of the user. The use of stop-loss orders is strongly recommended.

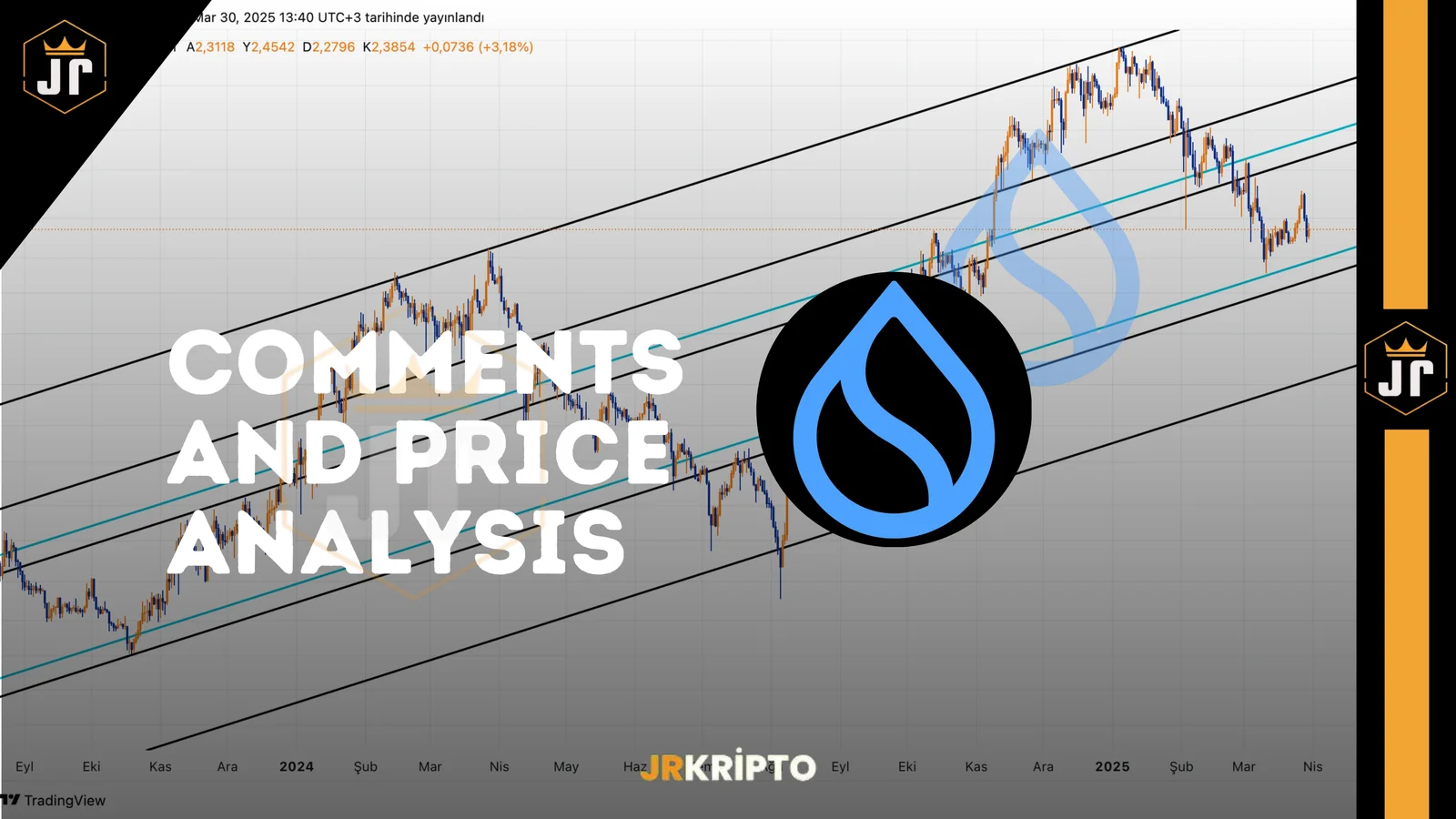

Sui (SUI) Technical Analysis: The Rising Channel Holds, Critical Support in Play Sui has shown an impressive bullish performance in recent months and is now attempting to stabilize. Despite market-wide pullbacks, SUI continues to maintain its long-term rising channel structure. This is an encouraging sign for many investors because as long as a strong trend remains intact, every pullback is merely a correction. SUI Ascending Channel Formation Currently, the price is trading at 2.3984, a significant level both technically and psychologically. This area aligns with the midline of the rising channel seen on the chart. Previously, buyers have stepped in around this zone, indicating its importance as a support level. The 2.1050 – 2.3333 range is a key support zone where buyers are actively defending the price. If this level holds, SUI Coin could initiate a move toward the 3.01 resistance. A breakout above this level could open the door for a stronger uptrend. Support and Resistance Levels Support Zones: 2.3333 – 2.1050 : The current support zone where the price is trying to hold. 1.5762 : The lower boundary of the rising channel. 1.1802 – 1.0648 : A major long-term support area. Resistance Zones: 3.0109 : The recent peak and first major resistance. 4.5000 : The target zone at the upper band of the channel. 5.5000 – 7.0000 : A broader resistance area where strong price movements could occur. The 2.16 – 2.33 range is the most critical support zone at the moment. This level has acted as support in the past and aligns with the midline of the rising channel, making it a crucial area for traders looking to open new positions. If the price holds above this support, the first target would be 3.01. A breakout above this level could lead to a broader rally toward 4.50. On the other hand, if the price closes below 1.57, it could signal a breakdown of the rising channel structure. This would be an important level for stop-loss planning, especially for long-term investors. In conclusion, SUI remains in a technically positive structure. Although short-term fluctuations may occur, the long-term rising channel is still intact, providing a strong technical foundation. Maintaining the current support zone is crucial for the price to retest key resistance levels. In a period of market uncertainty, seeing a coin with such a clear channel structure can be reassuring. However, risk management is essential, as even strong technical setups can experience unexpected movements. Disclaimer:This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.

