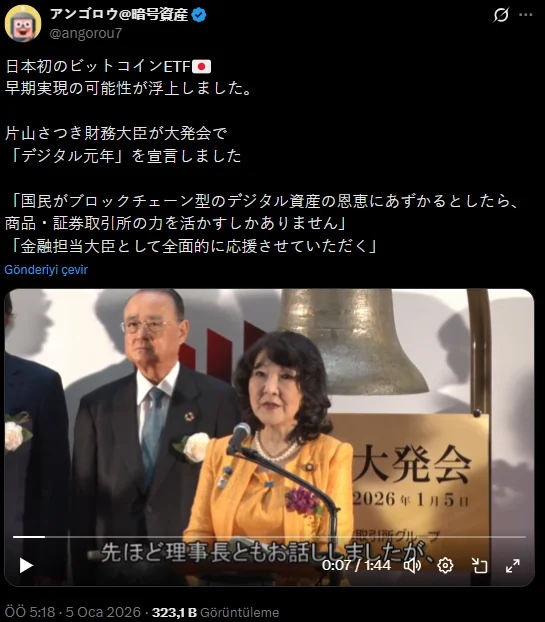

Japan has sent one of its clearest and strongest messages yet regarding the integration of crypto assets into the traditional financial system. Speaking at the Tokyo Stock Exchange on the occasion of the new year, Finance Minister Satsuki Katayama stated that making digital assets more accessible to a wider audience through securities and commodity exchanges is critically important. Katayama officially declared 2026 as the "digital year," emphasizing that the Japanese financial system will play an active role in this transformation.

According to local media agencies, Katayama stated that exchanges play a central role in the widespread public offering of blockchain-based digital assets. Recalling that cryptocurrency exchange-traded funds (ETFs) are used by individual investors as a hedge against inflation in the US, Katayama indicated that similar products could be considered in Japan. Currently, there is no cryptocurrency ETF open to local investors in the country, but the statements suggest this may change. Katayama said that the government will not only remain in a regulatory position but will also provide full support to exchanges for the modernization of financial market infrastructure. Katayama stated that they aim to create an environment that will pave the way for the integrated use of fintech solutions with digital asset trading, adding that this approach could put Japan back in the spotlight in global financial competition.

Japan continues to take steps towards crypto

This opening towards crypto assets is also consistent with Japan's recent accelerated regulatory reforms. Last year, the Financial Services Agency, the country's financial supervisory authority, opened discussions on allowing banks to directly hold and trade crypto assets. During the same period, JPYC, the first stablecoin pegged to the Japanese yen, was also approved. These steps are paving the way for crypto to become a legitimate tool not only for individual investors but also for institutional finance.

Another important step taken in November was the reclassification of 105 major crypto assets as "financial products" under existing financial legislation. This list includes the largest assets in the market, such as Bitcoin and Ethereum. This change could pave the way for these tokens to be used more widely alongside traditional financial products.

There is also a remarkable transformation on the tax side. Japan plans to reduce the tax rate applied to crypto gains from as high as 55% to 20%. This would place digital assets under the same tax regime as stocks and other traditional investment instruments. Furthermore, investors will be able to carry forward losses from crypto transactions for three years.

These regulations have whetted the appetite of Japanese financial giants. SBI Holdings has long been waiting for a suitable legal framework for crypto ETFs. Meanwhile, Ripple is reportedly preparing to launch its stablecoin, RLUSD, with SBI support in the first quarter of 2026.

Katayama describes 2026 as a turning point not only for digital assets but also for the chronic problems of the Japanese economy. In this process, supported by combating deflation, growth-oriented investments, and fiscal policies, digital finance is expected to play a significant leverage role.