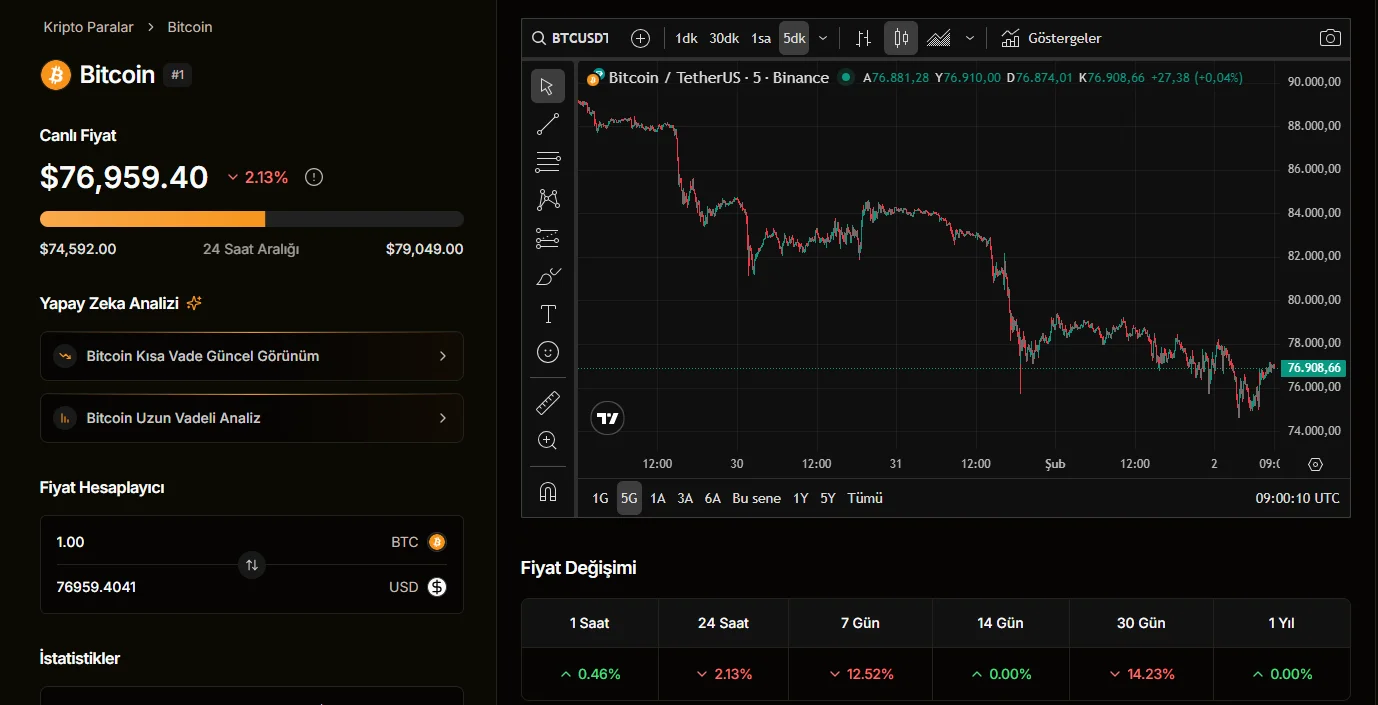

Bitcoin is seeking equilibrium again, recovering above $76,000 after a brief sell-off during weekend trading. Forced liquidations triggered when the price fell below $75,000 once again highlighted the shallow liquidity of the market. This brief visit below the support level resulted in a typical V-shaped price movement, demonstrating why sell-offs and recoveries are so sharp in shallow order books. According to price change data, Bitcoin has lost over 2% in the last 24 hours, while the seven-day performance shows a decline exceeding 12%. However, a limited recovery is noticeable in the short term; the price is currently positive on an hourly basis. Buying from the lows around $74,500 on the 24-hour chart has pushed the price back towards the $76,000 range. However, the double-digit loss in the 30-day outlook indicates that the market is still under strong pressure.

Massive Liquidation in the Market

In the last 12 hours, a total of $510 million worth of leveraged positions were liquidated in the crypto markets. Approximately $392 million of this figure consisted of long positions. The fact that the sales predominantly hit bullish positions revealed that there is already a large number of optimistic positions in the market, and therefore the price remains vulnerable to downward movements. Weak market depth means that even relatively limited sales can easily lead to the breaking of technical levels.

The weakening of risk appetite was also clearly felt in the altcoin front. Ether fell by over 8% in the last 24 hours, while losses in BNB, XRP, and Solana ranged from 4% to 6%. Assets with high volume but lower volatility, such as Dogecoin and TRON, weathered the period with more limited losses. The overall picture shows that investors are in a widespread risk-reduction trend.

On the macro side, manufacturing data from China, while signaling limited stability for global markets, did not create a direct catalyst effect on Bitcoin. While private sector surveys indicate a slight recovery in production, official data remains in contraction territory. Tight controls on the yuan and limited new stimulus measures are preventing direct impact of Chinese liquidity on crypto markets.

Bitcoin falls below average cost in ETFs

On the other hand, the picture is more fragile in the US spot Bitcoin ETF market. According to Galaxy Digital research director Alex Thorn, the Bitcoin price has fallen below the average cost of spot ETFs in the US. CoinGlass and BiTBO data show that ETFs hold approximately 1.28 million BTC and the average cost is around $87,800. A total outflow of $2.8 billion from spot ETFs in the last two weeks reveals weakening institutional demand.

Total ETF holdings have fallen by more than 31 percent compared to their peak in October, while the Bitcoin price drop has approached 40 percent. Thorn emphasizes that institutional investors have not completely abandoned their positions, but the appetite for new purchases has decreased significantly. Nick Ruck, Director of LVRG Research, warns that Bitcoin could enter a more pronounced bear market if the recovery is delayed. Increased macroeconomic uncertainty in the US, geopolitical risks, and tightening liquidity conditions continue to put pressure on the price.