According to crypto journalist Eleanor Terrett, the US Treasury Department is preparing to make a significant change to corporate crypto tax regulations, which have long been a source of controversy. Under the Corporate Alternative Minimum Tax (CAMT), which took effect during the Biden administration, large companies were required to pay a tax rate of at least 15% on their financial statement income. However, existing accounting standards were putting companies in a difficult position, especially when valuing digital assets like Bitcoin.

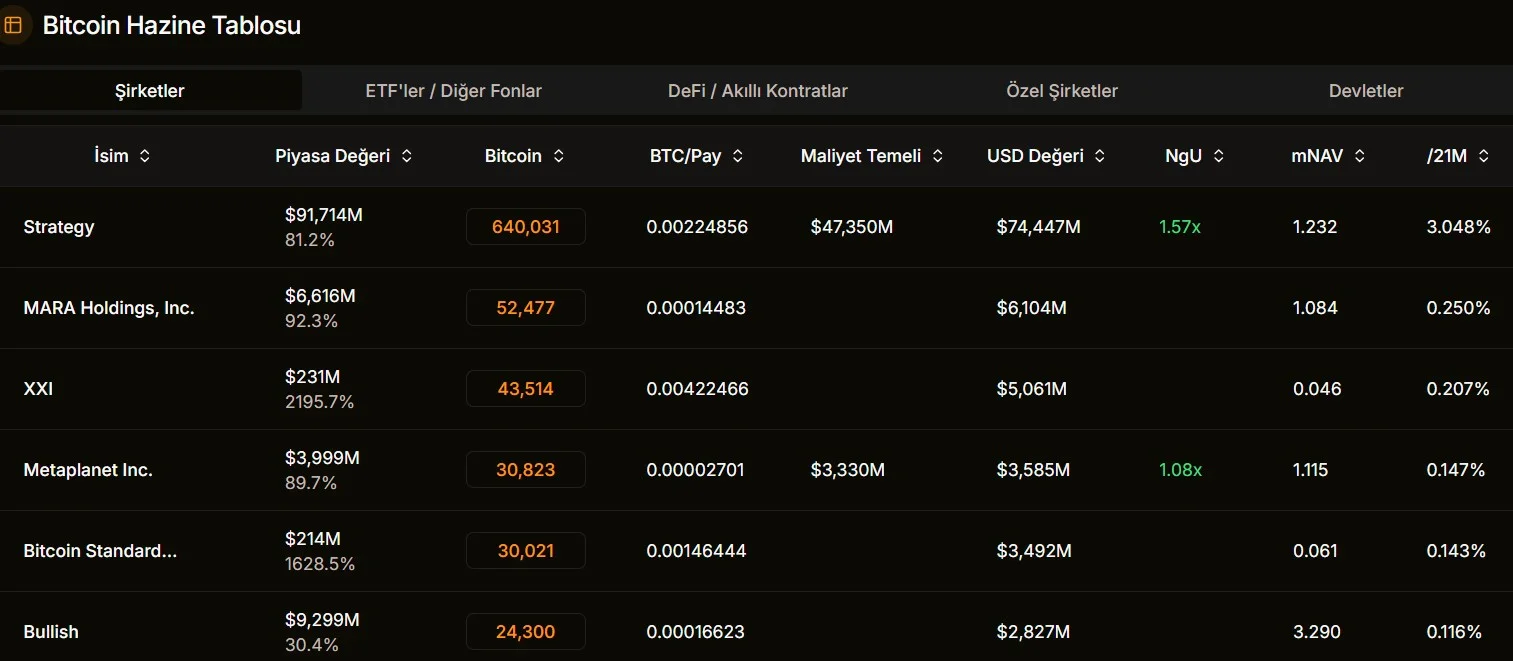

The Financial Accounting Standards Board (FASB) requires crypto assets to be accounted for using the "fair value" method. This means that companies must reflect fluctuations in the market price of Bitcoin they hold as profits or losses on their balance sheets, even if they haven't been sold. Therefore, while unrealized gains on stocks are tax-exempt, the possibility of Bitcoin gains being taxable has been raised. This could create billions of dollars in additional tax burdens for many institutional investors, especially Michael Saylor's company, Strategy, which holds approximately $73 billion in Bitcoin reserves.

Industry leaders Coinbase and Strategy have taken a united stand against this regulation. A joint letter sent to the Treasury in May stated that treating digital assets differently than traditional securities is unfair. The letter also emphasized that taxing unrealized profits could force companies to sell Bitcoin simply to pay taxes, creating selling pressure in the market and putting US companies at a disadvantage in international competition. Some experts even pointed out that taxing "non-existent income" could pose constitutional problems.

The issue has become increasingly prominent in recent months with the steps taken by the US Congress and the Trump administration regarding digital asset taxation. Crypto taxation will also be discussed at a hearing today by the Senate Finance Committee. These developments have influenced the Treasury Department's push to soften the controversial regulation.

A Great Relief for Institutional Investors

The anticipated change represents a significant relief for institutional crypto investors. Publicly traded companies, in particular, who hold large amounts of Bitcoin on their balance sheets, will be able to manage their assets in line with their long-term strategies without selling pressure. Experts state that the US is trying to integrate crypto into the financial system more fairly with this step, but the impact of the final decisions on the markets will become clear in the coming months.