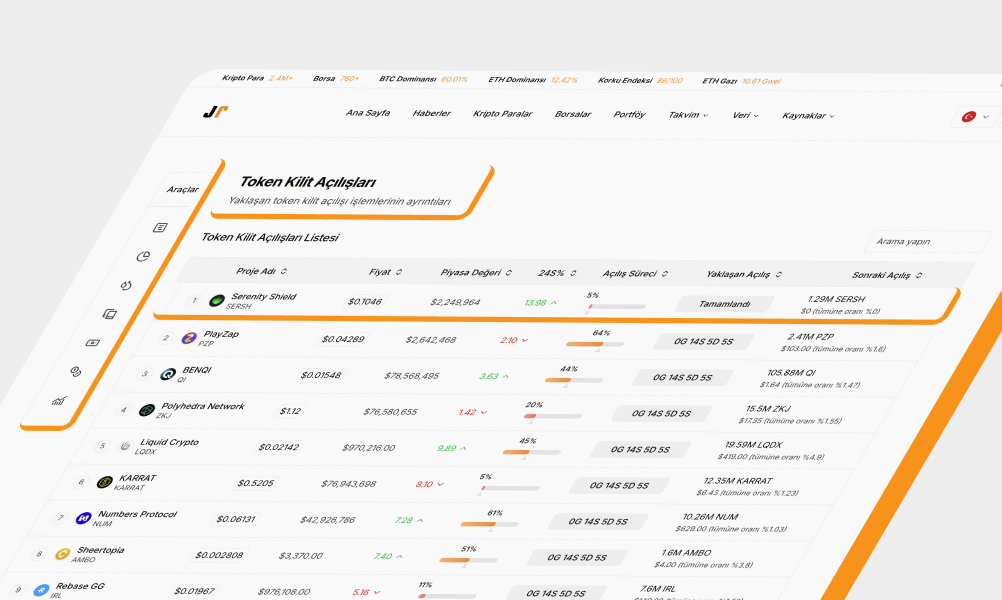

Binance is Delisting 6 Altcoins: Here's the Schedule

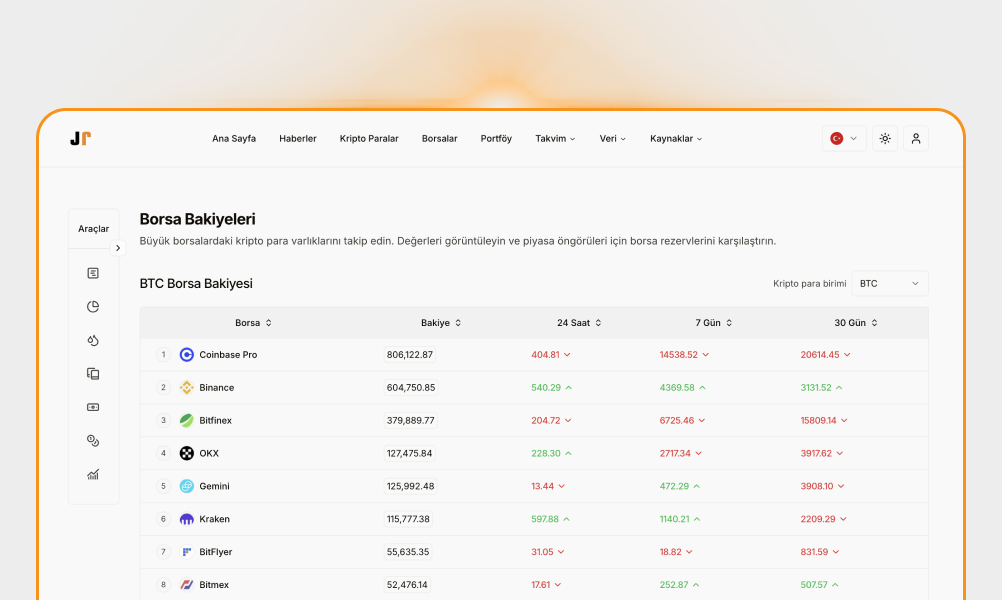

<p class="text-left mb-4 ">Binance announced that it has decided to delist six altcoins as of February 13, 2026. According to the exchange's official statement, Acala (ACA), Tranchess (CHESS), Streamr (DATA), dForce (DF), Aavegotchi (GHST), and NKN (NKN) will be removed from all spot trading pairs. The decision comes at a time when the market is generally weak, and the tokens in question have experienced sharp price movements in a short period. Binance emphasized that it regularly reviews the digital assets it lists and conducts more comprehensive reviews if certain standards are not met. </p><p class="text-left mb-4 ">The statement indicated that numerous criteria, including project team commitment, the level and quality of development activities, trading volume and liquidity, network security, community communication, regulatory requirements, and tokenomic changes, influenced delisting decisions. Unethical behavior, transparency issues, and community perception were also highlighted as part of the evaluation process. Spot trading for the tokens to be delisted will be completely stopped as of February 13, 2026 at 03:00 (UTC). After this date, all open orders in the relevant trading pairs will be automatically canceled. Binance will also gradually discontinue services associated with these assets, such as Trading Bots, Spot Copy Trading, and Convert. Specifically regarding Spot Copy Trading, a warning has been issued that the relevant pairs will be removed as of February 6, 2026, and any unsold balances may be compulsorily liquidated at market price. Significant changes are also in place for futures contracts.</p><p class="text-left mb-4 ">Binance Futures will close all positions in contracts for these tokens at 09:00 (UTC) on February 6, 2026, and will implement automatic settlement. Users are advised to manually close their open positions before this date. Binance also reminded users that it may take additional protective measures in parameters such as leverage