The June non-farm payroll and unemployment rate data released in the US at 3:30 p.m. Turkish time triggered significant price movements in the markets. The higher-than-expected employment data and falling unemployment rate dampened investors' hopes that the US Federal Reserve (Fed) would cut interest rates in July. The latest data reinforced expectations that the Fed will continue its “wait-and-see” policy on interest rate decisions.

Employment data exceeded expectations

According to data released by the US Department of Labor, non-farm employment increased by 147,000 in June. This figure far exceeded economists' expectations of 111,000. The previous month's figure was recorded as 139,000. During the same period, the unemployment rate fell to 4.1%, compared to the 4.3% expectation. This improvement demonstrated that the US labor market is still strong.

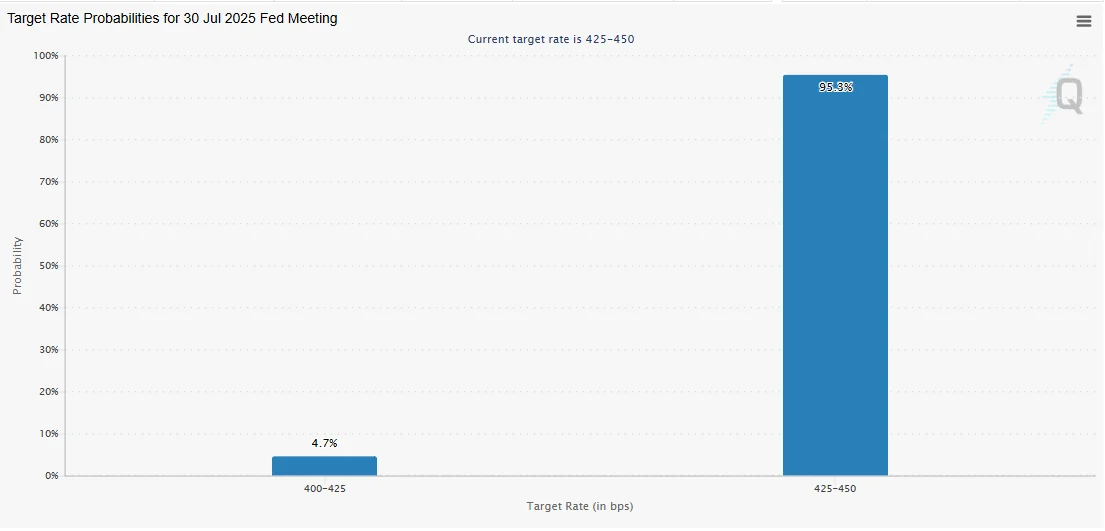

Following the release of the data, expectations in the futures markets that the Fed would cut interest rates at its July meeting fell sharply. Futures contracts tracked by CME FedWatch priced the likelihood of an interest rate cut at the end of July at just 4.7%. This rate had risen to 25% in recent weeks.

Powell's cautious statements had an impact

As we reported earlier, Fed Chairman Jerome Powell emphasized in a speech at a forum organized by the European Central Bank earlier this week that the possibility of an interest rate cut in July had not completely disappeared, but that the decision would depend on “incoming data.” However, the strong employment figures indicate that there is no urgency for the Fed to cut interest rates.

Powell stated that they need time to assess the effects of the new tariffs that the Trump administration plans to implement and that they want to see inflation decline permanently. When evaluated together with the employment data, these statements indicate that the Fed will maintain its cautious stance.

The view that interest rates will remain unchanged in July prevails in the markets

According to data from the crypto market prediction platform Polymarket, the probability of interest rates remaining unchanged at the FOMC (Federal Open Market Committee) meeting on July 30 has risen to 94%. This data indicates that investors have largely abandoned their positions in favor of interest rate cuts.

Investors had been thinking for some time that the Fed might bow to Trump's political pressure and cut interest rates if employment weakened. However, the strong picture seen on the employment front suggests that such a move will be postponed for now.

As a result, the fact that the non-farm payrolls data, one of the most important indicators of the US economy, exceeded expectations has significantly weakened the likelihood of an interest rate cut in July. As Powell also pointed out, the Fed is not expected to make a hasty move. On the contrary, current economic indicators provide a strong basis for keeping interest rates unchanged. The data released ahead of the FOMC meeting at the end of July will be decisive in determining the sustainability of this strategy.