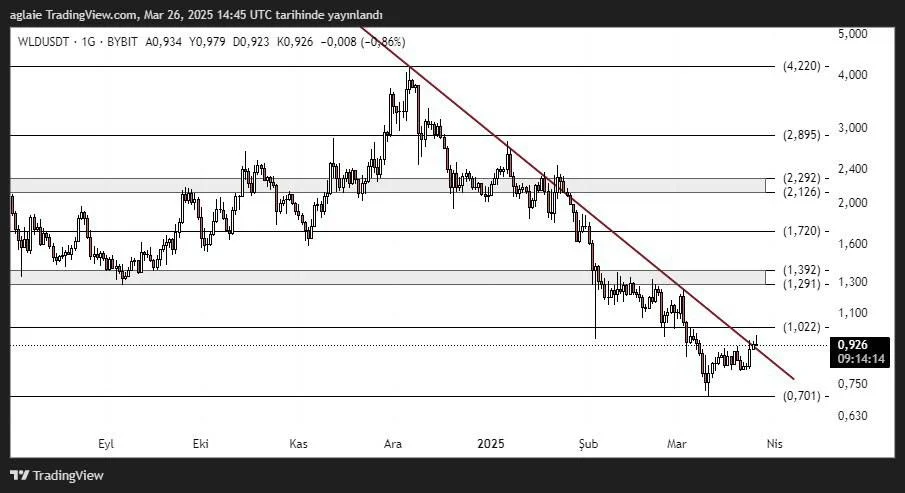

Worldcoin (WLD) Technical Analysis: On the Verge of Breaking the Downtrend

Worldcoin (WLD) has managed to climb back up to its descending trendline after experiencing heavy selling pressure in recent months. The current price sits at $0.926 USDT, a critical level from a technical standpoint, as it aligns with the resistance of the downtrend that has been in place since December.

If WLD fails to break this trendline, renewed downward pressure could emerge. However, a successful breakout would signal a potential trend reversal in the short term.

Key Technical Levels for WLD/USDT

Support Zones:

- $0.750 – Psychological support

- $0.701 – Major bottom level

Resistance Zones:

- $1.022 – Downtrend resistance + short-term horizontal resistance

- $1.291 – $1.392 – Medium-term resistance range

- $1.720 – Area of previous heavy selling

- $2.126 – $2.292 – Long-term target zone

- $2.895 – $4.220 – Broad time-frame potential resistance area

The red descending trendline on the chart represents a well-established resistance that has been tested multiple times, but not broken. In technical analysis, the more a trendline is tested, the stronger the breakout can be once it occurs.

Currently, WLD is very close to this trendline. A daily close above it would confirm a bullish breakout. Otherwise, the price could retrace back to the $0.750 – $0.701 support zone.

What Are the Technical Indicators Suggesting?

- RSI is in the neutral zone but has started to point upward, signaling potential momentum shift.

- Volume has noticeably increased over the past few days, indicating rising interest and suggesting any breakout may be supported by strong buyer activity.

Suggested Strategy for Traders

- Watch for Breakout Confirmation: Wait for daily closes above $1.022 to validate the move.

- Risk Management: A close below $0.750 would invalidate the bullish scenario.

- Stepwise Targeting: If the trendline breaks, consider targeting the $1.291 – $1.720 range progressively.

These strategies aim to help traders seize potential opportunities while minimizing risk as the price action unfolds.

Worldcoin at a Pivotal Decision Point

The WLD/USDT pair is currently testing the descending trendline. The next movement from this level will be crucial in determining the direction. A breakout with strong volume could lead to a quick rally toward $1.29 and even $1.72 in the short term.

However, if the price fails to break above and remains below the trendline, we may see continued consolidation or a pullback. That’s why this zone marks a key decision point for Worldcoin investors.

Disclaimer: This analysis does not constitute financial advice. It is intended to highlight potential trading opportunities based on support and resistance zones under current market conditions. All trading decisions and risk management remain the responsibility of the individual. Use of stop-loss orders is strongly recommended.