Surprise Move from South Carolina: State Treasury Investment in Bitcoin on the WayThe state of South Carolina is preparing to invest public funds in Bitcoin. A bill proposed by State Representative Jordan Pace suggests allocating 10% of the state budget to digital assets, with a focus on Bitcoin.Titled the "Strategic Digital Asset Reserve Act," the proposal sets a maximum limit of 1 million BTC for Bitcoin purchases and includes measures such as cold wallet storage, audit mechanisms, and regular reporting to ensure investment security. While Bitcoin is the initial focus, the bill hints that other digital assets may also be included in the future.Representative Pace stated that this move aims to make the state's economic reserves more resilient against inflation.South Carolina Is Not Alone in Seeing Bitcoin as a Reserve AssetThis proposal is part of a broader trend across the U.S. Donald Trump previously approved a plan to convert crypto assets seized from crimes into a national Bitcoin reserve. Shortly afterward, Senator Cynthia Lummis submitted a bill to Congress aiming to establish a federal reserve of 1 million BTC.South Carolina’s plan also introduces limitations, such as ensuring the Bitcoin investment does not exceed 3% of the total portfolio.What Are Other States Doing?Many states across the U.S. are exploring ways to incorporate digital assets into public finance:Texas has been one of the fastest movers, already passing a Bitcoin reserve law.Arizona and Oklahoma have enacted regulations for managing crypto assets seized from crimes.Kentucky is supporting the mining industry through tax incentives.In contrast, Wyoming, Montana, North Dakota, South Dakota, and Pennsylvania have temporarily backed away from similar initiatives, citing market volatility as the main concern.With this move, South Carolina has further strengthened the notion that Bitcoin can have a place in state treasuries. The presence of cryptocurrencies in public budgets is no longer just a concept—it is rapidly becoming the subject of concrete policy-making.

SEC Backs Down from Lawsuits Against Three Major Crypto CompaniesThe U.S. Securities and Exchange Commission (SEC) has made a significant policy shift by withdrawing its lawsuits against the crypto sector. The SEC has officially ended legal proceedings against Kraken, ConsenSys, and Cumberland DRW. Additionally, the cases were dismissed "with prejudice," meaning they cannot be reopened.This decision indicates that the SEC is moving away from its strict stance on digital assets and adopting a more open and collaborative approach toward the crypto industry.Case History and Closure ProcessKraken was accused in 2023 of operating as an unlicensed securities exchange.ConsenSys was alleged in 2024 to have conducted illegal securities sales through its MetaMask Staking service.Cumberland DRW was charged with acting as an unlicensed broker-dealer in transactions exceeding $2 billion.The SEC has also officially closed its investigation into Crypto.com.It is already known that the SEC similarly closed lawsuits previously filed against Robinhood, OpenSea, Uniswap, and Coinbase.A New Era Message from the SECActing SEC Chair Mark T. Uyeda stated that these steps are part of the agency’s vision to establish a more transparent and balanced crypto policy. Uyeda also clarified that the dismissal of these cases does not set a precedent for other ongoing investigations.The SEC has scheduled four new roundtable meetings for the April–June 2025 period. These meetings will gather input from industry representatives and reshape the regulatory framework.First Reactions from Companies: “Uncertainty Has Been Removed”Kraken stated that the end of the lawsuit removed uncertainty in the industry and opened the door for further innovation. The company also revealed that the option for a public offering (IPO) is now back on the table. If this move is realized, Kraken would become the second major crypto company after Coinbase to go public.The SEC’s decisions are being interpreted as the beginning of a more conciliatory era in the digital asset market.

Arbitrum (ARB) Technical Analysis Arbitrum has been moving within a sideways and tight price range in recent weeks. Following a rebound from the $0.30 level, the price is currently trading at $0.3494. This movement brings us to a critical point—the descending trendline resistance. At the same time, this area coincides with the $0.3983 resistance level, making it a significant decision zone. ARB Trend Structure One of the key observations on the chart is that the price has previously tested this trendline multiple times and faced rejection. However, this time, higher lows are forming, and the selling pressure appears to be weakening. This suggests that a potential breakout could be stronger than before. Resistance Levels: $0.3983 (Trendline breakout level) $0.4801 – $0.5100 (Target zone after breakout) $0.6042 $0.7158 – $0.7603 Support Levels: $0.2700 (Main support zone) $0.3050 (Intermediate support) The $0.3983 level should be closely monitored. If the price breaks above this zone and achieves a daily close above it, the descending trendline will be breached. In this scenario, the price could first rally towards $0.4800 and then potentially reach $0.5100. If this breakout occurs, a positive movement will occur in the long term. If we take a look at the chart in the longer term, we see a chart like the one below. ARB Daily Graphic From a broader perspective, the downtrend remains intact. However, the price appears to have found support at the channel’s lower boundary, which is typically a zone where upward reactions occur. To see a move towards the channel’s midline, the short-term descending trend must be broken, and the $0.4579 resistance level must be surpassed. Conclusion: Arbitrum is at a decision point in the short term. The price movement near the descending trendline will determine whether a new bullish phase begins or if the price pulls back to support levels for a more sideways and cautious movement. In the long term, short-term price movements will be critical. For a sustained uptrend and breakout, we need positive price action at the key levels identified in the short-term analysis. Disclaimer:This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.

