The crypto community has been reacting strongly to JP Morgan for the past 48 hours. Suspicions that the bank is behind the sudden crash in MicroStrategy (MSTR) shares and the sharp decline in Bitcoin are rapidly growing. Calls for a boycott are growing stronger on social media, while investors are discussing both JP Morgan's actions and a possible MSCI index change.

Panic began when MicroStrategy and Bitcoin prices plummeted without warning. Markets were stunned until Crypto Banter host Ran Neuner made a claim. Neuner suggested that the possibility of MicroStrategy being delisted from MSCI or NASDAQ might have triggered the price action. This claim immediately changed the topic of discussion.

Subsequent news released by MSCI further escalated tensions. It was suggested that the index provider could remove companies holding a large portion of their balance sheets in crypto assets from global indices starting in 2026. This possibility created widespread panic in the markets, and the selling pressure on MicroStrategy intensified.

JPMorgan is a target

From this point on, tensions shifted to JP Morgan. Trading firm Empery Digital accused the bank of "creating artificial pressure" on MicroStrategy. The firm alleged that JP Morgan's sudden, extremely negative outlook was not normal market commentary; it suggested an orchestrated move.

Empery also stated that the bank quietly raised the margin and collateral requirements for MSTR on July 7. This move allegedly created further volatility, forced selling, and deep price declines. Most investors were unaware of this increase, and the sudden liquidations created a knock-on effect.

MicroStrategy Chairman Michael Saylor reacted strongly. Saylor emphasized that the company was not merely a "Bitcoin carrier" but a software company generating $500 million in annual revenue. He also emphasized that they had $7.7 billion in Bitcoin-backed financial products.

Calls for a boycott spread rapidly.

Outrage quickly spread across social media. Influencer Adam B. Liv called for a full-scale boycott of JP Morgan. Liv also brought up some questionable past trading records and Epstein connections. The debate quickly escalated.

Another surprising statement came from real estate investor Grant Cardone. Cardone announced that he had withdrawn $20 million from Chase and said he was preparing for legal action. Max Keiser also joined the discussion, saying, "Break up JP Morgan, buy MicroStrategy and Bitcoin."

If MSCI's plan goes through, companies with more than 50% of their balance sheets tied to crypto assets could be excluded from the index. This could cut off billions of dollars in passive fund flows. It's rumored that companies will be forced to restructure their balance sheets to mitigate this risk.

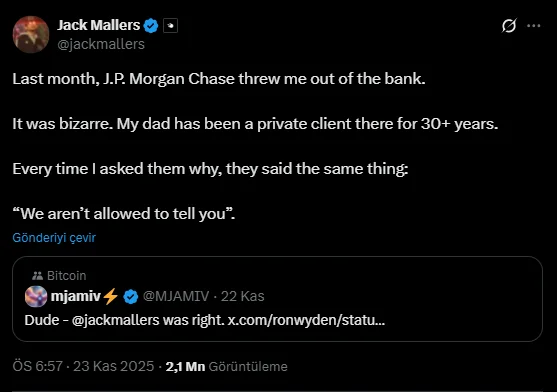

Another development that escalated the debate was the statements of Strike CEO Jack Mallers. Mallers stated that JP Morgan closed its accounts without providing a reason and downgraded it to "concerning activity." This situation has revived the long-discussed "Operation Chokepoint 2.0" allegations in the US.

The Trump administration signed an executive order banning such practices this summer. However, Mallers's experience has sparked speculation that the banking pressure on crypto companies continues.

Tether CEO Paolo Ardoino, however, supported Mallers, saying, "Bitcoin will survive in the long run, while the institutions that exert pressure will become history."