Crypto asset investment products recorded a total net outflow of $360 million last week. This decline is primarily due to Fed Chair Jerome Powell's emphasis that a new interest rate cut in December is "not a certainty." Powell's cautious remarks have plunged investors into uncertainty, dampening risk appetite.

CoinShares data draws attention: Bitcoin's significant outflow

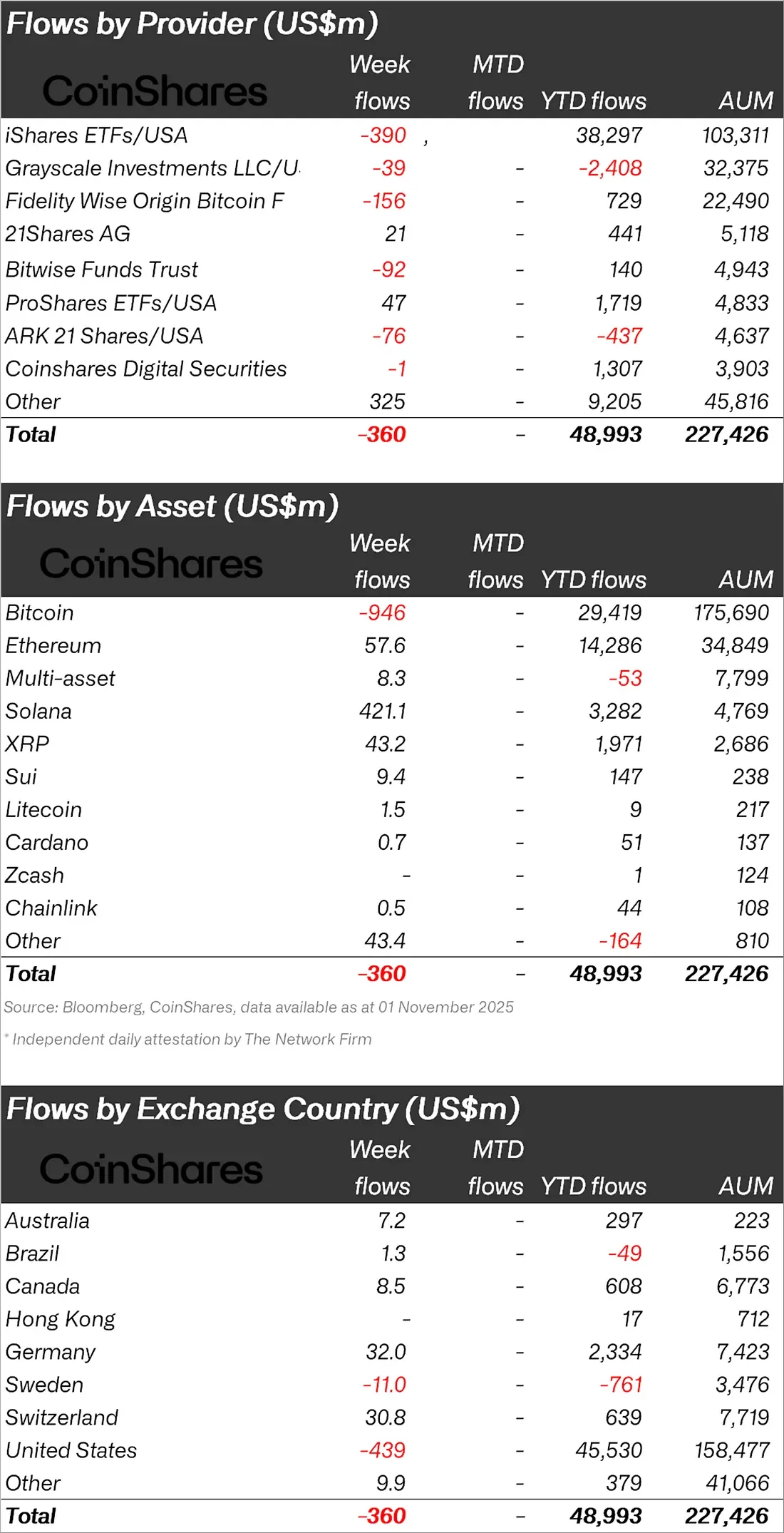

According to CoinShares data, the United States is at the center of these outflows. US-based funds saw $439 million in outflows, partially offset by inflows of $32 million from Germany and $30.8 million from Switzerland. Canada also closed the week in positive territory with $8.5 million in flows. Sweden, on the other hand, recorded an outflow of $11 million.

Bitcoin ETFs were the hardest-hit product group, with $946 million in outflows for the week. Despite the interest rate cut, Powell's "hawkish" rhetoric reiterated Bitcoin's sensitivity to monetary policy. While Bitcoin's total assets under management fell to $175.6 billion, the year-to-date inflow of $29.4 billion remained.

Solana was the star of the week. Driven by the launch of new Solana ETFs in the US, the funds saw $421 million in inflows. This figure marked the second-highest weekly inflow in Solana's history. This brings SOL's total positive year-to-date inflow to $3.3 billion.

Ethereum also saw $57.6 million in inflows. However, daily flow data suggests investors remain hesitant. Nevertheless, it's noteworthy that Ethereum maintained its strong year-to-date inflow of $14.3 billion. XRP also closed the week positive with $43.2 million in positive flow, bringing its total year-to-date inflow to $1.97 billion.

The picture was mixed for smaller altcoins. Sui saw $9.4 million inflows, Litecoin $1.5 million, Cardano $700,000, and Chainlink $500,000. Multi-asset funds saw a small inflow of $8.3 million, while Zcash remained stable. However, the "other" category saw a notable outflow of $43 million.

Among fund providers, iShares ETFs led the way with $390 million in outflows. Fidelity's Wise Origin Bitcoin Fund saw $156 million, Bitwise $92 million, and ARK 21Shares $76 million. ProShares and 21Shares AG also saw positive outflows, with $47 million and $21 million, respectively.

While a total of $49 billion has flowed into digital asset funds since the beginning of the year, fluctuations in recent weeks suggest that investors are still closely monitoring Fed policy.