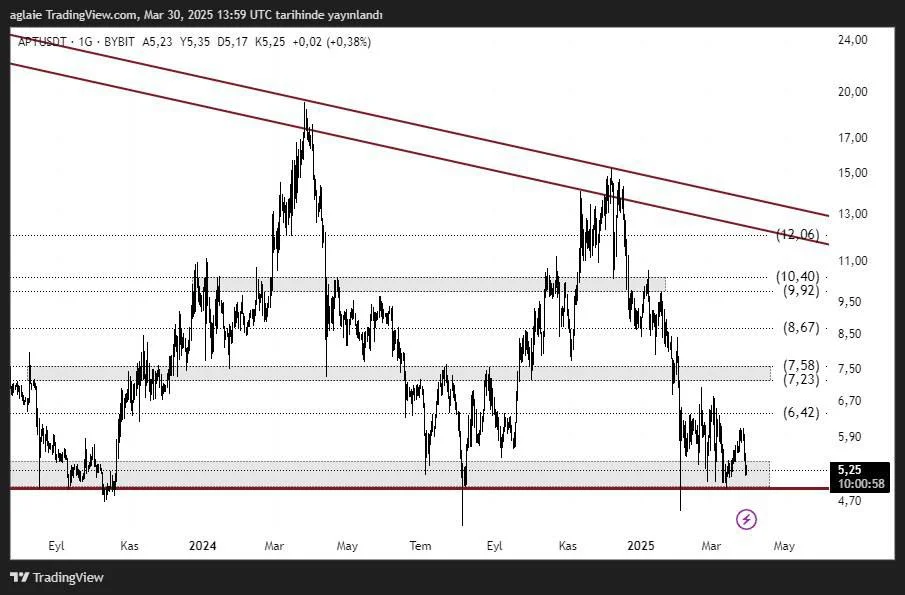

Aptos (APT) Technical Analysis

Aptos (APT) has been moving within a downward channel for an extended period and is currently trading quite close to the bottom of this structure. The chart shows that the price is touching a region that has previously acted as strong support, while still facing significant resistance levels above. This means that although APT remains under pressure in the bigger picture, a potential recovery from these levels could present serious opportunities.

The current price is around $5.25, and this region was tested multiple times in the last quarter of the previous year. Each time, notable buying reactions followed. Therefore, whether a similar reaction will occur again is of great importance to investors.

Support and Resistance Levels

Support Zones:

- $5.00 – $4.70: Main support lineClosures below this area could significantly damage market sentiment and accelerate the decline.

Resistance Zones:

- $6.42 – First short-term resistance

- $7.23 – $7.58 – Medium-term resistance zone

- $8.67 – $9.92 – Strong reaction zones from the past

- $10.40 – $12.06 – Major resistance

As long as there are no daily closures below $4.70, upward attempts remain technically on the table.If the price manages to hold above the $5.00 – $4.70 band, a recovery from this zone could target $6.42 as the first stop. In a stronger scenario, the price may gain momentum toward the $7.58 – $8.67 range. However, if this support area breaks to the downside, a scenario emerges where both technical and psychological supports are breached, deepening the pressure.

In conclusion, Aptos is currently positioned at a critical support zone from a technical standpoint. This area has worked previously and is now being retested. The chart offers potential opportunities for patient investors while also signaling the need for caution.

Disclaimer: This analysis does not constitute investment advice. It focuses on support and resistance levels that may present short- and medium-term trading opportunities based on market conditions. Trading and risk management decisions are entirely the responsibility of the user. Using stop-loss orders is strongly recommended.