BlackRock, the world's largest asset manager, is back in the spotlight with a new move strengthening its institutional presence in the crypto markets. According to on-chain data, the company made high-value Bitcoin and Ethereum transfers via Coinbase Prime, indicating continued fund flows linked to spot ETFs.

BlackRock Moves Bitcoin and ETH Holdings

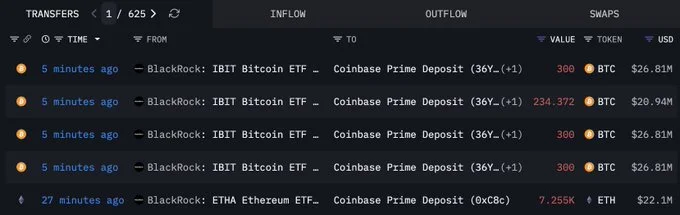

According to the latest on-chain data shared by the blockchain data platform Lookonchain, BlackRock made a remarkable new transfer via Coinbase Prime. The data shows that the world's largest asset manager deposited 1,134 BTC and 7,255 ETH into Coinbase Prime wallets. At current prices, the total value of this transfer is approximately $123.5 million. This move has once again brought BlackRock's approach to crypto assets to the forefront.

According to on-chain records, the total value of Bitcoin investments is $101.4 million, while the value of Ethereum transfers is approximately $22.1 million. It is noteworthy that the transfers were made to Coinbase Prime custody accounts linked to BlackRock’s spot ETF products. This indicates a funding and rebalancing process parallel to ETF demand, rather than direct trading activity.

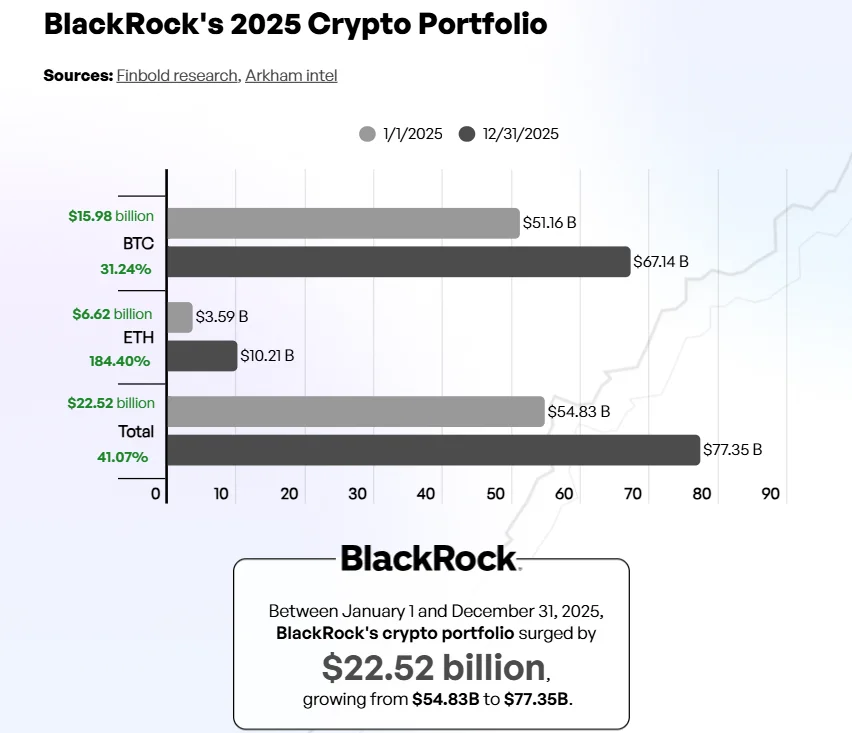

BlackRock acquired $22 billion in assets throughout 2025.

This latest move is seen as part of a broader picture showing BlackRock pursuing a non-aggressive but steady growth strategy towards digital assets throughout 2025. According to 2025 Cryptocurrency Market Report, the company added over $22 billion in new assets to its on-chain crypto portfolio during the year. The total value of Bitcoin and Ethereum assets, which was approximately $54.8 billion at the beginning of January 2025, increased to $77.3 billion by the end of the year. This increase corresponds to a growth of over 41 percent year-on-year.

Bitcoin continued to be the main backbone of BlackRock’s crypto portfolio. Assets, which were around 552,000 BTC at the beginning of 2025, rose to over 770,000 BTC by the end of the year. Thus, a net increase of 217,000 BTC was recorded on the Bitcoin side. In terms of value, the Bitcoin position increased from $51.1 billion to $67.1 billion. This shows that BlackRock continues to position Bitcoin as a strategic reserve asset even during volatile periods. On the Ethereum side, a more striking growth stood out. BlackRock's ETH assets increased from 1.07 million ETH to 3.48 million ETH throughout 2025. This increase indicates approximately 184% value growth on the Ethereum side. It is observed that interest in Ethereum accelerated, especially in the third quarter of the year, with tokenization, on-chain yield, and institutional consensus scenarios coming to the fore. The launch of spot Bitcoin and Ethereum ETFs in the US at the beginning of the year was one of the key factors determining the direction of institutional demand. Despite volatile price movements, ETF inflows have largely been concentrated in BlackRock products. iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA) have become regulated and transparent crypto access points for many investors.