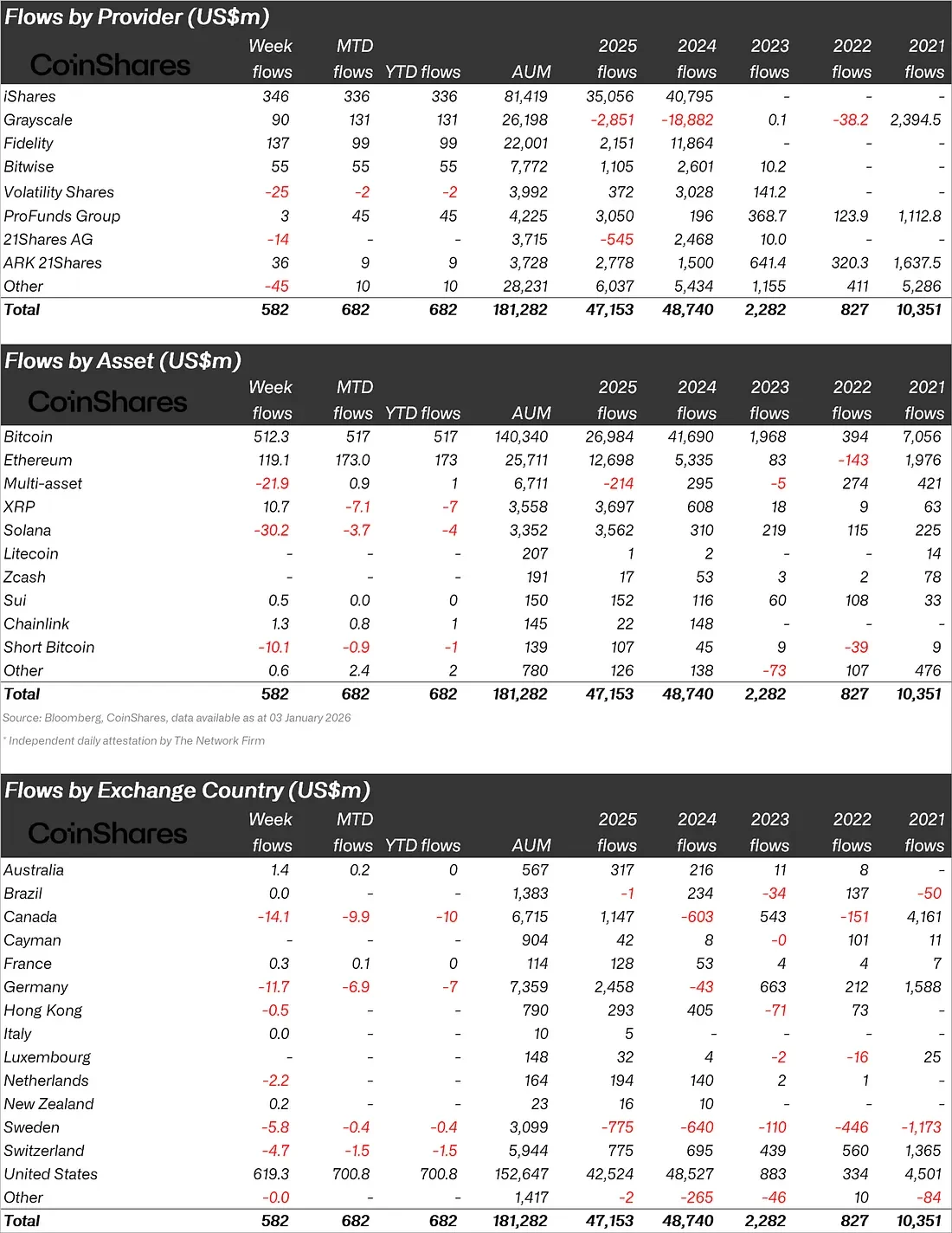

CoinShares' 2025 Digital Asset Fund Flows report reveals that crypto investment products ended the year with a strong but complex picture. Total money flowing into global digital asset funds reached $47.2 billion in 2025. This figure is just below the record of $48.7 billion recorded in 2024. A strong start to the year ensured that investor interest was generally maintained, despite the volatile movements and short-lived outflows seen in the middle of the week.

In the last week of the year, there was a net inflow of $582 million into global funds. Following the outflows at the beginning of the week, the inflow of $671 million on Friday alone showed that institutional demand is still strong. Looking at the regional distribution, the US maintained its clear lead. US-originated inflows reached $47.2 billion throughout 2025. Although this figure indicates a 12% decrease compared to 2024, it did not change the country's weight in global digital asset funds.

On the European side, a remarkable recovery stood out. Germany recorded a net inflow of $2.5 billion in 2025 after experiencing outflows of $43 million in 2024. A similar turnaround was seen in Canada. Canada, which experienced outflows of $603 million in 2024, closed 2025 with inflows of $1.1 billion. In Switzerland, appetite was more limited but stable; the country saw inflows of $775 million into digital asset funds, representing an 11.5% increase year-on-year. In contrast, Sweden was among the countries where outflows were concentrated, both weekly and year-on-year.

The balance is shifting in the altcoin arena

Asset-based allocation clearly reveals one of the most important trends of 2025: a rotation from a Bitcoin-centric structure towards selected altcoins. While Bitcoin still holds the largest share, fund inflows decreased by 35% in 2025 to $26.9 billion. Price pressure and volatility led some investors to short Bitcoin products. Throughout the year, $105 million inflows were recorded into short Bitcoin funds, but the total assets under management for these products remained at a niche level of $139 million.

Ethereum, however, was the clear winner of the year. In 2025, $12.7 billion inflows were recorded into Ethereum funds. This represents a 138% increase year-on-year. Both the expansion of institutional use cases for Ethereum and updates within the ecosystem significantly strengthened investor sentiment.

On the altcoin side, the most striking performance came from XRP and Solana. XRP recorded growth of approximately 500% with $3.7 billion inflows in 2025. Solana showed an increase approaching 1000% with $3.6 billion inflows. This picture shows that investors are increasingly gravitating towards projects with scalability, low transaction costs, and specific use cases.

The other altcoins in the image are showing more limited but noteworthy signals. Sui saw steady interest in 2025 with $152 million in inflows. Chainlink, with a net inflow of $22 million, demonstrated continued institutional interest, particularly in oracle infrastructure. Older projects like Zcash and Litecoin, however, saw limited inflows, indicating investor caution. Demand for multi-asset products and altcoins in the "other" category weakened throughout the year. According to CoinShares data, total inflows for altcoins excluding Bitcoin, Ethereum, XRP, and Solana declined by 30% year-on-year. The overall picture shows that 2025 was a year of selectivity in digital asset markets. While total inflows remained near record levels, capital was concentrated in certain assets. Although Bitcoin still held a central position, Ethereum and some major altcoins gained a stronger position in institutional portfolios in the past year.