One of the significant developments in the United States is a new bill that proposes the adoption of Bitcoin as a strategic reserve asset. Ohio Senator Bernie Moreno stated that this bill should be passed no later than August.Speaking at the Blockchain Summit, Moreno emphasized that for the U.S. to maintain its global financial leadership, Bitcoin and digital assets must now become part of the national strategy, and he stressed the need for the bill to be enacted quickly.A National Reserve Plan for 1 Million BTCKnown as the "Bitcoin Act," this proposal aims to establish a national reserve of 1 million Bitcoin within the next five years. The bill was introduced by Republican Representative Nick Begich and Senator Cynthia Lummis, and is also based on an executive order issued by President Donald Trump regarding a strategic Bitcoin reserve.In his speech at the event in Washington, D.C., Moreno stated that not only Bitcoin but also market structure and stablecoin regulations need to be addressed within the next five months. In a post on Twitter, he expressed hope for the bill’s passage, stating that the U.S. will become a global standard in the crypto space.Will the Bill Pass? Will the U.S. Buy Bitcoin This Year?The bill appears to have bipartisan support and the backing of President Trump. However, it remains unclear whether the U.S. government will actually purchase Bitcoin within this year. As of now, there is no official timeline for the passage of the bill, and the government has not yet taken concrete steps in this direction.In Summary:Bernie Moreno has called for legislation to establish a strategic reserve of 1 million BTC.The bill aims to create a national Bitcoin reserve over five years.It aligns with an executive order by President Trump.Pressure is mounting for the bill to be passed by August.It is still uncertain whether the U.S. will purchase Bitcoin this year.

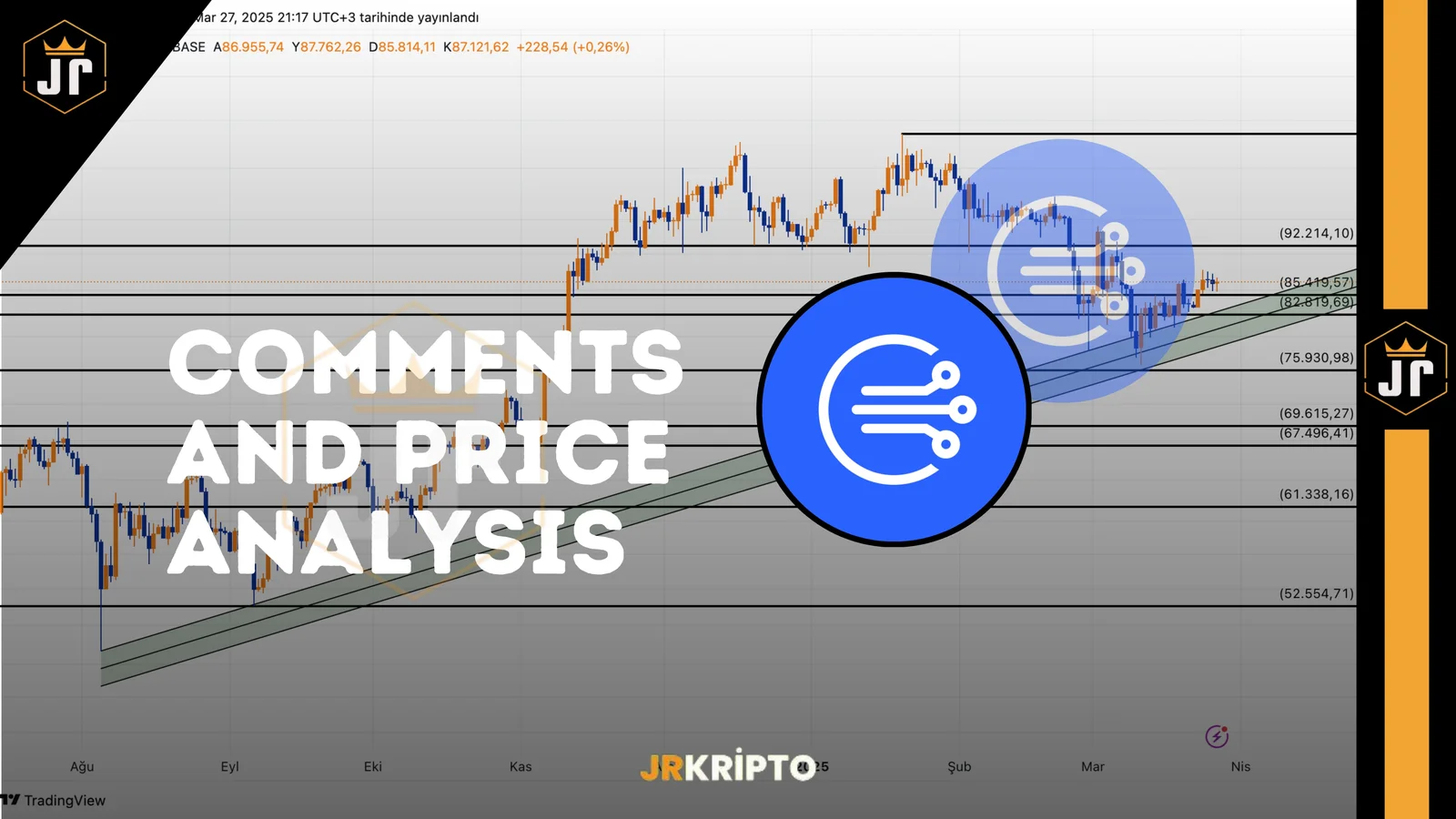

You can find today’s “Daily Market with JrKripto,” where we compile the most important developments in the global and local markets, below.Let’s analyze the overall market conditions together and take a look at the latest evaluations.Bitcoin (BTC) is currently trading at $85,200. The $79,100 – $80,763 zone stands out as a strong support area, while BTC has pulled back slightly after slipping below the $85,600 level. If the price fails to hold above $85,600, the decline may continue toward $83,763. However, if the $85,600 level is regained, the uptrend could continue toward $90,700.Ethereum (ETH) is trading at $1,910. ETH is currently below the $2,000 level, with $1,900 being followed as a critical support zone. If this area is lost, the price could retreat as far as $1,800. In upward moves, the $2,000 level may be tested again. Closures above this level could create momentum toward $2,250, $2,534, and $2,721.Crypto NewsThe U.S. Securities and Exchange Commission (SEC) has officially announced the dismissal of lawsuits filed against Kraken, Consensys, and Cumberland, and published the relevant notices.BlackRock’s Global Allocation Fund disclosed $47.4 million in Bitcoin ETF holdings.Bpifrance, the French state bank, launched a €25 million fund for new French crypto tokens.Circle and Ice will explore the integration of USDC and USYC into financial markets.Senator Moreno called for the passage of a bill to purchase 1 million #Bitcoin by August.CryptoTop Gaining Cryptocurrencies:WAL → +18.1%, reached $0.4635FAI → +13.1%, reached $0.02664SAFE → +11.8%, reached $0.5773AGENTFUN → +9.2%, reached $2.23GRASS → +7.9%, reached $1.64Top Losing Cryptocurrencies:MEOW → -17.9%, dropped to $0.00253DEEP → -17.2%, dropped to $0.07453KET → -16.2%, dropped to $0.2174NTGL → -15.8%, dropped to $0.00090FARTCOIN → -15.6%, dropped to $0.4932Other DataDominance:Bitcoin: 62.07% ▲ 0.53%Ethereum: 8.44% ▼ 2.23%Daily Net ETF Inflows:BTC ETFs: $89.00 millionETH ETFs: -$4.20 millionKey