TAO/USDT Technical Analysis

Bittensor continues to attract attention at the intersection of artificial intelligence (AI) and blockchain technology. With nearly 70% of TAO tokens staked and increasing institutional interest, the network shows strong potential to evolve from being “just a tech project” into a system with real-world utility.

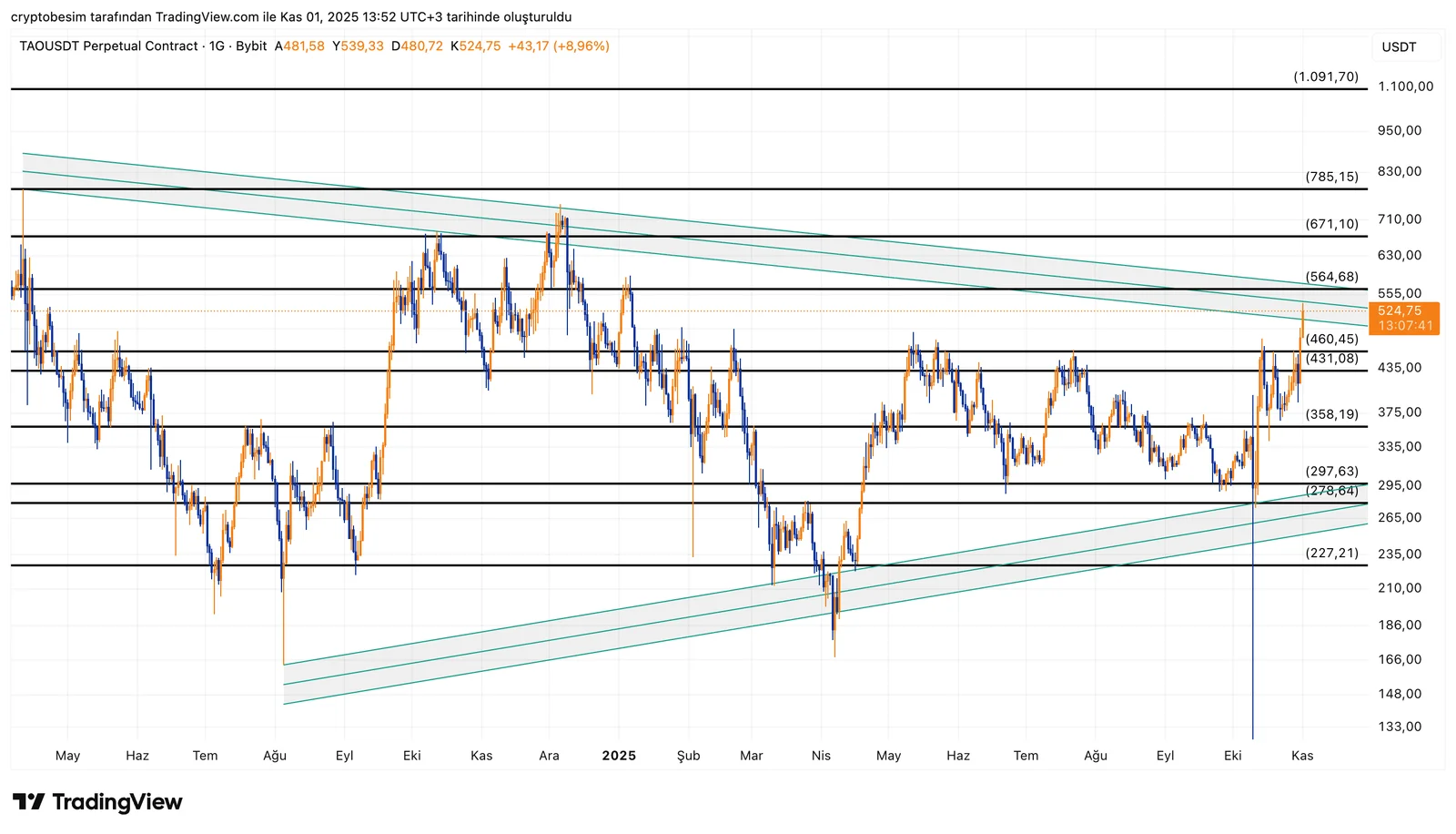

Analyzing the TAO chart on a daily time frame, we see that the coin is trading within a symmetrical triangle formation. As of today, the price has touched the upper trendline of the triangle, marking a critical short-term resistance zone around $524–$555. A decisive breakout above this area would confirm the bullish pattern, potentially driving the price first toward $565, then $671. In a broader scenario, the $785 region stands out as an extended target.

On the other hand, the $460–$431 range forms the first support area. If the price breaks below this zone, a deeper pullback toward $358—aligned with the triangle’s lower trendline—could occur. However, the current structure remains constructive, supported by repeated upper-band tests and sustained buying pressure.

- Summary• TAO is testing the upper boundary of a contracting triangle.• A breakout above $524–$555 could accelerate the uptrend.• Upside targets: $565 → $671 → $785.• A drop below $460 would signal short-term weakness.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during the transactions.