ratios, funding rates, and collateral requirements in cases of extreme volatility. The process is more complex for borrowing, margin, and portfolio margin. The relevant tokens for Cross and Isolated Margin trading will be completely removed on February 6th. During this process, open positions will be automatically closed, collateral will be used to pay off debt, and assets will be sold at market price if necessary. Binance specifically emphasizes that margin users should close their positions in advance to avoid potential liquidations.</p><p class="text-left mb-4 ">The timeline is also clear on the wallet side. Deposit transactions for these tokens will not be reflected in accounts after February 14, 2026. Withdrawal transactions will be completely stopped as of April 13, 2026. Binance stated that under certain conditions, the delisted tokens can be converted to stablecoins, but this is not guaranteed; if conversion is not possible, withdrawals may remain open as long as network availability allows.</p><h2 class="text-left text-foreground text-3xl font-bold mb-3 mt-1">Average 10% pullback in six tokens after the delisting decision</h2><p class="text-left mb-4 ">Following the delisting news, data shows that declines for ACA, <a href="https://jrkripto.com/tr/coin/chess" target="_blank" rel="noreferrer" class="text-primary underline">CHESS</a>, DATA, DF, GHST, and NKN were generally concentrated between 5% and 15%. However, it should be kept in mind that there is already an ongoing downward trend in the market as a whole. Here's how some altcoins reacted to their delisting announcements:</p><p class="text-left mb-4 min-h-[1.5em]"></p><p class="text-left mb-4 ">

<figure class="my-6">

<img src="https://minio-api-1.jrkripto.com/blog/dfusdt-2026-02-02-12-23-02-264b7d5e.webp" alt="DFUSDT_2026-02-02_12-23-02.png" width="auto" height="auto" class="w-full rounded-lg border" />

</figure>

<figure class="my-6">

<img src="https://minio-api-1.jrkripto.com/blog/nknusdt-2026-02-02-12-23-09-2f981666.webp" alt="NKNUSDT_2026-02-02_12-23-09.png" width="auto" height="auto" class="w-full rounded-lg border" />

</figure>

</p>