Data to Watch Today15:30 – U.S. | Core Personal Consumption Expenditures (PCE) Price Index (MoM, February)Forecast: 0.3%Previous: 0.3%15:30 – U.S. | Core PCE Price Index (YoY, February)Forecast: 2.6%Previous: 2.6%Global MarketsGlobal stock markets came under selling pressure after U.S. President Trump announced a 25% tariff on all cars not manufactured in the U.S. U.S. markets, fluctuating ahead of key economic data, ended the day with losses. The S&P 500fell 0.33%, the Nasdaq dropped 0.53%, and the Dow Jones lost 0.37%.Among the 11 sectors in the S&P 500, 8 closed in the green. Consumer staples rose 1.00%, while healthcare and discretionary sectors also posted slight gains. Losers included energy (-0.85%), telecommunications (-0.84%), and technology (-0.75%)—the weakest performers.The U.S. economy grew by 2.4% on an annualized basis in Q4 2024, slightly above the previously announced 2.3%forecast. The biggest contribution came from consumer spending, while housing investments and public spending also supported growth. However, non-residential fixed investments declined. Net exports added +0.26 percentage points to GDP.Labor market data was also monitored. Weekly jobless claims came in at 224,000, slightly below expectations of 225,000. The four-week average dropped by 4,750 to 224,000. Continuing jobless claims fell by 25,000 to 1.86 millionas of March 15. The insured unemployment rate remained steady at 1.2%.The U.S. trade deficit fell by $7.7 billion in February to $147.9 billion. Goods exports rose by 4.1%, while importsdecreased by 0.2%. In housing, pending home sales increased 2.0%, exceeding expectations (1.0%) and significantly improving from the previous month (-4.6%).The Central Bank of Mexico cut its policy rate by 50 basis points to 9.0%, in line with expectations.Today, markets will closely monitor important data, including the Core PCE index, one of the Fed’s key inflation indicators. The headline figure is expected to rise 0.3% MoM and 2.5% YoY. Also on investors’ radar are the University of Michigan Consumer Sentiment Index, ECB inflation expectations, and UK GDP data.Asian markets started the day negative, and European markets are also expected to open lower.Top Companies by Market Cap and Share PriceApple (AAPL) → $3.36T market cap, $223.85/share, ▲ 1.05%Microsoft (MSFT) → $2.90T market cap, $390.58/share, ▲ 0.16%NVIDIA (NVDA) → $2.72T market cap, $111.43/share, ▼ 2.05%Amazon (AMZN) → $2.13T market cap, $201.36/share, ▲ 0.11%Alphabet (GOOG) → $1.99T market cap, $164.08/share, ▼ 1.83%Borsa IstanbulVolatility and weak momentum continue on Borsa Istanbul. The Central Bank of Turkey’s reserves declined by $8 billion gross and $12 billion net. Additionally, a $440 million outflow from foreign investors occurred last week, and this trend is believed to be ongoing. Reducing short-term risks and focusing on strong companies in the mid-to-long term may be more prudent.Today, confidence indices in Turkey and Europe, and the Core PCE data in the U.S., which the Fed closely monitors, will be released. Inflation is expected to rise from 2.6% to 2.7%, potentially delaying rate cut expectations. Turkey’s 5-year CDS rose to 319 basis points, with concerns over U.S. debt repayment capacity contributing to the increase.In February, the foreign trade deficit was $7.8 billion. Exports fell 1.6% YoY to $20.8 billion, while imports rose 2.4%to $28.5 billion. The unemployment rate fell to 8.2%, while broad unemployment rose to 28.4%. The 2-year bond yield rose to 45.5%, and the 10-year yield to 33.5%.Although BIST-100 opened higher yesterday, it closed lower due to cautious foreign sentiment toward banking stocks and the CBRT’s interest rate policies. Garanti Bank, defense, and gold mining stocks outperformed.After the holiday, the market will focus on banking sector profit data on Wednesday and March inflation data on Thursday. March inflation is expected to