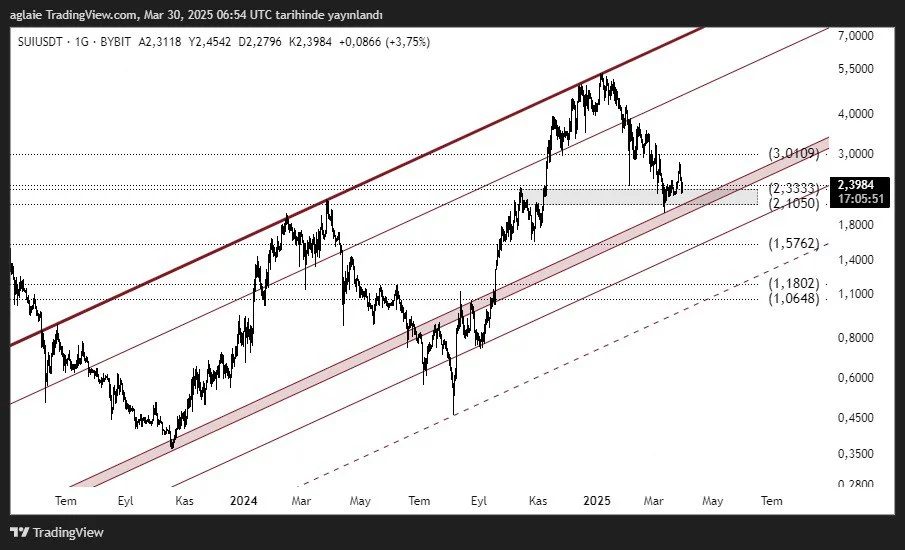

Sui (SUI) Technical Analysis: The Rising Channel Holds, Critical Support in Play

Sui has shown an impressive bullish performance in recent months and is now attempting to stabilize. Despite market-wide pullbacks, SUI continues to maintain its long-term rising channel structure. This is an encouraging sign for many investors because as long as a strong trend remains intact, every pullback is merely a correction.

Currently, the price is trading at 2.3984, a significant level both technically and psychologically. This area aligns with the midline of the rising channel seen on the chart. Previously, buyers have stepped in around this zone, indicating its importance as a support level.

The 2.1050 – 2.3333 range is a key support zone where buyers are actively defending the price. If this level holds, SUI Coin could initiate a move toward the 3.01 resistance. A breakout above this level could open the door for a stronger uptrend.

Support and Resistance Levels

Support Zones:

- 2.3333 – 2.1050 : The current support zone where the price is trying to hold.

- 1.5762 : The lower boundary of the rising channel.

- 1.1802 – 1.0648 : A major long-term support area.

Resistance Zones:

- 3.0109 : The recent peak and first major resistance.

- 4.5000 : The target zone at the upper band of the channel.

- 5.5000 – 7.0000 : A broader resistance area where strong price movements could occur.

The 2.16 – 2.33 range is the most critical support zone at the moment. This level has acted as support in the past and aligns with the midline of the rising channel, making it a crucial area for traders looking to open new positions. If the price holds above this support, the first target would be 3.01. A breakout above this level could lead to a broader rally toward 4.50.

On the other hand, if the price closes below 1.57, it could signal a breakdown of the rising channel structure. This would be an important level for stop-loss planning, especially for long-term investors.

In conclusion, SUI remains in a technically positive structure. Although short-term fluctuations may occur, the long-term rising channel is still intact, providing a strong technical foundation. Maintaining the current support zone is crucial for the price to retest key resistance levels.

In a period of market uncertainty, seeing a coin with such a clear channel structure can be reassuring. However, risk management is essential, as even strong technical setups can experience unexpected movements.

Disclaimer:

This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.