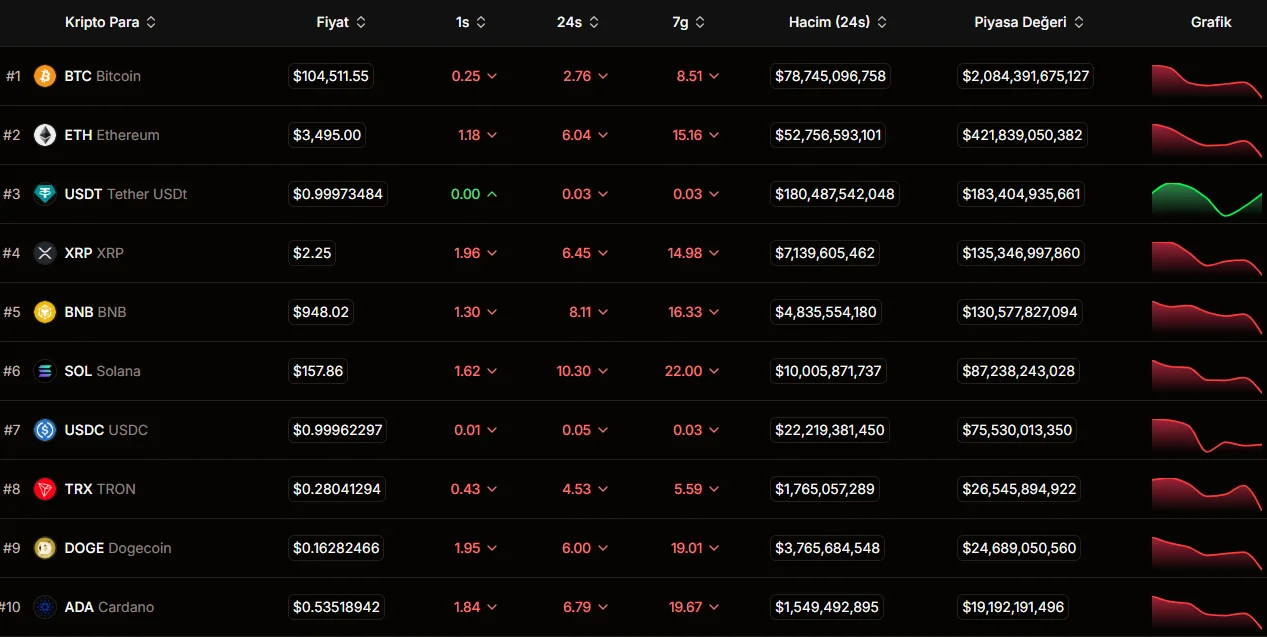

The crypto market was caught in a sharp sell-off again in the first week of November. Bitcoin tested below $105,000 for the first time in three weeks, while altcoins experienced even deeper losses. The combination of fear and liquidity squeeze across the market significantly reduced investor risk appetite.

With Bitcoin's decline, the Crypto Fear and Greed indicator dropped from 42 to 21, reaching the "Extreme Fear" level. This was its lowest point in seven months. The last time the index fell this sharply was in April. At the time of writing, the index was down 29 percent.

According to experts, there are multiple reasons behind the sell-off. The first factor is the lack of liquidity in the market. According to analyst Michaël van de Poppe, the circulating supply of many altcoins is limited. If only 10% of the total supply is traded, a large sell order can easily destabilize the market. Because the order books lack sufficient depth, the decision by a few large investors to sell can quickly drive prices down. This makes altcoins both more vulnerable to declines and more reactive to rises. Van de Poppe says, “Be patient. The cycle is not over. Altcoins may recover more strongly when liquidity returns.”

Another pressure factor in the market is Bitcoin's increasing dominance. Bitcoin, which holds more than 60% of the total market capitalization, is causing capital outflows from altcoins. As dominance increases, investors are turning to BTC again as a safe haven, accelerating the weakening of altcoins.

On the macro front, the liquidity shortage in the US is negatively impacting cryptocurrencies. The government shutdown and Treasury spending cuts have reduced cash flow in the market. The accumulation of approximately $1 trillion in the Treasury General Account (TGA) has reduced reserves in the system and pushed up money market interest rates. This squeeze has led to a flight from risky assets. Furthermore, cautious statements from Fed Chair Jerome Powell accelerated the sell-off. While markets were anticipating further interest rate cuts, Powell's message that "we won't rush" disappointed investors. Bitcoin fell below $108,000, while leading altcoins like Ethereum and Solana lost between 6-8 percent of their value. Trading volumes have decreased by nearly 40 percent since mid-October.

What lies ahead?

However, the outlook isn't entirely bleak. Historically, when Bitcoin dominance peaks and altcoins are weak, a strong altcoin rally usually follows. Experts suggest that the Fed could become dovish again (dovish, positive monetary policy) if the US government resolves the shutdown and economic data weakens. Such a scenario could trigger a potential liquidity expansion or a new wave of quantitative easing in 2026. In short, the crypto market is currently under pressure from shrinking liquidity, rising fear, and Bitcoin-centric capital influx. However, such periods can herald a new bullish cycle for patient investors.