The US Consumer Price Index (CPI) data for May was below market expectations on both monthly and annual basis. This raised hopes that the US Federal Reserve (Fed) may start cutting interest rates later this year, creating a positive atmosphere in the cryptocurrency market. Bitcoin rose briefly after the release of the data.

Surprise decline in headline and core inflation

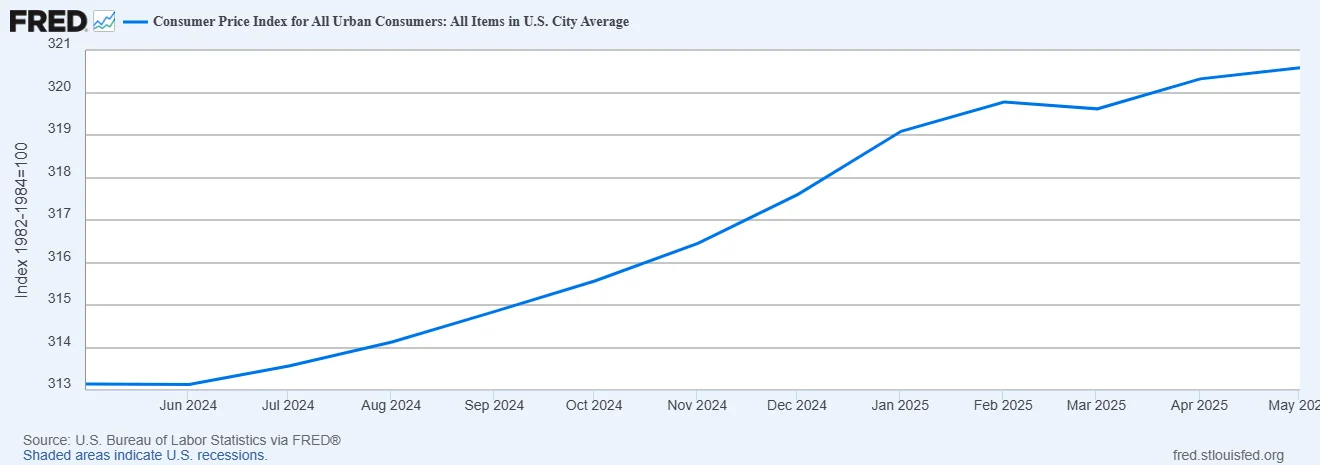

According to data released by the Bureau of Statistics of the US Department of Labor, the headline CPI rose by only 0.1% in May. This was below the market expectation of 0.2% and the 0.2% increase in April. On an annual basis, CPI rose by 2.4%. This was below analysts' expectations of 2.5% and slightly above the previous month's rate of 2.3%.

Core CPI, the more widely followed component of inflation (excluding food and energy prices), rose by 0.1% in May. This was below both the market expectations of 0.3% and the 0.2% increase in April. Annual core CPI remained unchanged at 2.8%, while the expectation was for 2.9%.

These data were interpreted as signs that inflation was coming under control. In particular, the weak course of core inflation has strengthened market expectations for the Fed to take looser steps in monetary policy.

Bitcoin approached 110 thousand dollars

After the announcement of inflation data, a rapid reaction was observed in cryptocurrencies, which fall into the category of risky assets. Bitcoin climbed 0.6% to $109,800 after the data. Bitcoin, which traded up 0.3% on a daily basis, signaled that it could continue its upward movement in the short term as investors' risk appetite increased.

Two interest rate cuts expected from the Fed

The weak course of inflation has strengthened markets' expectations that the Fed will start cutting rates later this year. According to the CME FedWatch Tool, investors are pricing in a first rate cut in September and a second rate cut in December, for a total of two rate cuts.

These developments may pave the way for positive pricing in the cryptocurrency market as well as traditional assets. Because while the low interest rate environment generally increases the tendency towards alternative and riskier assets, digital assets such as Bitcoin are among the instruments that benefit the most from this process.