Stream Finance is facing a major crisis in the decentralized finance (DeFi) ecosystem. The company announced that it has suspended all deposits and withdrawals following a $93 million loss reported by an external fund manager. Following the incident, a comprehensive investigation led by international law firm Perkins Coie LLP was launched.

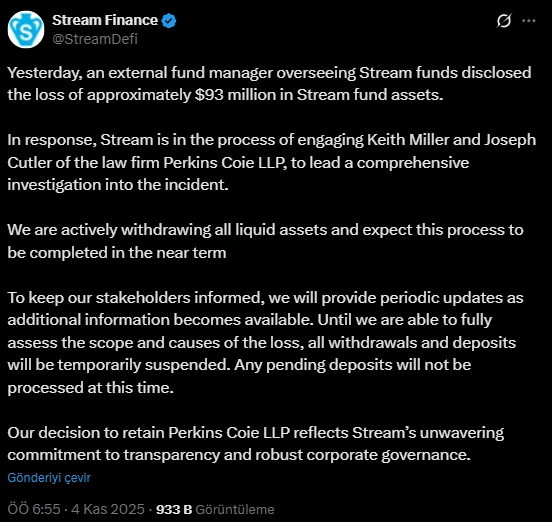

In a statement on X (formerly Twitter), the Stream Finance team announced that the fund manager reported the loss on Sunday and that urgent measures were being taken to secure the assets. The company stated, “We are in the process of withdrawing all our liquid assets and expect this process to be completed shortly. We will not resume deposits and withdrawals until we fully understand the scope of the incident.”

Perkins Coie LLP, which is conducting the investigation, has appointed attorneys Keith Miller and Joseph Cutler, known for their experience in the crypto and finance sectors. The firm has previously worked with fintech companies, providing consulting on compliance, cybersecurity, and internal audit processes. Stream Finance stated that this step demonstrates its commitment to the principles of “transparency and strong corporate governance.”

The stablecoin price fell below $1.

However, the impact of the incident wasn't limited to Stream Finance. The protocol's stablecoin, Staked Stream USD (xUSD), quickly lost its dollar peg. According to PeckShield data, xUSD fell to $0.51, breaking away from its $1 target. Analysts warn that this collapse could trigger a cascading wave of liquidations.

Platforms using xUSD as collateral include major lending protocols such as Euler, Morpho, and Silo. The total amount of collateral tied to Stream Finance on these platforms is estimated to exceed $280 million in debt and loans. Pseudonymous analyst YAM emphasized that this figure only includes direct collateral; indirect exposures, particularly the complex credit loops established with derivatives like USD, are not taken into account.

Stream Finance was previously a DeFi protocol known for its recursive looping, or repeating return models. This structure, which allowed users to earn higher interest by reinvesting their collateral, also carried high risks depending on market conditions. The company recently filed a complaint regarding DefiLlama's TVL (Total Locked Value) calculation method. DefiLlama stated that it did not accept Stream's model as "true TVL," and Stream began displaying the total of user deposits and strategic assets separately on its website.

DeFi experts believe this incident will increase awareness of the risks associated with complex yield strategies in the industry. "This clearly highlights how yield is generated and how risky strategies that don't align with standard metrics can be," said Minal Thurkal, Head of the DeFi ecosystem at CoinDCX.

Stream Finance's suspension of withdrawals until the investigation is complete has severely shaken user confidence. The company announced that it will provide regular updates on the process in the coming days. However, how this $93 million loss will be recouped and the extent to which investors will be compensated for their losses remains unclear.