Bitcoin made a notable surge in the cryptocurrency market in the first days of the new year, surpassing the $93,000 level on Monday. This movement, accompanied by a widespread increase in risk appetite, was not limited to Bitcoin; strong buying was also seen in many major crypto assets, especially Ethereum.

Bitcoin experiences a rise

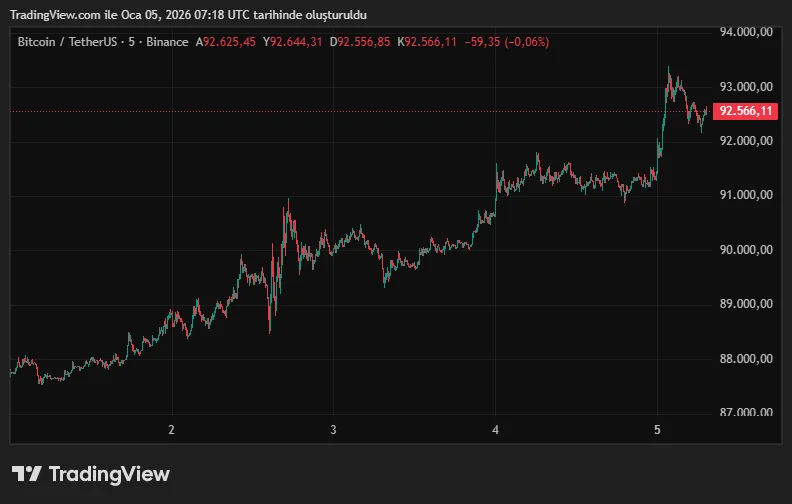

According to the latest price movements, Bitcoin crossed the $93,000 threshold overnight, with a 24-hour increase exceeding 2%. Ethereum rose to levels around $3,190, while major altcoins such as XRP, BNB, and Solana also recorded gains ranging from 2% to 5%. The price chart in the image shows that Bitcoin has been following a gradual upward trend in recent days and is continuing its efforts to hold above $92,000. In the short term, the $93,000 region stands out as a psychological threshold, and the market is closely watching whether this level will be permanent. Indeed, the BTC price has retreated to the $92,500 level at the time of writing.

The sudden volatility in the market has also had severe consequences in the derivatives market. According to Coinglass data, approximately $141 million worth of positions were liquidated in the last four hours alone. About $133 million of these liquidations consisted of short positions. The intense closing of short positions is considered one of the key factors accelerating the upward momentum of the price. Liquidations occur when investors experience insufficient collateral in leveraged transactions, resulting in the automatic closure of their positions. According to analysts, this rise is not unique to the crypto market. A similar picture is seen in Asian markets. South Korea's Kospi index and Japan's Nikkei index rose by more than 2%, highlighting a trend described as a "rally of everything" globally. Investors repositioning their portfolios in the first week of the new year is making assets with limited supply, such as Bitcoin, attractive again.

Military operation in Venezuela

Geopolitical developments also play a decisive role in pricing. News of the US military operation in Venezuela and the potential capture of leader Nicolás Maduro resonated in global markets over the weekend. With traditional markets closed, cryptocurrencies became one of the most liquid sectors pricing in the news flow. According to analysts, investors generally viewed these developments positively in terms of risky assets, supporting buying activity in the crypto market. Following these developments, oil prices saw limited pullbacks, while safe-haven assets like gold and silver experienced significant movements. The crypto market's ability to simultaneously price in both risk appetite and geopolitical uncertainty once again highlighted why Bitcoin excels during such periods. Looking ahead, investors are focused on the opening of US stock markets and the trajectory of macroeconomic data. The $95,000 level is particularly being watched as a significant resistance point for Bitcoin. A break above this level could accelerate the rise, while a short-term pause is anticipated.