Increased volatility and project-based risks in cryptocurrency markets are making exchanges' listing policies stricter and more dynamic. In this context, Binance has updated its Monitoring Tag list, which it uses to warn investors about potential risks. The platform announced that it will add four more crypto assets to its closely monitored list as of January 2, 2026.

Binance Adds 4 Cryptocurrencies to Monitoring

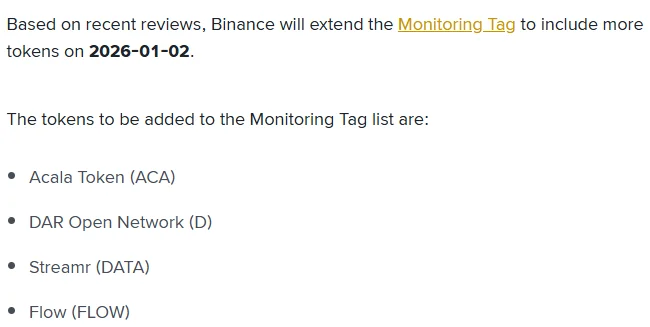

Binance announced that it has expanded its Monitoring Tag coverage as of January 2, 2026, adding four more crypto assets to its closely monitored list. According to the official statement, Acala Token (ACA), DAR Open Network (D), Streamr (DATA), and Flow (FLOW) are now among the assets that Binance classifies as high-risk. This decision was made as a result of the platform's periodic project evaluations.

Binance, one of the world's largest cryptocurrency exchanges, uses the Monitoring Tag application to warn investors about high volatility and increasing risks. Tokens with this tag may exhibit more volatile price movements compared to other listed assets and may carry certain risk factors on the project side. Binance regularly reviews these assets to assess whether they sustainably meet the listing criteria.

Tokens included in the Monitoring Tag do not directly mean a trading ban. However, users who wish to trade these assets must complete a risk awareness test every 90 days on the Binance Spot and/or Binance Margin platforms. In addition, users are required to accept the relevant terms of use. With this practice, Binance aims to ensure that investors consciously evaluate the risks carried by these tokens. Risk warning banners are also displayed on the trading pages and market overview screen of all assets with a Monitoring Tag. According to the exchange, numerous criteria are considered when adding a token to the Monitoring Tag list. These criteria include the commitment of the project team to the work, the level and quality of development activities, trading volume, and liquidity status. The network's security against attacks, technical stability, and the project's communication with the public are also important parts of the evaluation process.

Binance goes further, paying attention to the transparency of project teams, their interaction with the community, and their responses to regular audit requests. Unethical or fraudulent behavior, sudden and unjustified increases in token supply, significant changes in the token economy, or radical transformations in the team and ownership structure are also among the factors influencing the Monitoring Tag decision. In addition, community perception and new regulatory requirements are also considered in the review process. Acala (ACA), added to the Monitoring Tag list, is known for its DeFi solutions within the Polkadot ecosystem; DAR Open Network (D) stands out as a project focusing on gaming and Web3 infrastructure; Streamr (DATA) operates in the field of decentralized data sharing; and Flow (FLOW) is known as a blockchain network particularly associated with NFT and gaming projects. Flow may have been placed on the monitoring list due to a $3.9 million security breach on the network and subsequent unusual token activity. The Flow Foundation announced that following the attack, approximately 150 million FLOW tokens, representing about 10% of the total supply, were deposited into an exchange via a single account and quickly converted to BTC. Finally, Binance emphasized that other services related to these tokens will not be affected by this decision. Monitoring Tag updates are expected to be reflected platform-wide shortly after the announcement is published. Binance stated that the tag may be added or removed in the future based on further reviews.