be around 3%, and a pre-holiday sell-off may occur.Technically, BIST-100 tested 9,831 yesterday and closed at 9,613. A break above the 9,738–9,895 resistance range could support a move toward 10,197. The 9,594–9,473 zone serves as support, and if breached, the index may decline toward 9,221–8,870.In summary, uncertainty and volatility persist in the markets, so caution is advised. Focusing on solid companies may be beneficial. Upcoming economic data will be key in determining market direction.Top Gaining Stocks:DAGHL → ▲ 9.95% to 55.25 TLSKTAS → ▲ 9.93% to 4.54 TLCEMAS → ▲ 9.70% to 3.28 TLSANEL → ▲ 9.00% to 23.98 TLPOLHO → ▲ 8.19% to 14.26 TLTop Losing Stocks:ISMEN → ▼ 13.15% to 41.20 TLPAPIL → ▼ 10.00% to 30.24 TLOSMEN → ▼ 10.00% to 9.18 TLDYOBY → ▼ 9.98% to 20.74 TLKUYAS → ▼ 9.96% to 37.42 TLTop Market Cap Companies on Borsa Istanbul:QNB Finansbank (QNBTR) → 1.29 trillion TL market cap, 372.00 TL/share, ▼ 3.38%Aselsan (ASELS) → 533.52 billion TL market cap, 116.50 TL/share, ▼ 0.43%Garanti Bank (GARAN) → 517.02 billion TL market cap, 116.60 TL/share, ▼ 5.28%Turkish Airlines (THYAO) → 425.73 billion TL market cap, 305.50 TL/share, ▼ 0.97%Koç Holding (KCHOL) → 409.04 billion TL market cap, 160.10 TL/share, ▼ 0.74%Precious Metals and Exchange RatesGold: 3,751 TLSilver: 42.18 TLPlatinum: 1,210 TLDollar: 38.01 TLEuro: 41.01 TLSee you again tomorrow with the latest updates!

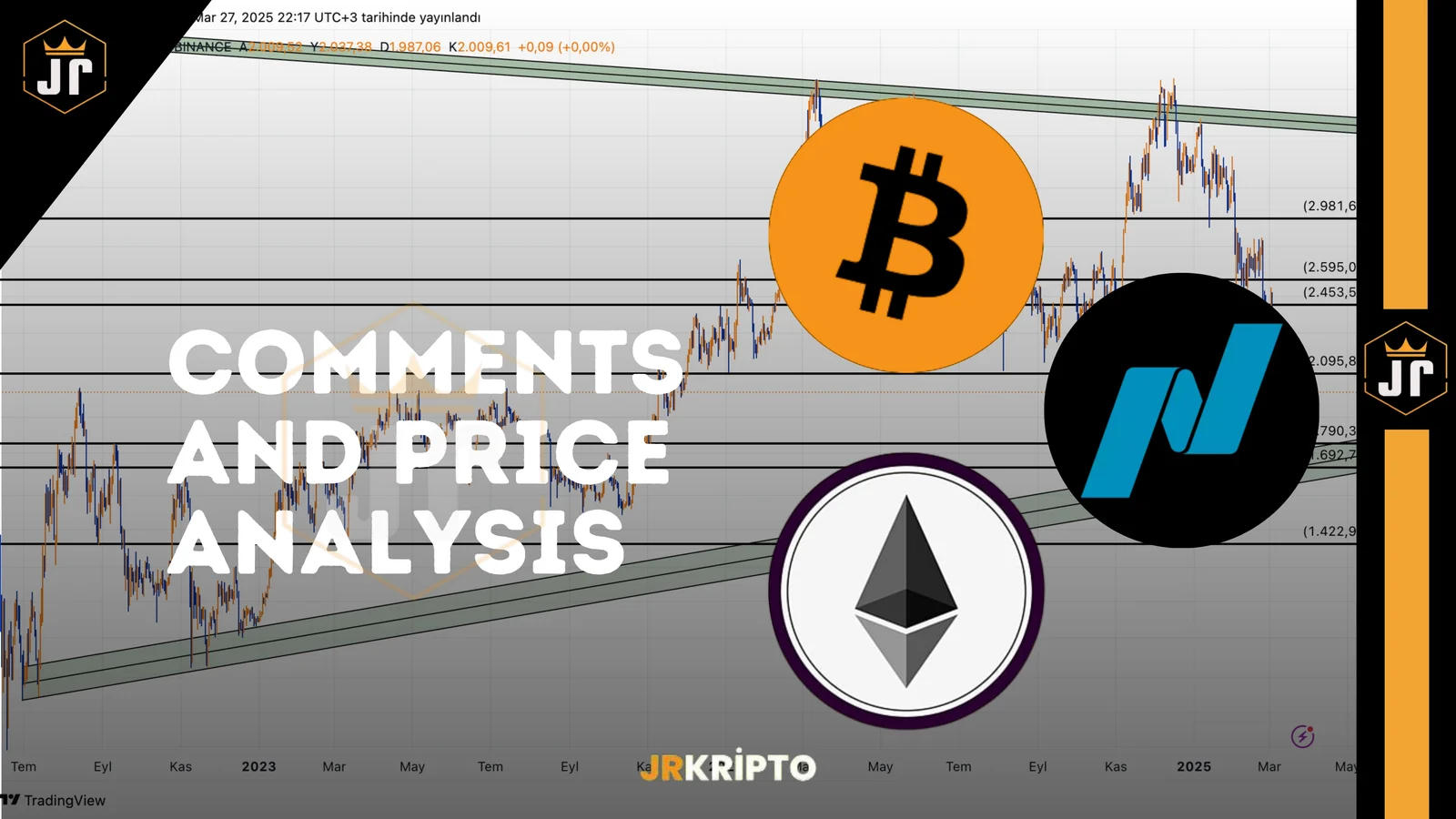

Bitcoin (BTC) and Ethereum (ETH) Technical Analysis: Key Levels and Market DirectionThe cryptocurrency market continues to be shaped by the price movements of Bitcoin (BTC) and Ethereum (ETH) in particular. Currently, the market is moving around critical levels, with key support and resistance zones that will determine future price action in the coming days. So, which levels need to be broken for a bull market to begin? At which zones could the price reverse? Here’s our latest technical analysis!Bitcoin (BTC): Key Levels for the Start of a Bull MarketBitcoin continues to receive strong buying interest around the $80,691 level. This area acts as a critical line of defense for BTC and has served as a strong support so far. If the price holds above this level, the likelihood of the bull trend continuing is quite high.However, if the $80,691 level is lost, selling pressure may increase, making a pullback toward the $73,336 area likely. This zone is one of the main turning points of the major uptrend that started from $15,500 for BTC, and any reaction from this level should be monitored closely. Let’s not forget that BTC previously initiated a 150% rally from the $73,336level. BTC Main Resistances Ahead for Bitcoin: How Far Can We Rise?The most important resistance BTC will face on its upward moves is $87,500. This area is a critical zone, both as an SR Flip (Support-Resistance Flip) and a POI (Point of Interest).If BTC can break above the $87,500 level with strong volume, the price may move toward $92,591.A strong close above $92,591 is expected to push BTC into the $95,745 – $97,213 liquidity zone.Price action above $97,213 has the potential to carry BTC toward the $110,000 level.Breaking through these levels could open the door to new all-time highs and put the $130,000 target on the table.Ethereum (ETH): The Keys to Upside and Target LevelsEthereum is trading at important support and resistance zones that will define the market trend. For ETH to sustain its uptrend, it must defend specific areas and break through key levels. ETH $1,692 – $1,574: Strong Demand ZoneAt these levels, ETH may attract institutional buying interest. If the price can hold above $1,692, a strong recovery movement can be expected.However, losing this support could increase selling pressure and pull the price down to $1,574. This zone will be a key defense line that will determine Ethereum’s trend.