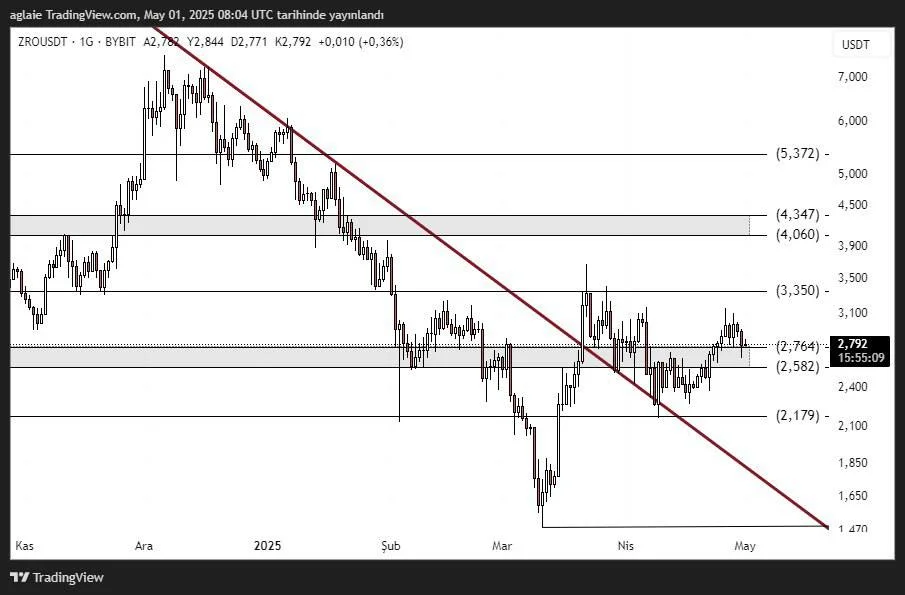

ZRO

ZRO has started to give strong signals in technical terms after a long period of decline. The price broke the red trend line on the chart to the upside and started to test important resistances after this break. Currently priced at $2,744, the ZRO is consolidating just above the region where selling pressure has been concentrated in the past.

Support Zones:

- $2,764 – $2,582: Current horizontal support - the price is trying to hold on here

- $2,179: Medium-term main support zone

- $1,770 – $1,550: Major support

Resistance Zones:

- $ 3,350: The peak of the last rise – the first target

- $4,060 – $4,347: Large-time major resistance area

- $5,372: Long-term target in the continuation of the rise

The falling trend line shown in red on the chart has now been left behind. The price not only broke this line upwards, but also created a strong support ground in the December of $ 2.58 – $ 2.76. The support-resistance transformation (SR Flip) seems to be completed in this region now.

If the price continues to stay above this zone, it can be expected that the rise will regain momentum and the $ 3.35 level will be tested in the first place. If this level is broken, the first target will be $ 3.35, followed by the $ 4.06 – $ 4.34 band. In case of a downward break, the $ 2.58 region should be carefully monitored. If this region is lost, short-term weakening may be observed.

In summary, with the breaking of the falling trend for ZRO, a period may have closed in a technical sense. A new bullish wave can be triggered if the jamming area that is currently forming breaks to the upside. However, for this scenario to strengthen, it is necessary that the price remains above $ 2.76. The technical structure is strong, but it would be the healthiest strategy to stay on track instead of opening a transaction without confirmation.

These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions.