The crypto derivatives markets have started 2026 with high volume. As of today, over $2.2 billion worth of options contracts tied to Bitcoin and Ethereum are expiring. This is being closely watched by investors and professional traders as it is the first large-scale derivatives settlement of the year. The fact that both assets are trading near their critical strike prices further highlights the possibility of post-settlement volatility.

Bitcoin has $1.87 billion in options

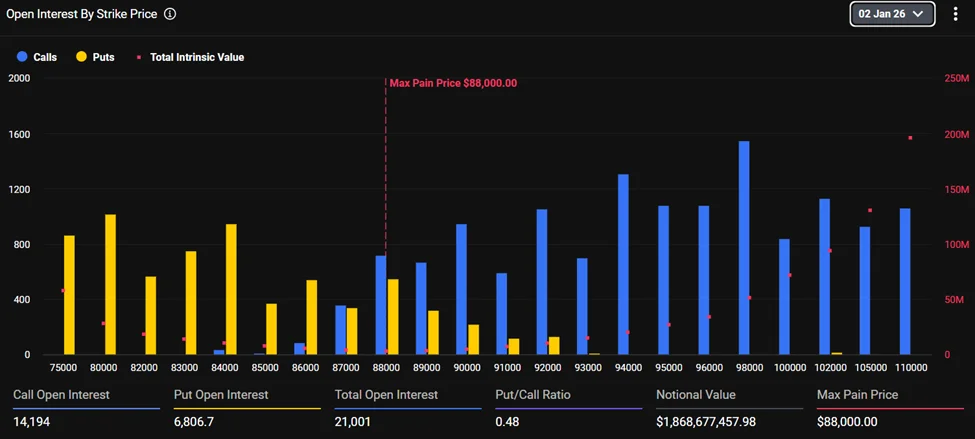

The lion's share of the settlement belongs to Bitcoin. Approximately $1.87 billion worth of option contracts are tied to BTC. At the time of settlement, the Bitcoin price is hovering around the $88,900 mark, slightly above the "max pain" level, which is estimated to be around $88,000. Max pain is known as the price level at which the most option contracts close worthless and usually creates an equilibrium point in favor of option sellers.

Open position data reveals a noteworthy picture on the Bitcoin side. Of the total 21,001 open positions, 14,194 are call contracts and 6,806 are put contracts. The put/call ratio of 0.48 indicates that the general market trend is based on upward expectations rather than downward hedging. This structure reveals that investors are betting on price increases, but also carries the risk of sharp movements if expectations are not met.

On the Ethereum front, the picture is more balanced but still optimistic. The total nominal value of ETH options is approximately $395.7 million. The Ethereum price is trading around $3,020, slightly above its maximum pain level of $2,950. There are 80,957 call and 49,998 put contracts open. The total number of open positions is 130,955, and the put/call ratio is 0.62. This ratio indicates a more cautious optimism compared to Bitcoin. The expiration dates of options are considered critical thresholds for derivatives markets. When contracts expire, investors either exercise or close their positions. During this process, prices often retreat towards maximum pain levels. However, once settlement is complete and this "magnetic effect" disappears, price movements can become freer and more volatile. Another factor that makes this settlement important is institutional positioning data. On the Bitcoin side, call contracts account for 36.4% of the volume in block transactions, while put contracts account for 24.9%. This difference is even more pronounced on Ethereum; 73.7% of block transactions consist of call contracts, with only a small portion being put contracts. Such block transactions generally indicate more strategic and long-term positions rather than short-term speculation. Furthermore, interest is not limited to near-term contracts. While March and June 2026 expiration dates stand out in Bitcoin options, strong demand is seen in quarterly expiration dates spread throughout the year on the Ethereum side. This suggests that traders are positioning themselves not only for short-term price movements but also for a broader bullish scenario extending into the coming months. However, high-volume settlements always carry risk. Price stability can weaken as hedging positions are unwound. In particular, if prices remain below critical levels, the expiration of numerous call options could increase short-term selling pressure.