$2,083 – $2,108: Resistance Flip Area (SR Flip)The first major barrier ahead of Ethereum is the $2,083 – $2,108 range.If ETH can break this zone with strong volume, upward momentum will accelerate.If it fails to stay above this zone, the price could return to lower support levels.The strength of buyers in this area will be one of the most crucial factors determining ETH’s trajectory.$2,534 – $2,723: Major Resistance and Breakout ZoneThis level is a critical resistance zone where Ethereum could establish a new upper trend structure.If the price holds here and encounters strong buying interest, a new upward movement toward $3,402 could begin.However, if strong rejection occurs at this level, the price may be pulled back to lower support areas.$3,402: Institutional Focus ZoneThis zone is carefully monitored by institutional investors. If ETH can maintain itself above $3,402, the $5,000 level may become inevitable.A strong breakout above this level could lead Ethereum into a price discovery phase, where new all-time highs may be tested.$5,000 and the Layer 2 EffectIf Ethereum reaches the $5,000 level, it could lead to massive capital inflows into Layer 2 projects such as OP, STRK, ZKSYNC, and ARB. This would cause serious price movements in projects within the Ethereum ecosystem.Key Levels That Will Determine Market DirectionIf Bitcoin loses the $80,691 support, $73,336 may be tested.If $87,500 is broken, it opens the door to $92,591, followed by $110,000.If Ethereum holds $1,692 – $1,574, a strong recovery could begin.A break above $2,083 – $2,108 could accelerate the uptrend.Sustained price action above $2,534 – $2,723 could lead to new highs.If $3,402 is broken, $5,000 becomes the next target.In conclusion, the market's direction will depend on how the price behaves around these levels.NASDAQ Technical Analysis and Market DirectionThe NASDAQ (NDX) index, which has high correlation with Bitcoin, stands out as one of the key factors determining overall risk appetite in the market. Price movements in NASDAQ also send important signals for Bitcoin and other risk assets. Let’s now examine key support and resistance levels for NASDAQ. NASDAQ Short-Term Resistance Zone: 20,269 – 20,475This range should be followed as NASDAQ’s short-term resistance area.If the price sustains above 20,269 – 20,475, positive price movements are expected to continue.A strong breakout above this zone with volume could increase buyer appetite in NASDAQ and across the market.However, if strong selling emerges at these levels, short-term corrections may be seen.Intermediate Support: 19,692The 19,692 level stands out as an important intermediate support for NASDAQ.Closing above this level is critical for the index to stay within its upward trend.If the price dips below this area, stronger support levels may be tested.However, if the level receives strong buying interest, an upward movement is expected to resume.Major Support Zone: 19,115 – 18,910This area has been a region of strong buyer dominance for NASDAQ.If the price drops to this level and buyers regain control, it could act as a major support and initiate an upward reversal.If this area breaks, selling pressure may deepen and lower levels could be tested.NASDAQ – ExpectationsIf 20,269 – 20,475 is broken, the uptrend could strengthen.If 19,692 is maintained, the index is expected to remain positive.The 19,115 – 18,910 zone is where buyers tend to enter; losing this could trigger a larger market correction.NASDAQ’s reaction at these levels will be critical for determining the direction of Bitcoin and other risk assets. You can build your strategy by closely monitoring price action.Disclaimer: These analyses do not constitute investment advice. They focus on support and resistance levels that may present trading opportunities in the short and medium term based on market conditions. However, trading and risk management decisions are solely the responsibility of the user. The use of stop-loss orders is strongly recommended.

