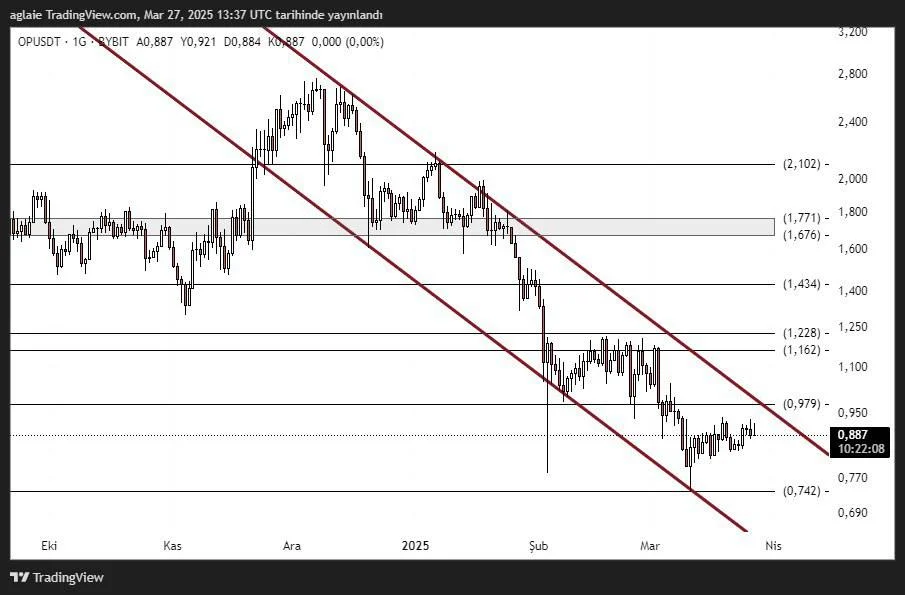

Optimism (OP) Technical Analysis

Optimism has been maintaining its descending channel structure for a while. Currently trading at 0.887$, the price is approaching the upper boundary of the channel. This level is technically critical for a potential breakout. The gradual recovery that started around the 0.742$ level has continued steadily, and now all eyes are on the 0.979$ resistance. This level is significant as it not only serves as resistance but also intersects with the descending channel.

Key Support and Resistance Levels for OPUSDT

Support Levels:

- 0.742 – 0.770 (Strong demand zone)

- 0.850 (Short-term support)

Resistance Levels:

- 0.979 (Critical resistance at channel intersection)

- 1.162 – 1.228 (Important medium-term resistance)

- 1.434 (Previous reversal level)

- 1.676 – 1.771 (Strong resistance zone, crucial for trend reversal)

The price is currently very close to the 0.979$ resistance. A breakout with strong volume could signal the end of the descending channel and the beginning of a new upward movement. Otherwise, there’s a risk of a pullback toward support areas.

From a technical indicator perspective, the RSI shows a slight upward move, which may signal a shift in momentum. While volume isn’t particularly strong yet, any breakout around this level may indicate that accumulation has started.

Strategic Suggestions for Investors

The 0.979$ level is important. A daily close above this level could be the first signal of a breakout. Following a breakout, the first target would likely be the 1.16-1.22 zone. However, daily closes below 0.850$ should be watched closely.

In summary, Optimism is approaching the end of its descending channel. If the price can surpass the 0.979$ level and hold above it with daily closes, it could mark the start of a new uptrend. If not, a retracement back to the 0.77- 0.74 range remains possible. This makes the current period a critical phase for OP. The next few days will provide clearer direction.

Disclaimer:

This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.