The Big Picture in the Crypto Market: Analysis of TOTAL, TOTAL2 and TOTAL3 When analyzing the crypto market, the TOTAL, TOTAL2 and TOTAL3 indices are the most critical indicators that allow us to understand the general situation of the market. TOTAL (Overall Crypto Market Value) → Shows the market value of all crypto assets. TOTAL2 (Altcoin Market Value Excluding Bitcoin) → Reflects the total value of all altcoins except Bitcoin. TOTAL3 (Altcoin Market Value Excluding Bitcoin & Ethereum) → Measures the market value of altcoins other than Bitcoin and Ethereum. These three data sets allow us to understand at what stage the market is and where investment opportunities may occur. Now let's examine each of them in detail. TOTAL – The General Health of the Crypto Market The TOTAL metric evaluates the overall market health by measuring the total market value of the 125 largest coins in the cryptocurrency market. This data, which includes Bitcoin, Ethereum and major altcoins, shows what level of liquidity is in the entire market and when bullish or bearish trends may start. TOTAL 2.86T - Decision Point: The Region where the Market Trend is Determined This level can be the determinant of a bullish or bearish trend. The fact that weekly or 2-day closures come above this level confirms that buyers are dominating the market. If the volume purchases continue, large funds and corporates may break this level, triggering the inflow of fresh money into the market. If we stay below 2.86T, there may be retreats and corrections in the crypto market. 2.68T - Accumulation and Demand Zone This is a support level that investors should pay attention to in the short term. If the market consolidates and gathers strength in this region, we may see upward movements again. If volume purchases do not come, it is likely that the price will sag to lower levels. 2.51T - Decline Scenario: The Buying Zone of Large Funds If the 2.86T level is not exceeded, the price may be withdrawn here. It is a region where institutional investors can make big purchases. It could be an area of opportunity for long-term buyers. 3.16T - Profit Selling Area & New Highs If the 2.86T level is exceeded strongly, its TOTAL value may rise to 3.16T. When this region is reached, it is likely that investors will realize profits. But if a volume break comes, we may see new highs in the crypto market TOTAL2 - The Pulse of the Altcoin Market The TOTAL2 metric measures the total market value of all altcoins except Bitcoin. This indicator is one of the most important data to understand whether the altcoin season has arrived. TOTAL2 1.09T - Decision Level in the Altcoin Market The fact that weekly closures occur above this level indicates the beginning of a strong upward trend in the altcoin market. If we stay above this level, we can see big rises in Ethereum and major altcoins. However, if the seller pressure is strong, the price may return to support levels again. 989B - 956B - Corporate Demand Zone This region is a critical level where large investors and funds will show great interest. If the price receives a strong reaction from here, we may see a big recovery in the altcoin market. 1,3T - Profit Realization and Withdrawal Area It attracts attention as a region where altcoin investors will make profit purchases. If the volume purchases continue, new peaks may be opened in the altcoin market. However, if we encounter resistance at these levels, it is possible for the price to fluctuate for some time. TOTAL3 - The Signal of the Altcoin Season The TOTAL3 metric shows the total market value of all altcoins except Bitcoin and Ethereum. This chart is very important for us to understand whether the altcoin season has arrived. TOTAL3 846B - Critical For Altcoins If the weekly closes remain above this level, we may see hard rises of between 20 Dec-50% in altcoins. A break of this level indicates that there will be a large flow of capital into the market. 787B - 779B - The Area of Interest of Large Funds It is the region where institutional investors can make intensive purchases. If a strong recovery comes from this region, we could see a big bullish wave in the altcoin market. However, if the sellers remain strong here, the price may move horizontally for a while. 961B - 981B - Profit Realization & New Peak Potential This region is an area where investors will consider taking profits. If the price breaks this zone with a strong volume, we may see new ATH levels in the altcoin market. However, if we are rejected in this region, there may be withdrawals in altcoins in the short term. TOTAL → Indicates the health of the overall market. If we exceed 2.86T, the journey to new heights can begin. TOTAL2 → Determines the status of the altcoin market except Bitcoin. If the 1.09T breaks, we could see a big altcoin bull. TOTAL3 → Gives the signal of the altcoin season except Bitcoin and Ethereum. The 846B breakage activates altcoins. It is very important to follow these levels in order not to miss opportunities in the market. By following these levels closely, you can see the opportunities and possible risks in the market in advance. These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions.

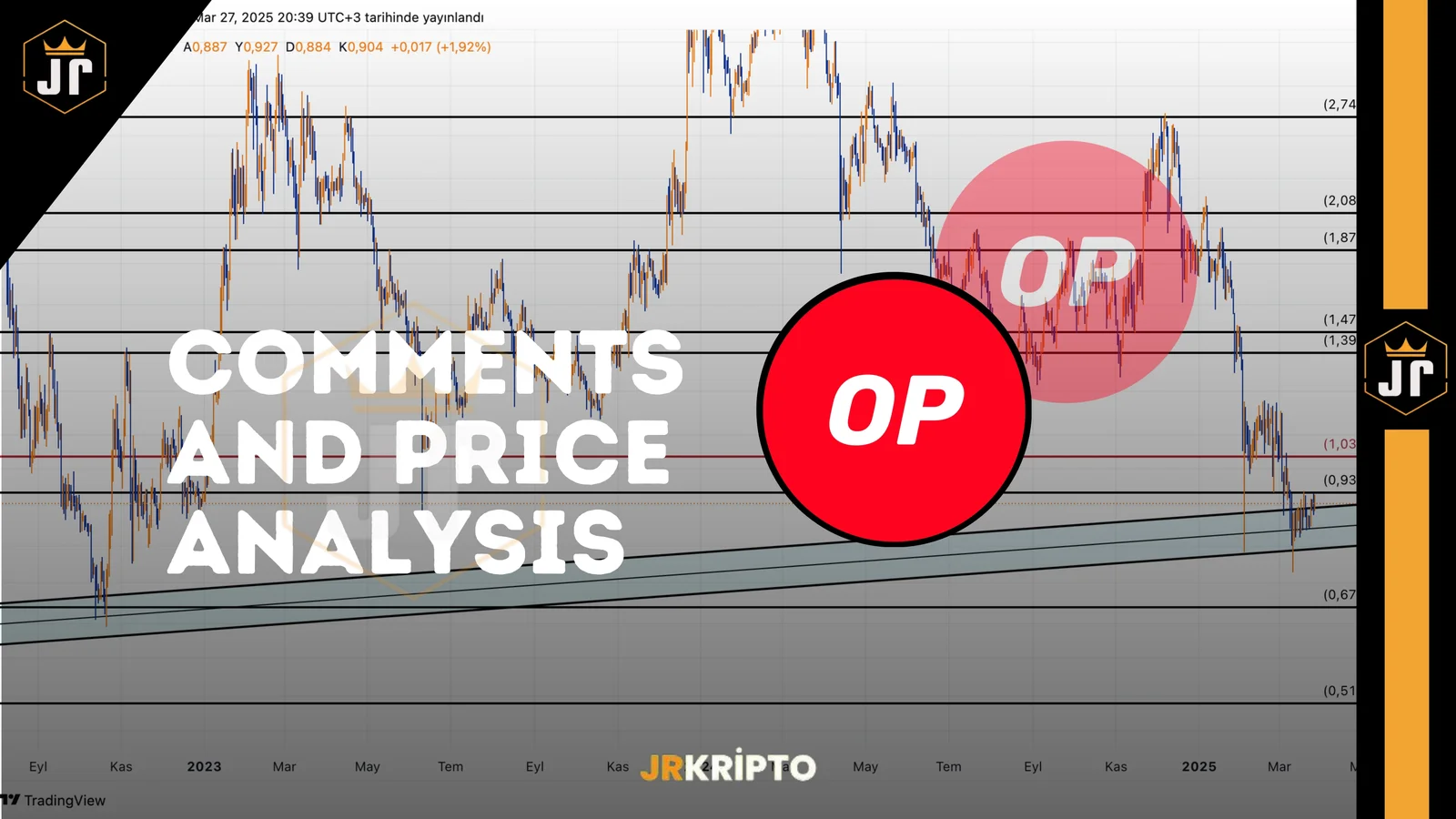

Optimism (OP) Technical AnalysisOptimism has been maintaining its descending channel structure for a while. Currently trading at 0.887$, the price is approaching the upper boundary of the channel. This level is technically critical for a potential breakout. The gradual recovery that started around the 0.742$ level has continued steadily, and now all eyes are on the 0.979$ resistance. This level is significant as it not only serves as resistance but also intersects with the descending channel. OP Key Support and Resistance Levels for OPUSDTSupport Levels:0.742 – 0.770 (Strong demand zone)0.850 (Short-term support)Resistance Levels:0.979 (Critical resistance at channel intersection)1.162 – 1.228 (Important medium-term resistance)1.434 (Previous reversal level)1.676 – 1.771 (Strong resistance zone, crucial for trend reversal)The price is currently very close to the 0.979$ resistance. A breakout with strong volume could signal the end of the descending channel and the beginning of a new upward movement. Otherwise, there’s a risk of a pullback toward support areas.From a technical indicator perspective, the RSI shows a slight upward move, which may signal a shift in momentum. While volume isn’t particularly strong yet, any breakout around this level may indicate that accumulation has started.Strategic Suggestions for InvestorsThe 0.979$ level is important. A daily close above this level could be the first signal of a breakout. Following a breakout, the first target would likely be the 1.16-1.22 zone. However, daily closes below 0.850$ should be watched closely.In summary, Optimism is approaching the end of its descending channel. If the price can surpass the 0.979$ level and hold above it with daily closes, it could mark the start of a new uptrend. If not, a retracement back to the 0.77- 0.74 range remains possible. This makes the current period a critical phase for OP. The next few days will provide clearer direction.Disclaimer:This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.